A February 2017 white paper by Deloitte Switzerland examined how blockchain could take off in Switzerland. It noted that the Swiss city of Zug offers the blockchain community huge potential as a place in which this technology can be developed and used. Zug’s Crypto Valley, where many blockchain startups reside, provides the most convincing evidence, said Deloitte. With that, global blockchain hubs can look towards Switzerland as a leading example on the development of blockhain technology.

According to the white paper, rapid technological development, constantly changing customer behaviour and ongoing regulatory amendments are forcing companies and organisations worldwide to conduct a critical review of their business models and business processes.

Blockchain technology presents a great opportunity to all Swiss companies needing to do this, as its distinctive characteristics – such as decentralisation, irreversibility and smart contracts – mean it provides considerable support to this transformation.

Blockchain or distributed ledger technology (DLT) is a technological protocol that enables data to be exchanged directly between different contracting parties within a network without the need for intermediaries. The network participants interact with encrypted identities (anonymously); each transaction is then added to an immutable transaction chain and distributed to all network nodes.

Deloitte noted that in view of the technical complexity and the lack of acceptance of these far-reaching changes in the private, public and commercial sectors, this new technology will in all probability only catch on gradually and depending on how it develops over the coming months and years.

The Rise of Blockchain Technology

Ongoing globalisation and the growing complexity and volume of global transactions are making this approach increasingly difficult, as it is becoming ever more time-consuming, costly and thus inefficient. Furthermore, the events of the last financial crisis showed that this intermediary-based system is highly vulnerable.

The digital currency bitcoin is probably the best known application of blockchain and is even better known than the blockchain technology on which it is based. Bitcoin highlighted the potential of DLT and identified other practical applications of the technology.

The cryptocurrency, a digital payment method based on cryptographic principles, is generated via a large number of Internet-linked computers with the aid of a mathematical formula and recorded in a database that is managed decentrally by all participants.

The currency can be transferred directly by means of a special peer-to-peer application, in other words without an intermediary. Encryption technologies ensure anonymity and ownership structures in the blockchain.

One interesting application of blockchain is the smart contract. A smart contract is an agreement between two parties that is stored in the blockchain. Such agreements may be concluded between two people, in other words peer-to-peer (P2P), person-to-organisation (P2O) or person-to-machine (P2M)5.

It can thus be specified that as soon as a given condition is met (e.g. sale of goods “1” on exchange “2”), the contract is executed automatically and assets (e.g. fiat money, digital currency, title of property, data) are exchanged between the contracting parties. The transaction is then replicated and validated on the blockchain.

Numerous industries are examining the potential applications of these digital contracts. For example, healthcare companies such as Novartis and Pfizer have recognised the added value offered by these contracts. In particular, tests are being conducted on the use of blockchain-based electronic medical records (EMR). For example, personal health records can be stored and managed via the blockchain in an EMR system.

Blockchain requires regulation to work effectively

The active involvement of authorities, supervisory bodies and politicians is crucial during this phase, said Deloitte. Blockchain technology has recently moved out of the hype phase and is currently at the start of the standardisation phase in the business innovation mode.

The current focus of blockchain technology is primarily on using the blockchain to validate, execute and store transactions, which is why development is being driven mainly by companies in the financial industry.

