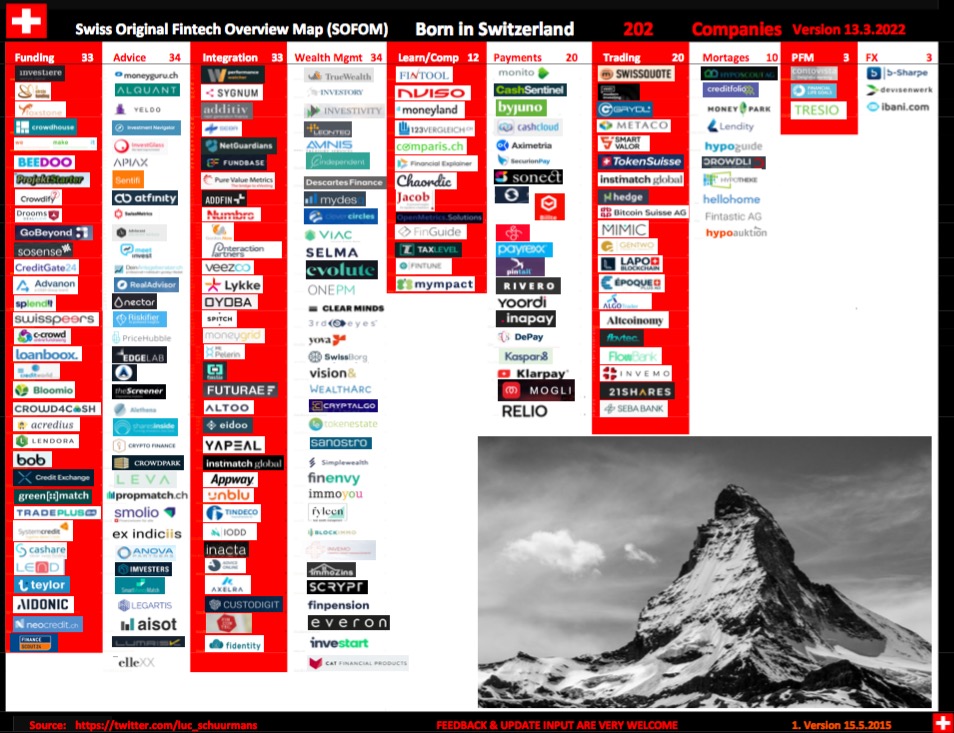

“BORN IN SWITZERLAND” Swiss Original Fintech Overview Map Update: 202 Companies

by Fintechnews Switzerland March 14, 2022Luc Schuurmans, Deputy CEO, Executive Management at Bank Linth, put together an updated overview map of Fintech Companies “Born in Switzerland”.

Here are the descriptions of all the Swiss Fintechs listed in Luc’s map:

Funding

Verve Ventures is a network and technology-driven venture capital firm based in Switzerland. Founded in 2010 by Steffen Wagner and Lukas Weber, Verve Ventures has grown to more than 45 team members and has become one of the most active venture investors in Europe with over 140 science and technology-driven startups in its portfolio. A dozen investment professionals identify the most promising digital, tangible and health & bio startups. Selected private and institutional investors get access to investment opportunities through a digital platform. The company invests EUR 0.5 million to several million from Seed Stage onward in startups across Europe. Verve Ventures’ dedicated team helps startups with their most pressing needs such as hiring, client introductions and an expert network of high-profile individuals.

Verve Ventures is a network and technology-driven venture capital firm based in Switzerland. Founded in 2010 by Steffen Wagner and Lukas Weber, Verve Ventures has grown to more than 45 team members and has become one of the most active venture investors in Europe with over 140 science and technology-driven startups in its portfolio. A dozen investment professionals identify the most promising digital, tangible and health & bio startups. Selected private and institutional investors get access to investment opportunities through a digital platform. The company invests EUR 0.5 million to several million from Seed Stage onward in startups across Europe. Verve Ventures’ dedicated team helps startups with their most pressing needs such as hiring, client introductions and an expert network of high-profile individuals.

With the aim of giving both borrowers and lenders more freedom and control over their loans, 3circlefunding allows fwealborrowers to set loan interest rates and investors to sell loan parts in its secondary market. This makes 3circlefunding one of the few secondary market providers in Switzerland.

With the aim of giving both borrowers and lenders more freedom and control over their loans, 3circlefunding allows fwealborrowers to set loan interest rates and investors to sell loan parts in its secondary market. This makes 3circlefunding one of the few secondary market providers in Switzerland.

Foxstone is a Swiss real estate crowdfunding platform. The platform proposes institutional-grade real estate deals in Switzerland through three types of investments: co-ownership, co-investment and mezzanine debt with a minimum investment amount of CHF 25’000.

Foxstone is a Swiss real estate crowdfunding platform. The platform proposes institutional-grade real estate deals in Switzerland through three types of investments: co-ownership, co-investment and mezzanine debt with a minimum investment amount of CHF 25’000.

Bricks & Bytes AG provides with crowdhouse.ch the first real estate crowd funding platform in Switzerland. By democratizing the way of being a real estate owner it makes everyone a happy landlord.

wemakeit.com was founded in Switzerland in February 2012 by the communication consultant Rea Eggli, the artist Johannes Gees and the interaction designer Jürg Lehni and within very short time grew into one of the largest crowdfunding platforms in Europe.

Beedoo is a platform proposing investment solutions to invest directly in the real economy, in startups & SME’s, Real Estate and Impact Investing.

Beedoo is a platform proposing investment solutions to invest directly in the real economy, in startups & SME’s, Real Estate and Impact Investing.

Projektstarter ist eine Crowdfunding-Plattform mit Sitz in Solothurn, welche seit dem Jahr 2011 tollen Ideen und ihren Machern eine Möglichkeit zur Finanzierung bietet. Sie ist in Besitz der Designatelier GmbH. ProjektStarter bietet den Menschen im Raum Schweiz die Möglichkeit ihre Idee oder ihr Projekt zu finanzieren.

Projektstarter ist eine Crowdfunding-Plattform mit Sitz in Solothurn, welche seit dem Jahr 2011 tollen Ideen und ihren Machern eine Möglichkeit zur Finanzierung bietet. Sie ist in Besitz der Designatelier GmbH. ProjektStarter bietet den Menschen im Raum Schweiz die Möglichkeit ihre Idee oder ihr Projekt zu finanzieren.

On the platform crowdify.net Initiators present their projects and leave them there for 100 days to be funded by Boosters.

On the platform crowdify.net Initiators present their projects and leave them there for 100 days to be funded by Boosters.

Drooms is the leading provider of data rooms in Europe, connecting professionals and information in the worlds´ real capital markets.

Drooms is the leading provider of data rooms in Europe, connecting professionals and information in the worlds´ real capital markets.

Go Beyond Investing brings together a group of private accredited investors dedicated to providing early-stage capital with entrepreneurs seeking investment capital. Go Beyond Investing enables novice & experienced, small & large investors, to access angel investing as an asset class through its unique platform, tools, training and expert angels.

Go Beyond Investing brings together a group of private accredited investors dedicated to providing early-stage capital with entrepreneurs seeking investment capital. Go Beyond Investing enables novice & experienced, small & large investors, to access angel investing as an asset class through its unique platform, tools, training and expert angels.

SoSense is a pioneer in digital social innovation with offices in Zürich (Switzerland) and Berlin (Germany). They design creative and engaging concepts, implement innovative and empowering solutions and help run impactful campaigns with leverage.

CreditGate24 connects borrowers with private and institutional investors and offers an efficient and scalable settlement of loans. CreditGate24 operates exclusively online, with no branches or high administrative expenses in order not to diminish the yields on investment and to minimize the cost for borrowers.

Advanon is an authorized financial intermediary that is directly subordinated to FINMA (Directly Subordinated Financial Intermediary, DSFI) according to the Anti Money Laundering Act (AMLA).

Advanon is an authorized financial intermediary that is directly subordinated to FINMA (Directly Subordinated Financial Intermediary, DSFI) according to the Anti Money Laundering Act (AMLA).

Splendit matches students and investor in an auction process, issue documentation and manages payments through the lifetime of the loans.

swisspeers ist eine unabhängige Crowdlending Plattform, die es Unternehmen erlaubt, bei Investoren direkt – also ohne Zwischenschaltung eines Finanzinstituts – Fremdkapital zu beschaffen.

c-crowd represents a new way of financing entrepreneurs while democratising the concept of business angels, brings together innovative entrepreneurs and investors.

