Proptech, a term referred to startups offering technologically innovative products or new business models for the real estate industry, has witnessed tremendous growth in the last years, with now more than 200 companies in Switzerland, according to a new report by Credit Suisse.

In recent years, proptechs have sprung up. Leveraging technologies including artificial intelligence (AI), smart homes and the Internet-of-Things, these companies are providing digitally based products and services aimed at various parts of the real estate value chain, promising the real estate industry not only efficiency gains but also improved information flows and transparency.

Excitement for proptech shows in the growth in funding in the sector. In 2017, US$12.6 billion in funding went into proptech startups, three times more than in 2016 with US$4.2 billion, according to MetaProp.

The Swiss proptech industry

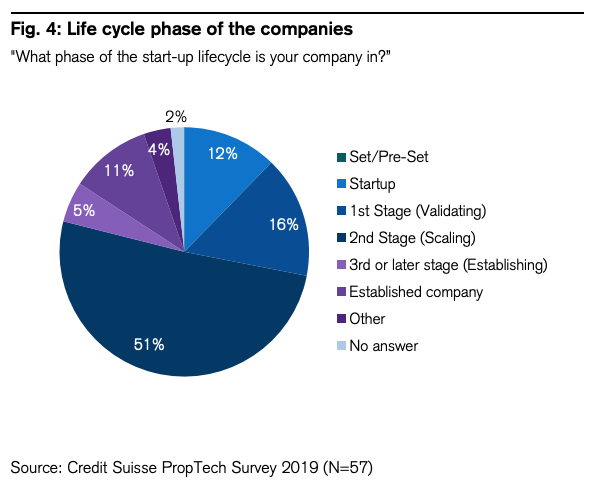

In Switzerland, half of proptech companies are in the scaling phase in which the main objective is to increase revenue, according to Credit Suisse’s Swiss Proptech Report 2019, released in May. These company’s products or services are being rolled out broadly to the market and offered to as many customers as possible.

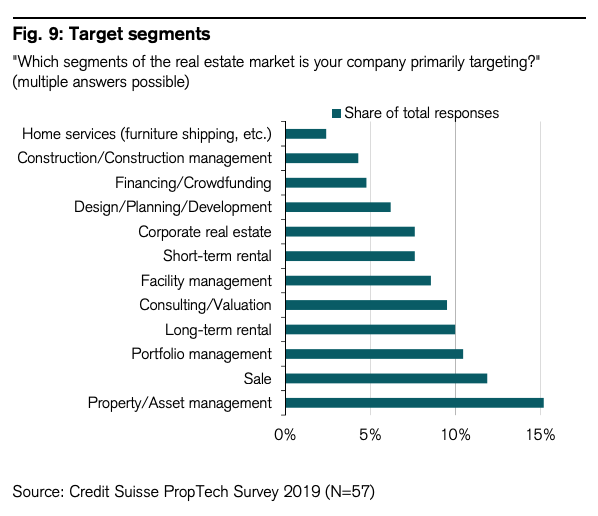

Credit Suisse, which surveyed 58 proptech companies that are active in Switzerland and the “100 heads of the real estate industry,” found that Swiss proptechs are primarily active in the business-to-business (B2B) business and mostly target the investment areas consisting of asset management and portfolio management, as well as the sales and transaction area.

The industry is largely self-funded with three quarters of the capital of proptech companies coming from founders and their partners.

The industry is largely self-funded with three quarters of the capital of proptech companies coming from founders and their partners.

