Neobanking Offering: Revolut Metal Named 2022’s Top Mobile Banking Service

by Fintechnews Switzerland January 16, 2023The Mobile Banking Benchmark, an annual study by consulting company Sia Partners focusing on identifying the world’s top ten mobile banking apps, has named Revolut Metal as the best mobile banking offering of 2022.

Each year, Sia Partners performs a benchmark on mobile banking offerings, searching for the best banking apps in the world. In 2022, the benchmark assessed the performance of 150+ banking apps in 22 countries across regions, evaluating each service based on three scoring streams: functionalities, user experience, and app store ratings.

Last year, it put Revolut Metal at the ranking’s first position, recognizing the offering for its superior functionalities and convenience, as well as for recording higher customer satisfaction than competitors.

Revolut Metal is a premium debit card and account launched in 2018 by UK-headquartered neobank Revolut. It’s the company’s most premium subscription plan, costing a monthly US$16.99 but coming with several exclusive perks and features. These include metal cards made from reinforced steel, additional accounts for younger family members, a higher interest rate on “Savings Vaults”, lower fees when trading stocks and cryptocurrencies through the app, the highest free ATM withdrawal limit, cashbacks, discounted airport lounge access, travel insurance, and more.

Founded in 2015, Revolut is a digital banking startup that offers banking services, including accounts, currency exchange, debit cards, virtual cards, Apple Pay, interest-bearing “Savings Vaults”, stock trading, crypto and commodities. The company operates in 28 European Union markets, in addition to the US, Mexico, Brazil, Japan, India, Singapore and Australia. It’s planning to launch in New Zealand in the coming months, which will be followed by more markets across Latin America, Asia, and the Middle East.

Revolut claims more than 25 million retail customers and over 330 million transactions each month. It says more than 2,000 new active businesses join Revolut Business each week.

Revolut Metal’s first position in the 2022 ranking represents an improvement for the company, which moved up two places from its previous position in 2021.

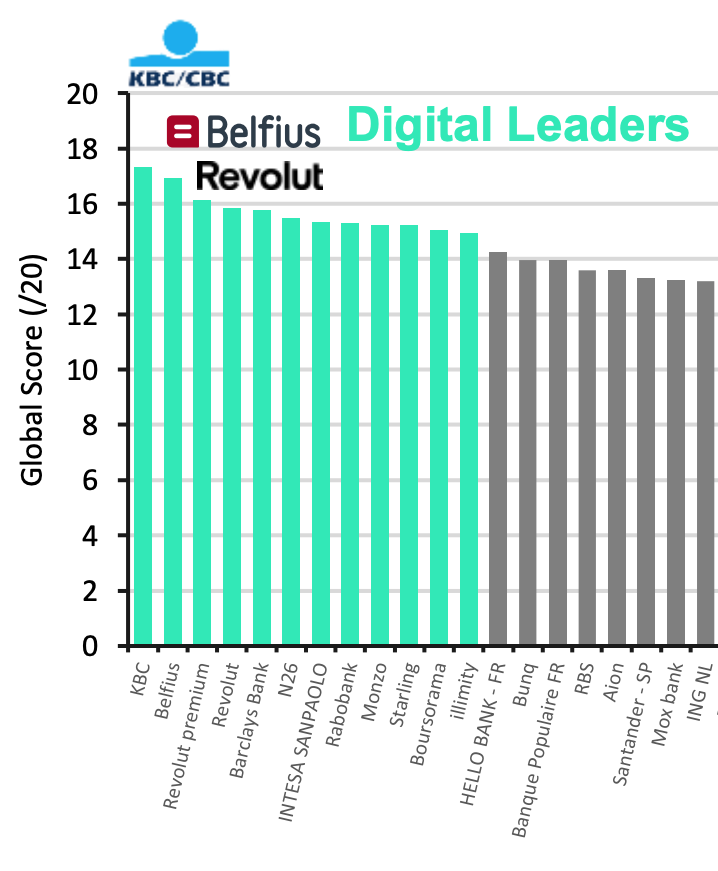

Top 20 Mobile Banking Apps, Source: 2021 Mobile Banking Benchmark, Sia Partners

After Revolut Metal, Italy’s Intesa Sanpaolo took the second position, moving up four places from 2021. The banking group was followed by KBC, a Belgian multi-channel bank-insurer, BBVA, a Spanish multinational financial services company, as well as the Starling and Monzo, two British digital challenger banks.

Newcomers in the 2022 top ten ranking include incumbents BBVA, ING and Chase. N26, a digital bank from Germany, Rabobank, a Dutch multinational banking and financial services company, and Boursorama, a French only financial group, meanwhile, fell off the list.

Chase was the only non-European company to make the 2022 ranking.

Global Top Ten Banks of 2022, Source: 2022 Mobile Banking Benchmark, Sia Partners, Nov 2022

In 2022, only three digital challenger banks made it into the ranking, compared to four in 2021. The decline implies that banking incumbents are ramping up their digital capabilities in response to customers’ changing needs and amid rising competition from new market entrants.

