Open Banking Adoption: 1578 Banking Platforms and 5564 APIs Worldwide

by Fintechnews Switzerland August 9, 2022Around the world, open banking adoption is rising steadily, embraced by a growing number of banks and fintech companies to provide innovative financial products and tap into new market segments.

A new report by Platformable, a Barcelona-based startup building data products and digital tools, looks at the latest developments in the global open banking/open finance scene, delving into emerging trends and key enablers of the sector’s growth.

According to the research, 2022 has so far been a fructuous year for the open banking industry. Among the key trends observed this year, the report notes that in Q2 2022, the number of open banking platforms and APIs available continued to rise, indicating rising adoption across stakeholders. Banks, meanwhile, pursued new business models and opportunities, including banking-as-a-service (BaaS) offerings and partnership models, and fintech companies continued to leverage banking APIs to innovate and launch new products.

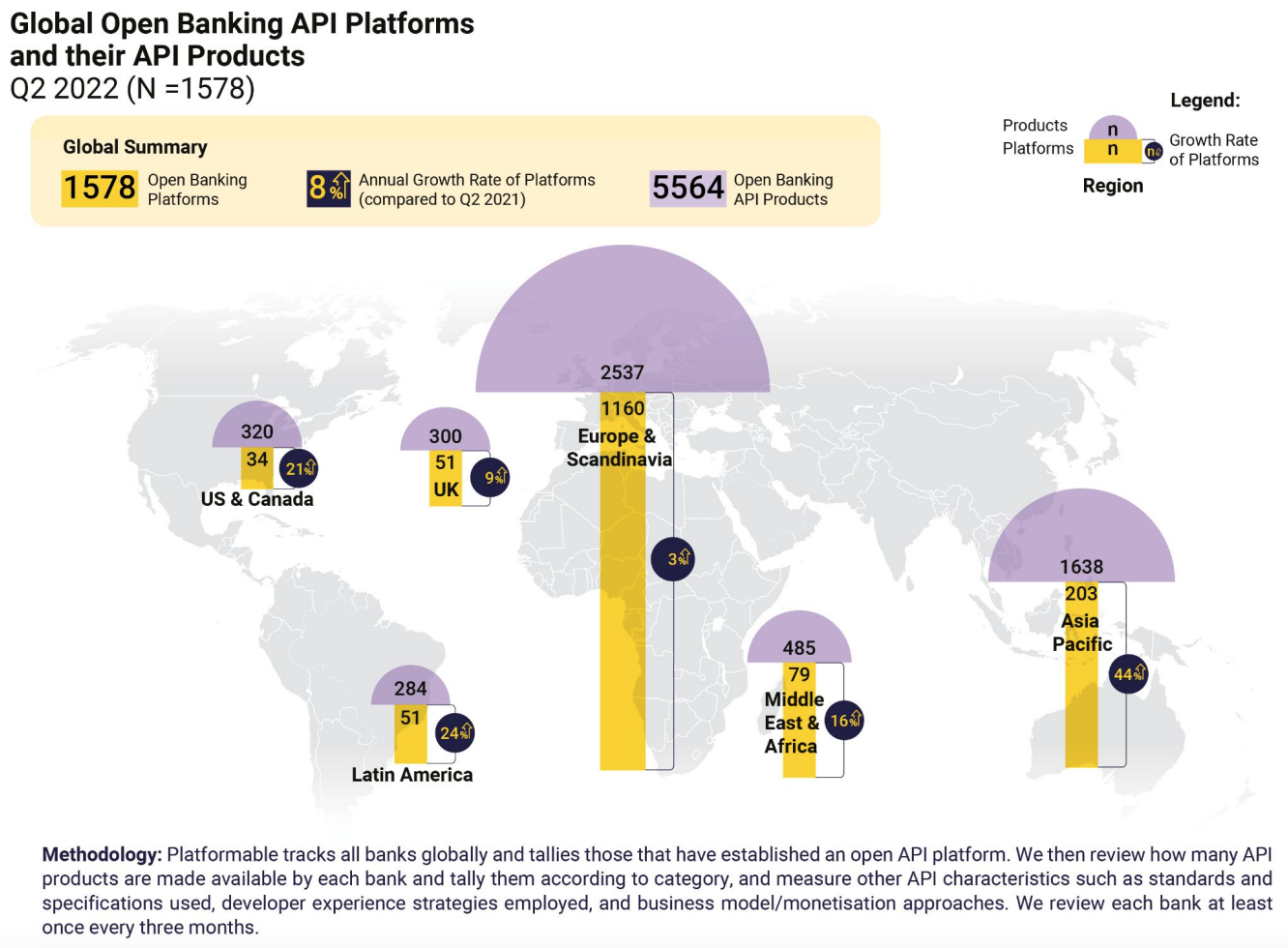

1,578 open banking platforms and 5,564 APIs worldwide

As of the end of Q2 2022, Platformable identified 1,578 banking platforms making APIs available, representing an annual growth of 8%. Collectively, these bank platforms made 5,564 open banking API products available to third parties, up from 4,831 in Q1 2022.

Europe remained at the forefront, accounting for 73.5% of the world’s open banking platforms (1,160), and 45.6% of available open APIs (2,537) as of the end of Q2 2022.

Though Europe led in terms of absolute numbers, platforms and products, Asia-Pacific (APAC) saw the strongest platform growth, with open banking platforms growing 44% in Q2 2022 year-on-year (YoY) to 203, a rise which was largely coming from Australia, Hong Kong, Indonesia and the Philippines, the research found.

Global open banking API platforms and their API products, Source: Open Banking/Open Finance Trends Q3 2022, Platformable

