2020 has set a record for fintech US$100 million+ mega-rounds, demonstrating strong investor appetite for large and mature fintech companies amid the global COVID-19 pandemic, according to new data from market intelligence startup CB Insights.

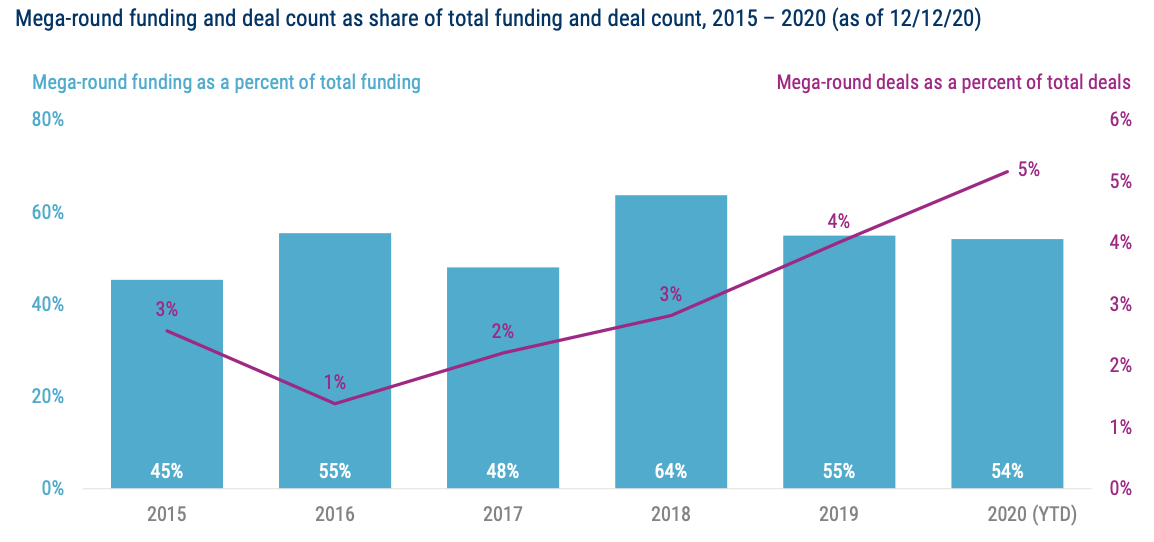

Preliminary findings for the upcoming annual State of Fintech Report say that, as of December 12, 2020, the global fintech industry recorded 97 mega-rounds year-to-date (YOT), surpassing 2019’s total of 92 mega-rounds. Mega-rounds represented 54% of all fintech funding, or about US$22,633 million, and 5% of total deals.

