Swiss Universal Banks Top Digital Performance Ranking Ahead of Neobanks and Challengers

by Fintechnews Switzerland October 24, 2022Traditional banking institutions are performing better than digital challengers on their digital presence, engagement, social media and app usage, according to Colombus Consulting’s latest edition of the Digital Index and Performance of Swiss Players report.

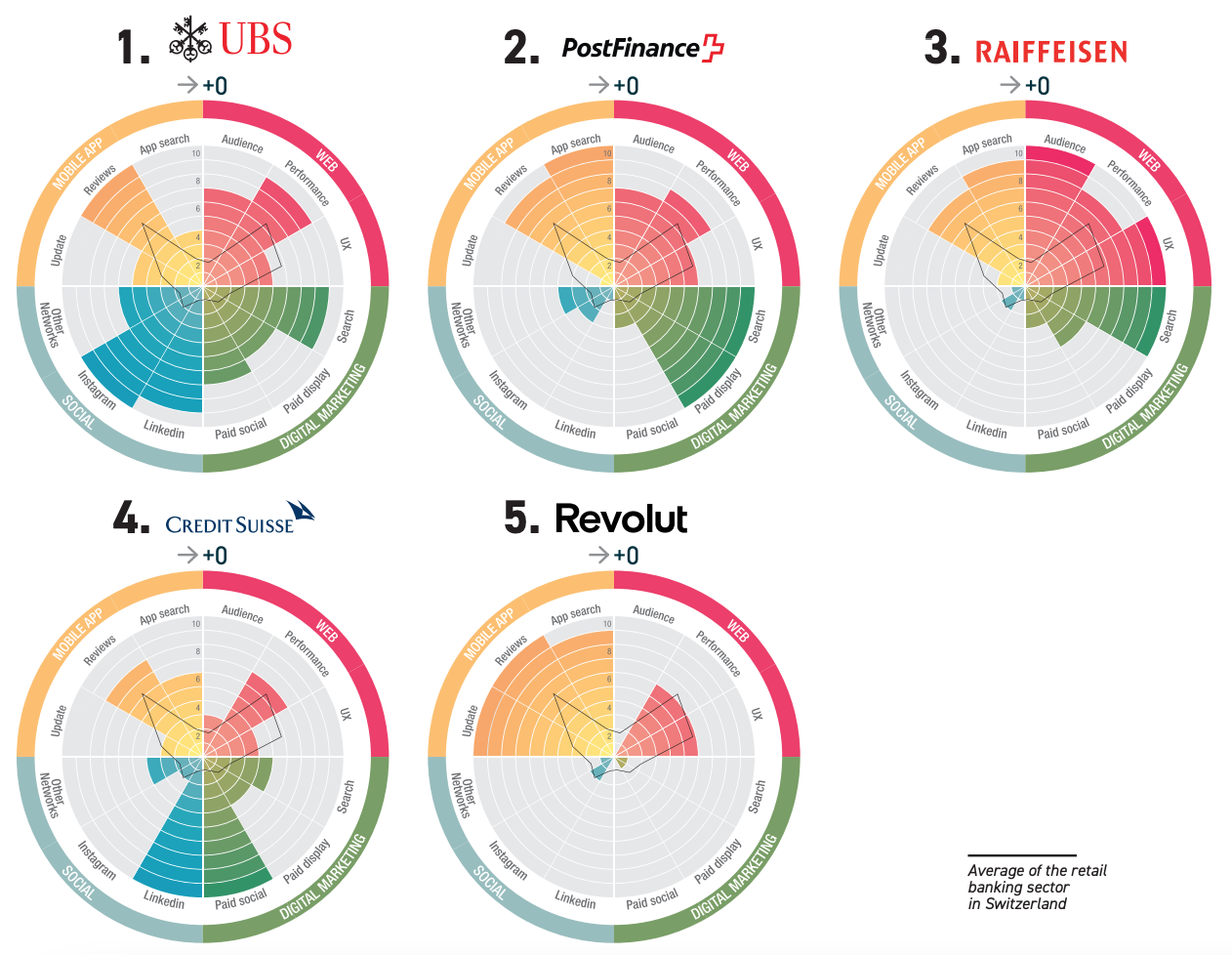

The study, which looks at digitalization of the customer experience in Swiss retail banking, gives a ranking of the country’s best performing banks and neobanks each year, taking into consideration 50 metrics in four categories: web, mobile, marketing, and social. The report also provides insights into how retail banks are digitalizing customer relationship and experience, and measures the evolution over time.