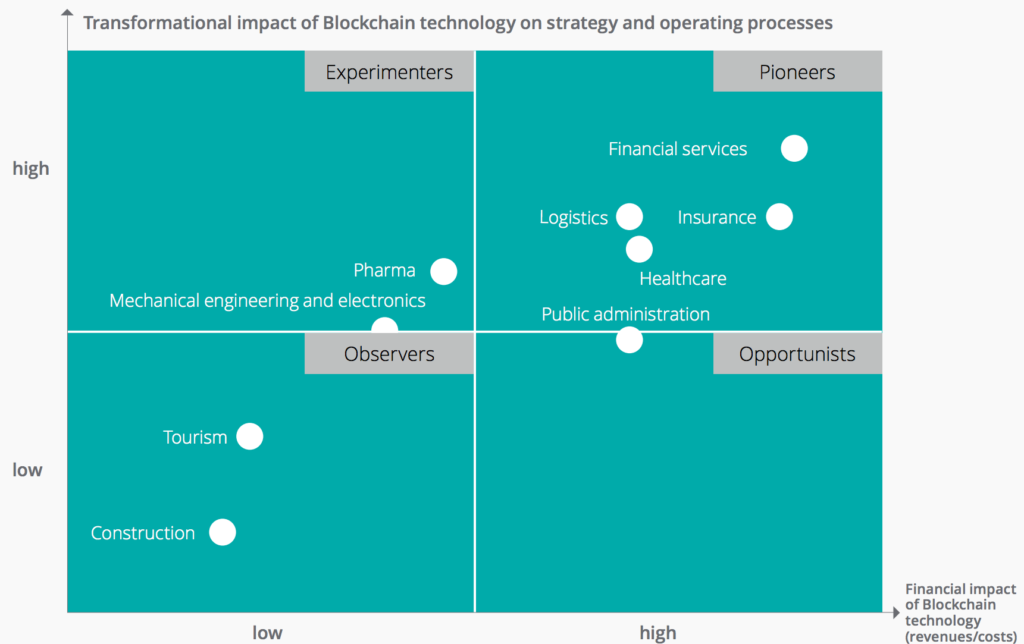

However, the transformational impact of blockchain, as calculated by us and presented in the matrix below, stretches to all sectors of the Swiss economy, albeit to varying extents, wrote Deloitte.

Switzerland’s positioning

Blockchain technology will continue to develop, characterised above all by increasing maturity and a growing number of participants contributing ideas, prototypes and initiatives to this evolution. It is therefore important for Switzerland to conduct a critical appraisal of its own position, examine its strengths and weaknesses and define a clear positioning strategy.

As the most competitive country in the world and the leader in numerous economic sectors, due in no small part to its strong position as a driver of innovation, Switzerland possesses characteristics that make it a suitable candidate to press ahead with the further development of blockchain.

The white paper suggested that the Switzerland should aim to become the central global contact for blockchain opinion leaders, start-ups and related firms at the cutting edge of blockchain innovations.

