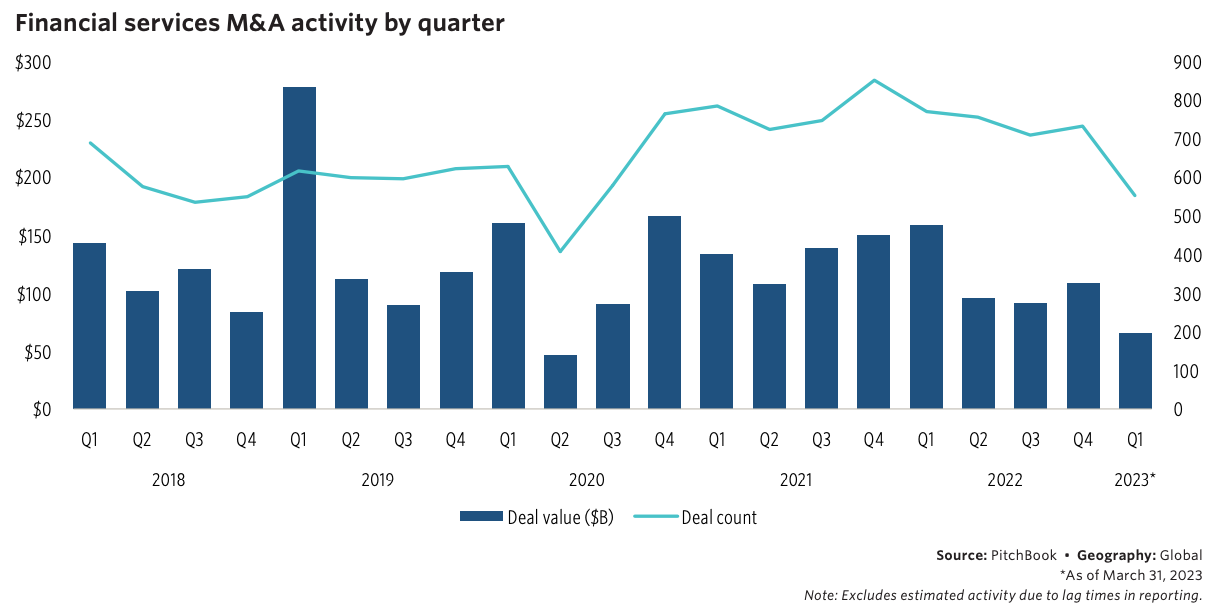

Mergers and acquisitions (M&A) activity in the financial services and technology industries continued their decline in Q1 2023, carrying on a trend that began last year.

Deal activity in these sectors is now reaching levels not seen since the start of the pandemic, new data from research firm PitchBook show.

The sector saw an estimated 856 deals, a decrease of 11.4% quarter-on-quarter (QoQ), while deal value sank 31.7% QoQ and 47.0% year-on-year (YoY), the report says.

Financial services M&A activity by quarter, Source: Q1 2023 Global M&A Report, PitchBook, April 2023

During Q1 2023, the market experienced distressed sales following the collapse of several small- to mid-size banks in the US, it notes.

Silicon Valley Bank (SVB) was acquired from the Federal Deposit Insurance Corporation (FDIC) by First Citizens Bank after an extensive sale process. SVB imploded in March after being forced to sell securities at a loss amid higher interest rates.

Spooked investors and depositors rapidly began pulling their money out, leading a staggering US$42 billion of deposits being withdrawn the day before the bank shut down.

Another acquisition occurred in Q1 2023 when Flagstar Bank, a subsidiary of New York Community Bancorp, acquired certain assets and assumed certain liabilities of Signature Bank from the FDIC.

Signature Bank closed down two days after the collapse of SVB after nervous customers withdrew more than US$10 billion in deposits. That run on deposits quickly led to the third-largest bank failure in US history.

Finally, the third deal highlighted by PitchBook was the purchase of Credit Suisse by fellow Swiss giant UBS after the bank’s shares and bonds slumped.