Loanboox is the independent money and capital market platform for public-sector borrowers and institutional investors. In contrast to conventional brokering, financing and investing through Loanboox is simple, transparent, safe and low cost, benefiting both borrowers and lenders alike.

creditworld verbindet Schweizer KMUs mit privaten sowie professionellen Investoren. KMUs profitieren von attraktiven Konditionen und fairen Vertragsbedingungen. Investoren erhalten Zugang zu einer neuen Anlageklasse mit interessanten Renditen und unterstützen dabei das Rückgrat der Schweizer Volkswirtschaft.

Bloomio is a digital investment platform connecting startups with individual investors. The platform allows startup founders to raise capital by tokenizing equity and gives investors the possibility to trade startup stakes through a secure blockchain-based marketplace.

Bloomio is a digital investment platform connecting startups with individual investors. The platform allows startup founders to raise capital by tokenizing equity and gives investors the possibility to trade startup stakes through a secure blockchain-based marketplace.

Swiss Crowdlending FinTech for private persons and SME. Crowd Solutions is the provider of Crowd4Cash.ch the innovative Crowdlending platform. Crowd4Cash brings investors and borrower together. For better returns for the investors and lower interest rates for borrower. 100% online, easy and simply fair!

Swiss Crowdlending FinTech for private persons and SME. Crowd Solutions is the provider of Crowd4Cash.ch the innovative Crowdlending platform. Crowd4Cash brings investors and borrower together. For better returns for the investors and lower interest rates for borrower. 100% online, easy and simply fair!

Acredius is an online platform that makes investors’ and borrowers’ needs meet in an unconventional, digital, intuitive and safe environment. Investors can diversify their portfolios and enjoy interesting yields. Borrowers get access to fair financing using their traditional and non-traditional data.

Lendora is a Swiss crowdlending startup. Our platform connects borrowers and investors online to make credit more accessible and investing more rewarding.

Lendora is a Swiss crowdlending startup. Our platform connects borrowers and investors online to make credit more accessible and investing more rewarding.

bob verbindet zuverlässige Finanzlösungen mit technischem Komfort und macht Ihnen mit seinen Online-Produkten das Leben so einfach wie möglich.

bob verbindet zuverlässige Finanzlösungen mit technischem Komfort und macht Ihnen mit seinen Online-Produkten das Leben so einfach wie möglich.

Führend in Immobilienfinanzierungen in der Schweiz Wir schaffen eine Verbindung zwischen Hypothekarkunden und institutionellen Kreditgebern und erreichen dadurch den besten Zins in Echtzeit. Dabei stehen wir für Integrität, Neutralität, Transparenz und die Sicherheit des Hypothekarmarktes. Unsere Partner zählen zu den Besten auf ihrem Gebiet, teilen unsere Werte und stehen für unternehmerisches Wachstum.

Führend in Immobilienfinanzierungen in der Schweiz Wir schaffen eine Verbindung zwischen Hypothekarkunden und institutionellen Kreditgebern und erreichen dadurch den besten Zins in Echtzeit. Dabei stehen wir für Integrität, Neutralität, Transparenz und die Sicherheit des Hypothekarmarktes. Unsere Partner zählen zu den Besten auf ihrem Gebiet, teilen unsere Werte und stehen für unternehmerisches Wachstum.

![GREEN[]MATCH](http://fintechnews.ch/wp-content/uploads/2018/12/GREENMATCH-150x150.png) Greenmatch combines the perspectives of all market participants on one single platform and allows for an efficient interaction. Thanks to the independent, certified financial model, discussions regarding deviations between the financial models of the buyer and the seller do no longer occur. Detailed risk analysis strengthen the trust of banks and accelerate the closure of the project financing. Thus, each market participant saves valuable time and can focus more on his key competences.

Greenmatch combines the perspectives of all market participants on one single platform and allows for an efficient interaction. Thanks to the independent, certified financial model, discussions regarding deviations between the financial models of the buyer and the seller do no longer occur. Detailed risk analysis strengthen the trust of banks and accelerate the closure of the project financing. Thus, each market participant saves valuable time and can focus more on his key competences.

Tradeplus24 specialises in providing Swiss KMUs with state of the art Insurance and Receivables Finance solutions. Unlike factoring, our innovative solution offers SMEs the opportunity to get a flexible credit line against their accounts receivable whilst offering them the option to insure their global accounts receivables against default. This way Swiss KMU’s can grow their export business in a financially sound and safe way, even when their buyers demand longer payment terms and want to trade own open account basis.

Tradeplus24 specialises in providing Swiss KMUs with state of the art Insurance and Receivables Finance solutions. Unlike factoring, our innovative solution offers SMEs the opportunity to get a flexible credit line against their accounts receivable whilst offering them the option to insure their global accounts receivables against default. This way Swiss KMU’s can grow their export business in a financially sound and safe way, even when their buyers demand longer payment terms and want to trade own open account basis.

Systemcredit is a service provider to the lending industry. As the external rating agency, it helps SME to get suitable financing faster, at lower cost. And it enables lenders to grow their loan portfolios at reduced risk and lower process cost.

Systemcredit is a service provider to the lending industry. As the external rating agency, it helps SME to get suitable financing faster, at lower cost. And it enables lenders to grow their loan portfolios at reduced risk and lower process cost.

Cashare was founded in January 2008 as a public limited company under Swiss law, has its registered office in Hünenberg (ZG) and is registered in the commercial register of the Canton Zug. They are an approved financial intermediary pursuant to Art. 2, para. 3 of the Swiss Money Laundering Act and are audited by PricewaterhouseCoopers AG.

was founded in January 2008 as a public limited company under Swiss law, has its registered office in Hünenberg (ZG) and is registered in the commercial register of the Canton Zug. They are an approved financial intermediary pursuant to Art. 2, para. 3 of the Swiss Money Laundering Act and are audited by PricewaterhouseCoopers AG.

LEND matches investors with borrowers. Investors earn substantial returns and borrowers benefit from low interest rates. From person to person. Without a bank in the middle.

LEND matches investors with borrowers. Investors earn substantial returns and borrowers benefit from low interest rates. From person to person. Without a bank in the middle.

Teylor is a Swiss technology company focused on building better financial products for small businesses in Europe.

Teylor is a Swiss technology company focused on building better financial products for small businesses in Europe.

Aidonic is a Blockchain-powered platform for social fundraising and digital last mile distribution of humanitarian aid.

Aidonic is a Blockchain-powered platform for social fundraising and digital last mile distribution of humanitarian aid.

neocredit.ch AG is a Crowdlending platform specialised in business loans to Swiss SMEs. Thanks to the simple, fast and transparent process, SMEs can easily finance their projects. neocredit.ch AG is the only Swiss Crowdlending platform uniting two strong partners: Vaudoise Insurance and Credit.fr, a leading French crowdlending platform.

neocredit.ch AG is a Crowdlending platform specialised in business loans to Swiss SMEs. Thanks to the simple, fast and transparent process, SMEs can easily finance their projects. neocredit.ch AG is the only Swiss Crowdlending platform uniting two strong partners: Vaudoise Insurance and Credit.fr, a leading French crowdlending platform.

FinanceScout24 ist der erste mitdenkende digitale Partner für die wichtigsten Finanz- und Versicherungsthemen des Lebens. Als One-Stop-Shop ermöglicht FinanceScout24 den Vergleich und Abschluss von Hypotheken, Motorfahrzeugversicherungen und Konsumkrediten und steht den Usern mit Hintergrundwissen und Beratung rund um diese Themen zur Seite.

Advice

moneyguru.ch ist der digitale Assistent für private Finanzen in der Schweiz. Der Moneyguru ist von den Gründern von moneyland.ch ins Leben gerufen worden. Die unabhängige Vergleichsseite moneyland.ch ist sozusagen die Mutter, die Datenlieferantin und der Rechner von Moneyguru.

Alquant improves traditional asset management through quantitative methods and artificial intelligence for the benefit of its clients. Alquant’s purpose is to enable more and more people to enjoy greater financial prosperity by protecting and growing their assets. At Alquant, we strive for clear, sound and effective investment solutions.