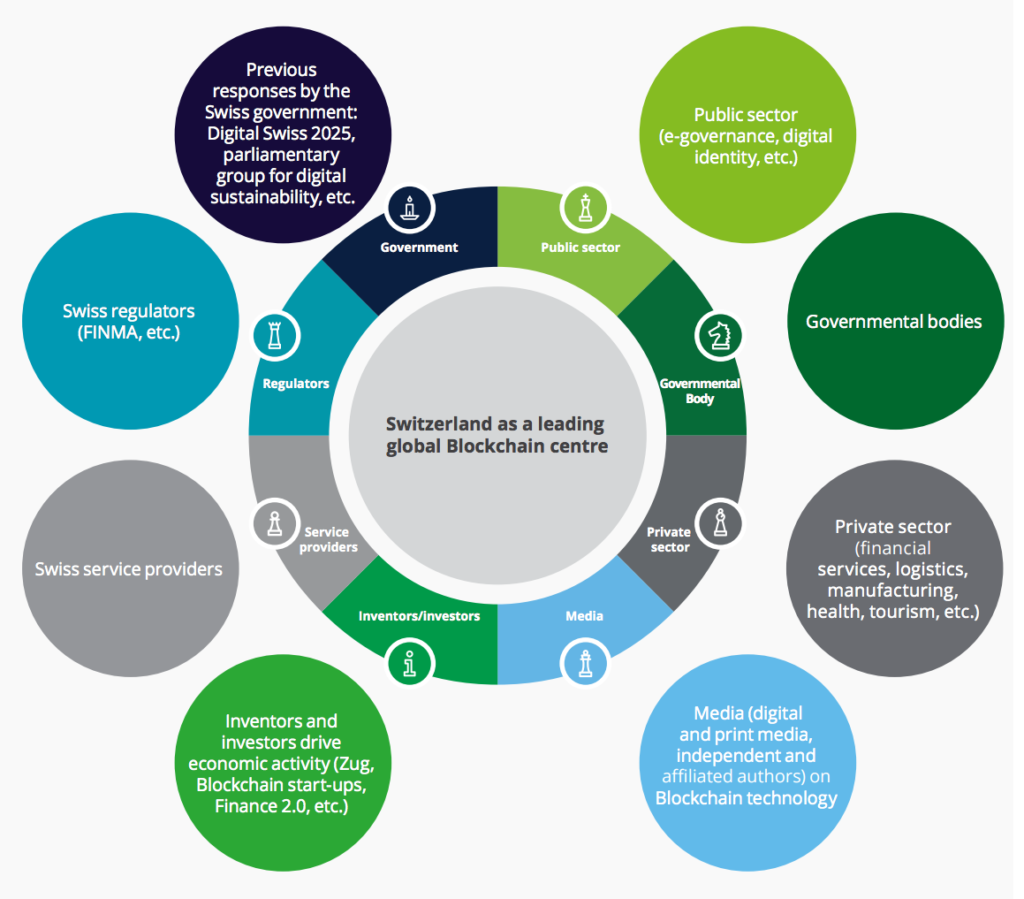

In the figure below, Deloitte has identified a total of seven focal points for the country’s positioning going forward, which will give Switzerland the maximum opportunity to assume international leadership over the long term by ensuring that all players in the Swiss ecosystem pull together.

Identification of business opportunities

Swiss firms can take advantage of Switzerland’s security, neutrality and reputation to underline the competitiveness of the location with regard to blockchain technology. Financial and insurance sectors, in which Switzerland is excellently positioned, offer a particularly large number of possible DLT applications, as do the energy sector and the services sector.

Supportive legal environment

Legal certainty is a key non-technical factor that is vitally important if a new technology is to become permanently established. This applies in connection with both the political stability of the economic environment and a binding legal framework. In the case of FinTech in general and blockchain in particular, numerous experts have already highlighted the importance of support from the relevant bodies, without which Switzerland will be unable to steal a march on other major blockchain centres such as Singapore or London

Controlled business process costs

The dynamic nature of their activities means that blockchain companies, especially start-ups that are still in their infancy, have to maintain rigid controls on their finances. As Switzerland is a high-cost country, this presents a challenge in respect of its positioning in the blockchain environment. Blockchain companies will only choose Switzerland as a location if these outgoings are offset by appropriate added value in other areas.

Coordinated standardisation

Deloitte highlighted that the absence of a uniform industry standard can delay the operational implementation of an innovation or even prevent it entirely, as private sector players attach risk profiles to their investments and would struggle to justify committing capital and human resources under such circumstances. It is therefore in the interests of all parties to reach agreement as quickly as possible so that development of the technology can continue through to integration into actual day-to-day business.

Security and Encryption

The best known application of blockchain technology – as the basis for cryptocurrencies such as bitcoin – has attracted a great deal of attention due to its security-related features, and this means that Switzerland, with its tradition as a neutral and stable location offering strong protection for personal and economic rights, is excellently positioned to establish itself as a global blockchain hub.

Controlling operational risks and vulnerabilities

High operational risks and payment default risks, such as the Lehmann Brothers fallout, call for strong mitigation measures. By contrast, a classic structure such as that encountered today whereby a central party assumes the role of a risk-mitigating trust figure involves a high degree of centralisation. Blockchain risks are mitigated by the almost realtime authentication and verification of transactions and the elimination of an individual central weak point. Swiss companies are therefore advised to familiarise themselves as soon as possible with ongoing decentralisation and its implications for day-to-day business.

