Conversations around the fintech revolution often revolve around the consumer and corporate space. A quick glance at the most valuable fintechs in Europe or anywhere in the world will more often support this narrative.

One of the often overlooked segment is the role of fintech in government digital transformation, or govtech, a term that is being bandied about more often of late. A study previously conducted by the European Central Bank documented in detail a statistically important impact of delayed payments on the economy.

The Role of Fintech in Govtech in Europe

From taxes to pensions, payments is one of the most common ways citizens interact with their government.

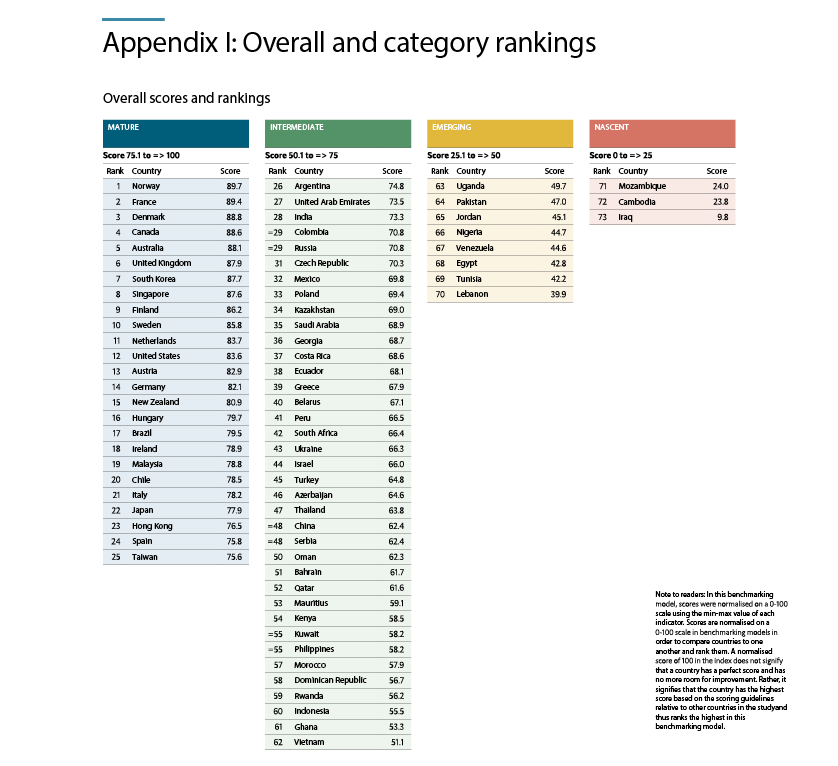

Governments in Europe have largely enabled a reasonably robust payments system. A recent study analysing the adoption of government e-payments shows that European countries like Norway, France and Denmark lead the way ahead of China, a poster boy for cashless QR payments.

Perhaps it is precisely because of the leadership in embracing e-payments that the role of fintech in govtech is not discussed as it often ought to be.

A World Bank study which examined “Brazil’s Bolsa Familia” a social safety net programme, shows that the government has saved up to 75% of administrative costs by making the shift to digital.

Brazil, is of course hardly alone in this case, there are a plethora of case studies illustrating fintech’s role in bolstering government efficiency and financial inclusion.

A Digital Currency Future?

Govtech in Europe has matured quite rapidly.

Many European nations have moved beyond the hygiene factors of embracing government e-payments to evaluating the role of digital currencies and cryptocurrencies in various government services.

Take Sweden for example, a country that is widely accepted as the most cashless society in the world, they are currently investigating the feasibility of central bank back digital currency “e-krona”

As cash continues to decline in Sweden, its central bank imagines a future where cash may be so marginalised that it becomes a difficult means of payment. The idea is that with e-krona the general public still has access to a state-guaranteed means of payment.

IMF’s Managing Director, Christine Lagarde even called out to nations around the world to consider exploring central bank backed digital currencies and it would appear that they have responded, more than 40 central banks around the world are working in some capacity with blockchain technology and distributed ledgers.

Meanwhile, going a slightly different route, Zug in Switzerland, became the first city the the world to accept bitcoin for government services. Ohio, United States quickly followed suit by enabling businesses to pay for taxes in bitcoin.

Interestingly, American politicians like Andrew Yang are even beginning to accept bitcoin for political donations.

Endless Possibilities

From digitising payment systems to the various models of adopting digital currencies, the potential for transformation are endless.

e-Estonia by the government of Estonia is perhaps the most significant govtech europe initiative. The movement aims to facilitate citizen interactions with the state through the use of electronic solutions and has given rise to e-services including e-Tax, e-Business or e-Banking.

Governments should continue to seek out new ways to utilise fintech within govtech in their quest to improve efficiency and the lives of their citizens.

Similarly, startups should also start looking at opportunities for govtech in europe and how to weave that into their offerings.

Featured image credit: Edited from Freepik