New Study Reveals Low Digital Banking Adoption Level Amongst Swiss SMEs

by Fintechnews Switzerland January 7, 2022Despite Switzerland being a global banking hub, a study commissioned by fintech firm Crealogix found low adoption of digital functionalities and low satisfaction ratings of digital banking amongst Swiss small and medium-sized enterprises (SMEs).

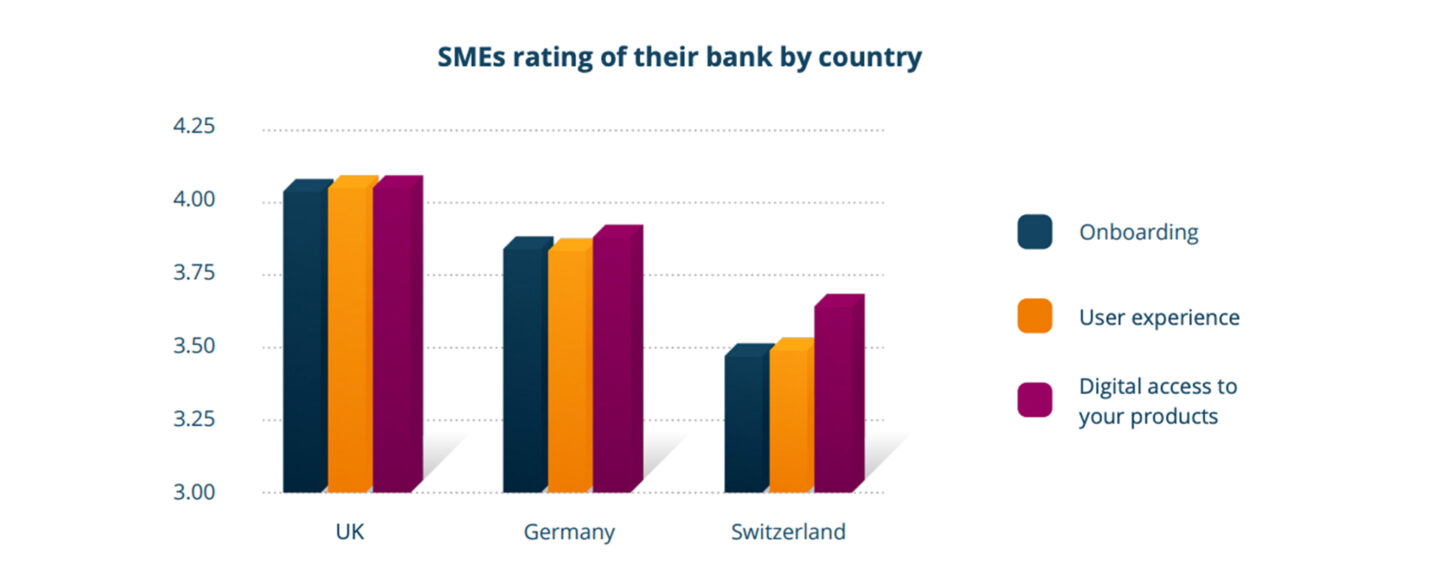

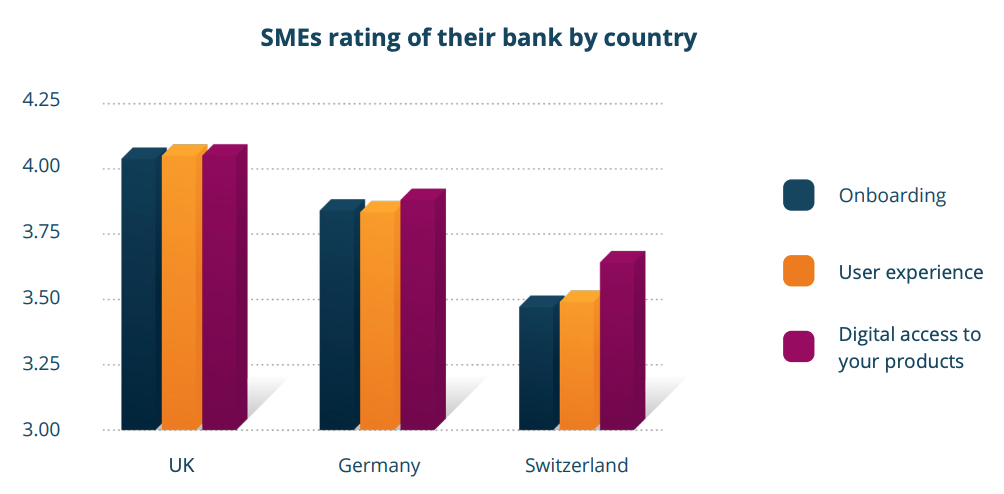

The survey, which polled SMEs in the UK, Germany and Switzerland, found that, across these three jurisdictions, Switzerland had the lowest adoption of digital SME banking functionalities, and the lowest satisfaction levels, suggesting that available solutions are either irrelevant or too difficult to use.

SMEs rating of their bank by country, Source: SME Banking Report, Crealogix, Nov 2021

Results from the survey found that only 22% of SMEs in Switzerland are satisfied with their bank’s digital offerings, compared with the survey’s average of 40%. At the same time, Swiss SMEs were found to be very keen to adopt digital services, with nearly 80% of respondents indicating a desire to increase the number of digital touchpoints with their bank.

These attributes make Switzerland an appealing market for SME banking fintechs, the report says, where existing services appear to not be meeting demand.

An underdeveloped industry

Digital SME banking is an underdeveloped fintech segment in Switzerland, despite SMEs making up 95% of the domestic economy.

Last year, serial entrepreneur and former CEO and co-founder of German neobank Penta Lav Odorovic said that he will be entering the market with a new SME banking startup.

Relio says it will provide businesses in Switzerland with digital banking accounts, fast and remote onboarding, as well as advanced tools and software integrations for SMEs to easily manage their finances. The company, which has applied for a Swiss fintech license, closed a pre-seed financing round of CHF 700,000 in April 2021.

Relio’s upcoming business account will be the first homegrown SME banking product in Switzerland and will be joining similar propositions from foreign digital banking startups including N26 and Revolut.