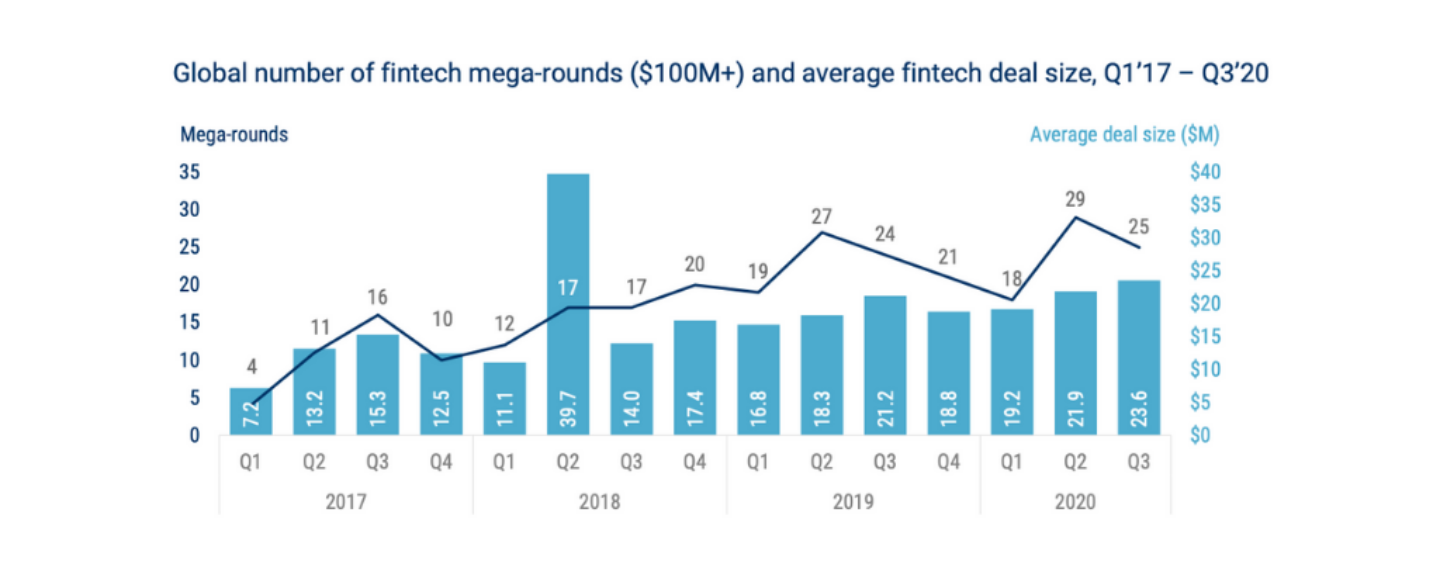

Mega-round funding and deal count as share of total funding and deal count, 2015 – 2020 (as of 12/12/20), State of Fintech Preview, CB Insights

In deal count, the US took the lion’s share, with 54 mega-rounds. China saw 7, Brazil 5, and the UK and Sweden both recorded 4.

Annual fintech mega-round deal count by region, 2015 – 2020 (as of 12/12/20), State of Fintech Preview, CB Insights

