Influence of Coronavirus? Investments in Swiss Startups Drop in Q1

by Fintechnews Switzerland April 9, 2020The Swiss Venture Insights report by startup.ch shows that the coronavirus and the threat of a possibly severe recession continue to create an uncertain environment for investors and startups.

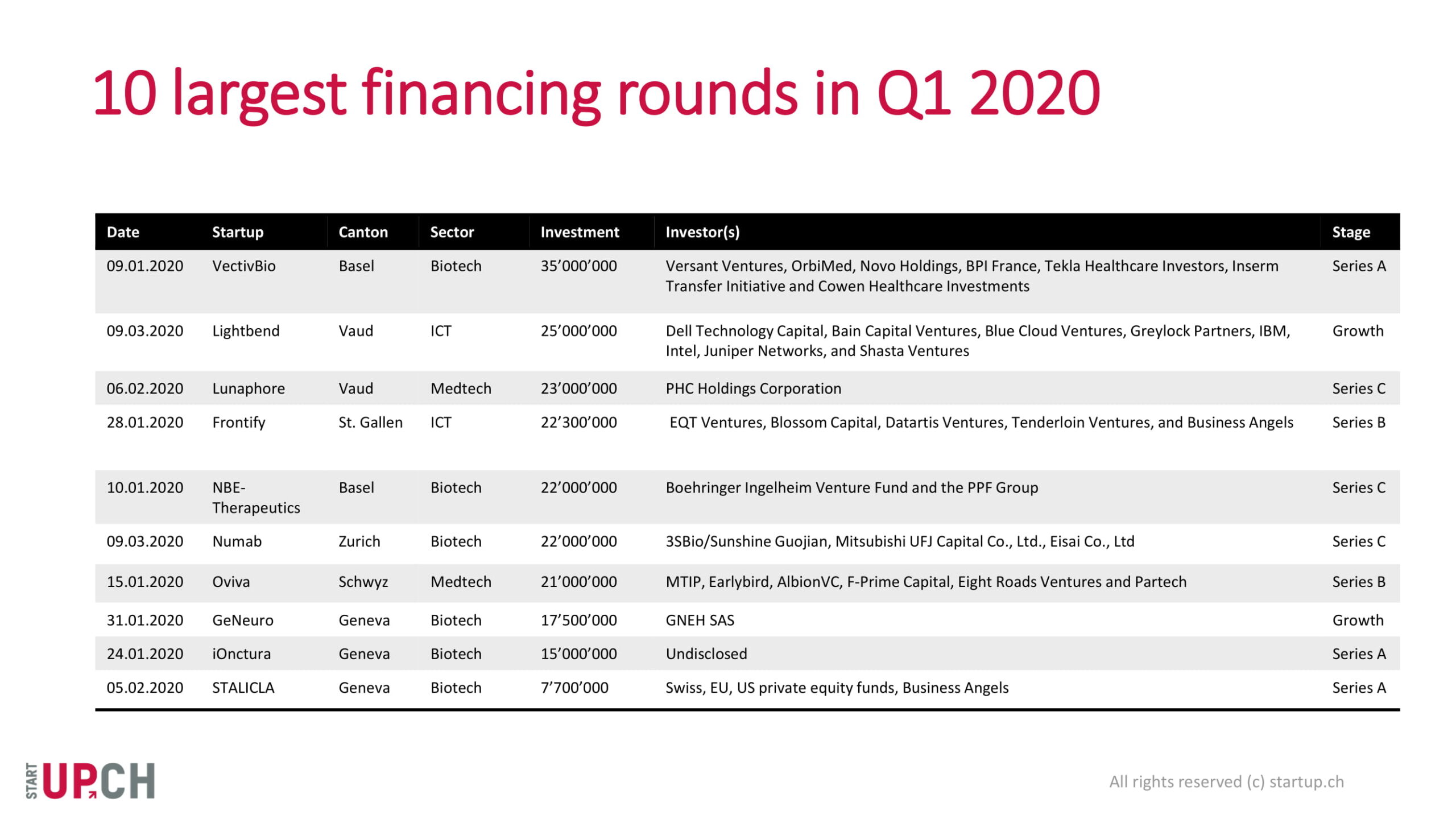

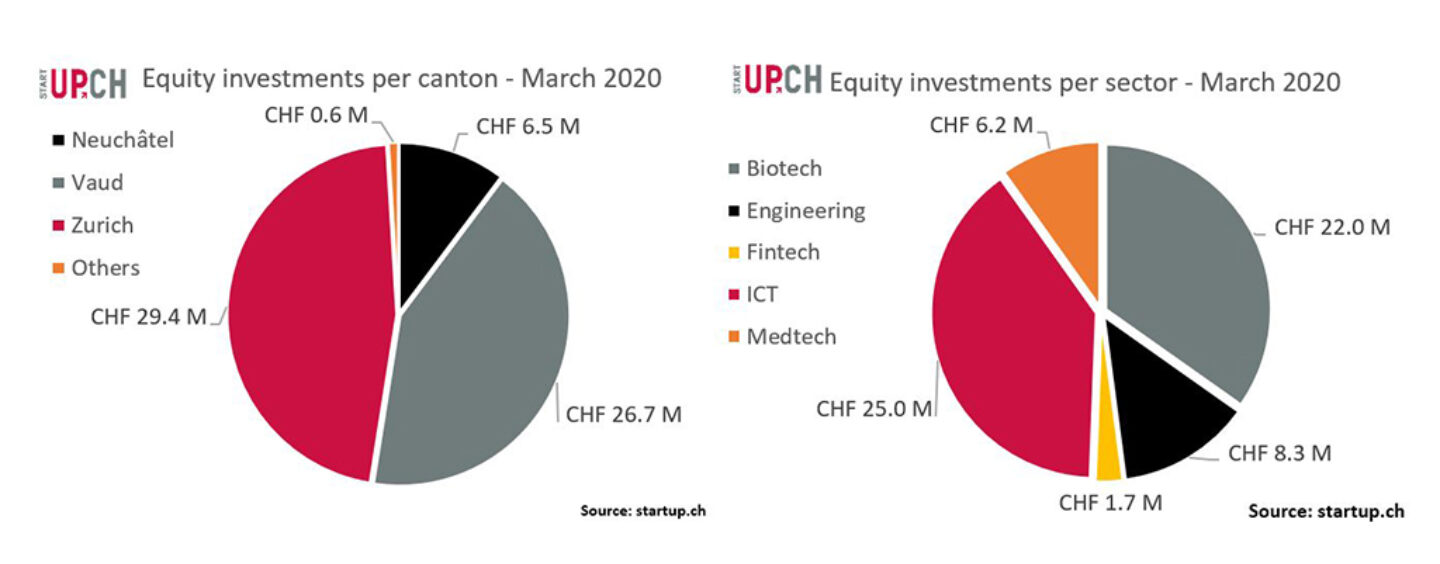

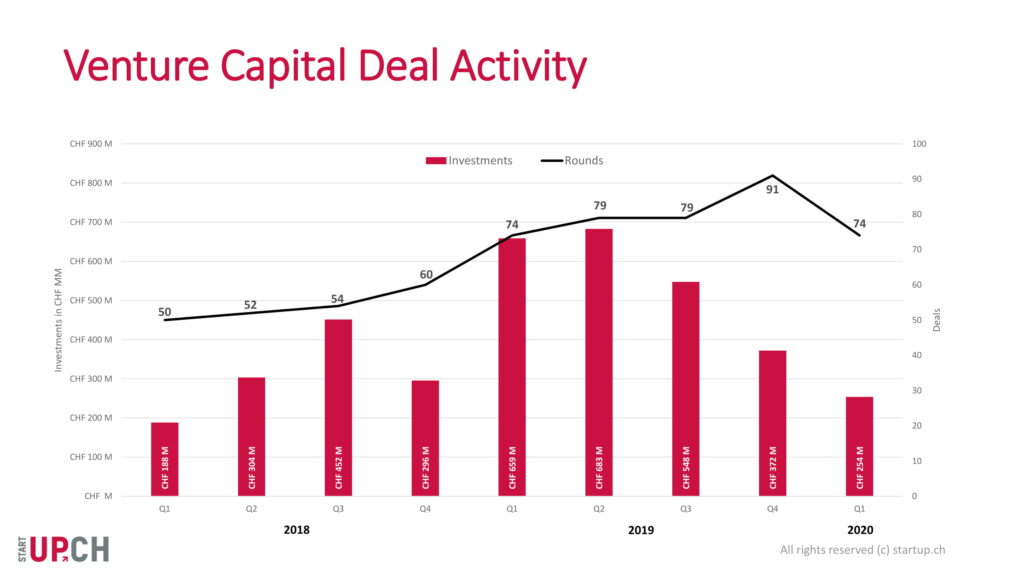

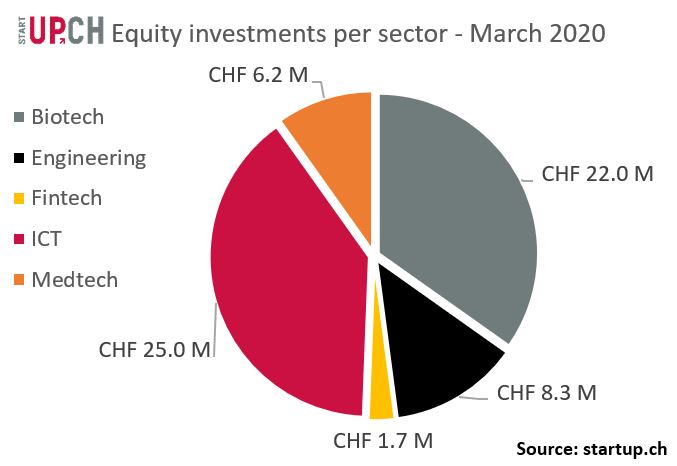

Despite a strong 2019, where equity investments passed CHF 2 billion for the first time, the economic fallout from the pandemic affects investments in 2020. While equity investments in the first three months of 2019 resulted in CHF 658.7 million, the money raised in the same period in 2020 adds up to CHF 254 million. Life sciences investments account for 47% (CHF 119 million) of the CHF 254 million, highlighting the continuous attractiveness of the sector in Switzerland. ICT startups attracted CHF 58 million and medtech startups CHF 56 million.

When looking back at Q1 2019, we see that Q1 was influenced by two outliers: Arvelle Therapeutics (USD 180 million in February 2019) and Wefox (USD 125 million in March 2019). When deducting these two mega-rounds of financing, the result is CHF 354 million. This means that in the first quarter of 2020, CHF 100 million less was invested in Swiss

startups than in the previous year.

Stefan Steiner

“Learnings from the financial crisis in 2008 or the burst of the .com bubble in 2001 show that investors will be very cautious in the coming months. Unless a startup is responding to an urgent digital need, such as e-commerce, home delivery, remote working, healthtech, or e-learning, then companies need to prepare for a downside scenario and consider cash conservation,”

said Stefan Steiner, co-managing director of Venturelab. Steiner continued,

“As we have seen in our survey at the end of March, startups do not yet benefit from the Federal Council’s liquidity assistance. We encourage and support startups to adjust their business plans and develop realistic scenarios of potential future market environments.”