Alquant improves traditional asset management through quantitative methods and artificial intelligence for the benefit of its clients. Alquant’s purpose is to enable more and more people to enjoy greater financial prosperity by protecting and growing their assets. At Alquant, we strive for clear, sound and effective investment solutions.

Yeldo is an innovative real estate investment platform based in Zürich and in Lugano. We are specialized in professional selection of real estate assets and investment structuring.

Investment Navigator is operated by Investment Navigator AG based in Zurich. Investment Navigator AG works closely with fundinfo, the leading platform for information and mandatory disclosures in the fund sector.

InvestGlass is a 24/7 financial markets platform built with Swiss banking know-how and a predictive algorithm. Their goal is to deliver smart financial information investors need at the right time and in the right format. Equities, Bonds, Forex, ETF, Futures, News and much more…

Apiax is a compliance digitally mastered. We transform complex regulations into easy-to-use digital compliance rules.

Sentifi is a leading Crowd-Intelligence platform for financial markets globally, receiving Swiss FinTech Award 2016. Their unique approach is to structure unstructured financial data from news, blogs and social media, identify and rank the sources for their relevance and apply self-learning algorithms and a financial expert system to extract insights from the content.

At atfinity, we disrupt the way thousands of businesses manage processes: We give companies the tools to create apps for simple or complex processes themselves. Our “Excel of processes” is used to create a wide range of tools from digital onboarding solutions and KYC processes to legal request handling.

SwissMetrics is a dynamic startup from Switzerland that has a mission to enhance the way companies monitor their credit risk. As finance professionals, they have developed a SaaS platform with the aim of promoting smarter collaboration within companies to work for a common goal – saving money through risk minimization.

With diverse academic backgrounds ranging from information technology, mathematics, business administration, political sciences and philosophy, economics, design, linguistics and psychology, Adviscent‘s team of experts brings solid domain expertise on board in the banking, pharmaceutical, manufacturing and food industries.

MeetInvest seeks to democratize stock market investment with a free service that combines a social media platform and an investor toolkit, bringing in one place all the necessary resources for people to start trading like pros.

By leveraging technology, Dein-Anlageberater.ch provides users with personalized investment advisory services and recommendations for asset allocation at a much lower price than traditional investment advisers.

RealAdvisor a pour mission d’améliorer et optimiser votre expérience de vente et d’achat de biens immobiliers en Suisse grâce à des outils modernes et précis. The most reliable real estate valuation tool in Switzerland.

Nectar Financial, formerly Etops, is a Swiss fintech company specializing in wealth and asset management. It provides middle and back office services for more than 30 family offices, independent asset managers and banks and supports them in managing assets in excess of CHF 35 billion.

Riskifier makes investment risk profiling simple, fun and insightful for everyone. Our solution uses latest advances of artificial intelligence to fulfill the requirements of MiFID II/FIDLEG investor risk profiling and KYC data collection, while digitalizing & gamifying user experience as well unleashing advantages of behavior based personalized investment risk profiles.

Pricehubble is a Swiss B2B proptech company that builds innovative digital solutions for the real estate industry based on property valuations and market insights. Leveraging big data, cutting-edge analytics and great visualization, PriceHubble’s products suite brings a new level of transparency in the market, enabling their customers to make real estate and investment decisions based on the most accurate data-driven insights and enhance the dialogue with end consumers.

Pricehubble is a Swiss B2B proptech company that builds innovative digital solutions for the real estate industry based on property valuations and market insights. Leveraging big data, cutting-edge analytics and great visualization, PriceHubble’s products suite brings a new level of transparency in the market, enabling their customers to make real estate and investment decisions based on the most accurate data-driven insights and enhance the dialogue with end consumers.

EdgeLab is a fintech company providing an investment intelligence web platform to help financial institutions taking smarter decisions.

EdgeLab is a fintech company providing an investment intelligence web platform to help financial institutions taking smarter decisions.

theScreener is the market leader for independent valuations of financial securities, equities, sectors and markets, and new funds.

Alethena is the first Swiss ICO and Blockchain-Asset Rating Agency and Due Diligence Service Provider.

Alethena is the first Swiss ICO and Blockchain-Asset Rating Agency and Due Diligence Service Provider.

With deep technical insight, vast financial market experience, and a conclusive rating methodology, Alethena bridges the gap between blockchain and established investors. As a Swiss company neutrality is a core of our culture.

As a Swiss FinTech company, we offer digital solutions for issuers to have a direct channel of communication to investors, on a global scale. Keeping up with the demands of increasingly tech-savvy investors is hard, Sharesinside aims to simplify this process, giving you more time to focus on what’s really important – your narrative.

As a Swiss FinTech company, we offer digital solutions for issuers to have a direct channel of communication to investors, on a global scale. Keeping up with the demands of increasingly tech-savvy investors is hard, Sharesinside aims to simplify this process, giving you more time to focus on what’s really important – your narrative.

Crypto Finance AG is a financial technology holding company founded in June 2017. The Group provides blockchain-related services through its three subsidiaries: Crypto Fund AG (Asset Management), Crypto Broker AG (Brokerage), and Crypto Storage AG (Storage).

The Swiss Real Estate sector is one of the most economically and politically stable in the world. It is very popular with institutional investors and remains difficult to access for private investors.

The Swiss Real Estate sector is one of the most economically and politically stable in the world. It is very popular with institutional investors and remains difficult to access for private investors.

In fact, the heterogeneity of properties, their acquisition values, the complexity of financing them and the retention of information signifies that this market still remains relatively inefficient.

Based on these observations, Crowdpark SA, established on December 1st 2017 in Geneva, is an independent company specialized in Swiss Real Estate Crowd-Investing.

Leva sets the new standard for investment syndicates. At the intersection of finance and technology, Leva has developed a novel technology to bring investment syndicates into the 21st century. Our platform allows a fully automated syndicate creation. With Leva, syndicate leaders can conveniently onboard new investors, manage the investor base, and raise capital efficiently.

Leva sets the new standard for investment syndicates. At the intersection of finance and technology, Leva has developed a novel technology to bring investment syndicates into the 21st century. Our platform allows a fully automated syndicate creation. With Leva, syndicate leaders can conveniently onboard new investors, manage the investor base, and raise capital efficiently.

Der erste Robo Advisor für die Immobilienwirtschaft. propmatch ist die einfache Lösung zur Analyse, Bewertung und Vermittlung von Standorten, Renditeimmobilien und Grundstücken in der Schweiz.

Der erste Robo Advisor für die Immobilienwirtschaft. propmatch ist die einfache Lösung zur Analyse, Bewertung und Vermittlung von Standorten, Renditeimmobilien und Grundstücken in der Schweiz.

Smolio ist dein Finanzbuddy. Wir begleiten dich und verkaufen keine Finanzprodukte. Anders als andere profitieren wir nicht versteckt von unseren Empfehlungen. Was du bezahlst finanziert die künftige Entwicklung von Smolio. Eben unabhängig.

Smolio ist dein Finanzbuddy. Wir begleiten dich und verkaufen keine Finanzprodukte. Anders als andere profitieren wir nicht versteckt von unseren Empfehlungen. Was du bezahlst finanziert die künftige Entwicklung von Smolio. Eben unabhängig.

ex indiciis believe that customer relationship is at the core of the wealth management industry. As a consequence we provide wealth managers with the necessary tools to deliver personalized content to any user interacting with the company through any digital channel.

ex indiciis believe that customer relationship is at the core of the wealth management industry. As a consequence we provide wealth managers with the necessary tools to deliver personalized content to any user interacting with the company through any digital channel.

Anova Partners provide an independent marketplace where investors and manufacturers meet to achieve better investment decisions facilitated through technologically enabled investment, risk, product management as well as execution services in order to manage your portfolio in a simple way.

Anova Partners provide an independent marketplace where investors and manufacturers meet to achieve better investment decisions facilitated through technologically enabled investment, risk, product management as well as execution services in order to manage your portfolio in a simple way.

Imvesters offers you concrete investments in performance real estate that will supplement your income every month.

Imvesters offers you concrete investments in performance real estate that will supplement your income every month.

SmartMoneyMatch.com offers two main functionalities: 1. Investments can be classified analogous to eBay and according to these criteria you can offer or demand investments. You can state what your supply is or your demand and giving other users the opportunity to search for supplied or demanded investments with the given criteria. 2. Users can mutually connect. This functionality is similar to LinkedIn with relevant criteria for the investment industry.