This year’s study ranked UBS, PostFinance, Raiffeinsen and Credit Suisse at the top of the list. These banks are surpassing their competitors in terms of monthly web visits, average time spent by visitors, and average page load time of their websites, an indicators of their websites’ usability and performances as well as of client experience. They also ranked high in digital marketing, leading the group in estimated annual digital market budget, the number of visits they get from banners, and the number of visits from search.

UBS topped the 2022 ranking this year again, recording a very good performance on social networks and good results on the web (especially in terms of performance) and on digital marketing. Social networking involves looking at components like the number of a bank’ subscribers and the volume of monthly engagement on popular social media platforms to gauge their reach and know whether or not they are actively interacting with users online.

After UBS, PostFinance, the financial services unit of Swiss Post, ranked second with a strong performance mainly in marketing, and partly in web and mobile applications. Mobile application criteria are centered around performances and reviews, and aim to get a sense of customer satisfaction of the banks’ mobile tools. PostFinance, however, underperformed on the social networking component.

Raiffeisen ranked third, outperforming competitors on web, but underperforming on social networks and marketing. The bank did rank respectably on mobile apps.

Credit Suisse maintained its fourth position this year, recording a more balanced profile than the rest of the players.

Revolut closed the top 5 ranking, standing out for its excellence in mobile apps but lagging far behind in areas including digital marketing and social networks.

Top 5 Digital Index and Performance of Swiss Players 2022, Source: Colombus Consulting, 2022

Besides Revolut, Swissquote and Yuh were the only other digital banks that made it into this year’s top ten ranking. Swissquote is a Swiss banking group founded in 1996 that specializes in the provision of online financial and trading services, and Yuh is a fairly new player launched just in May 2021.

A joint product from Swissquote and PostFinance, Yuh is an app-based online account and debit card that offers no fees for everyday spending and low fees for specialized services such as international transfers and investing.

Overall, this year’s study revealed that the digitalization of customer relations is accelerating in Switzerland, and that the gap is narrowing between traditional retail banks and digital banks, the report says. However, differences still exist, with digital challengers retaining the upper hand in innovation and digital customer relationship.

Revolut, for example, was the first bank to offer an education program that rewarded customers who completed training modules. It also provides innovative features on its mobile app like the ability to generate one-time virtual cards for online purchases that are automatically destroyed once payment is made.

Looking at trends observed over the past year, the report firm notes that digital account opening has become the new standard in the industry with the majority of banks in the country now offering fully remote onboarding.

It also notes that hybrid banking offers have become a popular strategy across traditional banking institutions, with Credit Suisse, for example, operating a dedicated digital banking brand called CSX which provides banking services online at more competitive prices.

CIC is one of the latest institutions to have entered the niche, having launching in September 2022 its CIC ON offering. CIC ON provides a comprehensive range of services, ranging from “everyday banking” to topic-specific investments and personal advice.

Others, like UBS, have embraced a multi-app strategy. The bank currently offers 15 different mobile apps focusing on different needs and users.

The UBS Mobile Banking app, for example, allows customers to manage their accounts; UBS Twint is a free mobile payment app; UBS Access is a security app that allows users to confirm new payment recipients and online purchases; UBS Safe lets users securely store their passwords as well as emergency documents like identity papers; UBS Welcome allows customers to verify their identity and/or electronically sign documents; and UBS Financial Services lets users manage their cash and accounts, set budgets and track spending.

Featured image credit: Edited from Unsplash