MeetInvest seeks to democratize stock market investment with a free service that combines a social media platform and an investor toolkit, bringing in one place all the necessary resources for people to start trading like pros.

“We want to empower investors by giving them the same toolkits that the professionals have,” Maria Jacquemai, co-founder of MeetInvest told the Telegraph in an interview.

“The financial world wants to keep this kind of information a secret but we have decided to give it away for free.”

In 2014, Maria and her husband Michel Jacquemai, founded MeetInvest with an aim to demystify stock trading and help small investors cut out the middlemen by bringing to the mainstream the tools that Wall Street professionals use at no cost.

This Swiss fintech startup is relying on an algorithm that mimics the stock-picking, buying, and selling decision of the world’s most successful investors. MeetInvest uses data that is in the public domain as the basis for calculations and screens 68,000 stocks a day, with performance back-tested to January 2000. Users can pick any of the 30 expert strategies currently available and replicate the behavior of successful investors.

“It’s a huge step, democratizing the whole investment area,” Michel told City A.M in an interview.

He continued:

“People have realized that they’re just paying fees. With MeetInvest, they just need to find a discount broker. We’ve seen smartphones consolidate tech, fintech starting to replace financial services and change people’s relationships with banks. The financial industry has created a wall and people are shut out. The biggest hurdle in investing is education.”

How it works

MeetInvest’s platform essentially provides members with knowledge on what, how and when to invest.

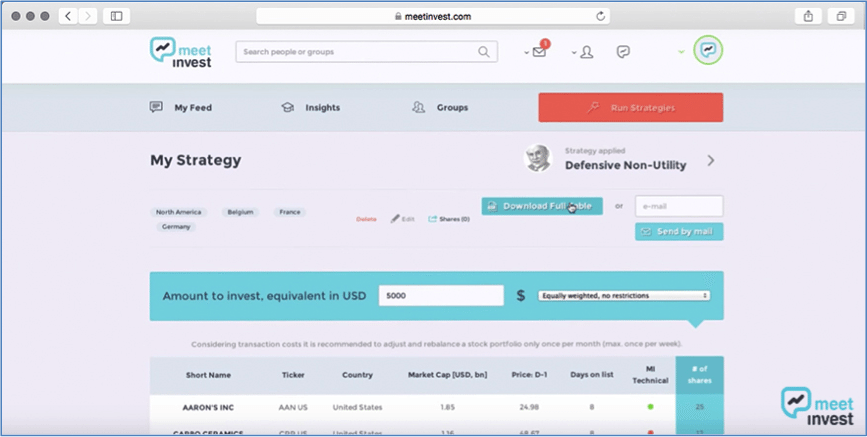

After signing up to MeetInvest and once you’ve logged in, you land on your “My Feed” page which displays posts from people and groups that you follow, or content related to your selected interests.

The “Insights” page features investing know-hows in comprehensive language.

The “What” section displays the various strategies from investment experts that MeetInvest has replicated. If you click on a strategy, you will see a brief summary, the success formula, and hypothetical back-tested strategy dating back to the year 2000.

The “How” section brings you all the information on the foundations of investment, while the “When” section will give you the right timing to invest.

Once you’ve chosen a strategy, click on “Run Strategies” and “Create a new basket.” Then you need to fill the necessary fields and choose the region that you’d like to invest in.

Once you’ve save the basket, you will receive notifications on new stocks that are relevant to your basket, as well as those no longer fitting the strategy’s criteria.

MeetInvest’s “Traffic Lights” system allows you to pick the stocks that are on an uptrend (green light). On the contrary, the red marker highlights the stocks that have a recent negative price history.

But MeetInvest isn’t just a free stock-picking tool as the platform also provides users with the ability to follow other investors, share posts, insights and strategies, and connect.

As of January 2016, MeetInvest reported a user base of more than 80,000 people mainly from Australia, Singapore, Indonesia, Russia and Canada. The company, which is currently marketing in the UK, is planning to rollout across Asia where the two founders believe the demand for such product is high.

MeetInvest will publicly demo for the first time its platform and showcase some of its new features at FinovateEurope 2016.

Featured image credit: Unsplash

3 Comments so far

Jump into a conversationThanks for sharing this great blog post about MeetInvest, a free toolkit for independent investors. It’s a great resource for anyone who’s looking to take control of their own investments and learn more about the market.

The two companies’ respective product portfolios in the regulatory and supervisory technology arena are enhanced by their merger. Furthermore, the two companies service complementary regions.