Sustainable Investing and Crypto Among Top European Fintech Trends in 2022

by Fintechnews Switzerland November 16, 2021The year is coming to an end and Finch Capital is sharing its fintech predictions for 2022. Among the hottest trends for the year to come, the venture capital (VC) firm cites cryptocurrencies, decentralized finance (DeFi), embedded insurance, and sustainable investing as some of the key sectors forecast to see notable traction in the European fintech industry in 2022.

These predictions were shared in the sixth and latest edition of the State of European Fintech, which gives an overview of the fintech landscape in 2021 and explores the top themes for the year to come.

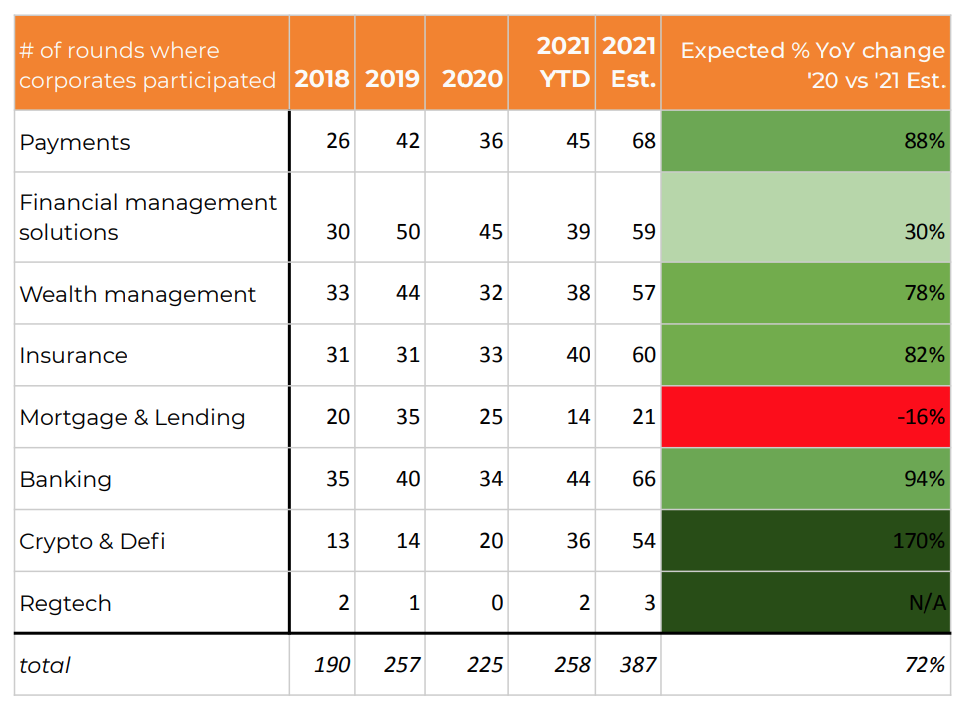

In 2022, the fintech-focused VC firm predicts that cryptocurrencies and DeFi will break into the mainstream as corporate VC funds continue their push into the emerging sector. The report cites their increased participation in crypto and DeFi deals over the past years at the detriment of sectors such as mortgage and lending.

Corporate participation, Source: Finch Capital

This past year has seen surging institutional adoption and interest in the cryptocurrency space. Out of the world’s 20 largest venture funds based on assets under management (AUM), 17 have invested in companies in blockchain or cryptocurrencies, according to a new research by Blockdata, a blockchain data and intelligence firm owned by CB Insights.

Blockchain companies raised a record of US$7 billion in H1 2021 driven by mega-rounds of US$100 million and over.

Insurtech is another segment to watch closely. After a blockbuster year 2021 with record funding levels and the minting of more than five insurtech unicorns, insurtech will continue to be a center of focus for investors and innovators, with business-to-consumer (B2C) insurtechs and embedded insurance, in particular, seeing notable traction.

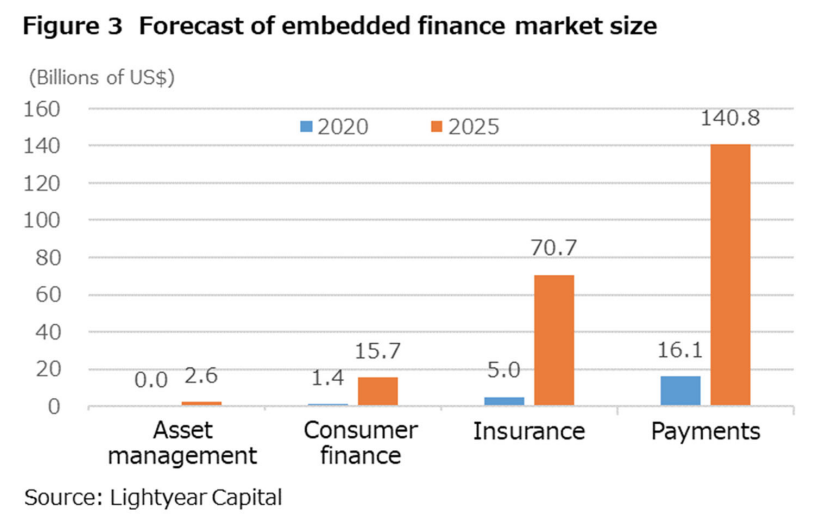

Leading super apps and money management apps will be driving the embedded insurance movement, the report says, pushing others to follow suit and copy the integration. In the broader embedded finance market, insurance is expected to witness one of the fastest growth rates.

US private equity firm Lightyear Capital predicts that the global market for embedded finance will grow more than tenfold from US$22.5 billion in 2020 to US$229.8 billion in 2025. The embedded payments will account for the bulk of the figure at US$140 billion (61%), followed by embedded insurance (30.8%), embedded consumer finance (6.8%) and embedded asset management (1.1%).

Forecast of embedded finance market size, Source: Lightyear Capital

Enabling software including those that leverage artificial intelligence (AI) for debt collection and process automation, as well as end-to-end (E2E) know-your-customer (KYC) solutions and banking-as-a-service (BaaS) will be a key theme in 2022.

Finch Capital predicts rising adoption of efficient KYC solutions amid increased sophistication of financial crime and regulatory pressure. The firm also forecasts increasing use of AI-enabled debt collection software as tech adoption for this particular field remains low while delinquencies continue to increase.

Sustainable investments will also pick up steam as consumer interest continues to rise and household savings keep on growing, opening doors for sustainable investment apps to get a share of consumers’ disposable income.

Over the past two years, sustainable fund flows have grown significantly and will continue to surge to ultimately triple in the next decade, the VC says.

Another key theme for 2022 is buy now, pay later (BNPL) arrangements, a type of short-term financing that allows consumers to make purchases and pay for them in installments that has risen sharply since the beginning of the pandemic.

Consolidation is already happening in the space with payment giant Square acquiring Australian BNPL leader Afterpay for a whopping US$29 billion, and Australian BNPL provider Zip embarking on an acquisition spree that resulted in the purchase of Twisto (Czech Republic), Spotti (United Arab Emirates) and Quadpay (US).

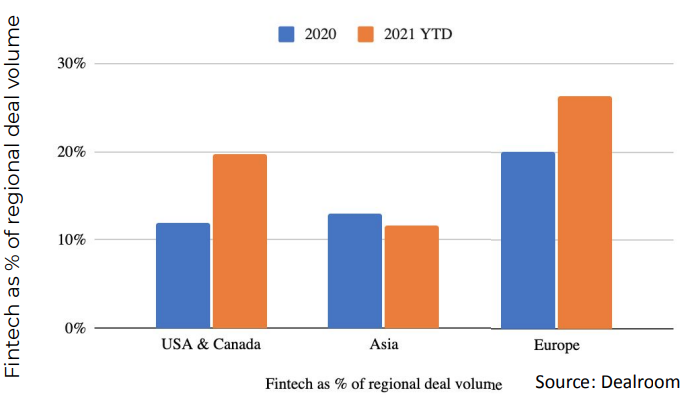

In 2021, fintech dominated the VC funding activity in Europe, making up more than 25% of regional deals, up from 20% in 2020, the Finch Capital report says.

Fintech as a percentage of regional deal volume, Source: Finch Capital

In 2022, fintech growth should stall amid rising war on talent, a slowdown in public and initial public offering (IPO) activity, and increased regulatory scrutiny notably in payment processing and lending.

German payment firm Wirecard collapsed last year following a series of accounting scandals. In the UK, fintech lender Greensill filed for insolvency in March amid overexposure and mismanagement of its loan book. And in the US, stock trading app Robinhood has been at the center of numerous controversies related to trading outages, negligence and misleading information.