As the New Year beckons, it’s time to speculate about what 2016 holds. Here are nine predictions from Ben Robinson, Chief Strategy & Marketing Officer at Temenos.

1. Talent management will be a much bigger issue.

In Temenos’ annual banking survey, double the number of bankers compared to last year told us that attracting and retaining the right talent was their biggest priority. And it is in technology that the issue is most acute. Banking has become a relatively less attractive place to work at the same time as facing increased competition with all industries for the same kinds of scarce profiles, such as the best data scientists.

The technology talent deficit runs across the whole organisation, with Accenture recently highlighting that banks’ boards have very few executives with professional technology experience.

2. From roboadvisor to bionic advisor.

We believe that in 2016 the industry will pivot to talking more about the bionic advisor than the roboadvisor. In 2015, the industry became very excited about roboadvisors: automated, algorithm-based portfolio management services. As a means to reduce fees and democratise asset management, roboadvisors represent a major structural shift.

However, combining roboadvisors with professional asset managers represents an opportunity to do the same, but with better performance – the algorithm makes the selections but is guided by an asset manager’s informed convictions.

3. Still not the year for the cloud…

We stick by our prediction that, by 2020, all new core banking replacements will be in the cloud. Banks won’t have any choice. Firstly, the economics of banking is changing and this will force banks to share infrastructure costs. Secondly, if banks are to keep data secure, they will need to cede this responsibility to datacentre providers like Microsoft which have the resources and scale to invest in staying ahead of cybercriminals.

Lastly, to cope with the massive rise in interactions resulting from the move to mobile and the Internet of Things, banks will need the scale provided by the cloud. That said, our data suggests that in 2016 at least we are unlikely to see a step change in the number of banks running core processing in the cloud.

4…or the Blockchain.

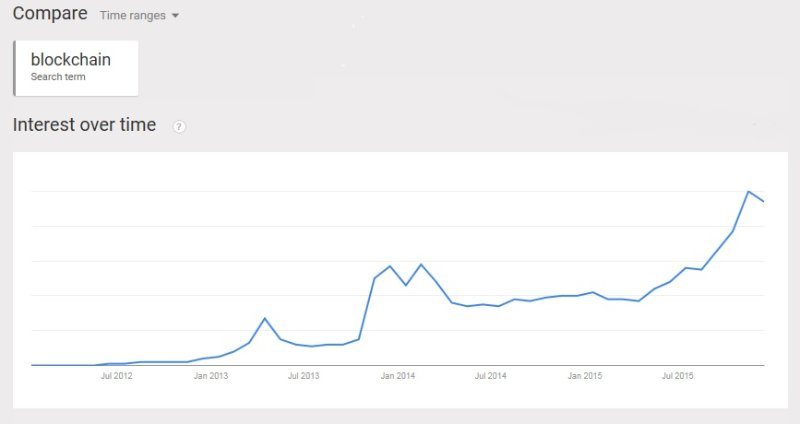

Blockchain technology is one of the best examples of Bill Gates’ maxim that we overestimate the change that will occur in the next 2 years, but underestimate the change that will occur in the next 10 years. There is no doubt blockchain will have profound effects on financial services, but it will take time for the benefits to crystallise.

Right now, there are millions of people experimenting with the technology, but only gradually will they determine the right use cases to apply the technology to, establish standards and protocols, and form the consortia needed to generate massive efficiency gains. In 2016, the concept of “Blockchain-as-a-service”, or blockchain platforms, will become prominent, as a way for third parties like Microsoft to help banks overcome the skills shortages and reduce the costs of innovating with the blockchain technology

5. From competition to collaboration.

The benefits of collaboration between banks and fintechs will become increasingly clear for both sides. On the one hand, fintechs are small, nimble and innovative. On the other, banks have customer trust, large distribution networks and large balance sheets.

Collaboration between banks and fintechs is therefore a win-win, improving the former’s capacity for innovation and giving the latter scale, credibility and route to market. In 2016 we expect to see many more of these types of partnerships, like the recent one between JP Morgan and OnDeck, with banks integrating fintech products and services into their customer offering.

6. Open banking will become mainstream.

We expect to see more of a move to open banking, where banks use APIs to open up data and resources to third-parties. On one level, this is will be technical integration, or “fintegration”, of fintech services, the latter interfacing directly to bank customers (rather than through, say, referrals). But, it is a broader phenomenon which will speed up the separation between the distribution and manufacturing of banking products.

Banks will need to make a call about where they sit in the banking value chain: distribution platforms or resource platforms. Unlike fintechs, they don’t have the cost structure to be single product manufacturers. As our banking survey highlighted, the majority of banks see open banking as essential to competing against technology players like Google. But few see it a major priority today. We think that will change in 2016 as competition hots up, and with advance of regulations like PSDII.

7. The battle for the customer.

In 2016, the fight to control banking product distribution will intensify. This will happen as more progressive banks transform themselves into sales platforms offering own labelled and white labelled products, as comparison sites and aggregators originate sales directly on bank platforms, and as the full extent of GAFA’s ambitions to go beyond payments and into distributing financial services becomes apparent.

8. From credit to debit.

In an effort to avoid large merchant fees on credit card transactions, which are actually much higher for online than offline transactions given higher risk and the need for a gateway, we predict a move to debit card payments or direct bank transfers.

In places like the UK and Singapore with near real-time payments, we predict that SME merchants will lead a movement towards debit card transactions settled through the faster payment network (PayM in the UK), thus avoiding merchant fees but without taking on any credit risk. In the US, we think that this will take the form of direct bank debits using the NACHA scheme that enables consumers to easily make online purchases and bill payments through the ACH by using their online-banking credentials.

9. Big rises in IT spending – and changes in how it is measured.

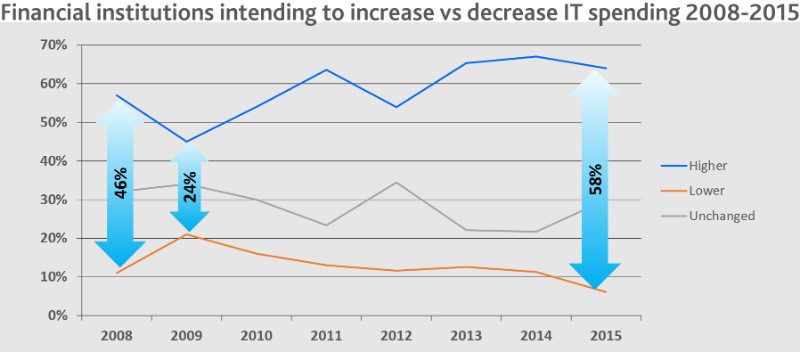

The metrics we track all point to significantly higher IT spend in 2016, especially in areas like core banking, analytics and channels, which will be needed if banks are to deliver customer intimacy at scale.

We also think that banks will look at IT spend differently, moving away from measures like IT spend/total costs, which become increasingly redundant in a world of higher automation and fewer branches. Instead, we believe focus will shift to different measures such as the share of IT directed to innovation compared to maintenance, and the split of front vs. back office spending.

This article has been first published on Linkedin Pulse

4 Comments so far

Jump into a conversationJe ne suis pas vraiment un lecteur Internet pour être honnête mais vos blogs vraiment sympa, continue comme ça ! 에볼루션카지노 Je vais aller de l’avant et ajouter votre site à vos favoris pour revenir à l’avenir. advgamble.com

I was looking for another article by chance and found your article keo nha cai I am writing on this topic, so I think it will help a lot. I leave my blog address below. Please visit once.