IFZ 2020 Swiss Fintech Study Highlights: Switzerland Still Behind Singapore

by Fintechnews Switzerland March 6, 2020The Swiss fintech industry is maturing and gradually consolidating, a trend showcased by the increase of the number of Series B rounds and the appearance of the first fintech exits in 2019, according to the IFZ Fintech Study 2020.

The Lucerne University of Applied Sciences and Arts has released its annual IFZ Fintech Study, which provides an overview of the Swiss fintech sector. This year’s study reveals a slower growth of the fintech sector compared with previous years, indicating the increased level of maturity of the sector.

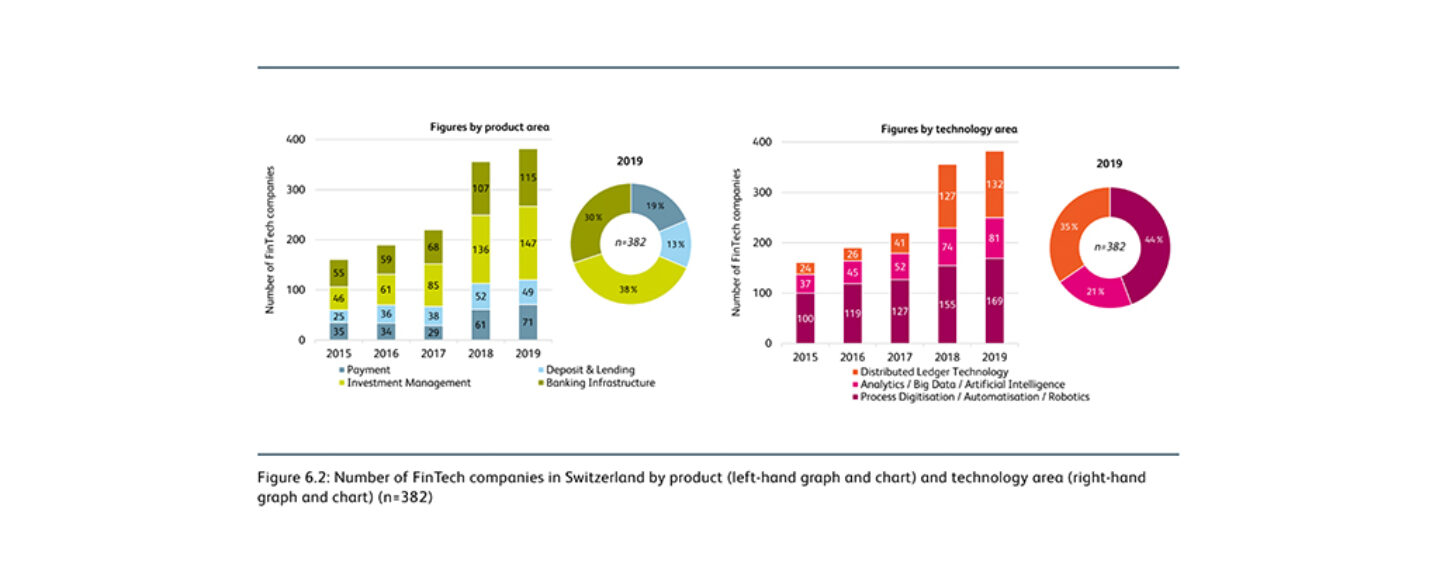

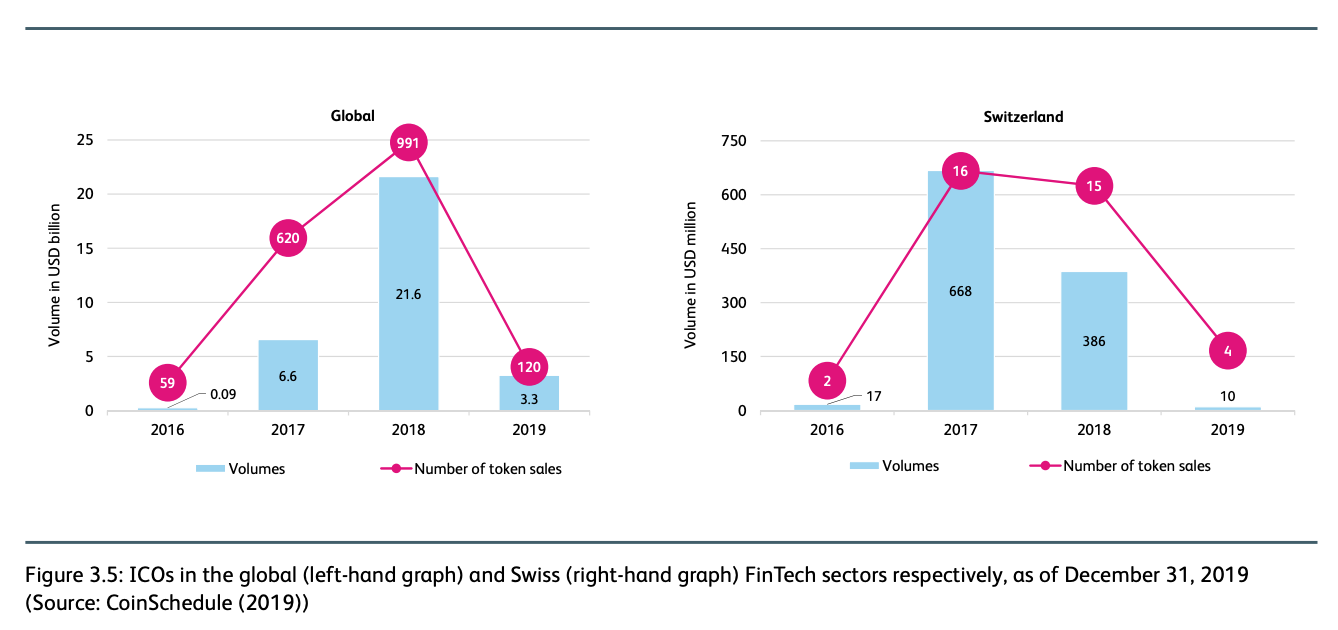

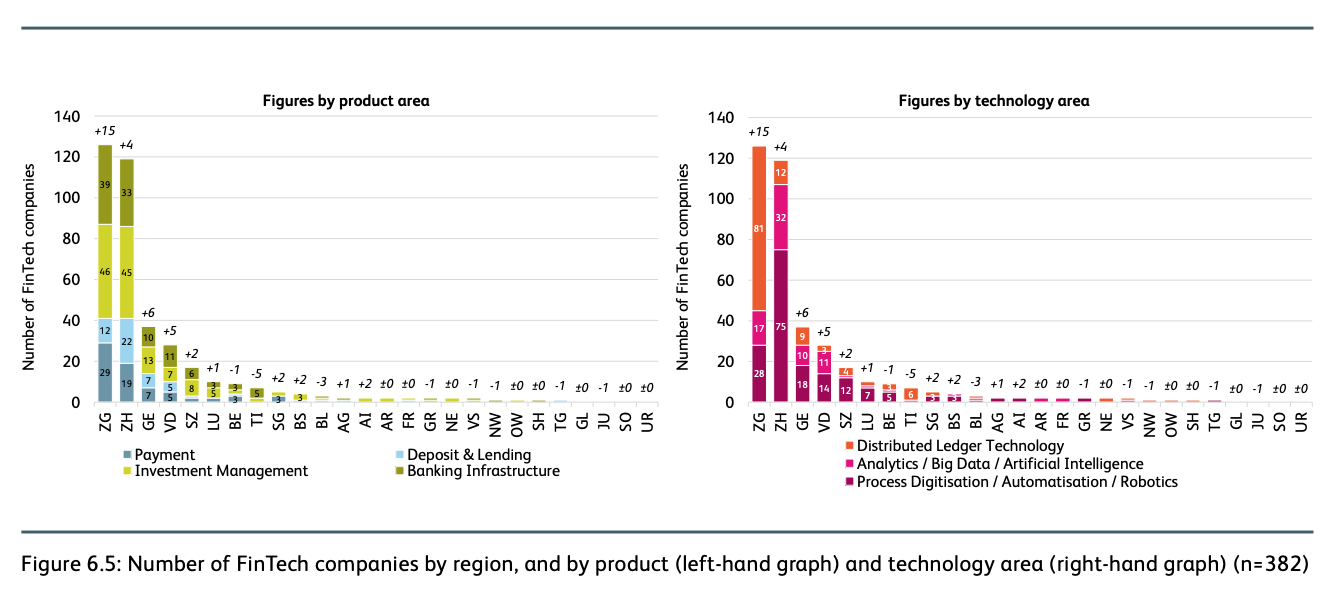

As of late-2019, Switzerland was home to 382 fintech companies, representing a 7% increase compared with 2018. A breakdown of these companies reveals that almost 70% of Swiss fintechs offer solutions in the area of investment management or banking infrastructure. The research also found that the most commonly used technologies by Swiss fintechs are process digitization, automation and robotics, as well as distributed ledger technology (DLT).

Number of Fintech companies in Switzerland by product (left-hand graph and chart) and technology area (right-hand graph and chart), IFZ Fintech Study 2020

A maturing industry

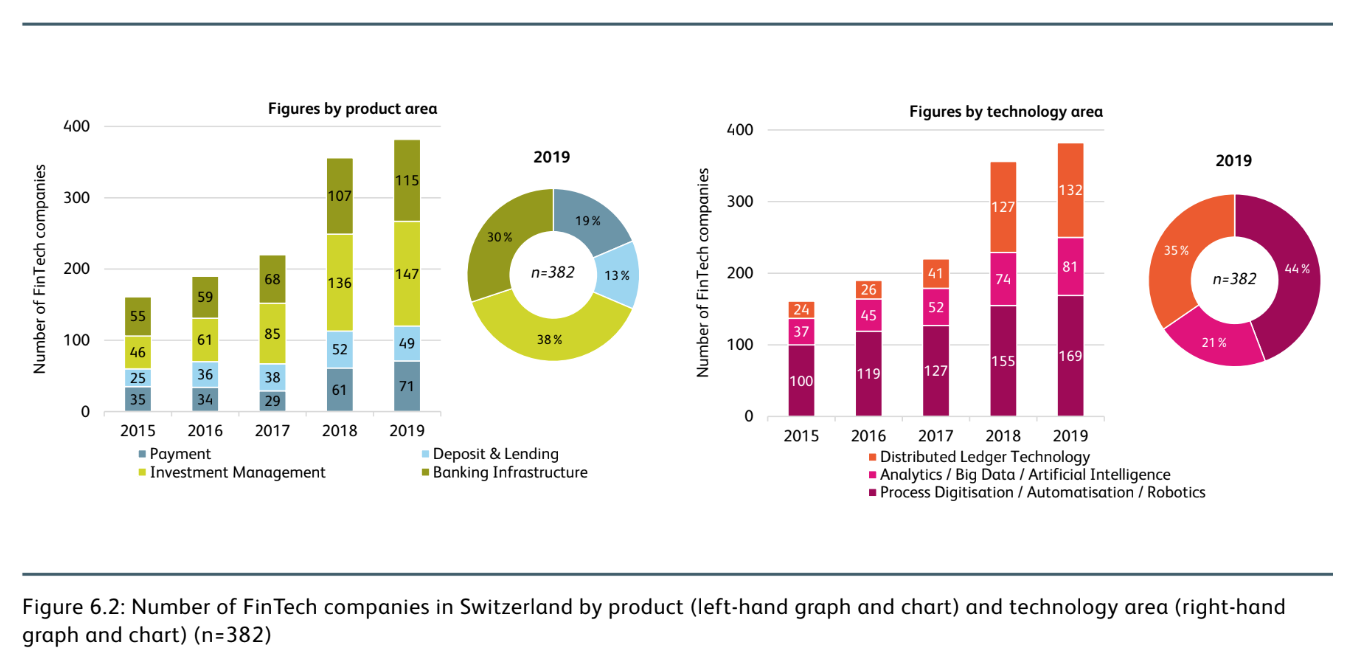

One major indicator that the Swiss fintech sector is maturing is the rise of Series B funding rounds in 2019. In fact, Series B capital dominated the venture capital environment in the Swiss fintech industry last year, exhibiting an impressive volume growth rate of 115% compared with the previous year. This indicates the increased relevance of later stage funding for the Swiss fintech industry, the report says.

Some of the largest Series B rounds last year include Numbrs Personal Finance (more than CHF 40 million), and Swiss Fintech/Loanboox (CHF 22 million).

Venture capital invested in Swiss FinTech companies, as of December 31, 2019, IFZ Fintech Study 2020

The report also notes the appearance of the first market exits in the Swiss fintech ecosystem, which shows that the market is gradually consolidating. It predicts increased acquisition and initial public offering (IPO) activity in the years to come.