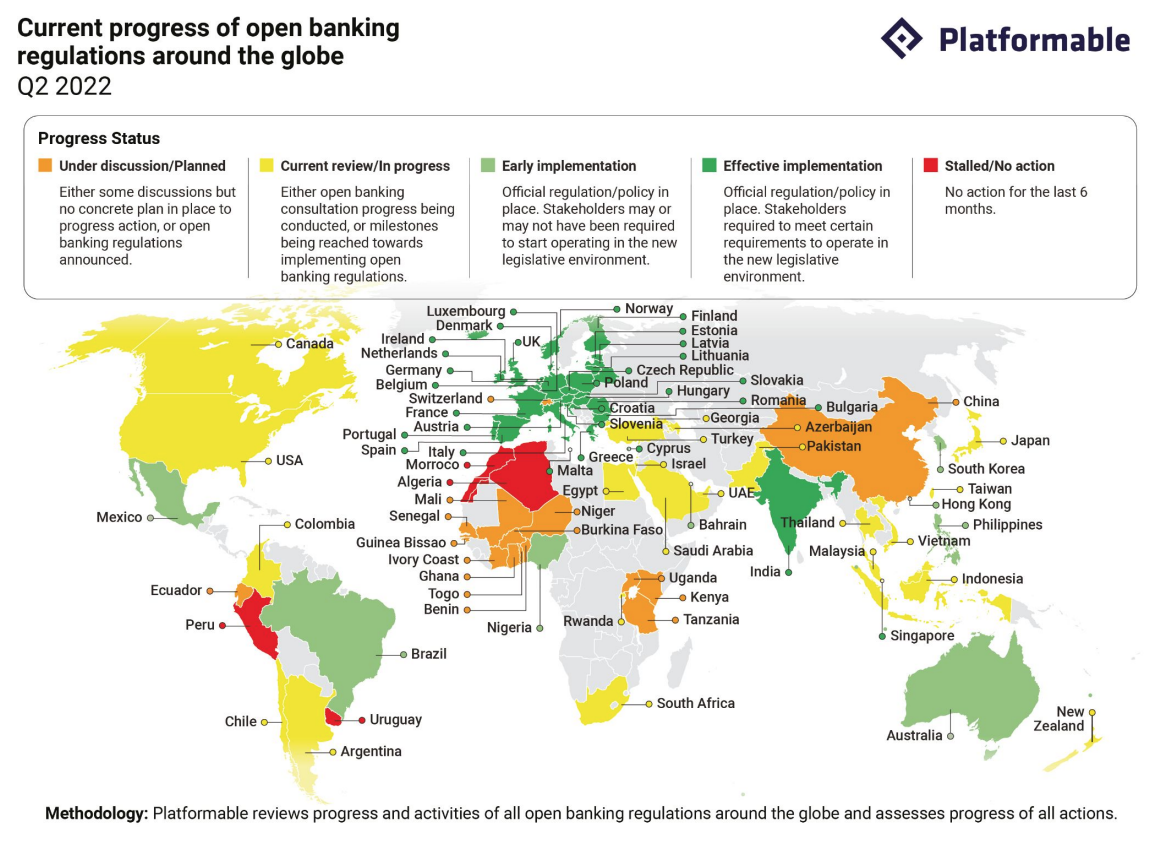

Open banking regulations advance

As of Q2 2022, 80 countries had open banking regulations in place, while 75 were either near or in implementation stages of open banking rules.

Europe and the UK made progresses towards an open finance framework. In Latin America, countries including Brazil, Argentina and Chile, continued laying out their national framework, providing greater clarity and rules for interoperability, mandating account aggregation capabilities, and introducing fintech laws.

In the Middle East and Africa, Bahrain issued amendments to its Open Banking rulebook, and Nigeria published open banking draft guidelines. And in APAC, India unveiled plans to share personal income data and opening e-government tools for global interested parties.

Current progress of open banking regulations around the globe Q2 2022, Source: Open Banking/Open Finance Trends Q3 2022, Platformable