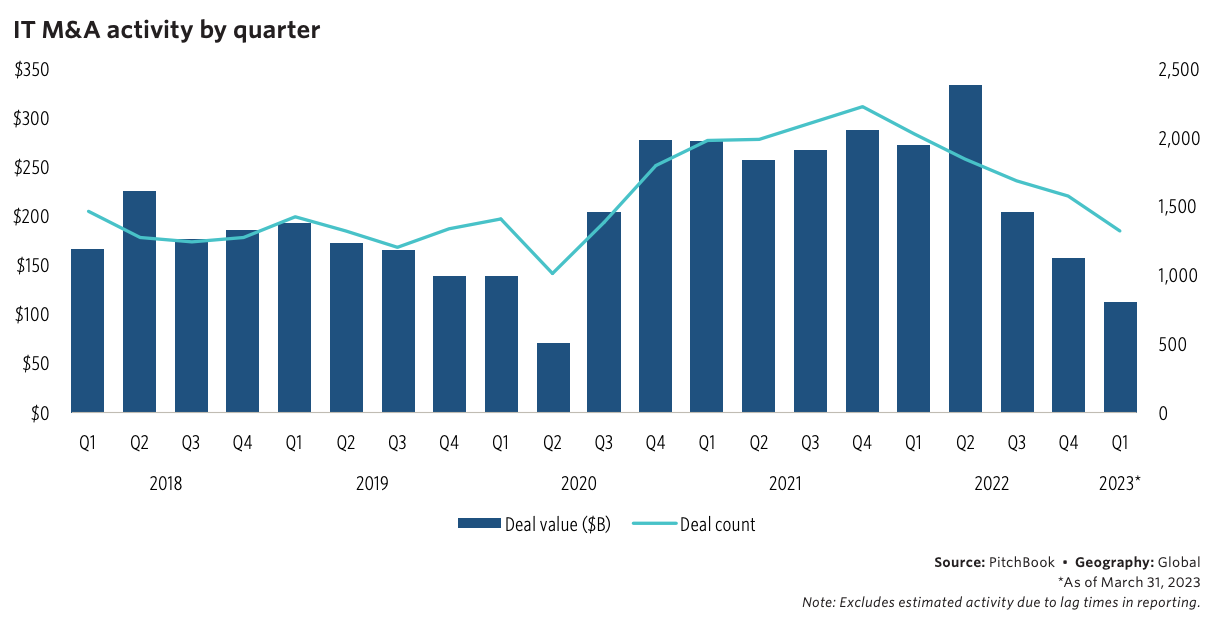

Like the financial services industry, the technology sector too experienced a slow start of the year, recording an estimated 2,043 deals closed or announced for a combined value of US$146.8 billion in Q1 2023. The figures imply a 1.3% decline QoQ in deal count while deal value went down 18.1%.

The quarter did, however, witness some notable mega-deals, including nine transactions above US$1 billion, according to PitchBook. One of these deals was the acquisition of Qualtrics, a provider of experience management software, by Silver Lake and the Canada Pension Plan in March. The deal valued Qualtrics at approximately US$12.5 billion.

IT M&A activity by quarter, Source: Q1 2023 Global M&A Report, PitchBook, April 2023

