Fintech Infographic of the Week: Blockchain for Trade Finance

by Fintechnews Switzerland June 28, 2019Historically inundated with paper trails and inefficiencies, trade finance is a centuries old industry that’s ripe for disruption. One particular technology that’s been increasingly adopted by financial institutions and companies to improve processes, increase efficiency and reduce costs, is blockchain.

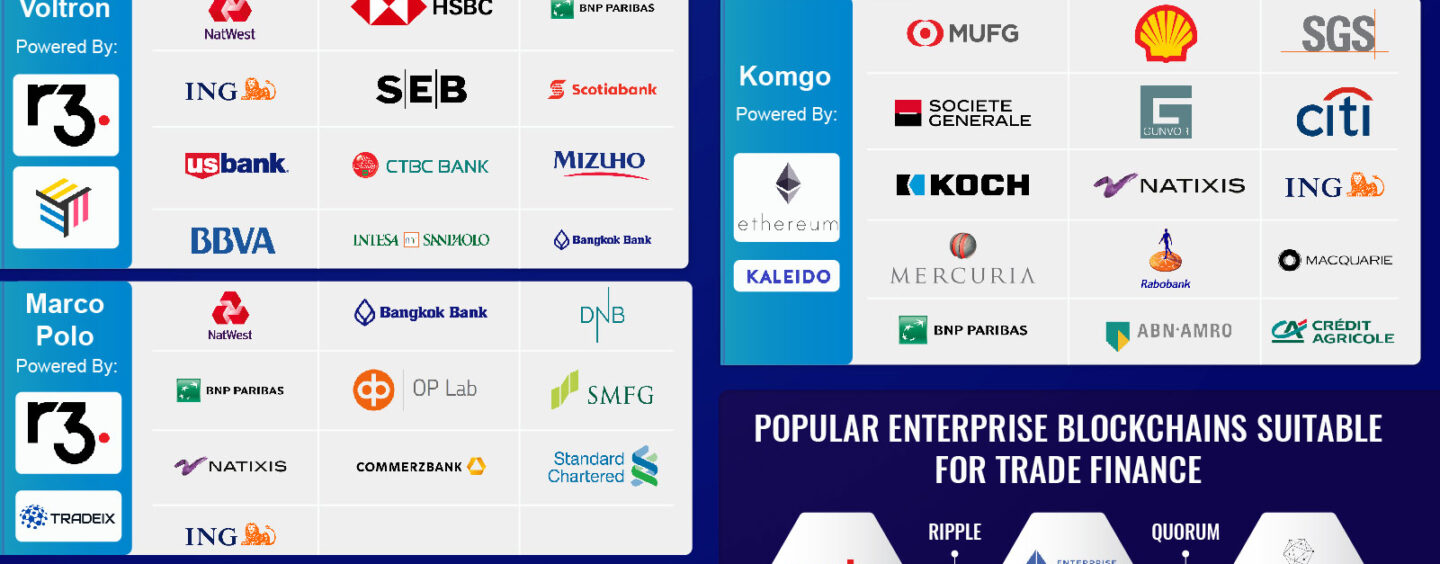

For this first edition of our Fintech Infographic of the Week series, we look at the state of blockchain for trade finance, the various consortia that have launched, the companies involved, and the enterprise blockchain platforms available, in an infographic about created by 101blockchain.com.

Blockchain for trade finance

Trade finance refers to financial transactions, both domestic and international, related to trade receivables finance and global trade. These include lending, issuing letters of credit, factoring, export credit and insurance.

Trade finance underpins the US$17 trillion international trade market and is estimated to represent between US$5 to US$10 trillion of trade. But one of the main hurdles involved with trade finance is the large volume of paper documents that still make up much of the information flow. For this, blockchain can provide a platform that embodies all of the necessary information in one digital document that’s updated nearly instantly and viewable by all members on the network at the same time.

Some of the key advantages that the technology promises include faster transaction settlement time, increased transparency between all parties, and reduced costs to up to 35%.

Blockchain consortia for trade finance

Over the past few years, companies have teamed up to launch consortia focused on trade finance to accelerate development and establish industry standards.

Such initiatives include the Hong Kong Trade Finance Platform (HKTFP), a venture led by the Hong Kong Monetary Authority (HKMA) that counts more than 20 members including HSBC, Standard Chartered, Hang Seng Bank, Bank of East Asia, Australia and New Zealand Banking Group, and Singapore’s DBS Group. HKTFP was established to digitize supply chain record-keeping and to eventually connect other blockchain-based trade platforms.

Blockchain startup R3 leads two trade finance-focused blockchain initiatives: Voltron, an open industry platform with the aim of improving the trade finance process by simplifying letter of credit transactions to deliver speedy settlement times and resolution of discrepancies, as well as improved sanctions screening; and Marco Polo, a bank-focused network of platforms offering ERP-embedded trade and working capital finance applications.

Organizations involved include ING, HSBC, BNP Paribas and BBVA for Voltron, and Bangkok Bank, Standard Chartered and Commerzbank for Marco Polo.

Last year, blockchain consortium Batavia was folded into we.trade. Both platforms are powered by Hyperledger Fabric and built by IBM.

we.trade, which went live in July 2018, is a solution for managing, tracking and protecting open account trade transactions between small and medium-sized enterprises (SMEs) in Europe. It connects parties involved in a trade deal in one place, helps SMEs initiate new trading relationships, and provides them with easy access to a range of financing solutions.

Meanwhile, Batavia had a similar focus on simplifying open account trade finance but aimed to cover all types of corporate clients and on a global scale.

Banks involved include UBS, Nordea, Santander and Deutsche Bank.

Finally, Komgo is a blockchain-based open platform for commodity trade finance. The platform aims to optimize financing processes and accelerate industry operations with digitized transactions and a trusted source of documents to reduce fraud. Komgo uses Enterprise Ethereum and was developed by ConsenSys and Kaleido. The initiative is backed by 15 of the world’s largest commodity trade and finance companies ABN-AMRO, BNP Paribas, Credit Agricole, Citi, Gunvor, ING, Koch Supply & Trading, Macquarie, Mercuria, MUFG Bank, Natixis, Rabobank, SGS, Shell and Societe Generale.

101blockchains.com Blockchain for Trade Finance infographic:

Other resources you might be interested in

Check out our resource page to find out other Fintech Infographics of the Week.