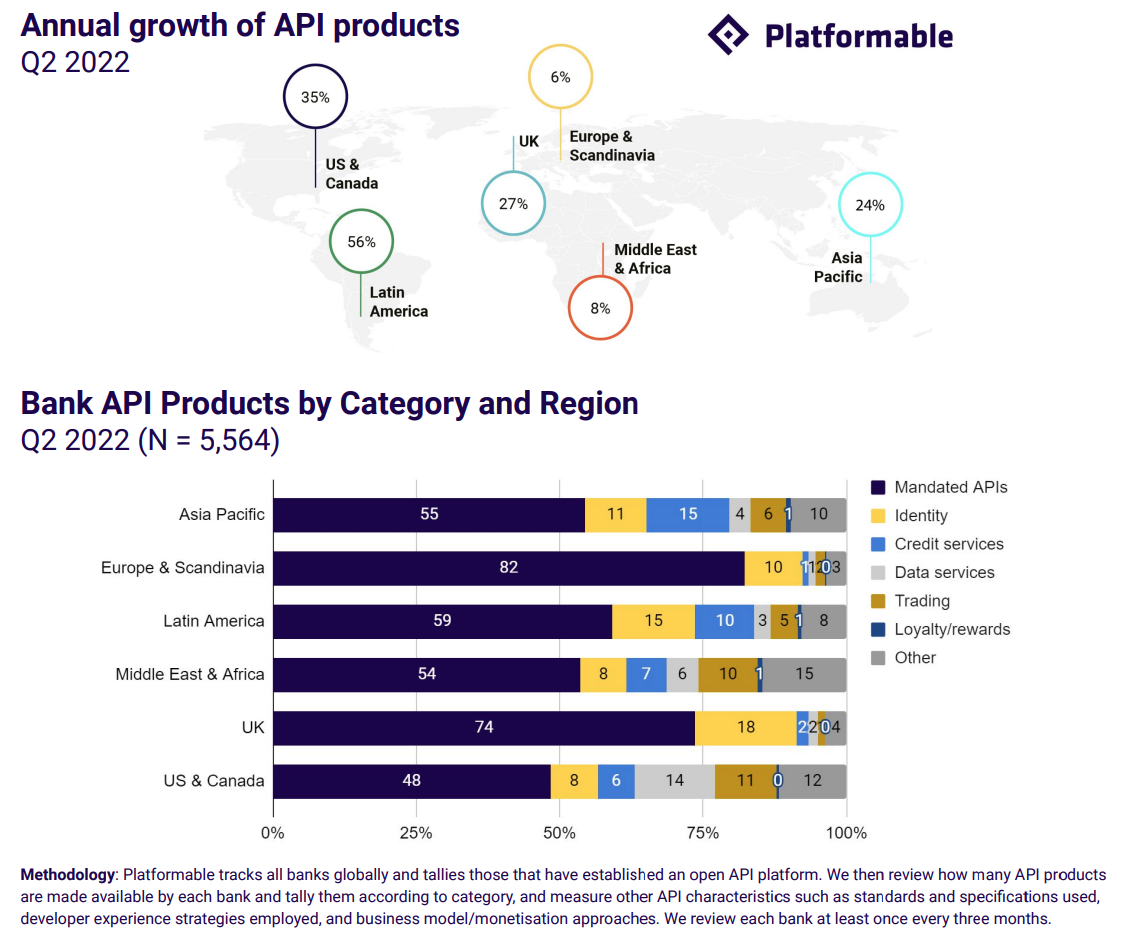

API product diversification

In Q2 2022, API products rose 15% YoY with the largest growth witnessed in Latin America (LatAm) (56%), North America (35%), the UK (27%) and Asia Pacific (24%).

Though most open banking APIs provided by financial institutions still remain mandated payments, accounts and bank products, other non-mandated APIs are growing fast, including know-your-customer (KYC) and identity, credit services, and trading, the research found, indicating that banks are keen on expanding their API offerings and embracing the trend.

Growth of API products, Source: Open Banking/Open Finance Trends Q3 2022, Platformable

Banks explore new business models

Banks are actively exploring new business models using APIs, including partnership programs, paid premium APIs, startup funding and mentorship programs, and BaaS offerings, the research found. Some, like the UK’s Starling Bank, Singapore’s DBS Bank and Brazil’s Banco do Brasil (BB), have gone a step further, embracing an open ecosystem approach and offering marketplaces that include third party apps and providers.

BB’s API program, for example, is split into two streams: BB’s open ecosystem and its Open Finance Brasil APIs offering which lists some third-party providers, and the bank’s own API portfolio of over 20 APIs under partnership and BaaS models.

Deutsche Bank is betting big on embedded finance, providing a wide range of APIs and embedded finance options. Deutsche Bank’s developer portal contains APIs for all banking sectors, as well as sandbox and productions environments.