There were at least four Swiss fintech acquisitions in 2019, the research found. These include the acquisition of Devisenwerk, a company offering currency exchange, by the Irish company Transfermate Global Payments, the takeover of PostFinance subsidiary Lendico Schweiz by crowdlending platform LEND.ch (operated by Switzerlend), and the purchase of iKentoo by Canadian company Lightspeed POS.

The most recent acquisition deal was completed in December 2019 when Swiss company Aduno increased its stake in Contovista from 70 to 100%.

Swiss fintech funding in 2019

2019 saw a slowdown in fintech funding volumes compared with the record year of 2018. Swiss fintech companies raised roughly CHF 210 million through 74 funding rounds in 2019, a 9% increase in deal count and a 35% decrease in funding amount, compared with 2018.

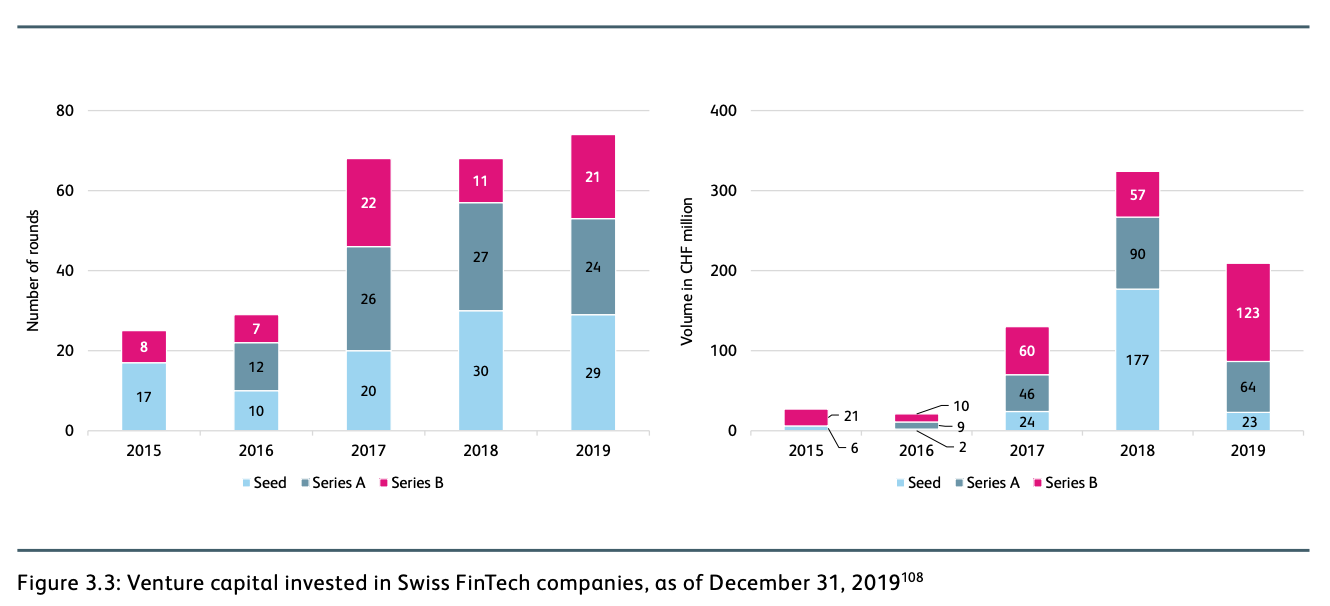

Unsurprisingly, token sale activity declined last year, like in other parts of the world. Only four token sales took place in Switzerland in 2019, and raised a combined US$10 million.

ICOs in the global (left-hand graph) and Swiss (right-hand graph) Fintech sectors respectively, as of December 31, 2019, IFZ Fintech Study 2020

Despite the significant decline, the Swiss crypto sector remained under the spotlight in 2019 with the establishment of the Libra Association in Geneva, the Facebook-led consortium aimed at launching a global stablecoin, the report notes.

