Don’t Overcomplicate Climate Change

by Elena Philipova, Director of Sustainable Finance at the London Stock Exchange Group (LSEG) June 14, 2022Asset managers can contribute most to a sustainable economy by sticking to a policy of steadily reducing their portfolios’ carbon emissions.

The November 2021 climate change summit in Glasgow (COP26) brought home the urgency of addressing global warming.

COP26 participants said that limiting warming to 1.5°C by 2050 requires rapid, deep and sustained reductions in global greenhouse gas emissions.

These include a cut in CO2 emissions of 45 percent by 2030 relative to the 2010 level, and to net-zero by mid-century.

The COP26 alarm bells are sounding even louder six months on from the Glasgow conference.

Researchers at the UK’s Met Office said this month that there’s now around a fifty-fifty chance that the world will warm by more than 1.5C in the next five years.

And it’s almost certain that 2022-2026 will see a new record warmest year, they say.

Asset owners, asset managers and greenwashing concerns

Asset managers have a big say in our response to this alarming forecast.

Via the investment products they develop and distribute, they help direct long-term savings towards more sustainable businesses and activities.

Asset managers also sit downstream from the institutional owners of large savings pools, who are becoming increasingly vocal about their climate change objectives.

The Net Zero Asset Owners Alliance (NZAOA), which controls an aggregate $10.4trn in assets, has recently said it wants to work more closely with asset managers, saying it wants to make sure both groups’ stewardship activities and public messaging are aligned.

Does this statement hint at a previous lack of focus in the asset management community? Possibly.

Undoubtedly, some asset managers have in the past struggled to define and label their environmental, social and governance-focused (ESG) investment products.

This derives from the fact that, when it comes to sustainable investing, there are no industry-wide definitions, standards and transparency requirements.

Getting the design of ESG products wrong is not just a matter of a lack of impact. It carries severe reputational—and even financial—risks for the firms concerned.

Around half of UK financial advisers surveyed late last year said that asset managers should face fines for so-called “greenwashing”—providing misleading information about their green credentials to bolster their reputation and increase fund sales.

Don’t overcomplicate climate change

Asset managers can best address these concerns by sticking to their decarbonisation goals. It’s not necessary to overcomplicate climate change, as financial markets have perhaps tended to do in the past.

And the most effective way to measure investors’ impact on the climate and their progress towards a net zero goal is to track their portfolio emissions.

Regulations are already pushing asset managers in this direction. For example, climate benchmarks are playing an increasingly important role in policymaking.

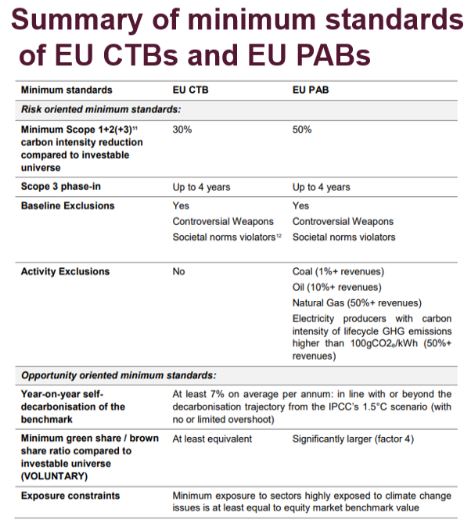

In 2020, the European Commission set out minimum standards for the so-called Paris-Aligned and Climate Transition benchmarks.

Paris-Aligned benchmarks set a goal of a 50 percent reduction in carbon emissions, with a minimum year-on-year decarbonisation rate of 7 percent. Climate Transition benchmarks decarbonise at the same pace but with a lower eventual emissions reduction target.

FTSE Russell has developed a Paris-aligned version of its flagship FTSE All-World index, which excludes companies producing high emissions or involved in controversial activities, as well as boosting green revenues and incentivising better corporate management.

Asset managers can also now access more sophisticated portfolio decarbonisation tools.

For example, the Carbon Footprint template, available in Refinitiv Eikon’s Portfolio Analytics app, helps asset managers calculate the carbon exposure of a portfolio and to report the associated data.

The template offers a weighted view of carbon emission exposures, allowing investors to quickly identify which companies in the portfolio have the greatest intensity of carbon emissions—both reported and estimated.

Source: Refinitiv Workspace as of May 1, 2022

We need step-by-step change

In addressing climate change, long-term goals are important. But just as we can individually make small contributions to sustainability by modifying our consumption patterns, reducing our use of plastics and recycling what we can, a step-by-step change that will have the most effect in the battle with global warming.

This is particularly true, given that there’s recently been disagreement about science-based climate change targets and the methodologies used to reach them. Unfortunately, using the language of commitments to show we’re making a difference can also be used as an excuse to delay action.

So let’s stick to evidence-based methods. And taking actions today, with an impact on the existing real economy, is what we should all be trying to do.

Discover how LSEG is enabling the global financial markets to achieve sustainable growth with our unique ecosystem of sustainable finance solutions and insights.

© 2022 London Stock Exchange Group plc (the “LSE Group”). All information is provided for information purposes only. Such information and data are provided “as is” without warranty of any kind. No member of the LSE Group makes any claim, prediction, warranty, or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance. No member of the LSE Group provides investment advice and nothing contained in this document or accessible through FTSE Russell products should be taken as constituting financial or investment advice or a financial promotion. Use and distribution of the LSE Group data require a license from an LSE Group company and/or their respective licensors.

Featured image credit: Unsplash