UK Challenger Monzo Ranks “Top” in Social Media Mentions Amongst Neobanks

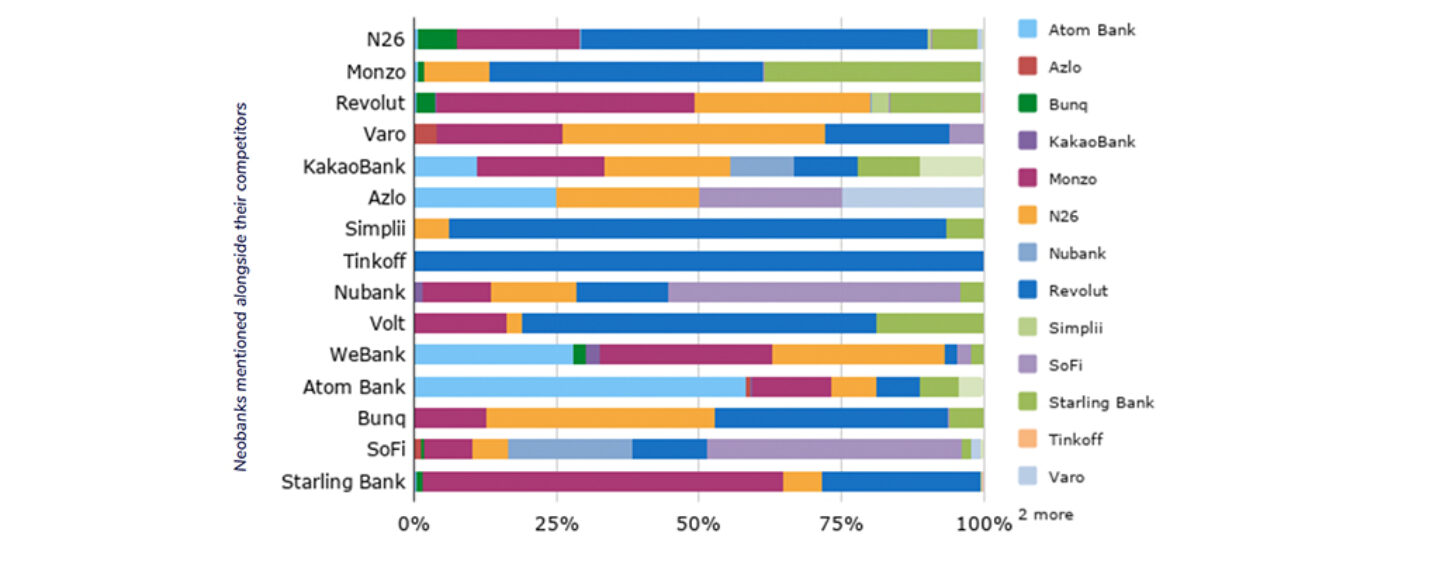

by Fintechnews Switzerland July 31, 2020Between December 2019 and June 2020, UK digital challenger Monzo dominated the neobanking conversation across all media ahead of other regional leaders including Revolut and N26, according to a new research by Ten Bear Group and Rila Global Consulting.

