4 Swiss Startups Make CB Insights’ 2020 Top 50 Blockchain Companies List

by Fintechnews Switzerland January 6, 2021SEBA Bank, Bitcoin Suisse, Metaco and GuardTime are the four Swiss companies that made CB Insights’ inaugural Blockchain 50, making Switzerland the second most represented country in the list.

The annual Blockchain 50 list recognizes the 50 most promising companies within the blockchain ecosystem. These top private companies are applying or analyzing blockchain technology to solve business or consumer problems across various industries, including payments, remittances, asset provenance and compliance.

The four Swiss startups that made CB Insights’ 2020 Blockchain 50 list are:

SEBA Bank, a FINMA licenced Swiss Bank providing a seamless, secure and easy-to-use bridge between digital and traditional assets, is the only global smart bank providing a fully universal suite of regulated banking services in the emerging digital economy. It has raised about US$136 million (CHF 120 million) in funding so far, from investors including Summer Capital and Julius Baer Group.

Bitcoin Suisse, a crypto-finance startup providing trading, prime brokerage, custody, lending and other crypto-financial services for private and institutional clients. Bitcoin Suisse is a Swiss financial intermediary and is undergoing licensing as a Swiss and Liechtenstein bank. The startup has raised US$49 million in funding from Roger Studer, according to CB Insights.

Metaco, a provider of security-critical infrastructure enabling financial institutions to enter the digital asset ecosystem. The company’s blockchain technologies and systems provide comprehensive management of digital assets including thousands of cryptocurrencies, tokens, and smart contracts with custom risk management. Metaco has raised US$17 million in funding from Swisscom, investiere, Swiss Post, SC Ventures and Zurcher Kantonalbank.

GuardTime, a provider of industrial blockchain platform designed to provide massive scale data authentication without reliance on centralized trust authorities. The company has developed KSI (Keyless Signature Infrastructure), a platform designed to ensure the integrity of systems, network and data at an industrial scale. Originally from Estonia, GuardTime recently moved its headquartered to Switzerland. It has raised US$8 million in funding so far from Horizons Ventures, SGInnovate, Horizon 2020, Ambient Sound Investments and Joi Ito, according to CB Insights.