SmartMoneyMatch.com offers two main functionalities: 1. Investments can be classified analogous to eBay and according to these criteria you can offer or demand investments. You can state what your supply is or your demand and giving other users the opportunity to search for supplied or demanded investments with the given criteria. 2. Users can mutually connect. This functionality is similar to LinkedIn with relevant criteria for the investment industry.

Legartis is developing an AI-based legal document life cycle solution provided as a SaaS system. It aids companies’ legal and compliance departments, HR and procurement to review, analyze, amend and manage all legal documents throughout their entire life cycle.

Legartis is developing an AI-based legal document life cycle solution provided as a SaaS system. It aids companies’ legal and compliance departments, HR and procurement to review, analyze, amend and manage all legal documents throughout their entire life cycle.

Aisot (“AISignals and Operations in Trading”) is developping algorithms for data analytics and predictive analytics.

Aisot (“AISignals and Operations in Trading”) is developping algorithms for data analytics and predictive analytics.

LumRisk is an independent company that provides state-of-the-art risk consolidation, analysis and reporting services to institutional clients. LumRisk provides risk analysis and reporting, based on full transparency into underlying instruments, on many types of investment programs, such as funds-of-hedge-funds, multi-asset programs, alternative risk premia programs and traditional long-only investments.

LumRisk is an independent company that provides state-of-the-art risk consolidation, analysis and reporting services to institutional clients. LumRisk provides risk analysis and reporting, based on full transparency into underlying instruments, on many types of investment programs, such as funds-of-hedge-funds, multi-asset programs, alternative risk premia programs and traditional long-only investments.

ElleXX ist die unabhängige Geld-Medien-Plattform für Frauen. Sie bringt Inhalte und Investieren zusammen. Frauen haben andere Lebensläufe als Männer. Sie verdienen weniger, erhalten schlechtere Kreditkonditionen, tiefere Darlehen, überziehen eher ihre Konten, zahlen mehr Gebühren und investieren weniger. Sie arbeiten mehr Teilzeit, erben weniger und leben länger. Das wirkt sich alles negativ auf ihre Finanzen aus.

Integration

Performance Watcher Evaluating and comparing the result of one’s investment portfolio must be accessible to everyone. Our aim is to popularize and demystify a traditionally opaque field. We believe in explanations that are simple, clear and understandable to everyone. With the disappearance of Swiss banking secrecy, increased competition, the Internet and a new generation of customers the transparency of results is born.

Performance Watcher Evaluating and comparing the result of one’s investment portfolio must be accessible to everyone. Our aim is to popularize and demystify a traditionally opaque field. We believe in explanations that are simple, clear and understandable to everyone. With the disappearance of Swiss banking secrecy, increased competition, the Internet and a new generation of customers the transparency of results is born.

Sygnum is a technology-driven company that empowers financial services for the digital asset economy. It develops an integrated solution to securely issue, store, trade and manage digital assets.

Sygnum is a technology-driven company that empowers financial services for the digital asset economy. It develops an integrated solution to securely issue, store, trade and manage digital assets.

Additiv develops and implements digital innovations and business models for financial services companies – tailor-made and turnkey.

At SEBA, we want to build a gateway that facilitates movement of assets between the crypto and traditional financial markets for major financial investors. Our ambition is to be one of the world’s first universal, fully licensed and supervised crypto banks, offering industry leading crypto-asset financial products and services.

At SEBA, we want to build a gateway that facilitates movement of assets between the crypto and traditional financial markets for major financial investors. Our ambition is to be one of the world’s first universal, fully licensed and supervised crypto banks, offering industry leading crypto-asset financial products and services.

Founded in 2007, NetGuardians was the first company to emerge from the innovation incubator Y-Parc, in Yverdon-les-Bains, Switzerland. The company now enjoys a solid international presence with a steadily growing clientele in Europe, the Middle East, Asia and Africa.

FundBase is a cloud-based platform to ultimately host the complete investment process for high-conviction alternative investments. Fundbase delivers to qualified investors a seamlessly integrated platform to discover, execute and monitor complex investments such as hedge funds, private equity and other high-conviction investments.

FundBase is a cloud-based platform to ultimately host the complete investment process for high-conviction alternative investments. Fundbase delivers to qualified investors a seamlessly integrated platform to discover, execute and monitor complex investments such as hedge funds, private equity and other high-conviction investments.

Pure Value Metrics provides active investors with a unique combination of Global Equity Portfolio Selection, Market Insight, Online Trading and discretionary Voice Execution.

ADDFIN is a business solution for professional investors who seek to benefit and leverage on the full potential offered by digitalization and information technology in order to standardize the workflow, processes and procedures.

Centralway Numbrs is a customer-centric financial services company. It enables its customers to manage their existing bank accounts and personal finances and to buy any financial product from every provider at the best possible price.

Monetas develops technologies that empower people to live and do business with greater freedom than ever before, and that make financial inclusion a reality.

Interaction Partners is a Swiss-based Investor Relations Services firm with a focus on facilitating broker-independent trust-building, live interactions (roadshows) between listed corporates and institutional investors in Zurich, Basel, Bern, Geneva, Lugano, Milan and London.

We believe that great decision makers are the ones that ask the right questions. Veezoo empowers them to find the answers efficiently by themselves. We make complex information easy to understand by answering any question with a clean visualization.

We believe that great decision makers are the ones that ask the right questions. Veezoo empowers them to find the answers efficiently by themselves. We make complex information easy to understand by answering any question with a clean visualization.

Lykke is a Swiss Fintech company building a global marketplace based on blockchain. It builds on decades of thought and research by company founder Richard Olsen, a pioneer in the field of high-frequency finance. Richard served as co-founder and CEO of OANDA, a leading foreign exchange company. Lykke received initial seed funding in 2015.

Lykke is a Swiss Fintech company building a global marketplace based on blockchain. It builds on decades of thought and research by company founder Richard Olsen, a pioneer in the field of high-frequency finance. Richard served as co-founder and CEO of OANDA, a leading foreign exchange company. Lykke received initial seed funding in 2015.

Oyoba is a finance-as-a-service platform, providing its users access to a wide range of fintech and blockchain services, including bank accounts, Bitcoin wallets, robo advisory, lending, P2P payments and debit cards. Oyoba’s vision is to turn consumer banking into a modern information service by using personal, financial and other data to create new, personalized and better services.

Oyoba is a finance-as-a-service platform, providing its users access to a wide range of fintech and blockchain services, including bank accounts, Bitcoin wallets, robo advisory, lending, P2P payments and debit cards. Oyoba’s vision is to turn consumer banking into a modern information service by using personal, financial and other data to create new, personalized and better services.

Spitch is a Swiss provider of solutions based on Automatic Speech Recognition (ASR) and voice biometrics, Voice User Interfaces (VUI), and natural language voice data analytics.

Spitch is a Swiss provider of solutions based on Automatic Speech Recognition (ASR) and voice biometrics, Voice User Interfaces (VUI), and natural language voice data analytics.

Mt Pelerin is a Swiss FinTech company creating solutions to bridge the crypto economy with traditional finance. Its two core products today are Bridge Wallet, the ultimate app to easily invest in Bitcoin and Ethereum assets, and Bridge Protocol, the open source asset tokenization technology. Mt Pelerin is also working on the holy grail of banking: a full reserve account, where 100% of deposits will be kept in the safe in Switzerland. It will be natively global with multi-currency crypto-fiat IBANs, fully tokenized and connected to digital asset marketplaces.

Mt Pelerin is a Swiss FinTech company creating solutions to bridge the crypto economy with traditional finance. Its two core products today are Bridge Wallet, the ultimate app to easily invest in Bitcoin and Ethereum assets, and Bridge Protocol, the open source asset tokenization technology. Mt Pelerin is also working on the holy grail of banking: a full reserve account, where 100% of deposits will be kept in the safe in Switzerland. It will be natively global with multi-currency crypto-fiat IBANs, fully tokenized and connected to digital asset marketplaces.

Moneygrid is born out of the vision that currency systems should be as diverse as possible and that they should connected to each other if it does make sense.

Moneygrid is born out of the vision that currency systems should be as diverse as possible and that they should connected to each other if it does make sense.

Build trust, not inconvenience. The Futurae Platform authenticates your end users, however you want it.