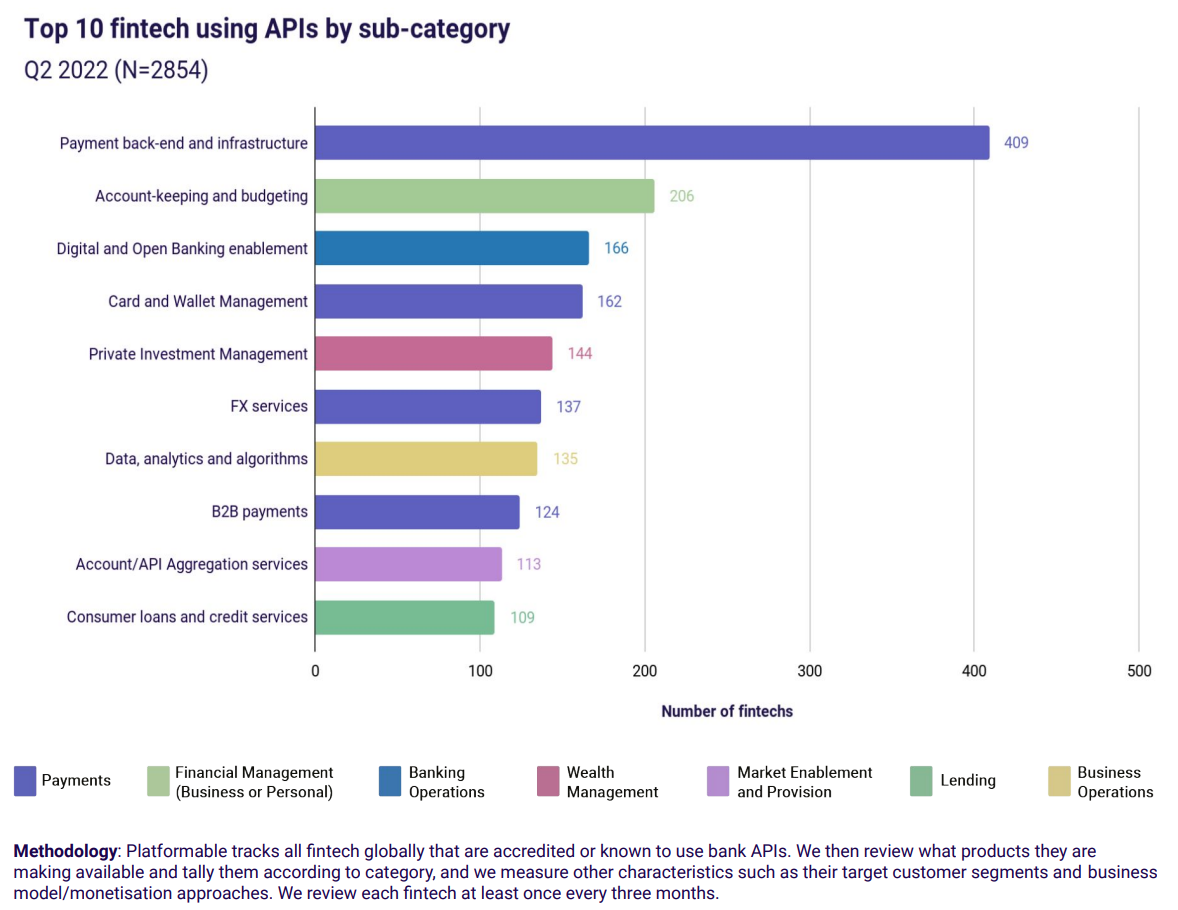

Open banking boosts fintech innovation

Looking beyond banks’ platforms and APIs, the research found that open banking is helping foster fintech innovation more broadly, and helping develop domestic fintech ecosystems.

In the US, 82% of API-enabled fintech companies are homegrown, a proportion which stands at 70% in the UK (the lowest), implying that open banking is enabling greater homegrown fintech to emerge.

Platformable identified 2,854 API-enabled fintech products as of the end of Q2 2022, and though payment solutions remain the dominant category, representing about a third of all API-enabled fintech solutions, other categories and sub-categories are also emerging, including account keeping and budgeting apps, digital and open banking enablement solutions, private management solution, data, analytics and algorithms, as well as consumer loans and credit services.

Top 10 fintech using APIs by sub-category, Source: Open Banking/Open Finance Trends Q3 2022, Platformable

