Meta Advances Work on Diem; Alphabet Shifts Focus on APAC Payment Market

by Fintechnews Switzerland January 20, 2022These past few years have seen American bigtechs continuing to make inroads into fintech, teaming up with legacy financial institutions to embed financial services into their platforms, and taking part in strategic funding rounds to get their hands on the latest tech.

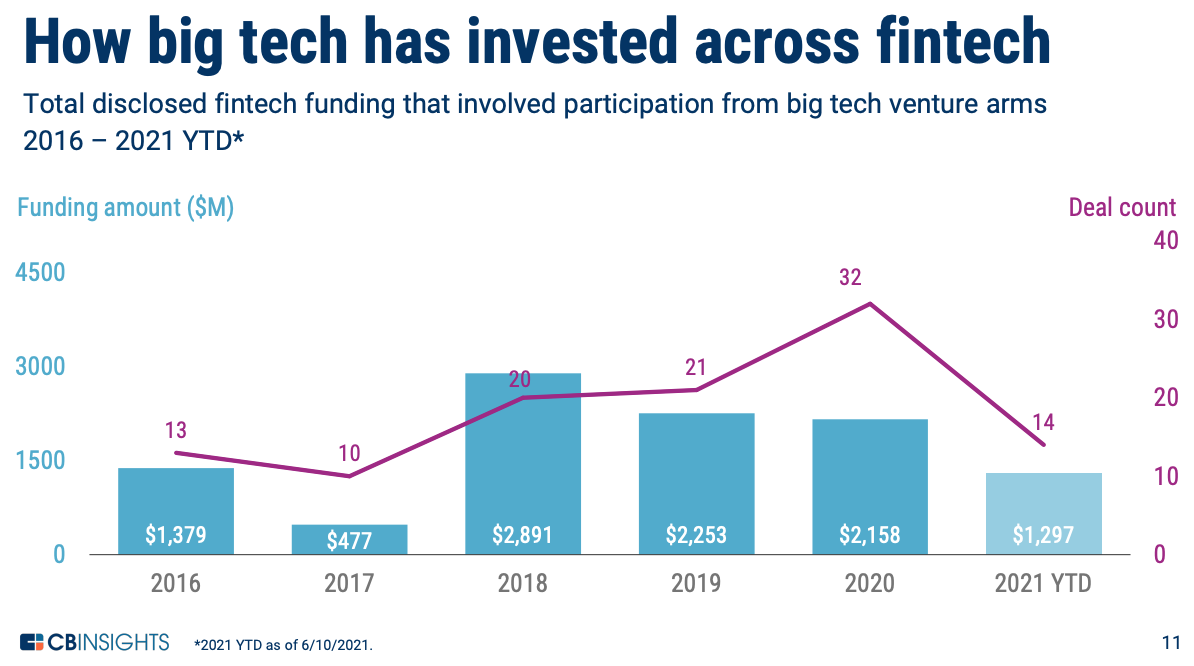

In 2020, US bigtech investments in fintech companies reached US$2.2 billion, data from CB Insights show. Though the amount represents a 4% drop from the previous year, deal count increased 52% year-over-year (YoY) hitting 32 deals.

Total disclosed fintech funding that involved participation from big tech venture arms 2016 – June 10, 2021, Source: CB Insights, The Big Tech In Fintech Report

In 2021, Alphabet, Google’s parent company, and Meta, the owner of Facebook, Instagram, WhatsApp, and other social media and technology brands, continued to grow their payment businesses with a view of establishing e-commerce powerhouses. While Facebook pursue its work on advancing its stablecoin plans, it appears that Google is putting an halt on its banking plans, shifting instead its focus on the Asia Pacific (APAC) region’s payment and remittance market.

Meta builds out e-commerce business

Meta Platforms has been focusing on strengthening its payment business as part of a broader push to develop a full-featured commerce platform.