Build trust, not inconvenience. The Futurae Platform authenticates your end users, however you want it.

Our mission is to increase the security of users online. We know that authentication and transaction confirmation can add value beyond a mere security guarantee. Our platform delivers that promise across industries: flawless customer experiences, real-time decision making, fraud prevention and customers insights analysis.

Altoo has developed its wealth platform in co-creatorship with its clients. Our independence and diversity enables us to connect people, wealth and processes by technology in a unique way.

Eidoo is more than a wallet; it’s a multidimensional, multicurrency crypto platform.

Eidoo is more than a wallet; it’s a multidimensional, multicurrency crypto platform.

Yapeal building a new digital bank and we’ll redefine the way people bank.

Yapeal building a new digital bank and we’ll redefine the way people bank.

Instimatch Global was founded in 2017. The inspiration for doing so, stemmed from the liquidity crisis in 2007/2008. Our founder witnessed first-hand how the interbank lending and borrowing system broke down and trust between financial institutions disappeared within a matter of days.

Instimatch Global was founded in 2017. The inspiration for doing so, stemmed from the liquidity crisis in 2007/2008. Our founder witnessed first-hand how the interbank lending and borrowing system broke down and trust between financial institutions disappeared within a matter of days.

Appway builds software for today, and innovates for the technology of the future. With over 15 years of industry experience, Appway guides the leading financial institutions, both big and small, as they build sustainable and scalable solutions that quickly adapt to changing conditions.

Appway builds software for today, and innovates for the technology of the future. With over 15 years of industry experience, Appway guides the leading financial institutions, both big and small, as they build sustainable and scalable solutions that quickly adapt to changing conditions.

Unblu helps the world’s leading banks deliver an in-person experience online. We provide highly secure engagement and collaboration software, enabling banks to enrich the digital experience of their clients.

Unblu helps the world’s leading banks deliver an in-person experience online. We provide highly secure engagement and collaboration software, enabling banks to enrich the digital experience of their clients.

Tindeco VISION is our award-winning fully integrated investment management platform. VISION is used by Banks, Family Offices and Fund Managers. VISION CORE Technologies provides Portfolio Administration, Portfolio Management, Risk Management, Order Management and Client Relationship Management – making it a comprehensive solution for Asset Managers.

Tindeco VISION is our award-winning fully integrated investment management platform. VISION is used by Banks, Family Offices and Fund Managers. VISION CORE Technologies provides Portfolio Administration, Portfolio Management, Risk Management, Order Management and Client Relationship Management – making it a comprehensive solution for Asset Managers.

IODD is the solution that allows you to have all the cards in hand to make informed decisions and manage your company efficiently

inacta AG delivers exceptional ECM solutions focusing primarily on the Swiss financial market

inacta AG delivers exceptional ECM solutions focusing primarily on the Swiss financial market

adviceonline.ch, the complete and regulatory conform Onboarding, Profiling, Opening Document Management, Advisory and Consolidation Suite for EAM and Banks.

adviceonline.ch, the complete and regulatory conform Onboarding, Profiling, Opening Document Management, Advisory and Consolidation Suite for EAM and Banks.

Axelra is a tech venture builder based in Zurich and loves to build, launch and scale digital products and services and the business around it.

Axelra is a tech venture builder based in Zurich and loves to build, launch and scale digital products and services and the business around it.

The Custodigit platform enables regulated financial service institutes to provide their customers full access to the Crypto Asset Class covering crypto currencies as well as digital assets.

The Custodigit platform enables regulated financial service institutes to provide their customers full access to the Crypto Asset Class covering crypto currencies as well as digital assets.

fidentity AG is a Simply Know Your Customer. Identity verification via document scan and liveness check. Audited customer onboarding fully automated and 24/7.

Learn/Compare

Anders als bei anderen Lernplattformen arbeitet fintool.ch bewusst mit Kurzvideos. Da auf der anderen Seite der zu behandelnde Stoff ausgesprochen vielfältig aber auch von immenser Breite ist, sind der Anzahl solcher Videos kaum Grenzen gesetzt. Der Stoff wird fintool.ch nicht ausgehen. Nach Erscheinen werden die einzelnen „Street-Videos“ in sogenannten Wissensgefässen „zusammengebunden“.

Anders als bei anderen Lernplattformen arbeitet fintool.ch bewusst mit Kurzvideos. Da auf der anderen Seite der zu behandelnde Stoff ausgesprochen vielfältig aber auch von immenser Breite ist, sind der Anzahl solcher Videos kaum Grenzen gesetzt. Der Stoff wird fintool.ch nicht ausgehen. Nach Erscheinen werden die einzelnen „Street-Videos“ in sogenannten Wissensgefässen „zusammengebunden“.

nViso provides the most scalable, robust, and accurate cloud service to measure instantaneous emotional reactions of consumers in online environments. We provide real-time and highly actionable information for Market Research, Brands, Creative Agencies and R&D Product Development. Using award winning and proprietary 3D Facial Imaging technology, compatible with ordinary webcams, we uncover the why and how of customer behaviour in real-time, letting brands make smarter business decisions and build more engaging consumer experiences.

nViso provides the most scalable, robust, and accurate cloud service to measure instantaneous emotional reactions of consumers in online environments. We provide real-time and highly actionable information for Market Research, Brands, Creative Agencies and R&D Product Development. Using award winning and proprietary 3D Facial Imaging technology, compatible with ordinary webcams, we uncover the why and how of customer behaviour in real-time, letting brands make smarter business decisions and build more engaging consumer experiences.

moneyland.ch is a Swiss comparison service site helping you with your financial needs. On moneyland.ch, you can use independent comparison tools for insurance, loans, credit cards, bank accounts, consumer credits, interest rates, trading and much more.

123vergleich – the portal for free insurance comparisons, offers and expert advice. 3 steps to the best offer: Compare – Request an offer – Save premiums!

Chaordic AML and Client Due Diligence Technology

Chaordic AML and Client Due Diligence Technology

Jacob Financial provides digital regulatory expertise trying to make the life of compliance officers a bit easier.

Jacob Financial provides digital regulatory expertise trying to make the life of compliance officers a bit easier.

OpenMetrics Solutions LLC is a software technology firm with a strong focus on financial engineering. Our core technologies are based on solid academic research at the Institute for Theoretical Physics at ETH Zurich (Swiss Federal Institute of Technology in Zurich).

OpenMetrics Solutions LLC is a software technology firm with a strong focus on financial engineering. Our core technologies are based on solid academic research at the Institute for Theoretical Physics at ETH Zurich (Swiss Federal Institute of Technology in Zurich).

Comparis is a Swiss Internet comparison service. On comparis.ch, consumers can compare rates and services of health insurances, other insurances, banks, telecom providers, property, vehicles and special offers from retailers – quickly and easily.

Ein Financial Explainer ist ein computergenerierter Erklärungsvideo. Mit Hilfe von Ton, Bild und Bewegung werden komplexe Sachverhalte verständlich erklärt. Gerade in der Finanzbranche, wo die Komplexität der Produkte und Dienstleistungen einen hohen Erklärungsbedarf mit sich bringen, kann ein Financial Explainer durch seine “Step by Step” Erzählweise sein ganzes Potenzial entfalten.

Ein Financial Explainer ist ein computergenerierter Erklärungsvideo. Mit Hilfe von Ton, Bild und Bewegung werden komplexe Sachverhalte verständlich erklärt. Gerade in der Finanzbranche, wo die Komplexität der Produkte und Dienstleistungen einen hohen Erklärungsbedarf mit sich bringen, kann ein Financial Explainer durch seine “Step by Step” Erzählweise sein ganzes Potenzial entfalten.

FinGuide offers a new service in Swiss Private Banking. So far, private banking customers have been directly acquired by providers, as investors you have been in a passive role. With FinGuide you can take control of yourself without having to spend a lot of effort. The approach: We record your individual needs in detail and show you which banks or asset managers suit you best. FinGuide is available to private individuals with assets available from 500,000 Swiss francs.

FinGuide offers a new service in Swiss Private Banking. So far, private banking customers have been directly acquired by providers, as investors you have been in a passive role. With FinGuide you can take control of yourself without having to spend a lot of effort. The approach: We record your individual needs in detail and show you which banks or asset managers suit you best. FinGuide is available to private individuals with assets available from 500,000 Swiss francs.