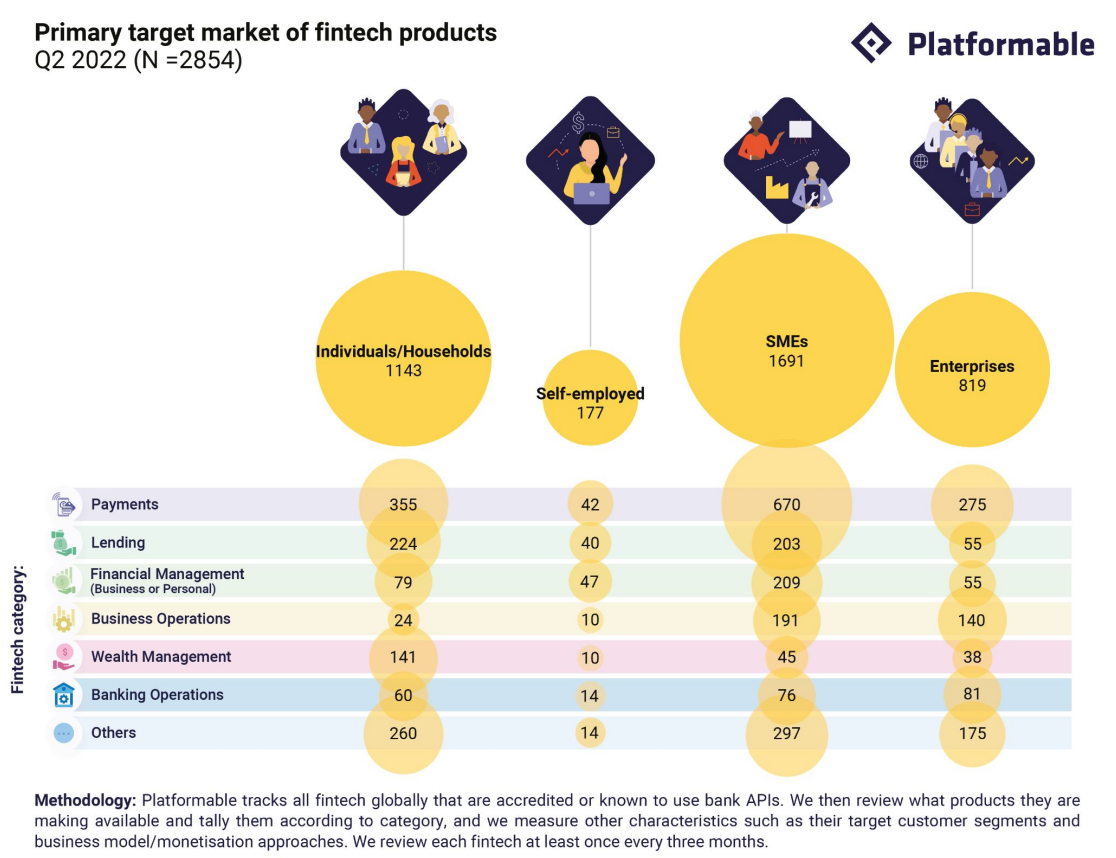

SMEs and individuals remain top target markets

The research found that fintech solutions that make use of bank APIs mainly target SMEs and individuals, accounting for 59% and 40% of all open banking fintech products globally, and are fairly generic in nature.

This implies that there is a huge opportunity gap to offer products that address specific customer segment needs, including immigrant workers, expatriates and freelancers, the report says.

Such products have nevertheless started to emerge, it notes, citing examples such as the US Viva First, a digital banking app for the Latino community in the US; Smile, a credit scoring platform for the Filipino workforce; and Yonder, a UK loyalty cards provider for expats.

Primary target market of fintech products, Source: Open Banking/Open Finance Trends Q3 2022, Platformable

An opportunity to improve financial inclusion

New technologies, including open banking and open finance, are driving down the costs of doing business and allowing a wider range of users to access financial services, introducing opportunities to help improve financial inclusion.

In Brazil, open banking is expected to bring 4.6 million more people into the formal credit market for the first time, expanding access to attractive borrowing rates, and inject BRL 760 billion (US$141 billion) into the economy, according to a recent study by Serasa Experian, a local credit research company.

Platformable estimates that 54% of existing fintech products built on open banking/open finance APIs could be used to address financial inclusion, highlighting the potential of open banking to drive social and economic development.

Featured image credit: Rawpixels