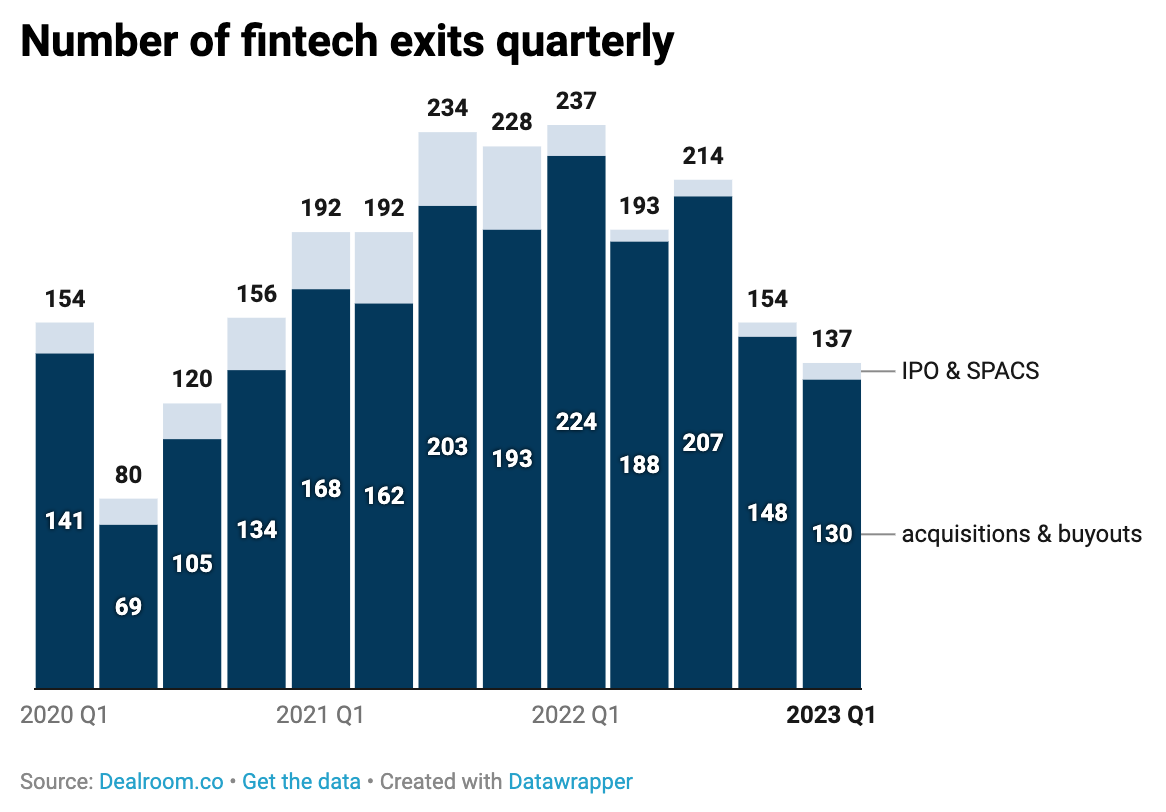

Fintech M&A activity set for rebound

Fintech M&A activity also cooled off, recording 130 acquisitions and buyouts in Q1 2023 totaling US$4 billion in value, data from intelligence platform Dealroom show. The numbers suggest a 55.6% YoY and 69% QoQ decline in deal value, while deal count pulled back 42% YoY and 12% QoQ.

M&A deals observed in Q1 2023 included acquisitions of fintech startups by incumbents as well as fast-growing startups consolidating their lead by acquiring rivals. The quarter also saw several PE firms take advantage of tumbling public valuations to acquire high-growth tech companies at more attractive prices.

UK embedded finance and banking-as-a-service (BaaS) provider and former fintech unicorn Railsr was sold earlier this year in a prepackaged bankruptcy to a consortium of investors; US-based savings and investing unicorn Acorns acquired London-based GoHenry, a startup providing financial education services and money management to kids and teens, to expand internationally and offer financial wellness; UK retail and commercial bank NatWest brought an 85% stake in workplace savings account provider Cushon to grow its product offering to businesses; and Vista Equity Partners, an enterprise software-focused PE firm, acquired Duck Creek Technologies in March. The software provider for property and casualty insurance went public in 2020 for a market cap of around US$5 billion, which fell below US$2 billion in 2022.

Number of fintech exits quarterly, Source: Q1 2023 Global M&A Report, Dealroom, April 2023

American law firm White & Case expects the fintech M&A downtrend to reverse. The sector is set to see a surge in M&A deal activity centered on the consolidation of existing market participants, together with investors taking advantage of lower valuations to acquire strategic stakes in scalable technologies, the firm’s M&A lawyers predict.

In addition, smaller fintech companies struggling to build scale will likely seek out strategic partnerships with larger corporations to achieve deep market penetration.

Fintech segments likely to see the most M&A activity include open banking, neobanking, regtech, green fintech, paytech and digital currency infrastructure providers, the experts predict.

