Deutsche Bank Whitepaper Explores Open APIs, Cloud, Blockchain and AI Regulations

by Fintechnews Switzerland November 5, 2018The emergence of new technology solutions leveraging open APIs, cloud, blockchain and artificial intelligence (AI) has driven increasing volumes of digital data, as well as new market players, business models and evolving client expectations.

Given the disruptive potential of these cutting-edge technologies on the banking sector, regulators around the world have taken a closer look into the opportunities and risks these may bring to the market.

In a new whitepaper titled Regulation driving banking transformation, Deutsche Bank provides an overview of applicable regulations around the world with respect to banks’ and their clients’ use of open APIs, cloud, blockchain and AI, and formulates recommendations to move forward.

Open banking and open APIs

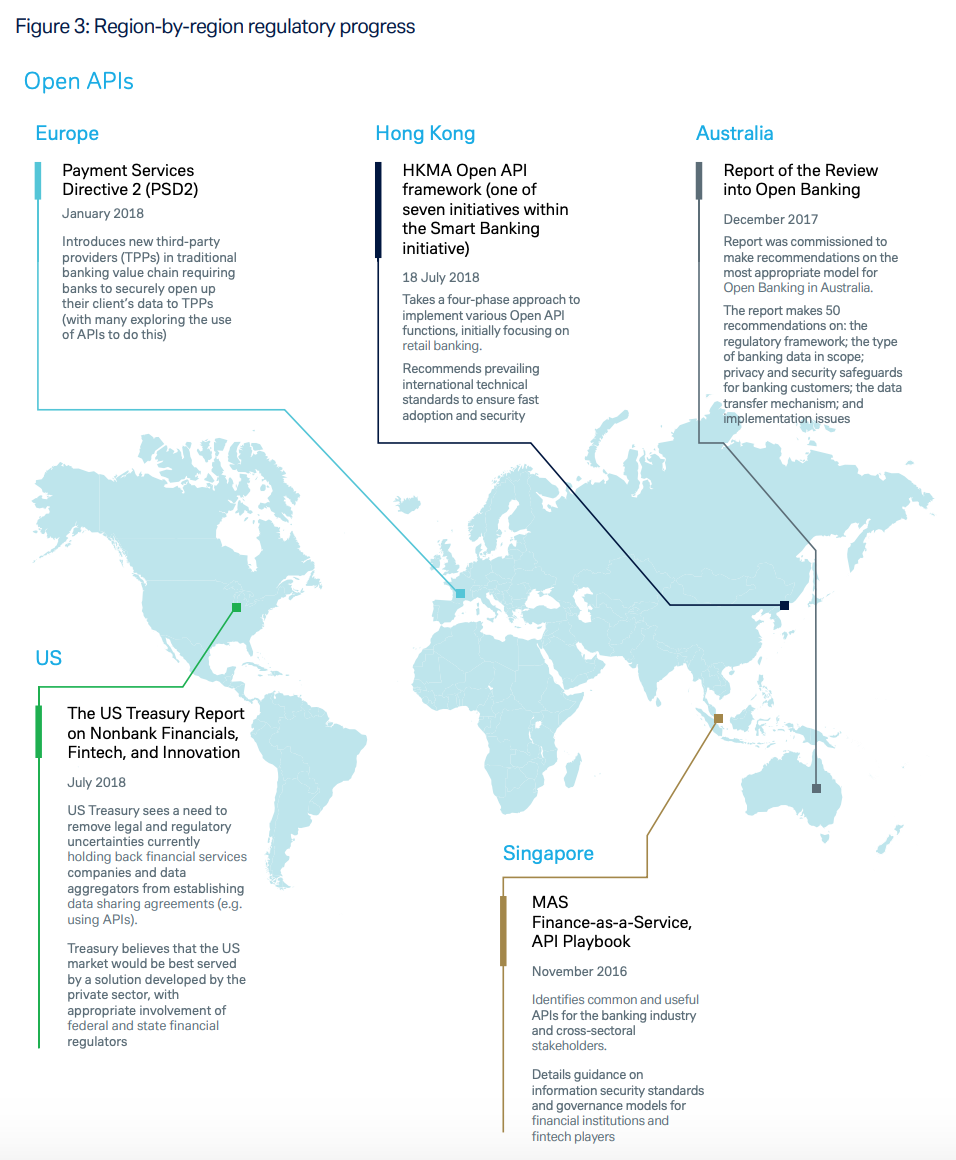

Regulators have broadly acknowledged the benefits of both open banking (as a means of providing a more competitive and innovative financial services landscape) and open APIs, as an enabler of this.

