Banks Need to Learn From Successful C2B Leaders Such as Google, Apple and Facebook

by Fintechnews Switzerland April 2, 2016To stay relevant at all times and provide consistent and fulfilling customer experiences in both the digital and physical spaces, banks need to build partnership with fintech startups and leverage the power of real-time analytics, according to a new report by Accenture.

In a new report entitled ‘Beyond the Everyday Bank,’ the consulting firm advises banks to learn from successful C2B leaders such as Google, Apple, Facebook and Amazon (GAFA). Banks should focus their investment strategies and create innovative business models that will multiply interactions with customers, generating valuable data and driving cross- and up-selling opportunities.

In a new report entitled ‘Beyond the Everyday Bank,’ the consulting firm advises banks to learn from successful C2B leaders such as Google, Apple, Facebook and Amazon (GAFA). Banks should focus their investment strategies and create innovative business models that will multiply interactions with customers, generating valuable data and driving cross- and up-selling opportunities.

The banking sector is rapidly changing and evolving toward consumer-to-business (C2B) relationships, as consumers are increasingly demanding greater accessibility and control. The report comes amid increasing competition from large tech firms.

A report by Capgemini released last month suggested that 40% of insurers considered Google as a potential threat because of its strong brand and ability to use customer data. Capgemini warned that technology, retail, e-commerce and non-banking financial institutions are entering into the different parts of the insurance value chain, naming the likes of Google, Walmart, and Amazon.

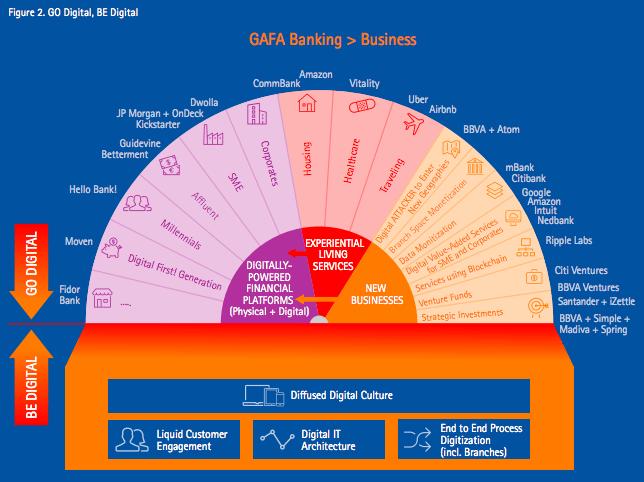

Accenture calls for a “GAFA Banking Approach” consisting in developing a viable response to emerging digital disruptors while managing strategic risk to avoid the loss of revenues to new disruptors.

“The key here is the interaction between ‘GO Digital’ and ‘BE Digital’ agendas, in which the former is about the businesses of focus, and the latter is about enablement,” the document reads.

“Careful attention will be required to select and manage the digital enablers necessary to execute a bank’s transformation – both in digital and physical terms. […] In an accelerated C2B world, playing catch-up will not be good enough because, by then GAFA and other competitors will have only advanced further.”

It is critical for banks to think innovatively and to act quickly, the firm says.

Accenture names three major sets of platforms and businesses that banks should consider within their “GAFA banking portfolio.” These strategies will not only generate new revenues but also act as a multiplier for customer interactions and touchpoints, it argues.

Digitally powered financial platforms: Banks could offer physical and digital choices both in terms of access and in terms of an easy and convenience user experience. An example is JP Morgan’s partnership with OnDesk which allows the bank to provide more financing opportunities at better pricing and engage the mass-market by addressing emerging sub-segments.

Experiential living services: Banks should partner with others to develop platforms that deliver “living services,” or services that can adapt in real-time to fulfill the needs of consumers’ everyday lives. These platforms enable an increased level of interaction with customers and would provide banks with extensive data on consumers’ behaviors. Banks would then be able to embed customized financial services propositions.

New businesses: Banks should explore new businesses with potential opportunities. This includes digital attackers for entering new geographies, branch space monetization, data monetization, digital services for SMEs and corporations, services leveraging blockchain technology, venture funds, and strategic investments.

Accenture believes that the successful implementation of a digital transformation agenda requires banks to manage four interacting steps.

The first one is to confirm the strategic direction by evaluating choices to reach a single vision. The second step is to design the digital agenda by creating a blueprint for the digital transformation. The third step is to enable fit-for-purpose digital governance that reflects new goals. Finally, the fourth step consists in conducting digital enablement activities by creating three-year execution plans.

Read Accenture’s ‘Beyond the Everyday Bank’ full report: https://www.accenture.com/t20160317T214400__w__/us-en/_acnmedia/PDF-10/Accenture-Banking-Beyond-Everyday-Bank-pdf.pdf

7 Comments so far

Jump into a conversationIt is always good to be connected to social networks, especially because of the importance that banks can have to keep up with technology.

This has become even more important in recent times, as it provides a way for people to connect and stay engaged, especially when physical distancing is necessary.

Ich nehme die Dienste der Ghostwriting-Firma schon seit mehreren Jahren in Anspruch und war immer beeindruckt von ihrer Professionalität, ihrem Fachwissen und ihrer Fähigkeit, meine Stimme und meinen Stil perfekt einzufangen. Sie haben mir bei einer Vielzahl von Projekten geholfen, darunter beim Schreiben von Blogbeiträgen, Artikeln und sogar meinem Buch. Ich empfehle ihre Dienste jedem, der ein hochwertiges, professionelles Ghostwriting benötigt.

Take control of the fruit fusion frenzy in the Watermelon Game, where addictive puzzle gameplay meets the challenge of surpassing global competitors on the leaderboard.

Social media connectivity is always beneficial, particularly given how crucial it can be for banks to stay current with technological advancements.