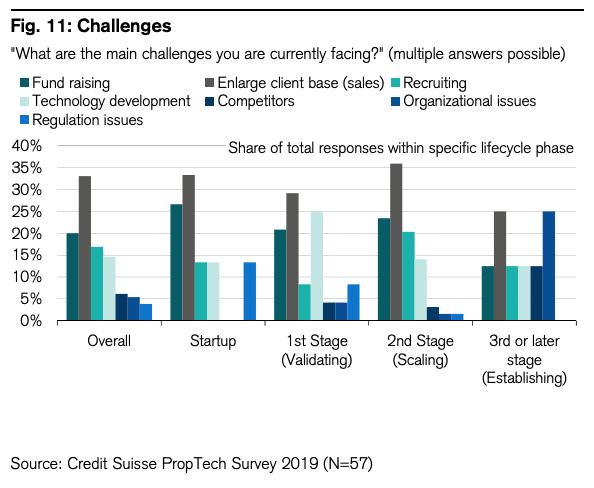

Among the main challenges faced by proptechs, these companies cited increasing sales figures, followed by raising capital and hiring additional personnel. Companies cited low level of brand recognition or limited marketing resources, unclear value-add provided for buyers by their products/services, weak product market fit, and communication problems as the top barrier in the development of proptech.

Nevertheless, the proptech industry has shown respectable success, the report says, with all respondents either maintaining or increasing their sales figures in 2018. Yet the road is still long and Credit Suisse estimates that only a fifth of the proptech companies are profitable.

Another key characteristic of Swiss proptech is the strong drive for international expansion. Approximately one-third are already internationally positioned and about 20% plan to take this step within a year. All in all, over 80% of respondents are aiming for international expansion sooner or later.

Real estate industry keen on leveraging technology

Overall, proptechs have been welcomed well by the real estate industry. The large number of events, awards, pitches, and accelerator workshops indicates the interest of the real estate industry in these young companies.

86% of real estate companies currently have partnerships with proptechs or purchase one or more products or processes from them. 42% of real estate companies even stated that they have business relationships with three or more proptechs.

The real estate industry is not only interested in the services provided by proptechs but is also seeking financial stakes or takeovers. 11% of the companies surveyed have acquired at least one proptech company and 26% report that they have taken a financial stake in one or more proptech players.

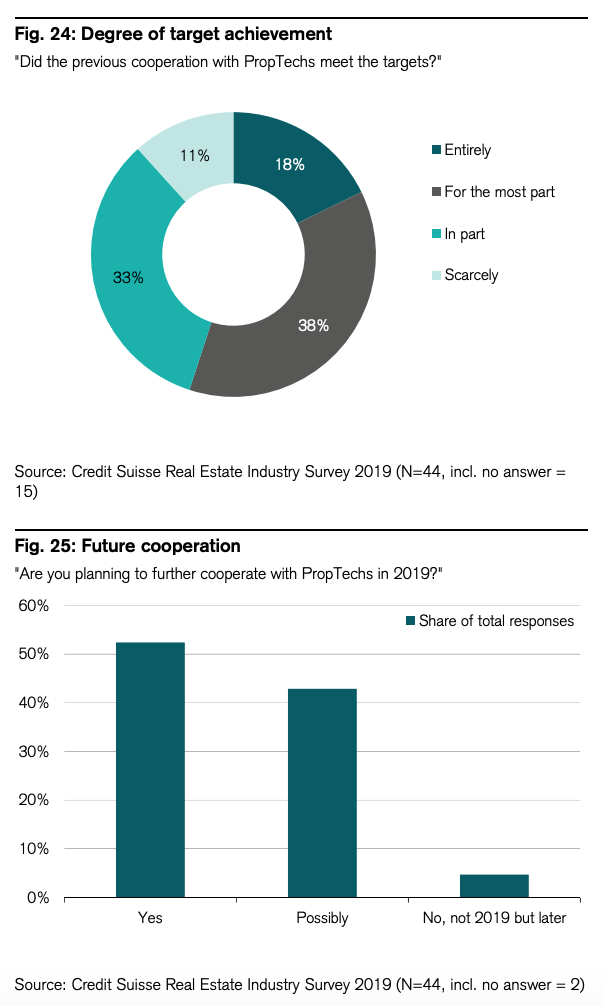

Although the real estate industry has been keen on partnering with these tech-enabled new entrants, incumbents showed mixed feeling about the results that ensued.

Only 18% of the real estate industry participants are completely satisfied with the joint projects, and only slightly more than half of the real estate companies already working with proptechs are planning additional cooperation in 2019.

Featured image credit: Unsplash