London-based Finastra strives to provide banks and financial firms with powerful solutions that allow them to meet consumers’ changing needs and expectations in the digital age. Last month, the company launched out of beta an open banking cloud platform, which it claims allows banks to more freely link into its larger network of innovation and enables them to bring digital solutions to market more quickly and at lower cost.

“When you think about fintechs today, they attach to a bank,” Martin Haering, chief marketing officer at Finastra, told American Banker. “They have to wait a lot of time before they can really access the banking infrastructure of a large tier bank for security and regulatory reasons, so it’s a long time to get real access.

“The fintech on a worldwide basis wants to sell to way more banks. Our platform is available worldwide with the same coverage and security and availability, and they get access to this large ecosystem.”

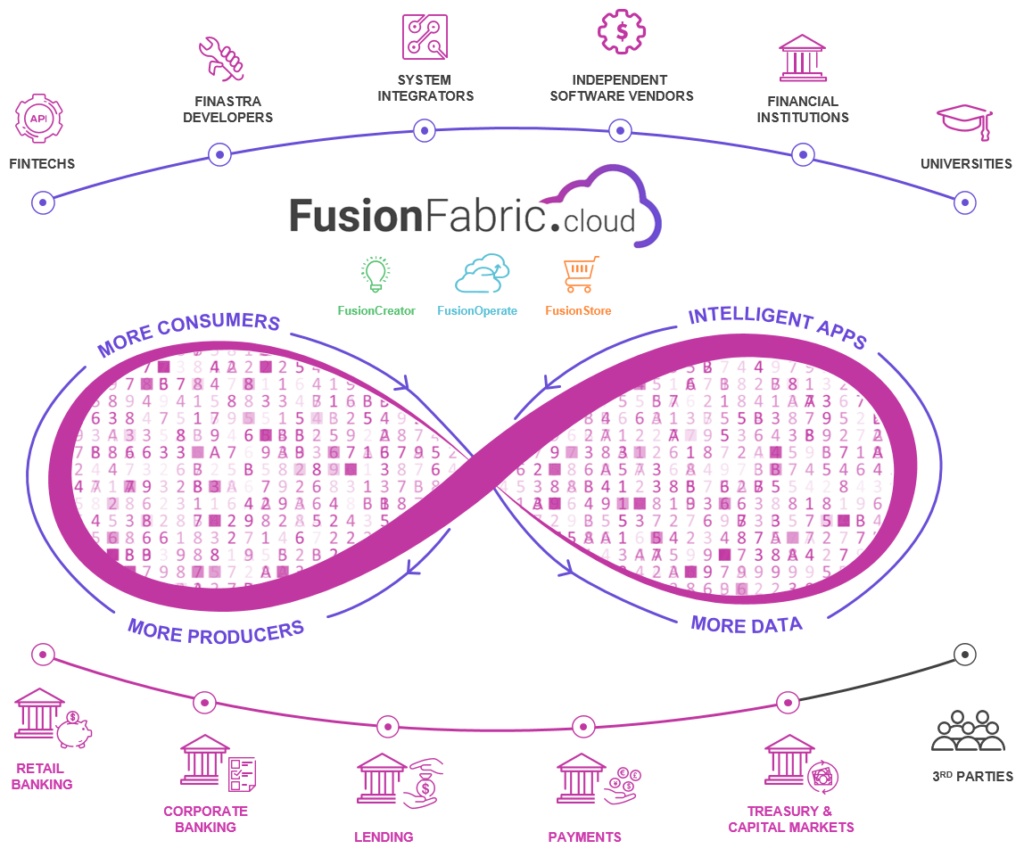

The platform, called FusionFabric.cloud and built on Microsoft Azure, opens up the FusionFabric platform that underpins Finastra’s core systems to all players in the financial services ecosystem, including banks, fintechs, system integrators, independent developers, consultants and students, and is provided for free.

FusionFabric.cloud has three components: Fusion Creator, a developer portal that hosts the company’s API catalogue; Fusion Operate, a secure production environment, hosted on Microsoft Azure, to connect clients’ apps to Finastra software; and FusionStore, a marketplace from which applications developed on FusionFabric.cloud can be promoted, bought, sold and consumed.

With FusionFabric.cloud, the company says it aims to “facilitate open collaboration, driving the future of banking through an open platform approach.”

FusionFabric.cloud illustration

FusionFabric.cloud was released during a hackathon in London during which Finastra announced 61 new APIs, mortgage and lending products integrated into Microsoft’s products, and NBKC Bank as the first bank to begin developing an app on the platform. Prior to that day, FusionFabric.cloud had only been available to early adopters, including 300 fintechs and 19 banks that have registered developers on the platform.

“Our product spread, which covers almost 90% of everything that a bank needs, makes it very attractive for fintechs to test and program on,” Haering said. “This is a free platform to play around on real core banking systems.”

Open Banking Movement

At the event, Eli Rosner, chief product and technology officer at Finastra, said that the company had looked at big tech companies and Asian tech giants, which have invented the emerging technologies that exist today, and taken these technologies to help financial institutions.

“We have the know-how to take those emerging technologies and take away the pain of using them in depth,” Rosner said. “We have a value proposition for you because our platform addresses the key challenges the industry has.”

FusionFabric.cloud is Finastra’s response to the open banking movement and the emergence of the platform-based model that are forcing banks to rethink their business and adopt a mindset that prioritizes collaboration.

“Open banking is more than another technology play,” Haering wrote in a post. “Beyond revenue generation, digitization is central to banks’ survival as the ecosystem of fintechs grows.

“Today’s banks are challenged to grasp a lesson that retailers had to learn the hard way: digitization is vital to survival as consumers’ expectations increase.”

Formed in 2017 by the combination of Misys and D+H, Finastra builds and deploys financial software products and claims the “broadest portfolio of financial services software in the world today,” spanning retail banking, lending, and treasury and capital markets.

With a global footprint and offices in more than 40 countries, Finastra serves over 9,000 customers, including 90 of the top 100 banks in the world, employs 10,000 people, and records some US$1.9 billion in revenues.

Haering, whose responsible for the global marketing organization and strategy of Finastra, has over 25 years’ experience in technology marketing. He is an influential tech marketer, regular speaker, and blogger on digital transformation within the world of financial services, and is recognized for his thought leadership around open banking.

Haering joined Misys in October 2013 as chief marketing officer and, prior to that, held executive leadership positions at Sun Microsystems, Oracle and Akamai Technologies Inc.

Watch Haering explain how Finastra’s FusionFabric.cloud platform can help banks and financial institutions innovate at this link.