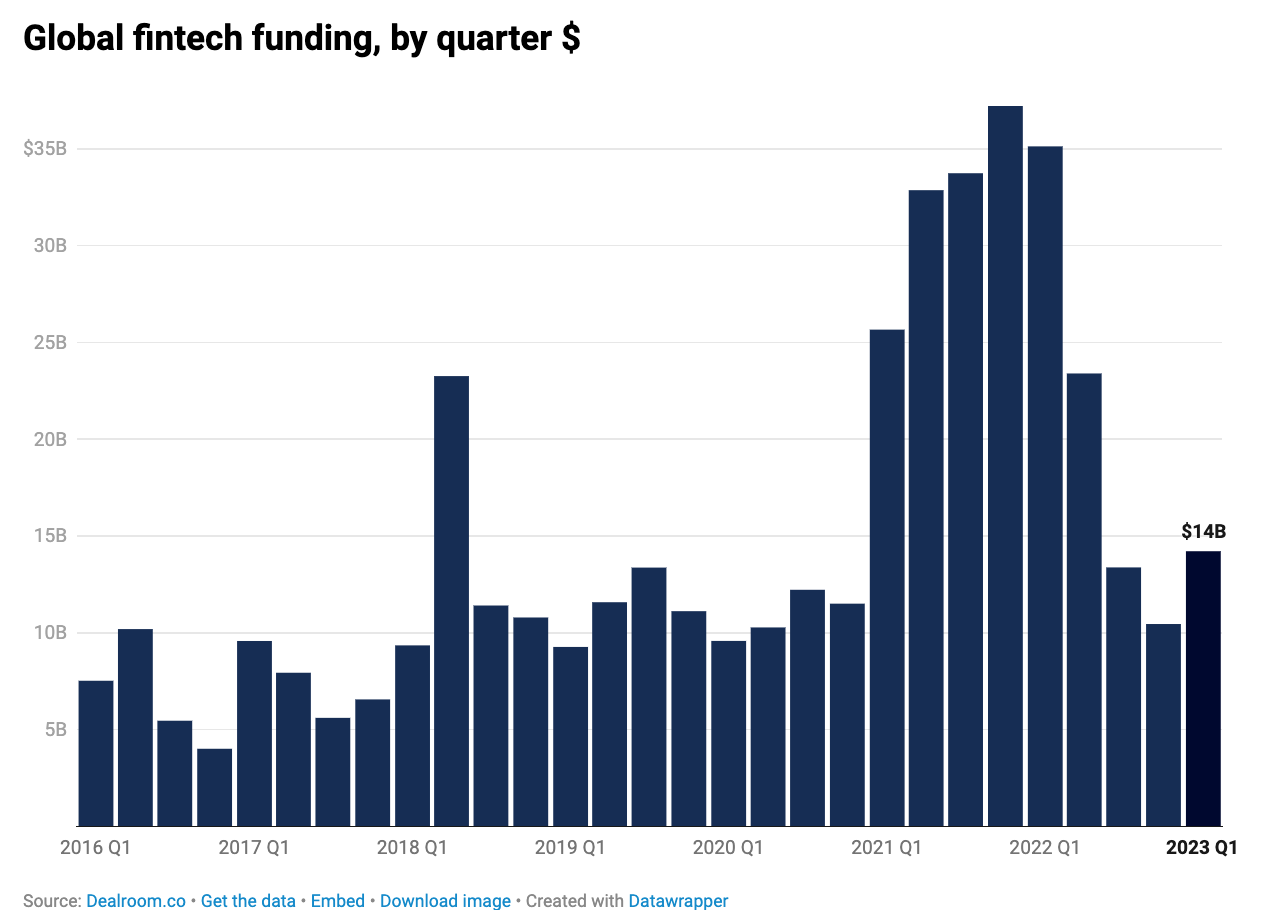

Fintech funding activity continued to decline in Q1 2023 and is on track to fall short of both 2021 and 2022, data from Dealroom show. Global fintech funding reached US$14 billion in the first quarter of the year, down 46% and 60% compared with Q1 2021 and Q1 2022, respectively.

Fintech was the most invested industry in Q1 2023 behind only enterprise software where funding activity was driven by OpenAI and the rest of generative artificial intelligence (AI).

Global fintech funding, by quarter US$, Source: Q1 2023 Global M&A Report, Dealroom, April 2023

Featured image credit: Edited from Freepik