These startups are evolving in a sector where Swiss incumbents have been slow to innovate. Credit Suisse’s affordable digital banking offering CSX is only available to the retail market, and UBS appears to be lacking a digital-first banking product for SMEs and instead provides online banking capabilities as well as discounts on fees for startups.

But 2021 saw a handful of Swiss banks making efforts to better service the SME market. Raiffeisen Switzerland, for example, teamed up with digital banking software provider Backbase last year to revamp customer engagement and improve experience.

The bank said it will base its retail and SME digital offerings on the Backbase Engagement Banking Platform to deliver a new customer experience and regroup all of its digital services into one single platform. This strategic move will allow Raiffeisen to deliver seamless experiences to customers, including digital engagement channels and the services provided in local branches, it said.

Europe’s red hot SME neobanking industry

These developments come on the back of a rapidly rising digital SME banking sector in Europe.

In the UK, SME business account provider Tide is one of the fastest growing fintech startups in the country, serving over 350,000 SMEs. The startup launched operations in India in 2020, its first international market.

In France, Qonto serves SMEs and freelancers, providing services including deposit accounts, financial management, debit cards for corporate expenses, payment solutions, and more. Qonto is one of the most well-funded fintech startups in France, and is reportedly in talks to close a EUR 400 million round at a massive EUR 4.4 billion valuation.

In Germany, Penta has amassed more than 25,000 business customers, allowing them to manage all of their financial activities from a single platform. The startup closed a EUR 22.5 million Series B funding round last year.

And in Greece, Viva Wallet raised US$80 million in April 2021 to expand its footprint across Europe and the services it offers. Viva Wallet currently serves customers across 23 European countries with services including business accounts, digital debit cards, small business payment solutions and credit card acceptance. The startup is reportedly working on a new round of funding which could include participation from JP Morgan.