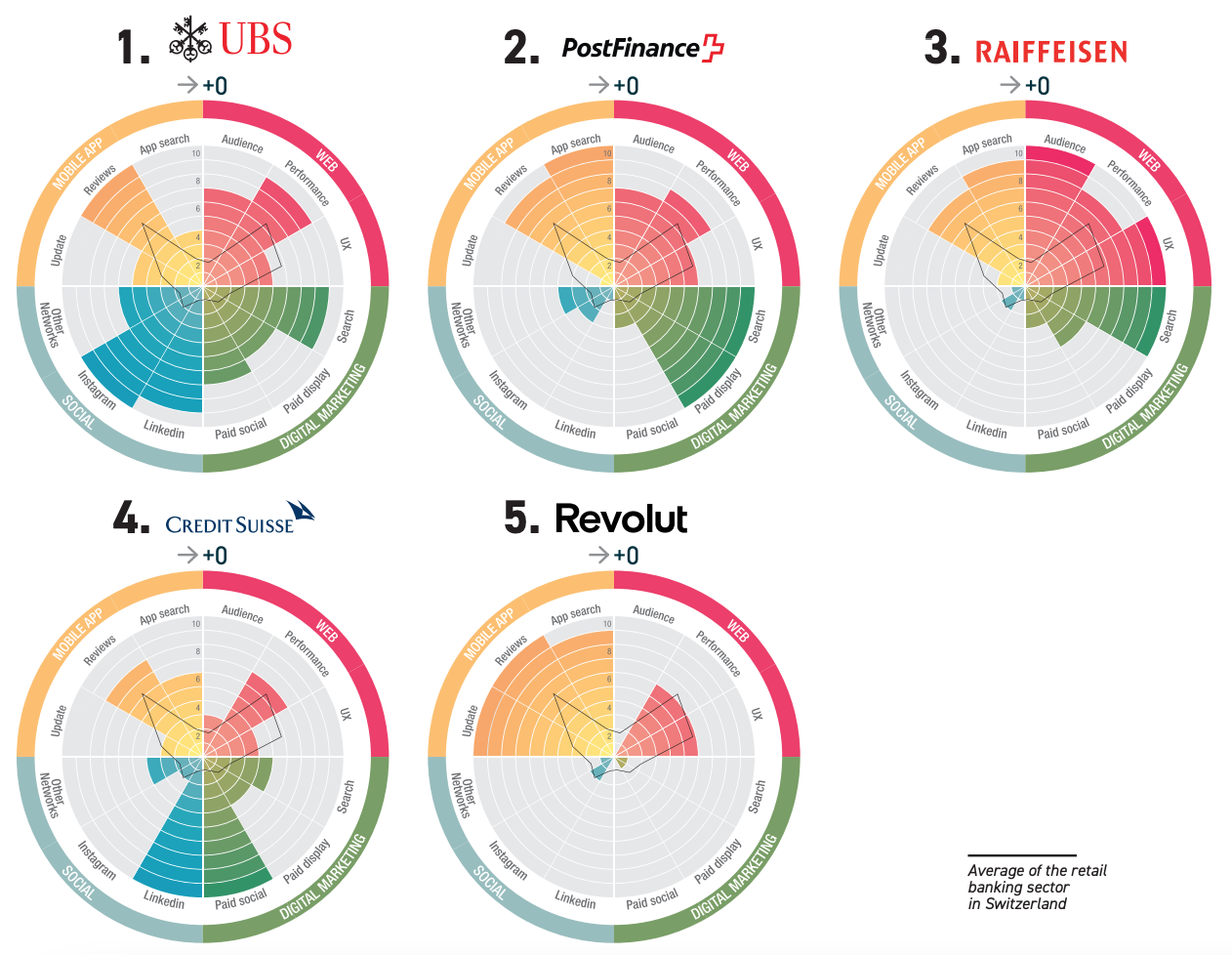

Findings of the Sia Partners study are consistent with those of a 2022 Colombus Consulting analysis which found that, in Switzerland, traditional banking institutions are performing better than digital challengers on their digital presence, engagement, social media and app usage.

The 2022 Digital Index and Performance of Swiss Players report, released in October, ranked UBS, PostFinance, Raiffeinsen and Credit Suisse at the top of the list.

These banks surpassed their competitors in terms of monthly web visits, average time spent by visitors, and average page load time of their websites, an indicators of their websites’ usability and performances as well as of client experience. They also ranked high in digital marketing, leading the pack in estimated annual digital market budget, the number of visits they get from banners, and the number of visits from search.

Top 5 Digital Index and Performance of Swiss Players 2022, Source: Colombus Consulting, 2022

Celent, a research and advisory firm focused on technology for financial institutions globally, estimates that global information technology (IT) spending in retail banking reached US$250 billion in 2022. It expects IT spending by retail banks in 2023 to grow 5.2% and reach US$263 billion.

By 2027, IT spending by retail banks is projected to climb to US$308 billion, representing 4.6% annual average growth from 2022 to 2027.

Increased IT spending by banks comes amid rising competition from new digital challengers. In Switzerland, independent homegrown neobanks and digital banks began emerging over the past few years, promising superior customer experiences and more affordable banking and financial services.

These players include Yapeal and Alpian, which both hold their own banking license (Yapeal’s being a fintech banking license), as well as Neon, a neobanking platform that’s partnered with Hypothekarbank Lenzburg.

Featured image credit from here