TaxLevel «THE NEXT LEVEL IN TAX REPORTING»bieten wir professionelle Dienstleitungen für Unternehmen und Privatpersonen im Themenbereich Steuer Reporting. Unsere Endprodukte unterstützen im Ausland steuerpflichtige juristische oder natürliche Personen.

Finny is a physical and digital companion for Kids to master money. We have built multiple elements around Finny to create a protected learning environment for the entire family.

Finny is a physical and digital companion for Kids to master money. We have built multiple elements around Finny to create a protected learning environment for the entire family.

Fintastic Ag is aDigital mortgage solutions for banks and insurance companies.

Fintastic Ag is aDigital mortgage solutions for banks and insurance companies.

Mit wenigen Klicks Angebote von bis zu 30 Banken und Versicherungen für die eigene Hypothek erhalten.

Payments

Monito is a comparison website for international money transfer services. We compare and review more than 450 money transfer operators, to help you find the best option for each of your international transaction.

CashSentinel is a fintech startup that developed an innovative payment solution, which is at the crossroads of escrow agents and mobile wallets, to facilitate vehicle transactions. CashSentinel’s service has opened in April 2014 in Switzerland.

Consumer finance company based in Zug, launches a new payment solution and is the only company in Switzerland to offer all services related to payment processing for purchase on account in e-commerce and at the point of sale from a single source.

Consumer finance company based in Zug, launches a new payment solution and is the only company in Switzerland to offer all services related to payment processing for purchase on account in e-commerce and at the point of sale from a single source.

CashCloud is a mobile payment system, but relies on a system of stability and security. They aim to create transparency and ensure ease of use, in order not to give rise to the scepticism and distrust which has grown between the people and the banks in recent years regarding mobile payments.

Aximetria is a crypto-centric mobile banking of the future.

Aximetria is a crypto-centric mobile banking of the future.

SecurionPay, established in 2014 in Switzerland, is a cross-device payment platform that enables businesses accepting online payments in 160 currencies through the checkout translated into 23 languages.

SecurionPay, established in 2014 in Switzerland, is a cross-device payment platform that enables businesses accepting online payments in 160 currencies through the checkout translated into 23 languages.

SONECT Creating virtual ATMs where users can withdraw cash from any shop that joins the program at over 50% cheaper than the current ATM withdrawal costs.

SmartLink is a mobile wallet services provider, offering white-label mobile transaction platform solutions, contactless transaction capabilities, know-your-customer solutions, and prepaid program management.

SmartLink is a mobile wallet services provider, offering white-label mobile transaction platform solutions, contactless transaction capabilities, know-your-customer solutions, and prepaid program management.

billte digitalize paper invoices and to automate the billing chain for small and medium businesses. Since the deal does not end with a bill, we surround the invoices with a wide range of features that are beneficial for both, companies and their customers. By providing Value Added Services, such as bi-directional communication channel, awarding offers, analytics, forecasting, financial support, we help to maintain existing relationships and gain new customers.

billte digitalize paper invoices and to automate the billing chain for small and medium businesses. Since the deal does not end with a bill, we surround the invoices with a wide range of features that are beneficial for both, companies and their customers. By providing Value Added Services, such as bi-directional communication channel, awarding offers, analytics, forecasting, financial support, we help to maintain existing relationships and gain new customers.

Founded last year, Zurich-based fintech startup Neon offers what is claims to be the first independent basic account offering of Switzerland that’s 100% geared for smartphones.

Founded last year, Zurich-based fintech startup Neon offers what is claims to be the first independent basic account offering of Switzerland that’s 100% geared for smartphones.

Payrexx is the first company that has developed an all-in-one cloud-based solution that allows you to accept online payments with payment tools such as Paylink, Virtual POS and One Page Shop without any programming skills.

Payrexx is the first company that has developed an all-in-one cloud-based solution that allows you to accept online payments with payment tools such as Paylink, Virtual POS and One Page Shop without any programming skills.

Pintail is a global social project aiming at financial inclusion. Today, some 2.5 billion people still do not have access to financial services.

Pintail is a global social project aiming at financial inclusion. Today, some 2.5 billion people still do not have access to financial services.

Rivero enables financial institutions to streamline digital payments, gain efficiency and unleash their full potential.

Rivero enables financial institutions to streamline digital payments, gain efficiency and unleash their full potential.

Mit Yoordi können Ihre Gäste im Haus und Ausser Haus bestellen, nachbestellen und bezahlen ganz ohne App und Wartezeit.

Mit Yoordi können Ihre Gäste im Haus und Ausser Haus bestellen, nachbestellen und bezahlen ganz ohne App und Wartezeit.

inapay is a mobile app which lets you accept payments in Bitcoin and other Cryptocurrencies in your business.

inapay is a mobile app which lets you accept payments in Bitcoin and other Cryptocurrencies in your business.

dePay a decentralized payment protocol that simplifies crypto payments.

dePay a decentralized payment protocol that simplifies crypto payments.

We want to take care of your financial life. That’s why Kaspar& is designed to provide seamless and comfortable access to professional financial services – starting with investing & saving.

We want to take care of your financial life. That’s why Kaspar& is designed to provide seamless and comfortable access to professional financial services – starting with investing & saving.

Klarpay AG is a modern swiss based merchant payments company with seamless digital accounts for acquiring and multi-currency settlement accounts under Swiss regulation.

Klarpay AG is a modern swiss based merchant payments company with seamless digital accounts for acquiring and multi-currency settlement accounts under Swiss regulation.

MOGLI LTD is the Swiss eWallet – Payments & exchange safe and easy.

Wealth Management

True Wealth AG was founded in 2013 as a Swiss corporation. An automated investment solution that is uncompromisingly cost-efficient so that our clients enjoy bigger returns.

With INVESTORY you can trade direct investments like stocks, etfs, futures, foreign currencies, precious metals, and commodities. Collective investments like mutual funds, structured products, and certificates are not available.

Investivity is a boutique investment company dedicated to delivering innovative solutions to the current challenges faced by wealth managers.

Leonteq is an independent expert in structured investment products and a leading fintech company with a highly automated multi-issuer platform that connects 30 issuers with more than 1’000 B2B clients. We are based in Zurich and have a global footprint with 13 offices across EMEA and APAC.

Leonteq is an independent expert in structured investment products and a leading fintech company with a highly automated multi-issuer platform that connects 30 issuers with more than 1’000 B2B clients. We are based in Zurich and have a global footprint with 13 offices across EMEA and APAC.

AMNIS provides small and medium enterprises via an electronic platform access on fair terms for currency exchange and foreign currency payments. Various automated systems and APIs (programming interfaces), it also allow the processes involved in dealing with foreign currency easier.

independent is an investment app that enables you to make more out of your savings. It’s easy, convenient and transparent. Open your account online, choose your investment strategy and start already with CHF 500. findependent takes care of your investments and the financial markets for you.

Descartes is a digital Swiss investment advisor bringing together the latest insights in financial theory, leading technology, and successful investment specialists. An easy, low-cost access to strategies and methods of well-known, independent investment specialists, portfolio managers and economists.

mydesq is a swiss startup which provides innovative solutions to wealth managers. We provide a comprehensive workbench which allows wealth managers to do all their daily activities in a single application on their ipad. The application allows wealth managers to truly work from anywhere, anytime and even works fully if there is no internet connectivity. But besides being powerful, the mydesq application has a gorgeous design and can be customised as we believe that each wealth manager is unique.

is a swiss startup which provides innovative solutions to wealth managers. We provide a comprehensive workbench which allows wealth managers to do all their daily activities in a single application on their ipad. The application allows wealth managers to truly work from anywhere, anytime and even works fully if there is no internet connectivity. But besides being powerful, the mydesq application has a gorgeous design and can be customised as we believe that each wealth manager is unique.

clever circles is a platform for building and managing your assets. clever circles is a platform for building and managing your assets.

VIAC A 3rd pillar solution that above all creates added value for the customer – not just for the bank.

VIAC A 3rd pillar solution that above all creates added value for the customer – not just for the bank.

Selma makes investing easy like Sunday morning. Start managing your personalized portfolio with Selma, while keeping your risks under control and your goals on track.

Selma makes investing easy like Sunday morning. Start managing your personalized portfolio with Selma, while keeping your risks under control and your goals on track.

