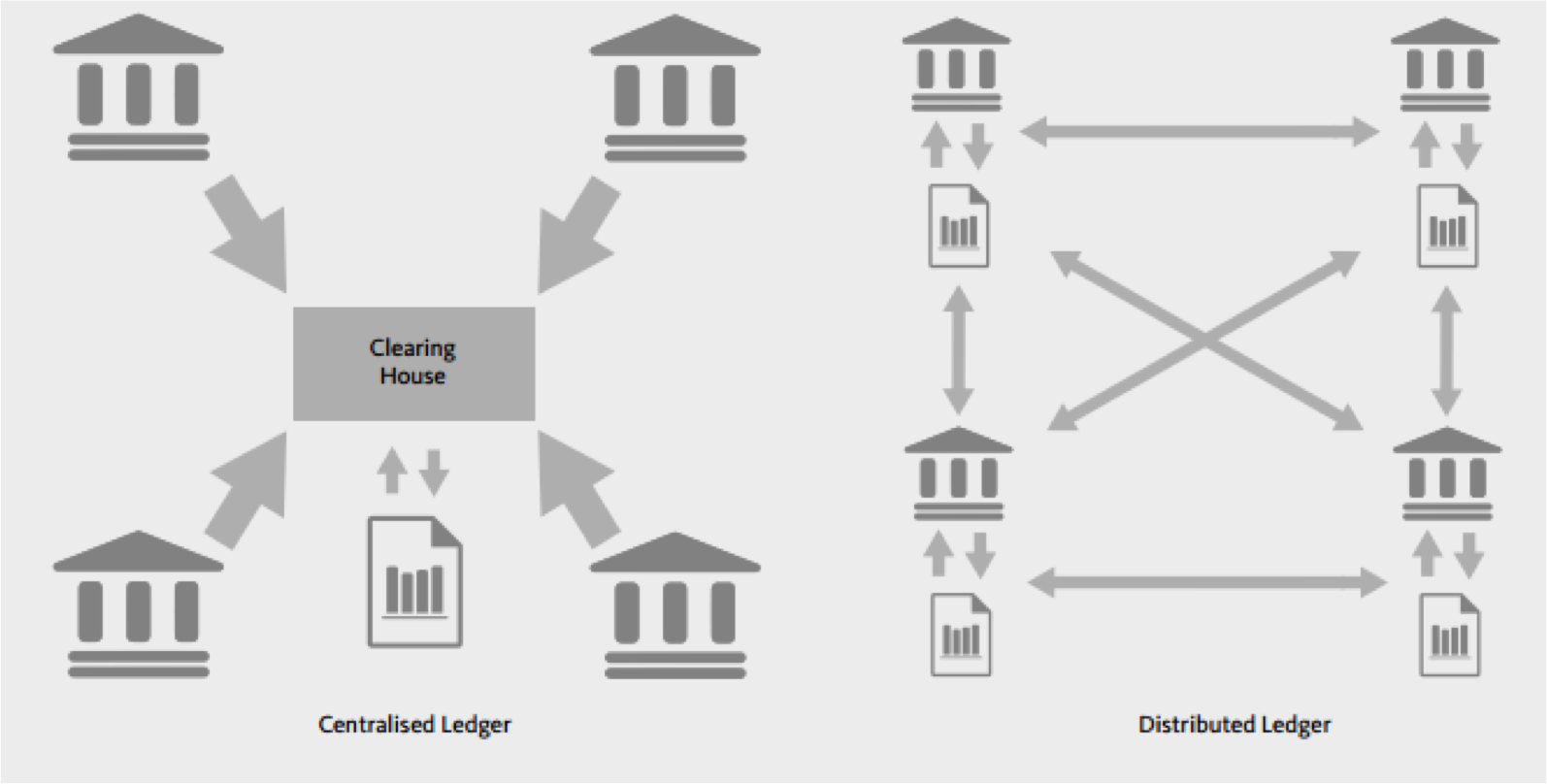

Given that the ‘distributed ledger’ technology upon which Bitcoin has been developed allows a payment system to operate without the need for intermediaries such as central banks, it is looking increasingly likely that the financial system is set to undergo a comprehensive transformation.