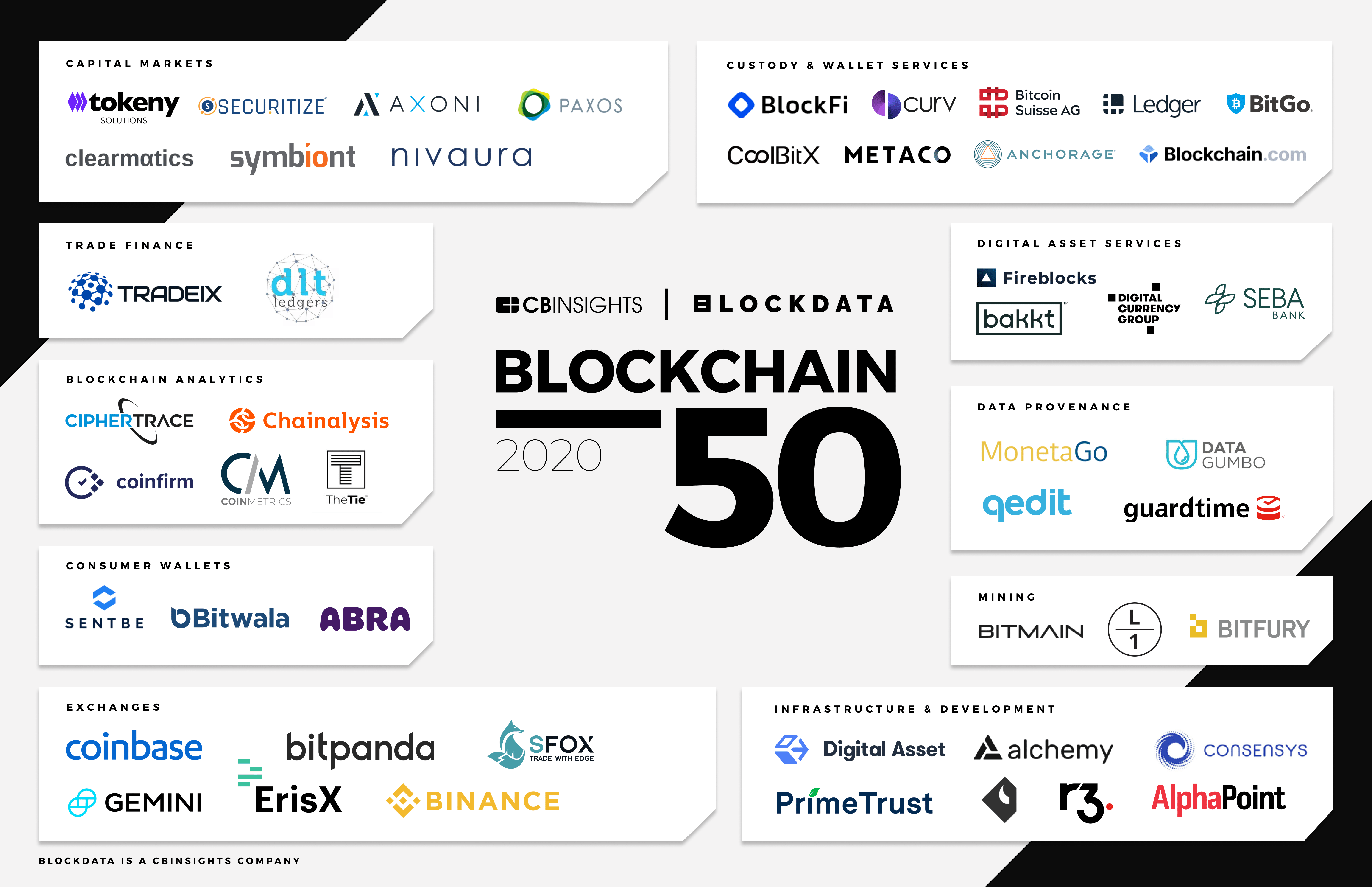

2020 Blockchain 50

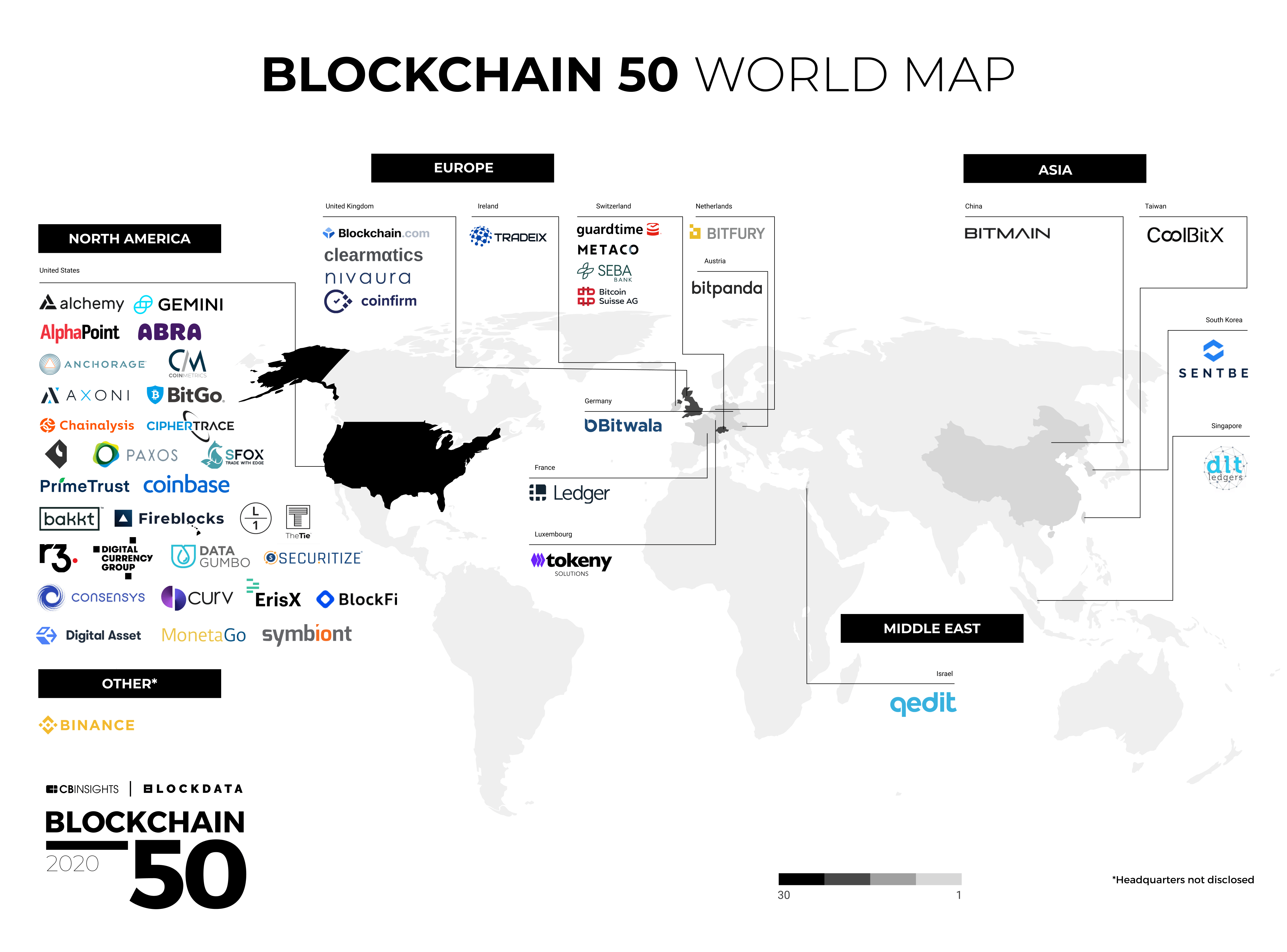

In 2020, the US was the most represented country in the 50 Blockchain list with 30 blockchain companies, or 60% of all 50 companies. The US is followed by Switzerland with four, the UK with three, and Luxembourg with two. Other countries represented include Austria, China, France, Germany, Ireland, Israel, the Netherlands, Singapore, South Korea and Taiwan.

2020 Blockchain 50 World Map, CB Insights, Dec 2020

The 2020 Blockchain 50 cohort has raised over US$3 billion in aggregate equity funding across 113 since 2017 and comprises companies across different stages of development.

Five of them are unicorns that are valued at or above US$1 billion as of their latest funding round: Coinbase, a cryptocurrency exchange and the most well-funded blockchain company of the list with US$539 million raised in disclosed equity funding; mining hardware and software providers Bitmain (China) and Bitfury (the Netherlands); blockchain analytics software Chainalysis (USA); and blockchain conglomerate Digital Currency Group (USA).

Other popular names that made the list include R3 (USA), Ledger (France), Blockchain (Luxembourg), BitPanda (Austria) and Bitwala (Germany).

The 2020 winners were chosen from pool of 2,700 companies based on factors including business models, market potential, market momentum, team strength and investor profiles. The list focuses on private companies that have raised equity funding, and excludes open source projects such as Bitcoin and Ethereum.

2020 Blockchain 50, CB Insights, Dec 2020