Evolute is a seamlessly integrated platform covering the entire wealth management value chain. Technology, Operations and Compliance services are unified on a single platform which is perfectly synchronized and modular. Evolute’s unique solution combines intelligent technology, sound knowledge, and personal advice in a tailor-made and solution-oriented offering for independent wealth managers and banks.

Evolute is a seamlessly integrated platform covering the entire wealth management value chain. Technology, Operations and Compliance services are unified on a single platform which is perfectly synchronized and modular. Evolute’s unique solution combines intelligent technology, sound knowledge, and personal advice in a tailor-made and solution-oriented offering for independent wealth managers and banks.

ONEPM is a cloud-based portfolio management platform (pms) for wealth, asset and fund managers. built upon the newest web technologies it is accessible from anywhere at any time and from any device as long as you are connected to the web.

ONEPM is a cloud-based portfolio management platform (pms) for wealth, asset and fund managers. built upon the newest web technologies it is accessible from anywhere at any time and from any device as long as you are connected to the web.

With our high-quality online investment advisory service, we offer you the ideal solutions for making your personal investment decisions.

With our high-quality online investment advisory service, we offer you the ideal solutions for making your personal investment decisions.

3rd-eyes is the software partner of choice for banks, insurance companies and investment advisers that wish to implement a digital goal based advisory process.

Yova is an investment platform that enables you to achieve your financial goals by investing your savings 100% consistent with your values and lifestyle. Topics include renewable energy, electromobility, medical technology, gender equality, human rights and more.

Yova is an investment platform that enables you to achieve your financial goals by investing your savings 100% consistent with your values and lifestyle. Topics include renewable energy, electromobility, medical technology, gender equality, human rights and more.

The SwissBorg Project aims to revolutionize asset management solutions with a community-centric approach powered by Ethereum. Members will be able to optimize their cryptocurrency holdings with the help of our Cyborg advisors and deep learning algorithms.

The SwissBorg Project aims to revolutionize asset management solutions with a community-centric approach powered by Ethereum. Members will be able to optimize their cryptocurrency holdings with the help of our Cyborg advisors and deep learning algorithms.

vision& is a Swiss based, SRO-regulated asset manager facilitating the access to innovative blockchain investment opportunities, based on professional investment research and integrated into a traditional banking framework.

WealthArc is a fintech company leveraging data analytics and artificial intelligence support systems to empower independent wealth managers to work more efficiently. Thus, we transform the way they share relevant and understandable information with their clients.

WealthArc is a fintech company leveraging data analytics and artificial intelligence support systems to empower independent wealth managers to work more efficiently. Thus, we transform the way they share relevant and understandable information with their clients.

By enriching an efficient asset management tool with an outstanding level of client interaction, WealthArc enables a digital transformation and simplification. It’s pioneering simplicity and revolutionary use of latest technologies finally makes it possible for wealth managers to unlock their full potential and capitalize on the new client experience.

CRYPTALGO is building an institutional, highly secure global cryptocurrency & Security Tokens Secondary Trading and Liquidity Platform that leverages the CRYPTALGO’s Galaxy, a distributed parallel computing connectivity backbone that addresses the fragmented nature of the market by interconnecting multiple crypto and security token exchanges and unifying the disparate API’s, data structures and will utilize the regulatory compliance frameworks for security tokens and their issuing protocols.

CRYPTALGO is building an institutional, highly secure global cryptocurrency & Security Tokens Secondary Trading and Liquidity Platform that leverages the CRYPTALGO’s Galaxy, a distributed parallel computing connectivity backbone that addresses the fragmented nature of the market by interconnecting multiple crypto and security token exchanges and unifying the disparate API’s, data structures and will utilize the regulatory compliance frameworks for security tokens and their issuing protocols.

Tokenestate.io is a blockchain-powered real estate investing platform: Invest in international real estate properties from your smartphone with no bank account, no minimum investment size and low transaction fees.

Tokenestate.io is a blockchain-powered real estate investing platform: Invest in international real estate properties from your smartphone with no bank account, no minimum investment size and low transaction fees.

Sanostro offer innovative, forward-looking hedging services to institutional clients willing to outsource certain market timing decisions. Our solutions are custom-tailored according to our client’s needs.

Sanostro offer innovative, forward-looking hedging services to institutional clients willing to outsource certain market timing decisions. Our solutions are custom-tailored according to our client’s needs.

SimpleWealth makes investment easy, with secure online banking services and tailored plans, to make money for your future while you live in the moment.

SimpleWealth makes investment easy, with secure online banking services and tailored plans, to make money for your future while you live in the moment.

Finenvy is a Digital Wealth Management platform focusing on Sustainable and Impact investing across any asset class and market without the need of changing your broker.

Finenvy is a Digital Wealth Management platform focusing on Sustainable and Impact investing across any asset class and market without the need of changing your broker.

ImmoYou ist eine innovative Club Investment Plattform für Wohn- und Gewerbe-Immobilien.

ImmoYou ist eine innovative Club Investment Plattform für Wohn- und Gewerbe-Immobilien.

Fyleen serves the interests of your assets thanks to efficient technology and human pedagogy.

Fyleen serves the interests of your assets thanks to efficient technology and human pedagogy.

blockimmo is a blockchain powered startup on the verge of becoming the go to marketplace for real estate tokenization.

blockimmo is a blockchain powered startup on the verge of becoming the go to marketplace for real estate tokenization.

Invemo is a Swiss crypto asset manager, broker and market maker focused on professional and institutional clients.

Invemo is a Swiss crypto asset manager, broker and market maker focused on professional and institutional clients.

ImmoZins offers property investors three different investment models. Common to all of them is the high level of transparency, for which the start-up company developed its own software, and the assumption of risk. ImmoZins invests in the projects and is 50% co-owner.

ImmoZins offers property investors three different investment models. Common to all of them is the high level of transparency, for which the start-up company developed its own software, and the assumption of risk. ImmoZins invests in the projects and is 50% co-owner.

Scrypt is a Swiss asset management company with a focus on technology and quantitative investment strategies in Digital Assets.

Scrypt is a Swiss asset management company with a focus on technology and quantitative investment strategies in Digital Assets.

finpension is specialised in the management and investment of 2nd and 3rd pillar pension assets. We use our pension and investment expertise to create attractive offers with added value for our clients.

Investart is a Swiss online investment platform for regular people who are not finance professionals nor high net worth individuals

Investart is a Swiss online investment platform for regular people who are not finance professionals nor high net worth individuals

Was bisher einer Minderheit vorbehalten war, wird jetzt allgemein zugänglich: Everon revolutioniert Private Banking.

Was bisher einer Minderheit vorbehalten war, wird jetzt allgemein zugänglich: Everon revolutioniert Private Banking.

CAT Financial Products AG ist einer der führenden Schweizer Anbietern von Anlagelösungen im Markt für Strukturierte Produkte. Seit 2008 bietet die CAT Financial Products professionellen Vermögensverwaltern, Banken und institutionellen Investoren ihre Dienstleistungen über eine der innovativsten Technologien an.

CAT Financial Products AG ist einer der führenden Schweizer Anbietern von Anlagelösungen im Markt für Strukturierte Produkte. Seit 2008 bietet die CAT Financial Products professionellen Vermögensverwaltern, Banken und institutionellen Investoren ihre Dienstleistungen über eine der innovativsten Technologien an.

Mortgages

As a fin-tech venture, Hyposcout has managed to make a name for itself in the digital marketing of mortgages in Switzerland. As an online brokerage platform, Hyposcout AG brings together investors (investors) and real estate owners (borrowers). Private investors, as well as institutional clients from all over the world who want to hedge their investment through a Swiss property and benefit from attractive interest rates, are eligible as investors. On the other hand, capital investors have the opportunity to raise capital at a market-oriented interest rate and provide their Swiss property as collateral.

As a fin-tech venture, Hyposcout has managed to make a name for itself in the digital marketing of mortgages in Switzerland. As an online brokerage platform, Hyposcout AG brings together investors (investors) and real estate owners (borrowers). Private investors, as well as institutional clients from all over the world who want to hedge their investment through a Swiss property and benefit from attractive interest rates, are eligible as investors. On the other hand, capital investors have the opportunity to raise capital at a market-oriented interest rate and provide their Swiss property as collateral.