It also implies that centralized payment systems could begin to be phased out and replaced by decentralized ones, with trading, clearing and settlement being just three examples of processes likely to undergo disintermediation.

Whereas a centralized system relies on all parties to trust a third party (the central bank, in most cases) to keep a secure, correct digital record of transactions, the Bitcoin transaction relies on there being numerous copies of this record distributed across the network. Assuming, then, that the cryptography of the system works, the requirement for a third-party becomes largely irrelevant.

(Source)

The monetary system of Bitcoin challenges the central banks’ role

Central banks play a pivotal role in ensuring financial stability within a monetary system, however, meaning that payment innovations are being closely monitored by banks such as the Fed, the European Central Bank and the Bank of England. Indeed, central banks have a responsibility in supporting safe payment systems.

Bitcoin’s notable price volatility since its creation, for instance, is one of the key concerns for central banks – were a systematic price crash to occur, it remains debatable as to just how much responsibility the central bank could or should bear. Even the bank is technically not at fault, a widespread loss of confidence in the bank and the financial system could still arise.

More researches on digital currencies are expectedly conducted

Most central banks are in ‘monitoring mode’ at present, generally stating that more research needs to be done before policy can be considered. More recently, however, Bitcoin’s growth has prompted some central banks to express interest in possibly issuing their own digital currencies, backed by their respective country’s government. While this is yet to materialise anywhere, the Bank of Canada has been among the most open to exploring such technology.

The bank’s senior deputy governor Carolyn Wilkins stated last month that “we have to envision a world in which people mostly use e-money, perhaps even one that’s not denominated in a national currency, such as Bitcoin”, although remained wary of the ostensible risks that could arise, where central banks would struggle to implement monetary policy and where massive losses could be realized were the currency to crash. Wilkins has made clear that the Bank of Canada will explore the implications of digital currencies over the course of its three-year corporate plan.

The idea is of Government-backed digital currency

While much of the attention (and indeed, risk-aversion) on Bitcoin has primarily been concerned with the currency’s nascent price volatility, the Bank of England (BoE) has focused more on the potential impact of the distributed ledger technology. The UK central bank has provided particularly glowing feedback to blockchain, with the bank’s chief economist Andy Haldane recently praising the technology’s potential capability in solving the challenge of ‘how to establish trust – the essence of money – in a distributed network’.

Like the Bank of Canada, moreover, Haldane is also in favor of issuing a government-backed digital currency, although in the UK’s case he argues that it could be used to charge a negative interest rate on currency, a measure which is not possible at present due to the widespread use of banknotes which could simply be held in safe deposit boxes to maintain value and would thus render attempts by the central bank to implement a negative rate as useless. The shift from paper to paperless currency, however, opens up the possibility of digital currency creation.

Bitcoin circulation in the market is considerable

In the BoE’s paper published last year, The Economics of Digital Currencies, the bank estimated that the amount of bitcoins circulating within the UK economy was less than 0.1% of sterling notes and coins and only 0.003% of broad money balances. As such, the impact from any serious Bitcoin fallout on the UK’s financial and monetary systems is considered negligible.

The Federal Reserve, meanwhile, has gradually become more vocal about the subject. During Bitcoin’s early existence, the US central bank was notoriously silent about Bitcoin, but began discussing the subject soon after the FBI shut down Silk Road – the illegal online marketplace – when 26,000 BTC worth $3.6 million was seized in October 2013.

In early 2014, Fed chief Janet Yellen stated that the Fed does not have the authority to regulate Bitcoin, due to the fact that this is ‘payment innovation that is taking place entirely outside the banking industry’. She did raise concerns about the potential for money-laundering, however, and has also recommended that Congress address the legality issues for those unregulated entities involved in virtual currencies.

The Fed has also conducted empirical analysis which has sought to test the security of the cryptography for transactions and the distributed maintenance of the ledger. The US central bank has remained somewhat averse to Bitcoin, highlighting the February 2014 bankruptcy of Mt. Gox, the largest bitcoin exchange at the time, and concluding, therefore, that Bitcoin many risks “whose nature and proportion are little, if at all, understood”.