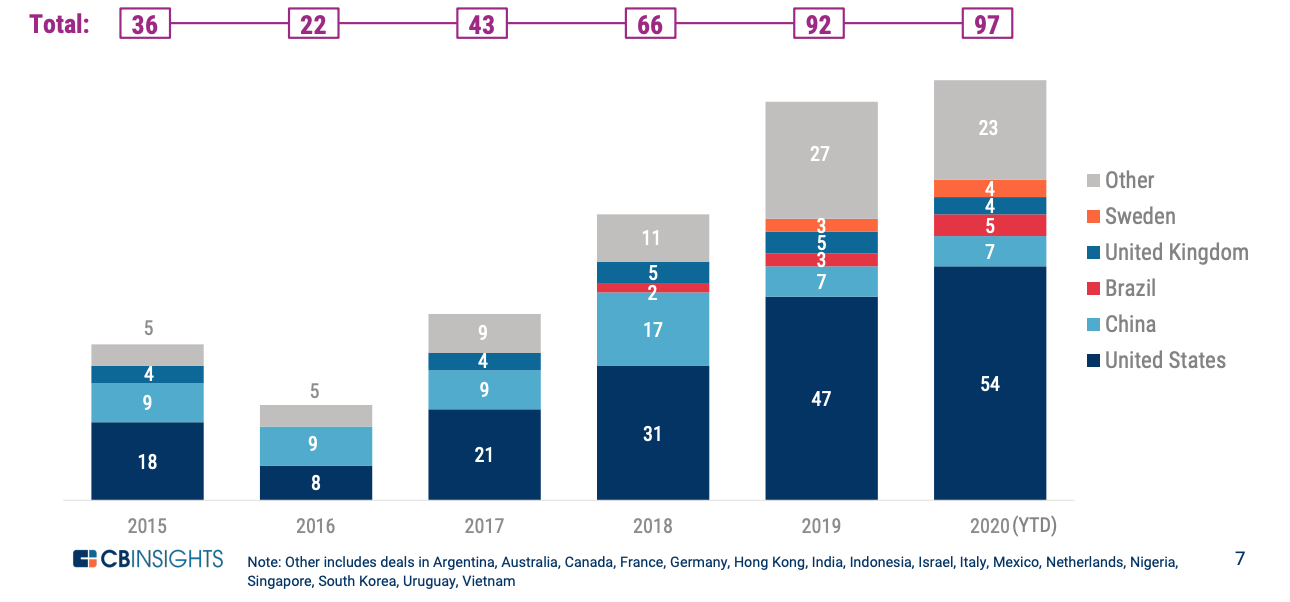

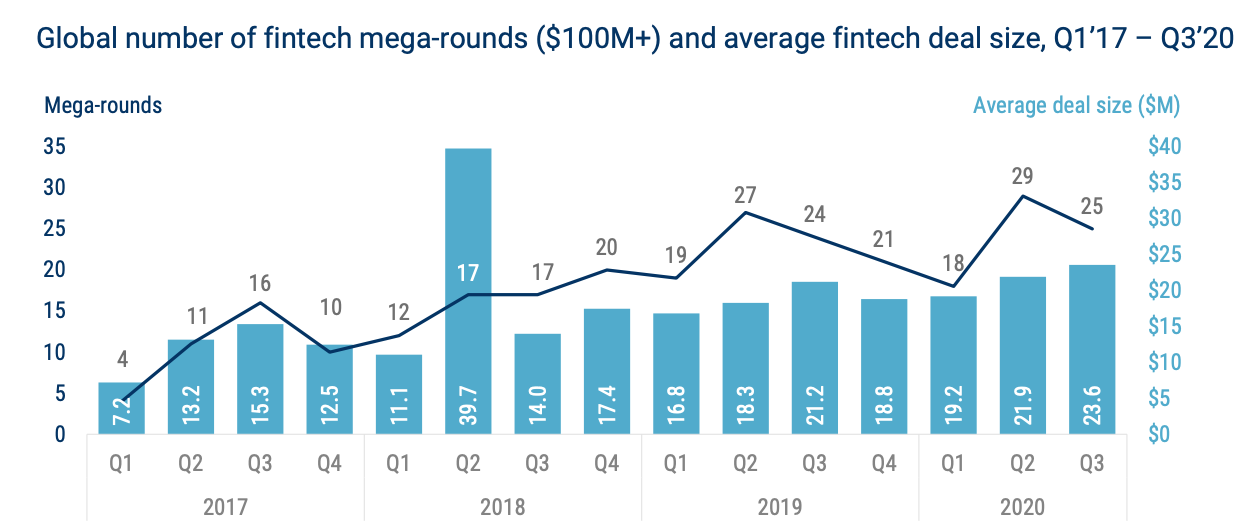

Previous fintech reports from CB Insights show that Q1’20 saw 13 mega-rounds, Q2’20 29, and Q3’2020 25, implying that as of December 12, 2020, Q4’20 recorded 30 mega-rounds, a new quarter high.

Global number of fintech mega-rounds ($100M+) and average fintech deal size, Q1’17 – Q3’20, State of Fintech Q3’20 Report, CB Insights

2020 fintech mega-rounds

2020 saw later-stage fintech companies raised massive amounts in funding. Notably, companies such as Chime, AvidXchange, Klarna and Robinhood have each raised multiple mega-rounds this year.

Notable fintech mega-rounds in 2020 include:

Q4’20

- Paxos (US$142 million, December), a US-based crypto firm;

- Tink (US$103 million, December), a Swedish open banking platform;

- Creditas (US$255 million, December), a Brazilian consumer lending startup;

- Addepar (US$117 million, November), a US-based wealth management platform; and

- Molo (GBP 266 million, October), a UK-based digital mortgage lender.

Q3’20

- Chime (US$485 million, September), a digital challenger bank;

- Robinhood (US$660 million, September), a stock trading app;

- Bright Health (US$500 million, September), a health plan provider;

- Klarna (US$650 million, September), a Swedish payments and shopping services provider; and

- Nubank (US$300 million, August), a Brazilian neobank.

Q2’20

- Varo (US$241 million, June), a mobile banking startup.

- N26 (US$100 million, May), a German digital bank;

- Carta (US$300 million, May), a company focused on private company ownership and related legal complexities;

- BioCatch (US$145 million, April), a behavioral biometric specialist; and

- Stripe (US$600 million, April), a US-based payment firm.

Q1’20

- Bakkt (US$300 million, March), a consumer digital wallet and crypto exchange;

- Revolut (US$500 million, February), a UK neobank;

- Toast (US$400 million, February), a restaurant point-of-sale (POS) platform;

- Tradeshift (US$240 million, January), a US-based supply chain payment startup and marketplace; and

- AvidXchange (US$260 million, January), a US-based business payment processing firm.

