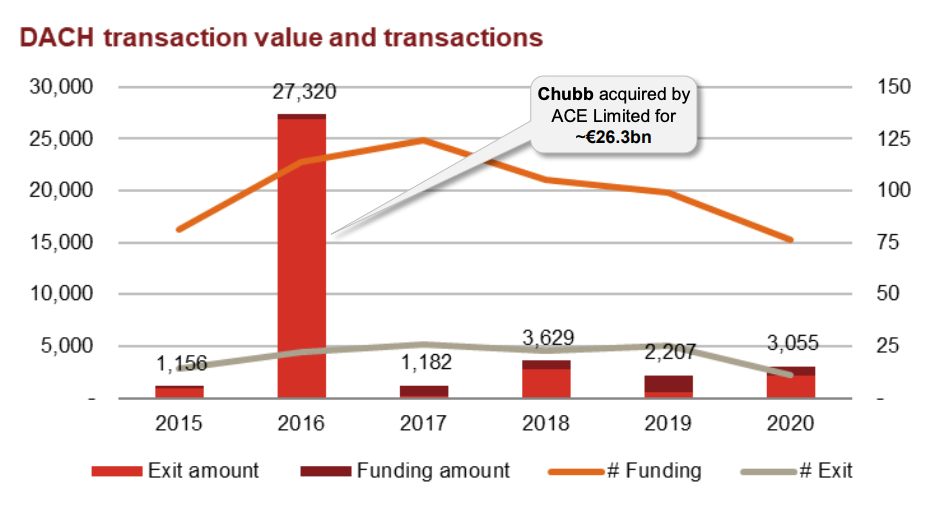

Despite an initial fall in transaction value and volume in the first half of 2020, fintech funding in Germany, Austria and Switzerland, or the DACH region, rebounded significantly in the second half of the year with EUR 2.2 billion raised during H2 2020.

This brought the total amount of funding raised by DACH fintech companies in 2020 to over EUR 3 million, a report by PwC says.

DACH fintech transaction value and transactions, Source: Dealroom, PwC Analysis, via Fintech deals in Continental Europe, March 2021

Released in March 2021, the report looks at fintech funding trends in Continental Europe between 2018 and 2020, and shares emerging trends to watch out for this year.

In 2020, investors in the DACH fintech sector favored more mature, less capital intensive, and therefore less risky fintech companies, focusing on larger, later-stage rounds for established companies amid the global pandemic.

Banking companies will retain attractiveness

Data reveal that fintech companies in the banking subsector were able to attract a strong level of investments despite the COVID-19 crisis, with, for instance, Germany’s digital bank N26 raising over EUR 500 million in its Series D funding round, and Solaris Bank, a banking-as-a-service platform provider, closing a EUR 60 million Series C funding round. Both are from Germany.

Across all fintech subsectors, banking will remain amongst the most resilient fintech segments in DACH during the prolonged health crisis, PwC predicts. This will be owed to the shift in consumer behavior to digital banking and the fact that companies are continuously improving their digital operations.