Other findings

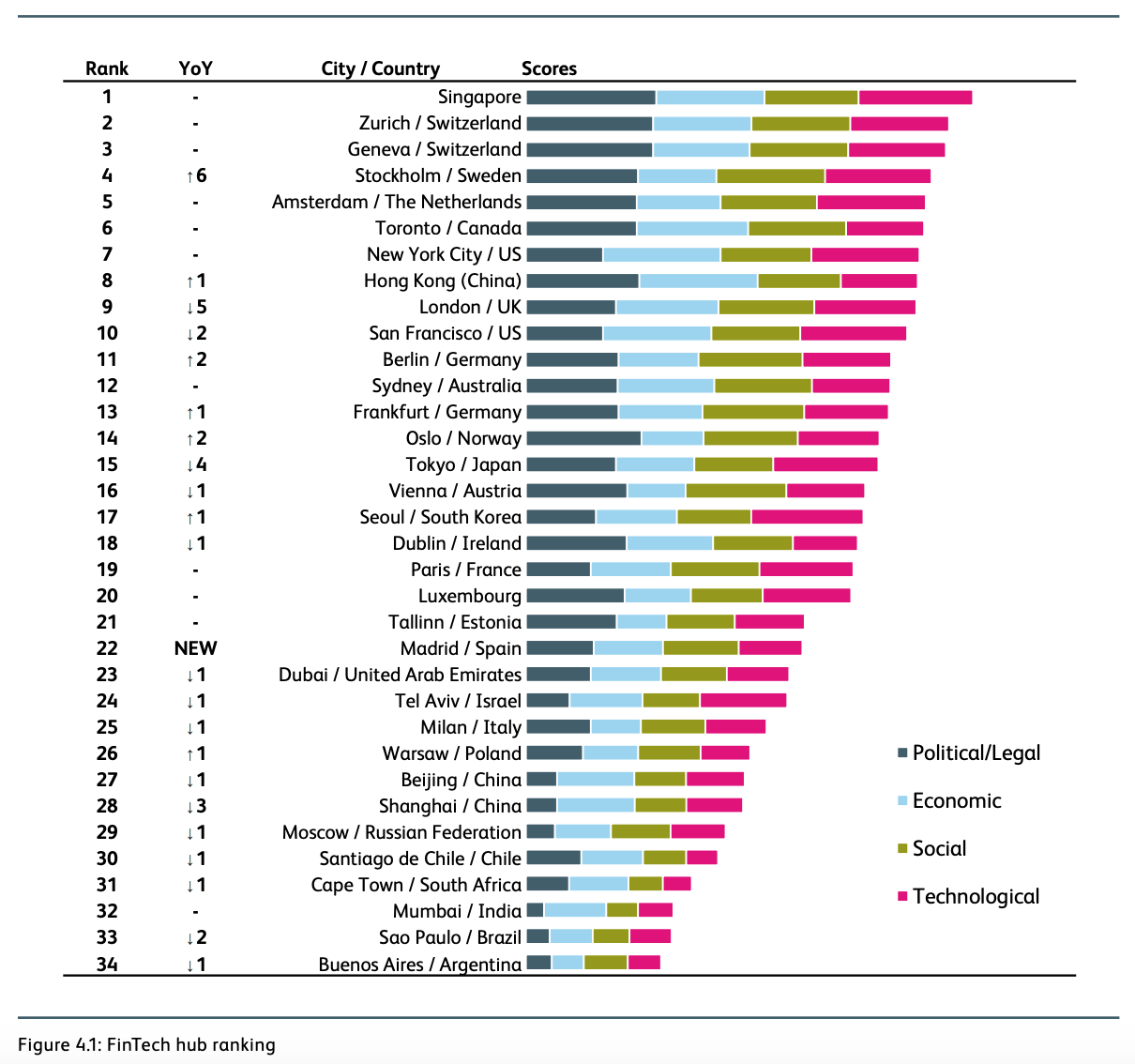

The research ranked Singapore the world’s top fintech hub, followed by Zurich and Geneva. The two Swiss cities were recognized for the political stability and legal landscape.

Fintech hub ranking, IFZ Fintech Study 2020

With 118 companies, Zurich was the second largest Swiss canton last year, after Zug (126 companies), as measured by the number of fintech companies. The majority of Zurich-based fintech companies use process digitalization, automatization and robotics as their main technology, and operate in the field of investment management and banking infrastructure, the research found.

Number of fintech companies by region, and by product (left-hand graph) and technology area (right-hand graph) (n=382), IFZ Fintech Study 2020

Another key finding from this year’s study is that Swiss fintech companies are still struggling to establish a customer base and proposing solutions that solve real problems. The report cites the case of DLT which has not yet proven its importance in the financial industry.

The research also found that Swiss banks have been slow in responding to the changing landscape and the rise of fintech.

Moving forward, it predicts that more fintech-friendly rules will be implemented with the next significant development likely to be the Swiss DLT draft law planned for 2021.