Amazon’s Foray into Fintech Aims to Increase Participation in E-Commerce Ecosystem

by Fintechnews Switzerland April 4, 2022Amazon has been dabbling in fintech for a couple of years now, but while the anticipation for a forthcoming “Amazon bank” continues to build-up each year, evidence suggests that instead the e-commerce giant remains mainly focused on offering products that support its core strategic goal: increase participation in the Amazon ecosystem.

This is the conclusion made by market intelligence company CB Insights in a freshly updated research that looks at the different moves the firm has made throughout the years to understand its future ambitions.

The report dismisses rumors that Amazon is building the next-generation bank, claiming that instead, the e-commerce firm is carrying on developing and proposing new services that increase both buyers and sellers participation on its platform, and reduce friction.

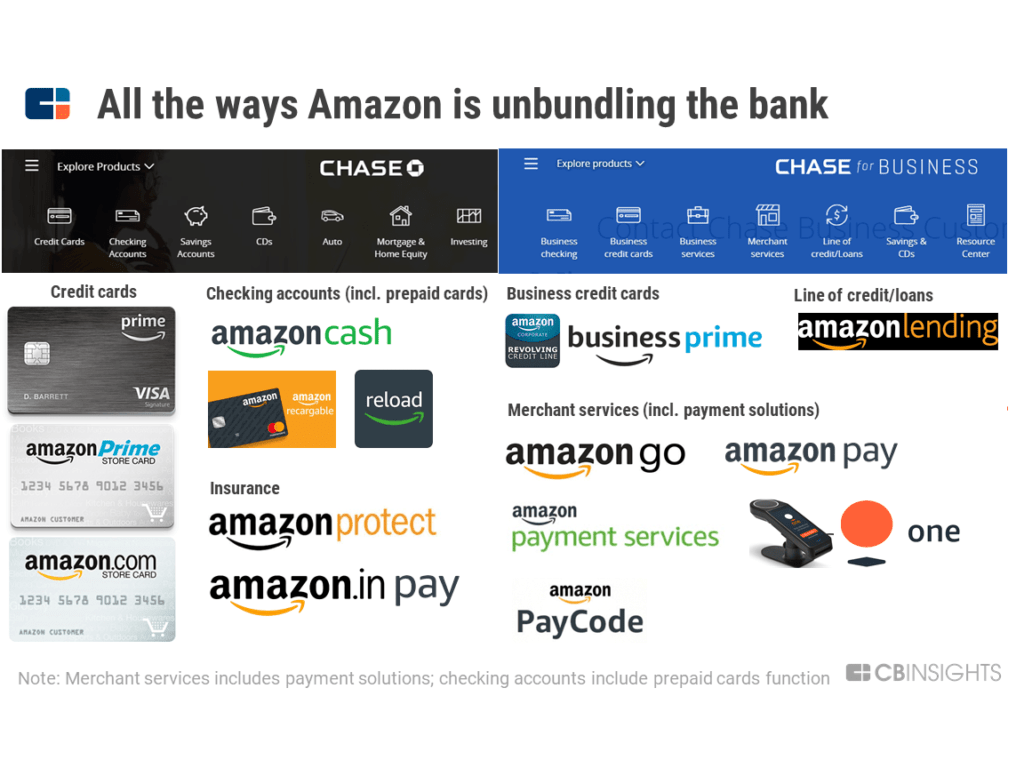

“These product development and investment decisions reveal that Amazon isn’t building a traditional bank that serves everyone,” the report says. “Instead, Amazon has taken the core components of a modern banking experience and tweaked them to suit Amazon customers (both merchants and consumers).

“In a sense, Amazon is building a bank for itself — and that may be an even more compelling development than the company launching a deposit-holding bank.”

Payments, cash deposits and lending as key financial pillars

In the financial services space, Amazon’s focus has been centered around three key pillars: payments, cash deposits and lending.

In the payment space, the firm has aggressively invested in payments infrastructure and services over the last few years, focusing on making payments more cash-efficient and frictionless.

Everything you need to know about what Amazon is doing in financial services, Cbinsights