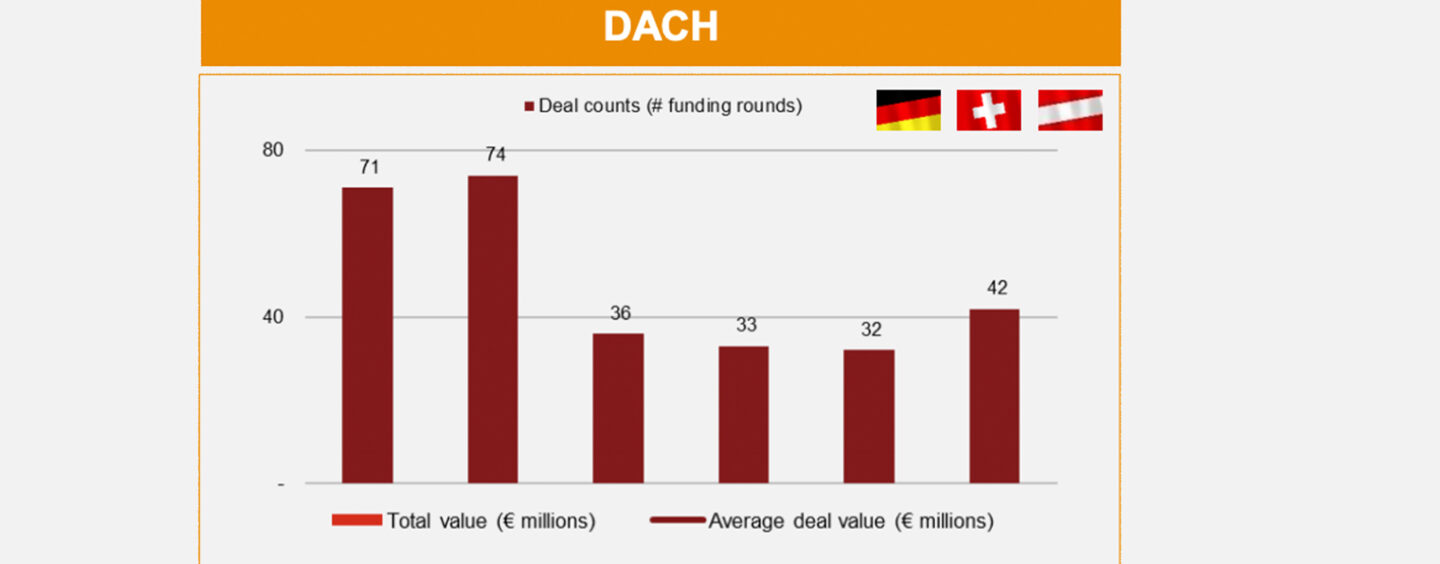

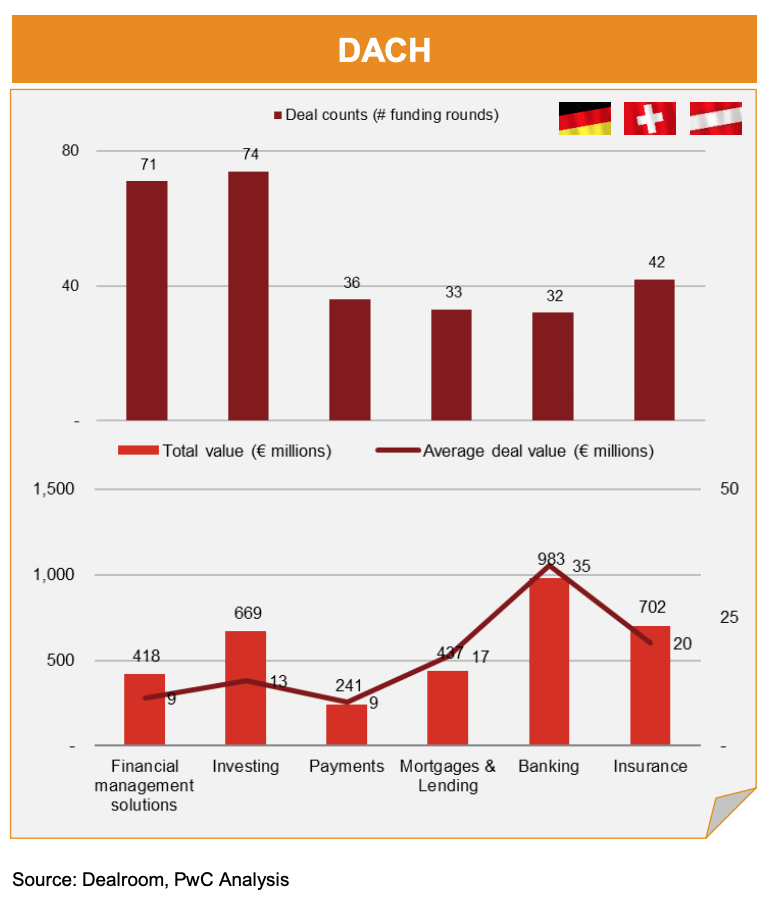

Banking, insurance and investment lead in DACH fintech funding

Between 2018 and 2020, DACH fintech companies operating in the banking segment raised the most funding with a total of EUR 983 million. Average funding round was larger for banking companies than other fintech segments at EUR 35 million.

After banking, insurtech was another favored fintech segment in DACH, with companies in the space raising a total of EUR 702 million between 2018 and 2020.

Insurance-related funding rounds included Wefox’s EUR 200 million Series B, Friday’s EUR 115 million Series A and B, and Ottonova’s EUR 54 million early venture capital (VC) round. All these rounds were closed in 2019 and involved German digital insurance providers.

Ranking third in total funding amount for the period is the investment segment. Companies in the space raised a total of EUR 669 million, though rounds were smaller in size with an average of EUR 13 million.

Notable deals included Tradeplus24’s EUR 100 million+ Series A and SEBA Bank’s EUR 90 million early VC round. Tradeplus24 provides financing solutions to small and medium-sized enterprises (SMEs) and SEBA Bank is a regulated crypto bank. Both are from Switzerland.

DACH– Fintech funding rounds (no M&A) by sector over 2018-2020, Source: Dealroom, PwC Analysis, via Fintech deals in Continental Europe, March 2021

Signs of consolidation

The 2019/2020 DACH Report, released in December 2020 by Frontline and Speedinvest, notes that the three markets have seen continued growth in their respective fintech sector, pointing out to signs of consolidation in all three.

In Switzerland, fintech continues to show signs of success, supported by a strong banking ecosystem. The cryptocurrency and blockchain space in particular has witnessed significant growth with two of the largest rounds in 2019 going towards startups in the sector: Bitcoin Suisse (US$47 million Series B) and Metaco (US$18 million Series A), the report says. 2020 saw the acquisition of Swiss banking software developer Avaloq Group by Japanese electronics giant NEC for a whopping CHF 2.05 billion.

In Austria, fintech is amongst the most developed tech sectors. Despite having a relatively small startup ecosystem, Austria has nevertheless managed to produce several fintech winners, including Bitpanda, Trality and Blockpit, the report says. Crypto exchange Bitpanda reached unicorn status in March 2021, becoming the first Austrian startup to reach a valuation of over US$1 billion.

And in Germany, fintech is an emerging sector that has begun consolidating with the number of deals starting to stabilize. N26 is reportedly looking to make its first acquisition while just recently Wefox recently announced a USD 650m Funding round bringing their valuation to over US$ 3billion, giving them room for acquisitions.

DACH Fintech Webinar

This and other topics will be discussed on the Fintech News Webinar this Thursday. Register here: