Switzerland’s Futurae and Investglass Amongst Winners of 2020 Financial NewTech Challenge

by Fintechnews Switzerland July 10, 2020The Swiss Startups Futurae and Investglass were named amongst this year’s winners of the Financial NewTech Challenge.

The Financial NewTech Challenge, organized by Capgemini and Efma, and hosted on the FintechVisor portal, is a competition that aims to recognize the most innovative financial newtechs and identify the most inspiring collaborative projects between newtechs and financial institutions.

This year, a total of 164 submissions were received from around the world and more than 2,700 votes were cast to select the winners across three categories – Retail Banking, Payments, and Wealth Management, Investment and Capital Markets – and two maturity stages – Startups and Scaleups –, as well as the most innovative project from a newtech/financial institution partnership.

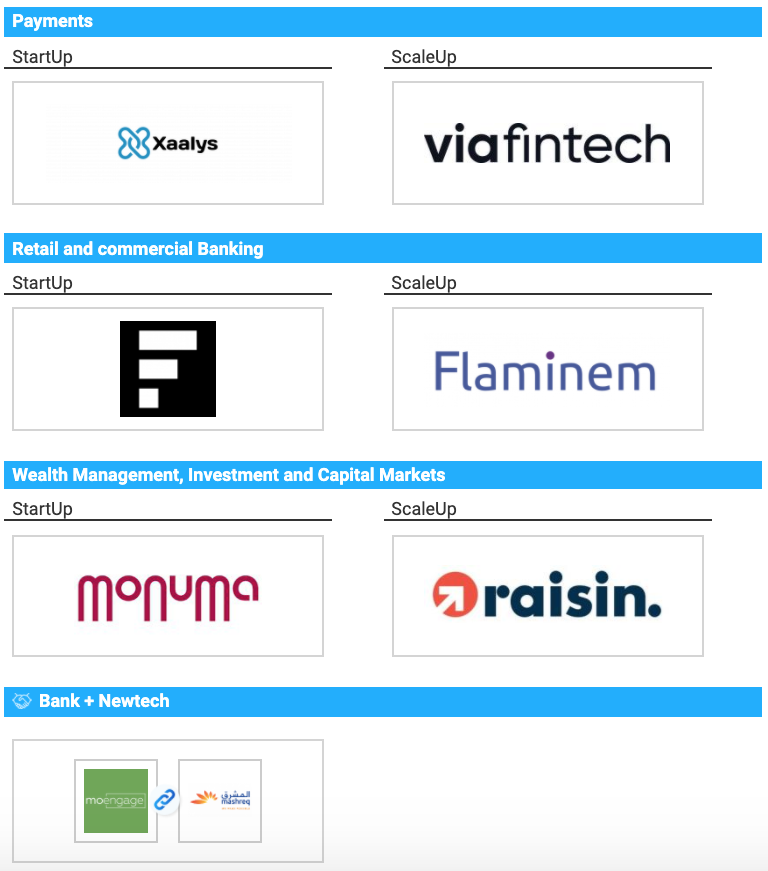

2020 Financial NewTech Challenge winners

Futurae Technologies was named the winner in the Retail Banking, Startup category, and was recognized for its seamless and secure multi-factor authentication and transaction confirmation process.

Founded in 2016 by security researchers from ETH Zurich, Futurae Technologies offers a suite of multi-factor authentication tools that provide a high degree of security, improve the customer experience, and protect users’ privacy. The suite consists of a full range of authentication and transaction signing for web and mobile applications that give companies complete flexibility.

Futurae Technologies joins Flaminem, from France, which was selected as the winner in the Retail Banking, Scaleup category. Flaminem provides a cloud-based know-your-customer (KYC) solution that acts as a single window for digitizing the full KYC diligence process.

In the Payments category, Xaalys, from France, and Viafintech, from Germany, won in the Startup and Scaleup categories, respectively.

Xaalys offers personalized digital banking services as well as financial education content aimed at the teenage market, while Viafintech provides a bank-independent payment infrastructure that digitally connects retailers, corporations, and consumers all over Europe.

In the Wealth Management, Investment and Capital Markets category, Monuma, from France, and Raisin, from Germany, won in the Startup and Scaleup categories, respectively.

Monuma provides a global blockchain application dedicated to certifying and transporting goods securely, while Raisin offers a marketplace for term deposits from partner banks across Europe.

Finally, in the Financial NewTech Collaboration category, the partnership between MoEngage, from the US, and Mashreq Neo, from the United Arab Emirates (UAE), to develop Sherpa was named this year’s winner. Sherpa is an intelligent customer engagement platform that enables Mashreq Neo, a mobile banking app, to understand customer behavior.

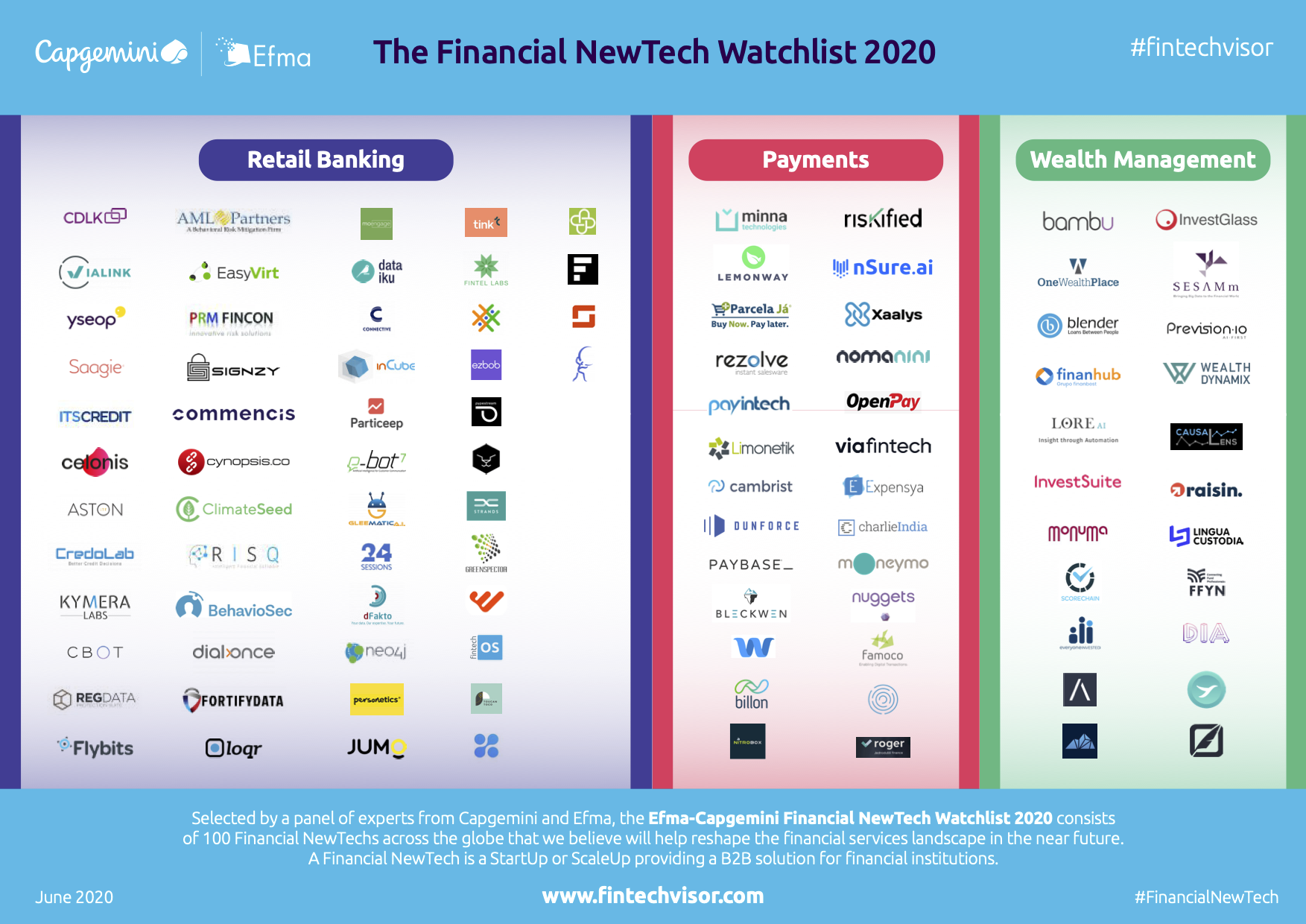

The Financial NewTech Watchlist 2020

The Financial NewTech Watchlist 2020, May 2020, Efma and Capgemini

Alongside announcing this year’s winners, Capgemini and Efma have also released a shortlist of 100 financial newtechs from across the world which they believe will help transform the financial services landscape.

In the Retail Banking category, fintechs that made the list include CredoLab, a credit scoring platform leveraging artificial intelligence (AI) from Singapore, Jumo, a mobile financial services platform from South Africa, and Tink, an open banking platform from Sweden.

In the Payments category, fintechs cited include Lemonway, a payment institution dedicated to e-commerce websites, crowdfunding platforms, and marketplaces from France, Riskified, a provider of fraud and chargeback prevention technology from Israel, and Nuggets, a decentralized, self-sovereign payments and identification platform from London.

Finally, in the Wealth Management category, Bambu, a business-to-business (B2B) robo-advisory platform from Singapore, InvestGlass, the provider of an integrated wealth advisor platform from Switzerland, and InvestSuite, a Belgian startup offering automated investment solutions, were named amongst the most promising wealthtech providers around the world.

Financial Newtech Challenge 2020 Hall Of Fame Winners: