Switzerland has one of the most regulatory heavy ecosystems in the world.

Every year, more advanced regulations and compliance are put in place, making it more expensive for financial institutions to meet requirements. Consumers, accustomed to seamless user experiences with larger online players, are now expecting the same level of service with their banks. As new technologies are introduced, sandboxes and startup competitions are set in place to encourage innovation.

As a result of these developments, financial services players and other industries are turning to eKYC in order to reduce costs, enhance customer experience and implement new technologies that distinguish them from competition.

The regulatory requirements in Switzerland

Switzerland not only has one of the strongest financial centres globally, but also the strongest privacy culture in the world: they were the first to issue a bank secrecy law back in 1713. This culture of regulation and privacy means Switzerland takes regulations very seriously, with financial institutions having to meet increasingly stringent requirements every year.

Currently, Switzerland has many AML (Anti-Money Laundering) laws in place in order to identify, trace and seize illegal assets. Swiss companies must also comply with the European GDPR, PSD2 and MiFIDII/MIFIR, all designed to protect consumer data. Most AML laws in Switzerland are focused on KYC rules, procedures and internal documentation, requiring banks and managers to verify identities with personal documents, previous addresses and more. These laws are overseen by the Swiss Financial Market Supervisory Authority (FINMA) and are regularly updated.

Traditionally, Swiss banks onboard their customers manually and in person. This is frustrating for both banks and customers: manual procedures are slow and frustrate customers, and are an expensive and time-consuming procedure for banks. For this reason, Swiss regulators introduced a new law in 2016 offering financial institutions the possibility to do their onboarding online – but 4 years later, only a few Swiss banks offer digital onboarding with video.

Recently, Swiss regulators have been setting new regulations in order to encourage institutions to offer digital alternatives, as traditional onboarding becomes less secure. In January 2019, the Swiss Parliament created a Fintech categorisation so all Fintechs were subject to AMLA laws. More recently, in January 2020, FINMA introduced a new law to make digital onboarding more secure than before: the Federal Act on Financial Services (FinSA) and the Federal Act of Financial Institutions (FinIA). Currently, only a few Swiss banks do digital onboarding through video; the objective of this law is to encourage more financial institutions to move away from cumbersome video onboarding processes as well as traditional practices and utilize more efficient KYC technologies.

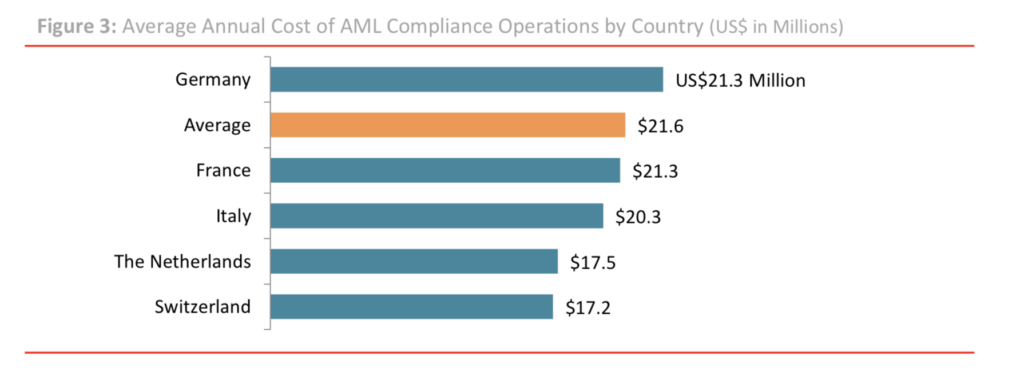

Things are moving forward in the Swiss KYC landscape. According to a LexisNexis survey report, financial institutions in France, Germany, Italy, the Netherlands and Switzerland are spending US$83.5 billion on compliance every year. Switzerland is also taking steps to encourage more financial technology, with a staggering increase in Fintech investment of 61.8% in 2018. The country is also garnering a reputation as a Fintech hub for blockchain and wealth management, attracting talent and investment from all around the world. Regulators are stepping in by organising sandboxes, startup competitions and accelerators to further encourage innovation.

credit: LexisNexis survey report

As banks look for ways to lower costs and meet demanding compliance, fintech solutions that focus on fixing one pain point, use advanced technology and enhance customer experience appear to be the best way forward.

The role of eKYC in Switzerland

Money laundering from narcotics-related activities is still a huge issue in Switzerland, causing regulatory compliance to become more stringent and complex every year. This is what makes identity verification expensive and time-consuming for financial institutions.

The new laws, increasing costs and rising customer demand means Swiss financial institutions are turning to eKYC as a way to solve all the issues in one go. Digital KYC is the best solution for banks to offer secure, regulatory and fast compliance requirements. With tech such as AI and APIs, the entire KYC process can be automated and all the data stored on the cloud, drastically lowering the cost of onboarding customers. In addition, a transparent and secure digital onboarding process increases trust with customers and improves the whole customer experience.

However, creating an eKYC system from the ground up can be costly and time-consuming for bank incumbents in Switzerland, which is why many are partnering up with Fintechs that focus solely on eKYC in order to help with digital onboarding, automation and risk management.

As costs are lowered, the financial services chain will reduce in size, encouraging more partnerships in the ecosystem and sharing of consenting user data – this is apparent already in Europe with the PSD2 directive. Combining regulation and technology is a big step towards increasing security, lowering costs and improving the relationship with the customer.

Switzerland’s regulatory landscape gives the country a reputation as a trustworthy and reliable centre for finances. The mix of banking experience, developed infrastructure and regulatory advancement means that it is a growing hub for innovation; the Swiss Federal Council and regulators are continuously introducing laws that encourage blockchain and other advanced technology.

In the past, intense regulatory requirements meant that banks and financial institutions were wary of innovating or introducing new initiatives. However, as traditional KYC becomes more expensive and cumbersome, financial services players are finally looking towards Fintech and digital solutions in order to help with the process as well as stand out. Those who won’t adopt run the imminent risk of becoming obsolete.