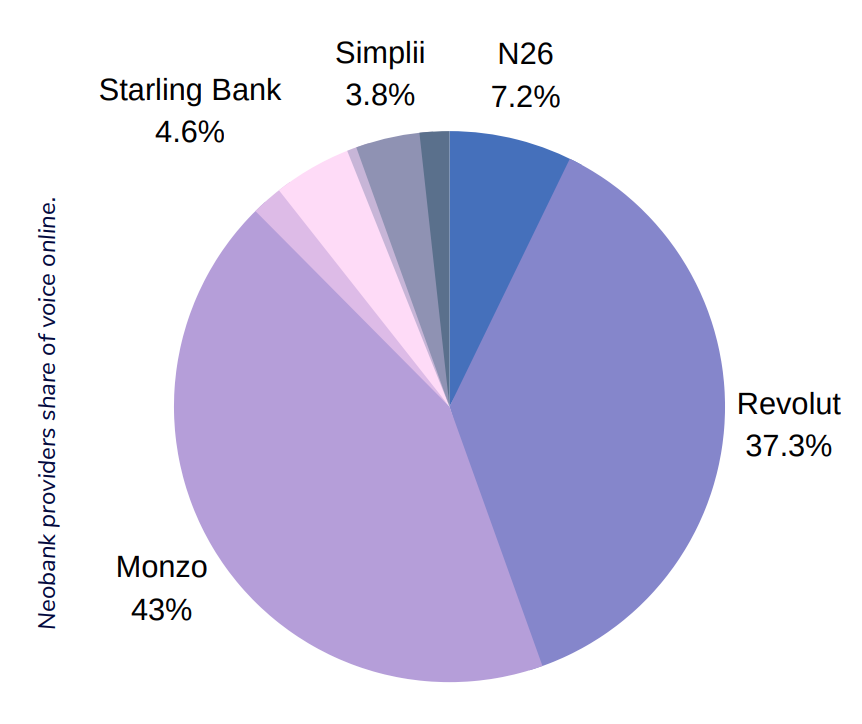

The study, which analyzed social media data of 15 international neobanks to understand overall performance, providers’ consumer trends and social strategy, found that Monzo was the most talked about neobank during the period (43%), garnering the most mentions amongst all the neobanks analyzed. The majority of Monzo conversations were held on Twitter and forums on Monzo.com, and consisted of users reaching out to customer support.

The report notes Monzo’s #YearInMonzo campaign in January which gathered multiple mentions for the brand and proved to be a “smart engagement strategy with customers,” it says. It adds that Monzo has also been successfully cultivating an engaged community on its own forum where members regularly seek support services and draw comparisons between Monzo and competitors.

But mentions of Monzo don’t always come with a positive sentiment, and many users complained online about fraudulent calls. The company also saw a spike in June when tweets from staff members who were threatened with redundancy went viral.

Amid the COVID-19 pandemic, Monzo has been facing turbulences. Following the shuttering of its Las Vegas-based customer support office and almost 300 staff being furloughed in UK, Monzo announced internally in June that up to 120 UK staff would be made redundant. The startup also had to accept a 40% reduction in its previously GBP 2 billion valuation as part of its last funding round with a new valuation of GBP 1.24 billion.

Neobank providers share of voice online, Neobanking- provider performance, consumer trends and audience segmentation, Ten Bear Group and Rila Global Consulting, July 2020

After Monzo, UK challenger Revolut was the close second, representing 37.3% of all mentions during the period. Topics mentioned included Revolut’s transparent no hidden fees policy and ease of use, the report says, while negative mentions were mostly driven by customer support-related inquiries from users locked out of their account.

Meanwhile, German digital bank N26 garnered a large portion of their mentions from users sharing referral codes. People also connected with N26 on social media to inquire when they will be available in various countries, implying that mentions of the digital bank during the period were mainly positive.

Of the 15 neobanks analyzed, Atom Bank, from the UK, was ranked the highest on Trustpilot, a popular online review platform, with a score of 4.7 out of 5. Atom Bank was followed by Varo Money, from the US, with a score of 4.6. Dutch digital bank Bunq and Simplii Financial, a division of the Canadian Imperial Bank of Commerce, were ranked the lowest with a score of 2.4 and 1.6, respectively.

In terms of customer service, Atom Bank, Starling Bank and Monzo were ranked the top three neobanks. At the other end of the spectrum, Simplii Financial, Revolut and N26 were rated the lowest in customer service.

Other key findings

The research also found that COVID-19 has so far proven to be “incredibly beneficial to the neobanking industry and providers.” Usage of banking and financial apps has increased since the beginning of the pandemic and users on social often cited factors such as traditional banks’ dated technology, slowness and lack of money management features as the main reasons to switch to a neobank.

During the period studied, international banking users accounted for 24% of neobanks’ customers and were found to be early adopters of digital banks. These users chose them for traveling and to send money to family overseas, the research found, and are part of a rapidly growing customer segment comprising expats and online business owners.

Besides global banking services, another key feature mentioned by users was trading capabilities. Cryptocurrency and stock-savvy customers are increasingly looking to neobanks for fast, online transactions and trading options, the report says.

Savings and money management features, low/no fees, security, and customer support, were also named amongst the features users of neobanks most cared about.