Creditfolio ist eine seit 2017 aktive Crowdlending-Plattform mit Fokus auf Privatkredite. Die Creditfolio-Plattform ermöglicht Privatpersonen einen Kredit schnell und einfach zu fairen Konditionen aufzunehmen – ganz ohne das Einwirken einer Bank.

Creditfolio ist eine seit 2017 aktive Crowdlending-Plattform mit Fokus auf Privatkredite. Die Creditfolio-Plattform ermöglicht Privatpersonen einen Kredit schnell und einfach zu fairen Konditionen aufzunehmen – ganz ohne das Einwirken einer Bank.

MoneyPark is the leading mortgage and real estate specialist in Switzerland and has more than 300 employees. The young FinTech offers comprehensive and customized mortgage and real estate solutions with a combination of personalized advice and pioneering technology.

MoneyPark is the leading mortgage and real estate specialist in Switzerland and has more than 300 employees. The young FinTech offers comprehensive and customized mortgage and real estate solutions with a combination of personalized advice and pioneering technology.

Lendity provides institutional-grade investment solutions to access marketplace and private debt opportunities across the globe. Lendity monitors platforms and dynamically invests in loans from those with the most attractive risk reward profile, obtaining an optimum diversification of both loans and platforms. Through its infrastructure, Lendity creates streamlined structures for global transactions and simplifies access through the traditional capital market.

Lendity provides institutional-grade investment solutions to access marketplace and private debt opportunities across the globe. Lendity monitors platforms and dynamically invests in loans from those with the most attractive risk reward profile, obtaining an optimum diversification of both loans and platforms. Through its infrastructure, Lendity creates streamlined structures for global transactions and simplifies access through the traditional capital market.

SMG Swiss Marketplace Group AG is a pioneering network of online marketplaces and a leading European digital company that simplifies people’s lives with groundbreaking products.

CROWDLI ist eine Crowdfunding-Plattform zur Vermittlung von Miteigentumsanteilen an Immobilienkapitalanlagen. Bei CROWDLI kannst du mit überschaubaren Investitionsbeträgen erfolgreich in nachhaltige Immobilien investieren und von vierteljährlich ausgezahlten Renditen profitieren.

CROWDLI ist eine Crowdfunding-Plattform zur Vermittlung von Miteigentumsanteilen an Immobilienkapitalanlagen. Bei CROWDLI kannst du mit überschaubaren Investitionsbeträgen erfolgreich in nachhaltige Immobilien investieren und von vierteljährlich ausgezahlten Renditen profitieren.

Hypotheke.ch connects property owners with banks, insurance companies and pension funds.

Hypotheke.ch connects property owners with banks, insurance companies and pension funds.

Mit Hellohome möchten wir unseren Beitrag dazu leisten und die Stakeholder zusammenbringen und für alle Beteiligten einen Mehrwert schaffen. Sicherheit für alle involvierten Parteien und ein transparentes Modell zeichnen Hellohome aus. Die Traumimmobilie rückt so wieder in greifbare Nähe. Ohne Kopfschmerzen und böse Überraschungen. Klingt toll, oder? Finden wir auch.

Trading

Swissquote bietet innovative Lösungen und Analysetools für die unterschiedlichen Kunden-Ansprüche und Bedürfnisse . Auf der Plattform stehen neben verschiedenen Dienstleistungen zum Online Trading auch Lösungen für eForex, ePrivate Banking und eHypotheken zur Verfügung. Die Muttergesellschaft, Swissquote Group Holding AG, ist an der SIX Swiss Exchange kotiert (Symbol SQN).

Swissquote bietet innovative Lösungen und Analysetools für die unterschiedlichen Kunden-Ansprüche und Bedürfnisse . Auf der Plattform stehen neben verschiedenen Dienstleistungen zum Online Trading auch Lösungen für eForex, ePrivate Banking und eHypotheken zur Verfügung. Die Muttergesellschaft, Swissquote Group Holding AG, ist an der SIX Swiss Exchange kotiert (Symbol SQN).

Grydl Analytics is a startup based in Geneva that specializes in blockchain, Big Data and artificial intelligence technologies. The company provides cryptocurrency investors with an online platform that allows them to find investment opportunities by evaluating different strategies.

Grydl Analytics is a startup based in Geneva that specializes in blockchain, Big Data and artificial intelligence technologies. The company provides cryptocurrency investors with an online platform that allows them to find investment opportunities by evaluating different strategies.

Metaco is a software provider specializing in distributed ledgers. The company serves financial institutions, enabling them to exploit blockchain technology.

Based in the Swiss Crypto Valley, SMART VALOR is a blockchain startup set to enable borderless crypto finance. We are building a decentralized marketplace for tokenized alternative investments backed by secure custody for crypto assets.

Based in the Swiss Crypto Valley, SMART VALOR is a blockchain startup set to enable borderless crypto finance. We are building a decentralized marketplace for tokenized alternative investments backed by secure custody for crypto assets.

Vestr facilitates the creation and life-cycle management of Actively Managed Certificates, a fast and cost-effective way of replacing investment funds.

Vestr facilitates the creation and life-cycle management of Actively Managed Certificates, a fast and cost-effective way of replacing investment funds.

Hedge is a fintech company developing tools, strategies and products that simplify investing in crypto markets.

Hedge is a fintech company developing tools, strategies and products that simplify investing in crypto markets.

Bitcoin Suisse AG is a Swiss-based financial service provider specializing in crypto-assets. It specialize in alternative finances / non-banking assets, outside of the traditional financial system & banking establishment, so called “decentralized finance” or “digital finance”.

Bitcoin Suisse AG is a Swiss-based financial service provider specializing in crypto-assets. It specialize in alternative finances / non-banking assets, outside of the traditional financial system & banking establishment, so called “decentralized finance” or “digital finance”.

Zurich-based innovative securitization specialist GENTWO has created a new generation of financial products. The innovative financial solutions provider enables institutional clients to securitize not only bankable, but also non-bankable assets with a Swiss ISIN.

Zurich-based innovative securitization specialist GENTWO has created a new generation of financial products. The innovative financial solutions provider enables institutional clients to securitize not only bankable, but also non-bankable assets with a Swiss ISIN.

LAPO Blockchain brings stability with traditional Swiss expertise in financial services to crypto-assets worldwide.

LAPO Blockchain brings stability with traditional Swiss expertise in financial services to crypto-assets worldwide.

TokenSuisse AG (former Coinlab Capital AG) is the leading European provider for Crypto Asset Investment Solutions. As dynamic and innovative Crypto Asset start up, our mission is to provide you with simple & regulated access to the world of Bitcoin and Altcoins.

TokenSuisse AG (former Coinlab Capital AG) is the leading European provider for Crypto Asset Investment Solutions. As dynamic and innovative Crypto Asset start up, our mission is to provide you with simple & regulated access to the world of Bitcoin and Altcoins.

Instimatch Global was founded in 2017. The inspiration for doing so, stemmed from the liquidity crisis in 2007/2008. Our founder witnessed first-hand how the interbank lending and borrowing system broke down and trust between financial institutions disappeared within a matter of days.

Instimatch Global was founded in 2017. The inspiration for doing so, stemmed from the liquidity crisis in 2007/2008. Our founder witnessed first-hand how the interbank lending and borrowing system broke down and trust between financial institutions disappeared within a matter of days.

MiMiC makes your connection smarter, faster and more secure so you instantly realise its full potential.

MiMiC makes your connection smarter, faster and more secure so you instantly realise its full potential.

Epoque Plus develops “Artificial Intelligence Trading Services” specialising in Forex and indices.

Epoque Plus develops “Artificial Intelligence Trading Services” specialising in Forex and indices.

algotrader A fully integrated algorithmic trading platform for both traditional and crypto assets.

algotrader A fully integrated algorithmic trading platform for both traditional and crypto assets.

Altcoinomy is the premier facilitator in cryptocurrency cash-out and KYC for early adopters and ICOs in Switzerland.

Altcoinomy is the premier facilitator in cryptocurrency cash-out and KYC for early adopters and ICOs in Switzerland.

flovtec is a Swiss technology company with the purpose to unlock digital assets by providing liquidity.

Flowbank. Seriously Simple Swiss Banking. Creating your new investment experience.

Invemo is a cryptocurrency mining company that manufactures and operates mining facilities under the most effective economic conditions in the world. The company enables private and institutional investors to join the cryptocurrency mining industry in an efficient and cost-effective way.