More recently, the Fed’s official position has been to quietly monitor developments as they happen, but it has not stated whether it is considering issuing its own digital currency.

Digital currency, Bitcoin, raises several potential risks

The Bank of International Settlements (BIS), however, seems to have recently shown considerable enthusiasm towards the advancement of digital currencies. Although not explicitly a central bank, the BIS holds the membership of 60 global central banks, and has been instrumental in determining much of the regulatory landscape since 2007’s financial crisis. In its November 2015 paper, the CPMI Report on Digital Currencies, the BIS states several potential risks arising from the growing use of digital currencies, such as consumer losses resulting from excessive volatility, as well as fraud – a problem which has plagued Bitcoin on previous occasions.

The report also acknowledges the diminished role that financial intermediaries could play as digital currencies and distributed ledger systems become smarter. Ultimately, though the BIS’ opinion on digital currencies remains favorable, especially pertaining to those which have a decentralized payment mechanism, describing them as “an innovation that could have a range of impacts on various aspects of financial markets and the wider economy”.

Yuan was used in 80% Bitcoin transaction

The challenge in addressing Bitcoin appears to be more complex for China’s central bank at present, however. According to Goldman Sachs research from March 2015, the Yuan is being used for 80% of global transactions into and out of Bitcoin, indicating the digital currency’s overwhelming popularity in China. This wouldn’t be so much of a problem were it not for the fact that the People’s Bank of China banned the handling of Bitcoin transactions in December 2013, before closing down more than 10 of the currency’s exchanges in March 2014.

The view from the central bank is that the currency has no ‘real meaning’, but the consensus view is that it is being used for large-scale money laundering. The huge popularity of Bitcoin in China suggests that, while some may be using Bitcoin for speculative purposes, a large proportion are using the currency to shift money illegally out of China.

Conclusion

More recently, however, it appears that China’s view towards Bitcoin could be warming. In an October publication, the Cyberspace Administration of China (CAC) stated clearly that we are now in the “post-Bitcoin era,” acknowledging the development that bitcoin has ushered in through the “expansion of distributed payment and settlement mechanism”. Whether such sentiment will ultimately be transmitted through the corridors of the central bank remains to be seen at this stage.

Given that minting and distributing a digital currency should cost a fraction of the cost of printing and distributing a physical currency note, one should also bear in mind the seignior age benefits of moving towards paperless currency – that is, the potential revenue the government will retain from such a cost-saving. Along with the fact that digital currency transactions will be easier to track and less susceptible to illegal uses, there seems to be plenty of incentives for central banks to promote the development of digital currencies like Bitcoin.

37 Comments so far

Jump into a conversationSingapore’s Central Bank Still Enthusiastic About Blockchain-based International Payments

https://cryptocomes.com/singapores-central-bank-still-enthusiastic-about-blockchain-based-international-payments

Bitcoin has become more and more popular all over the world, there are many advantages when it is growing stronger, but it is also impossible to avoid unnecessary risks.

And now it’s the other way around. Banks are beginning to perceive the Bitcoin more realistically.

Currently, the Bitcoin market is unstable, causing difficulties for merchants and players.

She eagerly welcomed female club members.

a lot of people are now miserable because of bitcoin

Getting assistance with assignments is a breeze with abc homework help. Talk to one of our experts and explain the situation. She was thrilled to have women join the group.

Because of bitcoin, a lot of individuals are now suffering.

Good day! This post could not be written any far better!

That seems to be a problem with the connection to me. Can you check if this console is correctly connected to the adjacent one? If everything seems fine, you can try contacting support. It is possible that the control panel needs to be replaced if it flickers.

That seems to be a problem with the connection to me. Can you check if this console is correctly connected to the adjacent one? If everything seems fine, you can try contacting support. It is possible that the control panel needs to be replaced if it flickers.

Can I share it?

Indeed, the development of Bitcoin and the underlying distributed ledger technology, known as blockchain, has the potential to revolutionize the financial system. The decentralized nature of blockchain allows for peer-to-peer transactions without the need for intermediaries, such as central banks or traditional financial institutions.