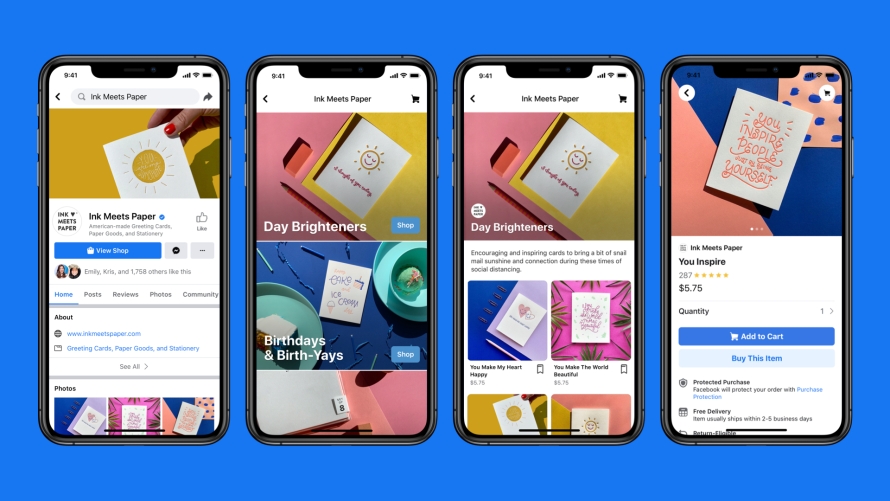

In 2020, the firm launched Facebook Shops, allowing business profiles to easily set up a single online store for customers to access on both Facebook and Instagram. Customers can pay through Facebook Pay and carry their payment credentials from one app to another. After its introduction to the US market, Facebook Shops was rolled out to businesses in the UK and Canada last year.

Facebook Shops

Meta has been dabbling in fintech for couple of years now. Facebook Pay was introduced in 2019 as a way to establish a payment system that expands across the company’s apps for peer-to-peer (P2P) payments, donations and e-commerce. In 2020, the firm began rolling out payment functionalities on its WhatsApp messaging platform, starting with India and Brazil.

In tandem, a new blockchain division was set up to research and work on a cryptocurrency project. This would later become Diem, formerly known as Libra, an initiative aimed at developing a blockchain-powered payment system and stablecoin to facilitate transactions across Meta platforms.

Digital wallet Novi began trialing in October 2021, allowing a small group of users in the US and Guatemala to send and receive money using the Paxos USD stablecoin (USDP). Novi is designed for the Diem payment system, and the company plans to replace USDP with the Diem stablecoin at some point.

The Novi pilot was extended to WhatsApp last month, letting users transact directly through the messaging app.

Both Facebook Pay and Diem are overseen by Facebook Financial (F2), a division formed in 2020 to manage all of the firm’s payment efforts and establish coherence in its payment strategy.

Facebook’s parent company changed its corporate name to Meta Platforms in October 2021 as part of a major rebrand. The company said it will shift its focus toward building the metaverse, an immersive virtual environment. This ultimately led in December 2021 to the acquisition of the Meta Financial Group, an US regional bank that operates through its banking subsidiary MetaBank, for a whopping US$60 million.

Google puts a focus on APAC

After scrapping plans to launch bank accounts, Google’s parent company Alphabet appears to have shifted its focus on strengthening its payment business in the Asian continent.

News broke in July 2021 that the tech giant was working on the acquisition of Tokyo-based cashless payment and settlement startup Pring, reported Nikkei. The 20-30 billion yen (US$180 million to US$270 million) deal aims for Google to start offering fintech services such as payments and transfers in Japan this year.

This built on similar payment initiatives the firm undertook in 2021, including its entry into the remittance market last year through a partnership with Wise and Western Union. The partnership has enabled US Google Pay users to send money to India and Singapore. In India, Google Pay is one of the most popular digital wallets, holding a 35% market share in real-time payments.

Google has operated mobile payment service Google Pay, formerly Android Pay, since 2015. The service covers 40 countries and boasts over 150 million monthly users.

In 2020, Google said it would enter the banking sector through a partnership with Citigroup and Stanford Federal Credit Union. A service called Plex was meant to start letting users open bank accounts right from the Google Pay app beginning in 2021.

Instead, the firm said it will focus on “digital enablement for banks and other financial services providers rather than us serving as the provider of these services,” a spokesperson told CNBC in October 2021.

Like Meta, Google is looking to conquer the online shopping market, having, for example, teamed up with Shopify to allow merchants to more easily sign up to feature their products appear across Google Search, Maps, Images, Lens and its YouTube platform.

New e-commerce tools have also been launched to upgrade user experience for shoppers, leveraging for instance artificial intelligence (AI) to enhance retailers’ e-commerce capabilities and help them deliver personalized customer experiences. It’s also working on a new feature that would recognize products found in images on a website to make them instantly “shoppable.”