Central Bank Digital Currency: Non-Implementation Poses Risks Too, Warns Swiss Bankers Association

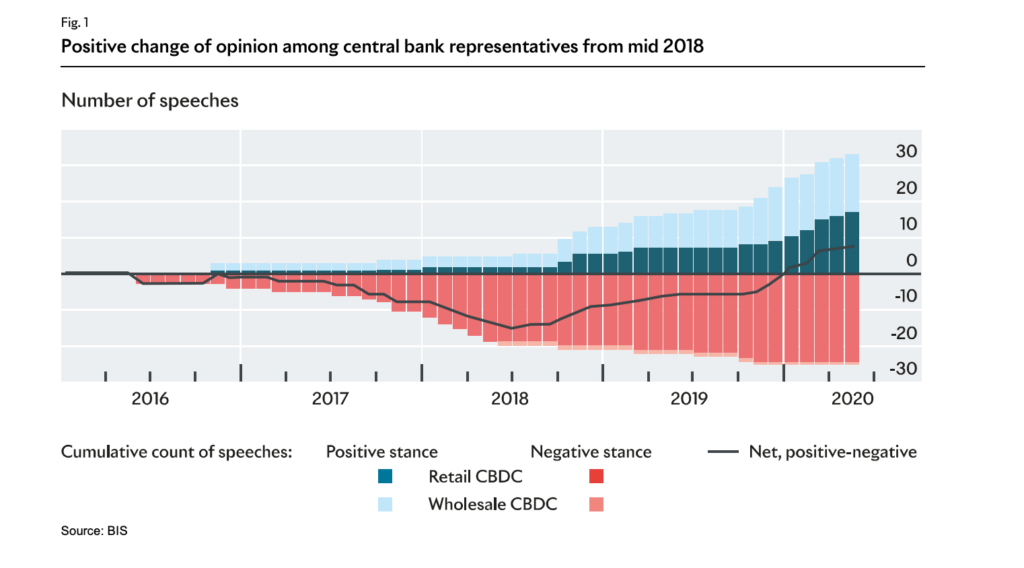

by Fintechnews Switzerland July 12, 2021At a time when central banks around the world are ramping up digital currency plans, Switzerland’s inactivity and possible “non-implementation” of a central bank digital currency (CBDC) could, in the long run, jeopardize the country’s competitiveness, and turn it into a digital laggard compared to international counterparts, warns banking trade group the Swiss Bankers Association (SBA).

In a new discussion published on June 24, 2021, the SBA traces the international development of digital currencies and presents the opportunities and challenges CBDCs pose for the Swiss banking industry.

The Swiss Bankers Association discussion paper

According to the paper, because the Swiss financial and payment system works well and runs smoothly, the pressure to take immediate action appears to be lower for the SNB than for other central banks.

Though at first glance, remaining inactive could seem like the most beneficial option for Switzerland in terms of minimizing risks for the banks, in the future, this could be detrimental for the country.

“It can be presumed that in the absence of a modern means of payment, the digitalization of the economy and business models would proceeds more slowly,” the paper reads. “Outdated legacy systems for payment transactions could not be efficiently and fully adapted to the new circumstances of the global digital economy. Interoperability with foreign digital markets would be a challenge.”

There’s also the risk that if Switzerland does not issue its own CBDC, consumers would turn to platforms using foreign digital currencies or digital money for their payment transactions, introducing thus systemic and monetary policy risks due to the loss of currency sovereignty, the paper says.

Nevertheless, it notes that digital forms of money do come with risks and challenges for banks. For example, the widespread use of a private stablecoin like Facebook-backed Diem could reduce banks to a mere provider role or even displace them altogether. Assuming that demand for these new forms of digital money takes off, this could create a large-scale, system-wide displacement of deposits created by commercial banks. A bank run from current bank deposits to CBDC balances would pose a risk to financial stability.

Not only that, but a programmable digital currency also introduces privacy and political risks. For example, in the event that a digital currency provided by a foreign issuer rises to prominence, the issuer would be able track all the transactions and exclude groups of people from using it. Such information and the possibility of exclusion could, for example, be abused in the form of political pressure on a country.

Hence, a decision to introduce a CBDC goes far beyond monetary and economic policy considerations and is ultimately a strategic challenge for a state, the paper says. The SBA thus encourages public authorities and the business community to take a more productive position on the topic of CBDC, urging the general public to “drive the opinion-forming process.”

The release of the SBA paper came on the back of the announcement by the SNB a few weeks ago that the central bank has no plans for a CBDC in Switzerland, neither retail nor wholesale, reported Swiss business publication Handelszeitung.

At a recent press conference hosted by the banking trade group in June, SNB’s chief economist Carlos Lenz said there is no need for a digital Swiss franc at the moment since “the current payment system works well.”

According to Lenz, there is no risk for the Swiss franc to be displaced by other currencies if Switzerland were to decide not to issue a CBDC. “We had such discussions when the euro was introduced,” Lend said. “There was also fear that payments would suddenly be made in euros,” which didn’t come true, he added.

Despite the seemingly negative stance, Switzerland has been researching CBDCs. Project Helvetia, undertaken by the SNB, financial infrastructure operator SIX and the Bank for International Settlements (BIS) Innovation Hub Swiss Centre, reported in December 2020 on two successfully conducted feasibility studies on the settlement of tokenized assets in a CBDC on a distributed ledger.

In June 2021, SNB, Banque de France and the BIS Innovation Hub announced an experiment using a wholesale CBDC for cross-border settlement.

Featured image: Photo by Abdul basit on Unsplash