Capital Market Firms Must Collaborate with Fintechs to ‘Drive Their Own Evolution’

by Fintechnews Switzerland September 28, 2016Innovation in capital markets is an “absolute imperative for investment banks to survive and thrive into the future,” according to a new report from Ernst and Young (EY), and with fintech booming all around the world, “the better answer for both fintech and incumbent firms is to collaborate rather than compete.”

In a new report titled ‘Capital Markets: innovation and the fintech landscape,’ EY maps out how the investment banking industry can evolve over the coming years by collaborating with fintech companies.

In a new report titled ‘Capital Markets: innovation and the fintech landscape,’ EY maps out how the investment banking industry can evolve over the coming years by collaborating with fintech companies.

“If investment banks can take the right steps today, the outlook for the industry is much brighter than many commentators are currently suggesting,” the report says.

“A whole world of businesses is emerging that will need to be served, but isn’t being served today — and investment banks are ideally placed and equipped to fill the gap.”

In order to sustain their business in the long term, capital market firms need to collaborate with fintechs and build collaborative ecosystems that would help to reduce investment banks’ structural costs and enable enhanced regulatory compliance and better service to customers.

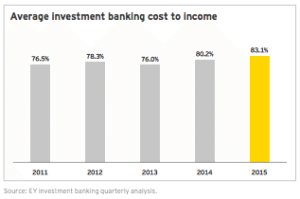

As the capital markets industry face a number of challenges, including the decline of investment banking revenues by almost 4% in 2015 from the previous year, and the deterioration of the industry’s cost-income ratio to 83.1%, these firms must focus on identifying sources of future growth in order to increase revenues and market share. This should be combined with a focus on innovating in products and services to deliver more value to underserved client and market segments.

“Capital markets and investment banking firms invested heavily in digitizing their front offices years ago, because there was a commercial imperative to do so,” said Anthony Woolley, UK chief information officer of Société Générale.

“The business model is changing, and we have to find new ways to reduce structural costs and simplify our architecture. We have to innovate, and we are engaging our people at every level in the organization in the innovation agenda.”

EY estimates that there are now over 5,000 fintech firms in existence, and this number is expected to continue to grow, leaving countless opportunities for collaboration between investment banks and the fintech community.

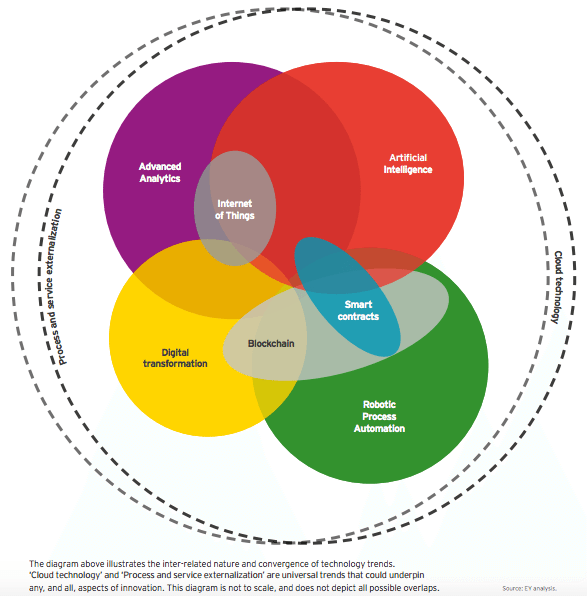

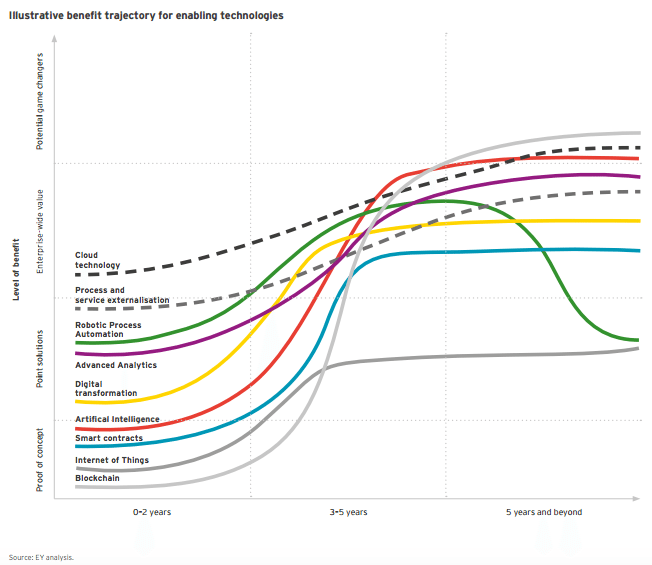

The report names nine technology-enabled trends that will support innovation in the industry:

Cloud technology: The primarily benefits of cloud include lower costs, reduced capital expenditure, scalability flexibility and speed of setup. While investment banks have started to adopt cloud solutions, there are still perceived barriers to full adoption such as risk management or regulatory considerations over data privacy, location and transfer.

Process and service externalization: Process and service externalization, which includes managed or outsources services, industry utilities, application programming interface (API)-enabled collaboration and “co-opetition” by creating interoperability with peers to enhance geographic or product reach, works on the principle that a service can be performed more effectively by a dedicated external third party than it can within the business.

Robotic process automation (RPA): RPA involves using software robots to undertake operational tasks in specific areas such as operations and finance. Benefits of RPA include cost reduction; improved performance; improved quality, consistency, reliability, control and traceability; KPIs for automated processes; support for strategic platform upgrades and regulatory change; and increased agility and accelerated innovation.

Advanced Analytics: Advanced analytics help organizations to gain more precise insights and make better decisions through the use of sophisticated tools and extensive data sets. Like RPA, advanced analytics are used to solve specific problems and include a number of techniques and disciplines such as behavioral analytics, predictive analytics, sentiment analytics and data visualization.

Digital transformation: Digital transformation includes the channels through which capital markets organizations interacts with other market participants, but also the systems and processes used as part of an organization’s end-to-end value chain, as well as the enterprise tools used in daily working life.

Blockchain: Blockchain technology and distributed ledgers is a hot topic and the subject of considerable hype in a number of industries. For capital markets, blockchain technology could have a profound and positive transformation effect over time including reducing costs and transaction times while improving security, control, resilience and auditability.

Smart contracts: Smart contracts, which are programs that are able to operate autonomously, can help to facilitate, verify and enforce the negotiation or performance of a contract without themselves being legal contracts. Smart contracts can be used to model the terms of a real-world contract and automatically enforce its clauses as contractual conditions are met.

Artificial Intelligence (AI): AI has a number of subfields for applications across a range of industries. These include natural language processing (NLP), machine learning, planning and decision-making, and perception, which involves using inputs from sensors to deduce aspects of the world.

Internet-of-Things (IoT): The IoT is a network of physical objects that are able to exchange data over the Internet. The IoT places emphasis on sensors to monitor and detect physical events, and on the communication of data about these events to support decision-making. The potential for the IoT to transform the real economy is considerable, and notable uses include media and advertising, environmental monitoring, manufacturing, transportation and supply chain manufacturing.

Featured image by Rido, via Shutterstock.com.