Thanks for sharing and I will follow you in future. And please share more knowledge if you have.

Online multiplayer battle royale game called Stumble Guys! Online races between up to 32 players feature frantic obstacle courses.

Wordle is an online game that challenges players to guess a five-letter word within six attempts. Each guess is met with color-coded feedback: green for correct letters in the right position, yellow for correct letters in the wrong position, and gray for incorrect letters. The objective is to decode the hidden word using these clues. play NYT Wordle and Improve Your Vocabulary.

Wordle 2 is an updated version of the popular word puzzle game called “Wordle.” The word-guessing game challenges players to guess a hidden five-letter word within six attempts. Here’s how to play Wordle 2

Waffle Game is a virtual gaming experience that combines the joy of waffle appreciation with immersive gameplay. It’s not just about flipping waffles; it’s about navigating through a world filled with syrupy challenges and delightful surprises.

This is a risky market. For those who don’t understand it, research carefully before investing in anything.

This is a risky market. For those who don’t really understand it, please research carefully before deciding to invest in anything.

Visit our site to find more about wedding photographer Northern Virginia. We offer engagement and proposal photography in Va.

This is such a great resource that you are providing and you give it away for free. I love seeing blog that understand the value of providing a quality resource for free.

Elevate your word game with the daily challenges presented by Wordle on The New York Times.

That gives off an impression of being fabulous anyway i am still not very beyond any doubt that I like it. At any rate will look much more into it and choose by and by!

Your post has those facts which are not accessible from anywhere else. It’s my humble request to u please keep writing such remarkable articles

Great job for publishing such a beneficial web site. Your web log isn’t only useful but it is additionally really creative too. There tend to be not many people who can certainly write not so simple posts that artistically. Continue the nice writing

Today bitcoin price is 65,000. Who thought that bitcoin hit that point again after pandemic

Who purchase bitcoin in start is very lucky and who starts this digital currency is real genius

I take bitcoin before corona pandemic I loss my a lot of savings after that I didn’t buy any digital coin Specific Solutions

I want to purchase it but i don’t have enough savings

Harvey s Menu Prices Canada, a vairety of items, prices ranges from CAN 0 19 to CAN 18 19, Working hours from 10 30 am till 11 00 pm

Central banks play a pivotal role in ensuring financial stability within a monetary system, however, meaning that payment innovations are being closely monitored by banks such as the Fed, the European Central Bank and the Bank of England

central bank is that the currency has no real meaning but the consensus view is that it is being used for large-scale money laundering

the Bitcoin transaction relies on there being numerous copies of this record distributed across the network

Networking has long been hailed as a crucial component of professional success, and in today’s digital age, its significance has only magnified. In the realm of career advancement and personal growth, the ability to forge meaningful connections can open doors to opportunities that may have otherwise remained elusive. Understanding the dynamics of networking and how to navigate them effectively is key to leveraging its full potential.

My process for recovery has been kind of a bumpy process because of the fake recovery agents I encountered earlier on, however with the support given to me in the consultation and during my one on one conversations with the Team via their Email ( WZARDGARRYSPEEDHACK @GMAIL .COM ) and I have collectively succeeded in recouping my locked up BTC Assets valued at $326,790 within the space of 48 hours !! Or rather the team worked hard on my behalf, I only had to provide them with a few details regarding my investment with the fraud company and they did the rest for me. Prior to meeting SPEED RECOVERY FIRM, i had met a few recovery agents as well that only seemed to care about their service fee similar to what the fraud company was doing to me and at some point I almost gave up the believe that I would ever get back my money but today, I’ve done full circle to come back here and give my own thankful review since I learnt about the team through the many reviews on here. I feel ready to take on the world with my new found awareness and SPEED RECOVERY on my team! … I wish they would create more awareness platforms and opportunities to help enlighten more people about crypto and how best to navigate the digital financial landscape, this will surely help to reduce the fast spreading fraudulent activities going on there and save potential investors from falling prey!. Glad I know it now and I can teach it to my children so they wont make the same mistakes I did. You can also contact them via their official email address ( WZARDGARRYSPEEDHACK @GMAIL .COM ) OR WhatsApp +1 336 394 2139