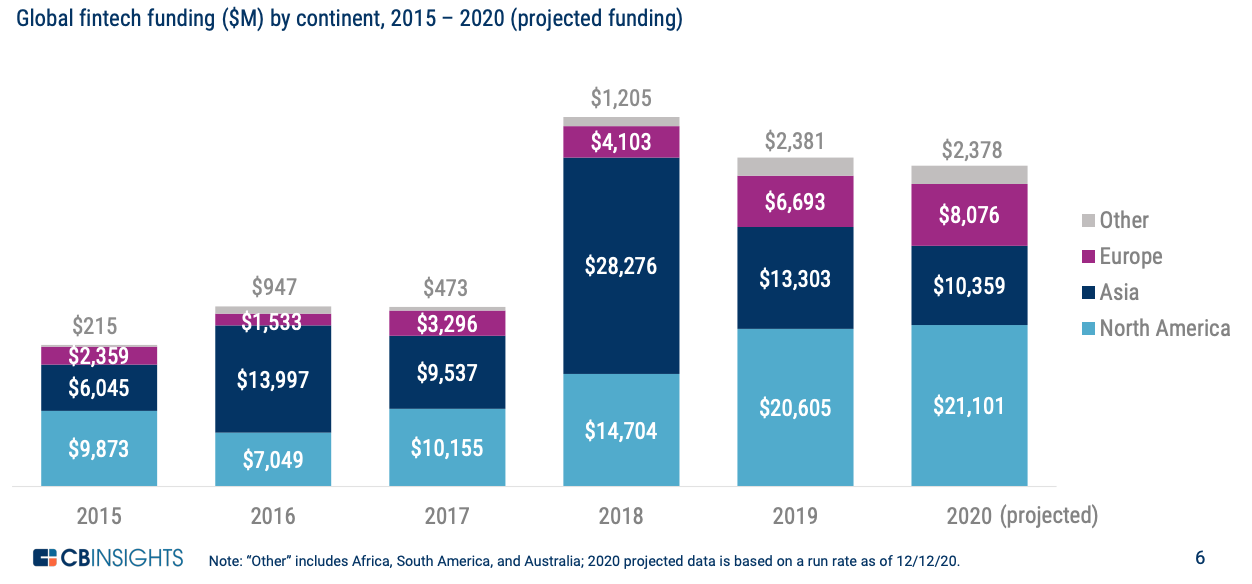

Besides a jump in fintech mega-rounds, preliminary findings from CB Insights suggest that 2020 fintech funding will likely decline this year compared to 2019. It projects fintech companies to raise a total of US$41,914 million, with half of that amount (US$21,101 million) going towards North American firms. Asian fintechs are set to raise US$10,359 million (or 24.71% of all funding), followed by European companies at US$8,076 million (19.27%).

Global fintech funding ($M) by continent, 2015 – 2020 (projected funding), State of Fintech Preview, CB Insights

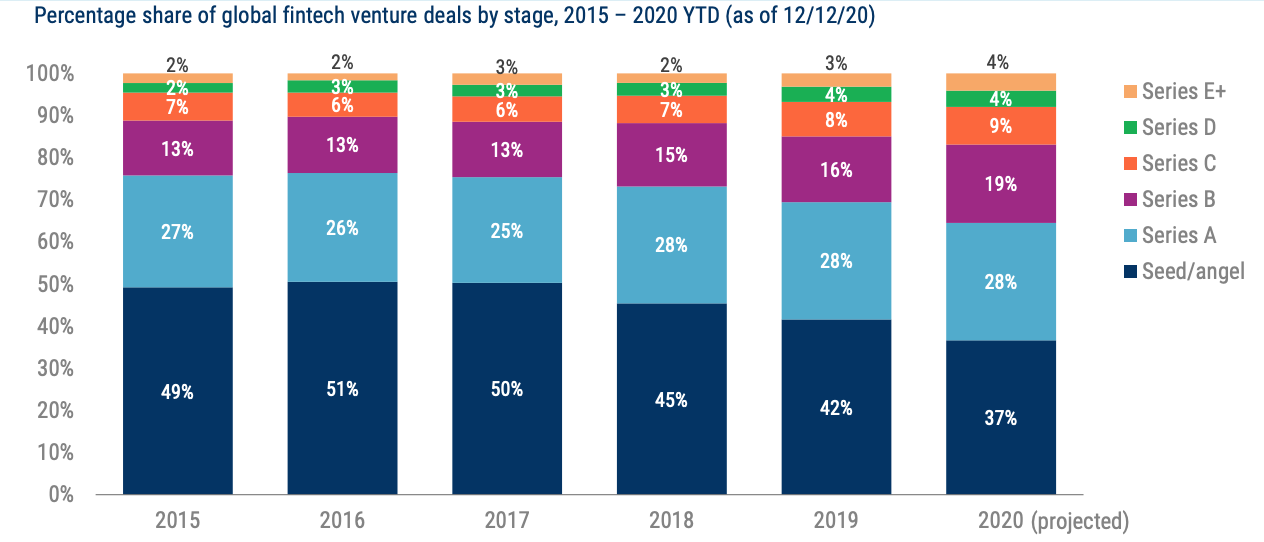

Share of seed and angel funding will likely drop this year as investors favor more mature, established fintechs. Seed and angel deals should fall to 37% of total deal activity in 2020, down from 42% in 2019, while Series B rounds are projected to finish the year with the greatest increase in share, up 3 percentage points to 19% by year-end.

Percentage share of global fintech venture deals by stage, 2015 – 2020 YTD (as of 12/12/20), State of Fintech Preview, CB Insights

The COVID-19 pandemic has profoundly impacted fintech funding, with early-stage fintechs in particular struggling to attract cash, prompting increased consolidation among fintechs.

Apple acquired Canada-based mobile payments company Mobeewave for US$100 million, Goldman Sachs acquired online brokerage Folio Investing for US$500 million, and fintech unicorn Social Finance (SoFi) acquired bank account infrastructure company Galileo Financial Technologies for US$1.2 billion.