Diverse Stakeholder Map

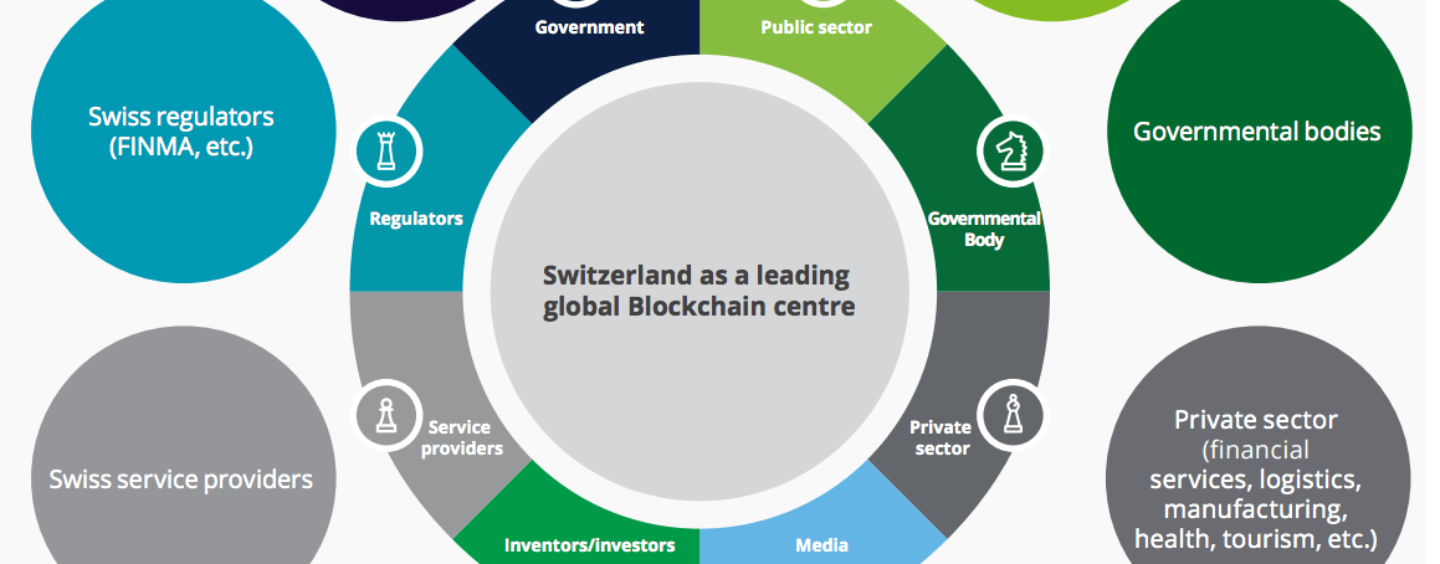

The diagram below shows the groups that are relevant for Switzerland with regard to blockchain and need to be involved in the process. While the questions that all players need to answer and their common goal are identical – to ensure that Switzerland is positively positioned in the global blockchain environment – the procedure is not necessarily coordinated.

Given the range of challenges involved, the successful long-term positioning required to ensure that players are able to respond to even the most detailed questions concerning growing data volumes, data types, transaction details and nodes can only be secured through an institutionalised round table.

The growth of blockchain

The total venture capital investment in blockchain activities reached a new high of US$ 1.1 billion in 2016. The main reason for this rapid growth is the effort being made by the financial industry to capitalise on this highly promising technology. New consortia are being established almost daily and investing further hundreds of millions of US dollars in blockchain technology.

However, blockchain has not achieved the level of hype that surrounded the Internet, which peaked in 1996. This is in part attributable to the challenges facing blockchain in terms of scalability. The traceability offered by blockchain can only be achieved by storing the full details of each stage of a transaction, which in turn influences the size of each block and the time required to validate a transaction.

Fast-paced industries such as financial services need to process thousands of transactions per second and require correspondingly scalable networks and infrastructures. Blockchain networks such as bitcoin and Ethereum are developing concepts for multiplying transaction volumes in order to fulfil these requirements, said Deloitte.

Blockchain is a highly dynamic technology. In addition to an increase in activities in all sectors, Deloitte expects to see further innovations and surprises that will confirm Blockchain’s potential. In view of the factors highlighted above, all these developments offer a host of opportunities for Switzerland to expand its profile as an internationally competitive and innovative centre.