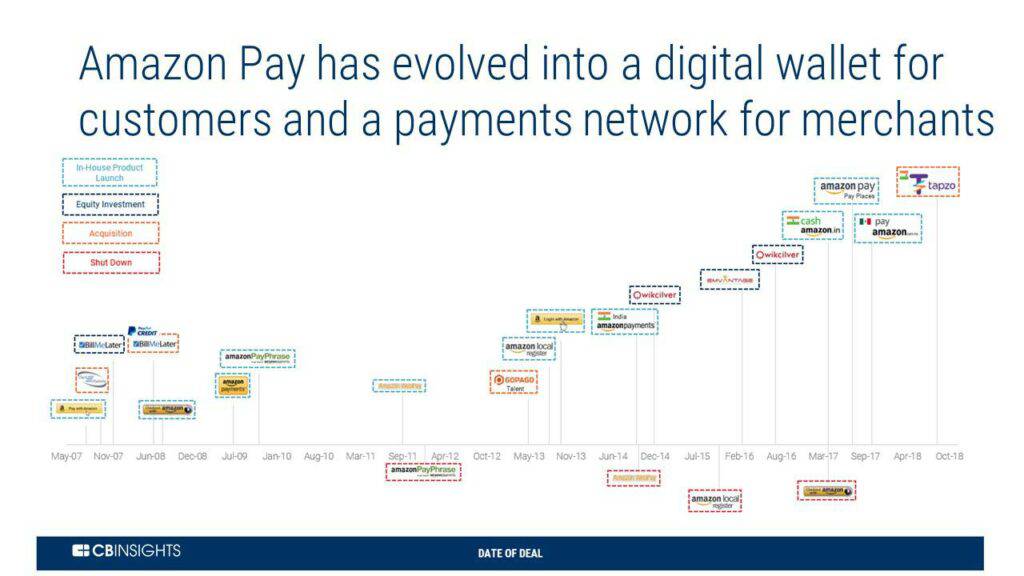

Amazon’s foray into payments started back in 2007, and since then, Amazon Pay has evolved to include a digital wallet for customers and a payments network for both online and brick-and-mortar merchants. Today, Amazon Pay is one of the largest online payment provider in the US, with a reported 24% user share.

Recent developments show that the firm is now expanding from e-commerce payments to omnichannel, focusing notably on biometric payments and Internet-of-Things (IoT) devices.

Amazon’s biometric payment technology, Just Walk Out, uses computer vision, sensor fusion and advanced machine learning (ML) to enable a frictionless payments experience by suppressing the checkout process altogether. Customers just need to grab products and go without needing to stop and check out to pay. Amazon Go convenience stores have been the testbed for the cashierless technology.

Alongside its cashierless technology, Amazon has also had its eyes on eliminating the need for physical credit and debit cards. Amazon One was launched back in 2020, offering a set of software and hardware technologies that lets users pay using their palms. The service was initially introduced at Amazon Go stores in Seattle.

Work is also being done to develop payments through voice commands. In 2020, Amazon launched a new feature that allows customers to pay for gas at over 11,500 gas stations across the US with a voice command to their Alexa-enabled vehicles or other mobility devices.

Alongside payments, cash deposits have been a key area of focus. The Amazon Cash program, which was launched in 2017, aims to bridge the gap between online and offline commerce by allowing customers to deposit cash, without a fee, to a digital account at a partner brick-and-mortar retailer. The vision here is to include underbanked and unbanked populations in the Amazon ecosystem.

Along the same line, Amazon introduced PayCode in 2019, allowing customers to purchase goods on Amazon and pay for them in cash via QR codes. PayCode was first piloted in emerging markets, including Colombia, Hong Kong, Kenya, Indonesia, Malaysia, the Philippines, Taiwan, and Thailand.

Finally, in the lending space, Amazon is active in both business lending and consumer lending. In business lending, the company launched back in 2011 Amazon Lending, which helps merchants finance and sell more products on the e-commerce platform. Maximum loan amount varies from one market to another. In the US, Amazon’s partnership with Goldman Sachs’ Marcus provides credit lines of up to US$1 million, while in Germany, its partnership with ING gives loans between EUR 10,000 and EUR 750,000.

To further build its Amazon Business suite and attract new businesses to the ecosystem, Amazon has introduced corporate cards, offering perks such as analytics tools for spend and inventory management, discounts on Amazon Web Services (AWS) and control over employee spend.

A business-to-business (B2B) buy now, pay later (BNPL) offering called Pay by Invoice was also launched, providing merchants with the ability to buy now and pay within 30 days, or 60 days for Prime customers. As of February 2022, Amazon Business had more than five million customers worldwide, and growth has been steadily since its launch in 2015, the report says.

Everything you need to know about what Amazon is doing in financial services, CBInsights

In consumer lending, Amazon has tried out several partner cards for both Prime and non-Prime customers, focusing primarily on growing the Prime customer base and increasing marketplace sales. These cards offer different perks including cashbacks and 0% financing on certain purchases.

Last year, Amazon entered the consumer BNPL space, teaming up with Affirm and Barclays.

Next financial pillars

Besides strengthening its payments, cash deposits and lending business lines, Amazon is also exploring other areas within the financial services ecosystem, in particular insurance, the report says.

Amazon started dabbling in the insurance space back in 2016, and since then, has developed a number of fully fledged products.

Amazon Protect, for example, is a white-label service in the UK that provides accidental and theft insurance on certain consumer goods. Amazon has also teamed up with insurtech startup Next Insurance to provide eligible Business Prime members with access to small business insurance policies.

Since 2019, the company has been providing Amazon Care, a telehealth program that offers immediate access to a wide range of urgent and primary care services, including flu testing and vaccinations.

A pilot was first rolled out for employees in Seattle, before expanding to the general public and other employers. As of early 2022, the virtual Amazon Care service was available across the US. Amazon is planning to launch in-person services in another 20 cities later this year.

The CB Insights report also looks at Amazon’s rumored checking account plans. Though 2004 patents hinted at a forthcoming bank account, recent developments suggest that the firm has abandoned plans to create its own checking account, possibly worrying about strict banking regulations.