Hence, open banking regulatory initiatives have, and will to continue to act as a catalyst for the development of open APIs. However, open banking regulation varies globally and the lack of standardization could potentially jeopardize the security and efficiency of solutions, ultimately undermining the experience banking clients receive, the report claims.

In Europe, PSD2 has been a major driver of the move towards open banking. From September 2019, the regulation will oblige banks to give third-party providers access to customer accounts, with their explicit consent, through a new interface.

In Asia, the Monetary Authority of Singapore (MAS) has been proactive in encouraging financial institutions to develop and share their APIs openly. Similar support for open banking has been witnessed in Hong Kong.

Cloud

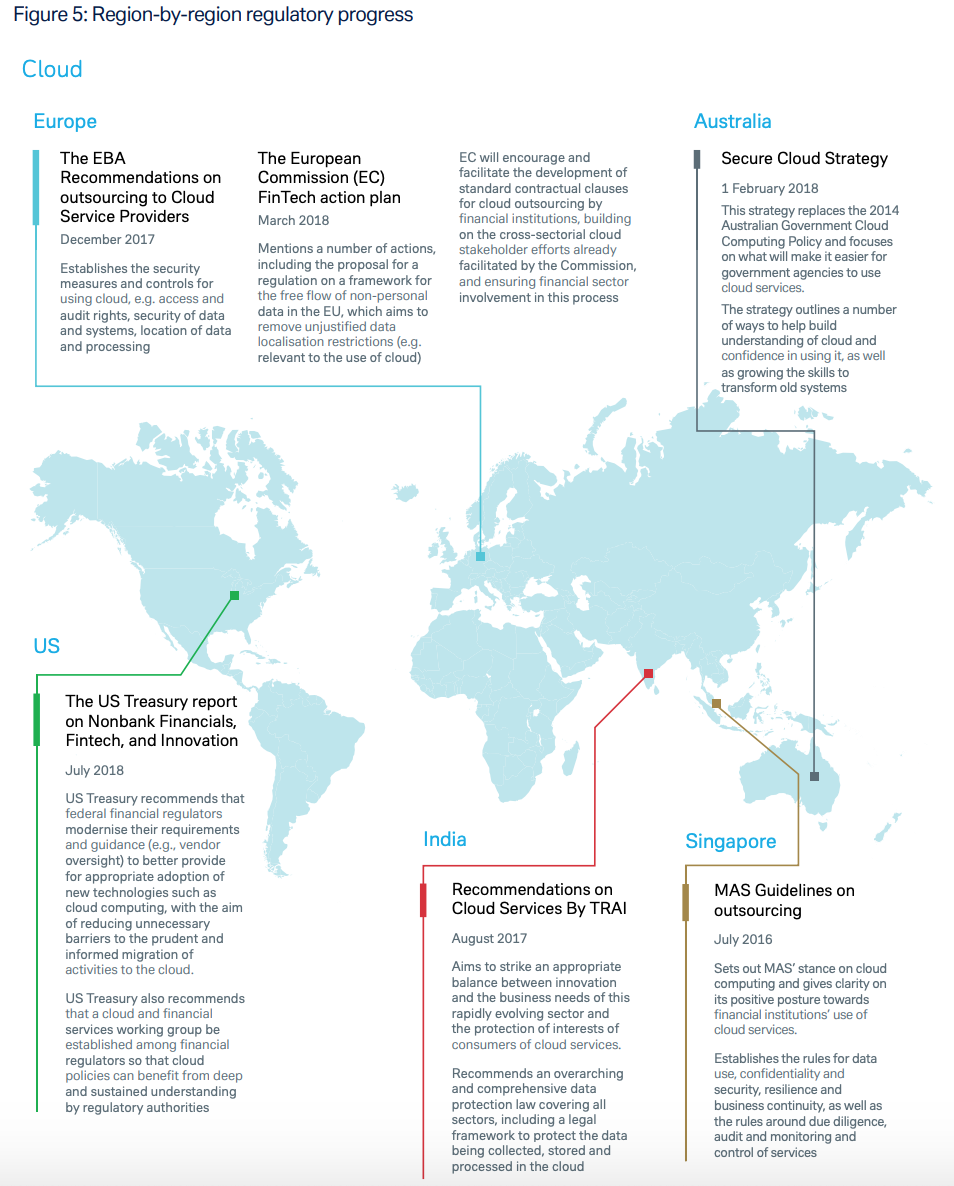

By providing near-unlimited hardware and software resources on a global and pay-as-you-go basis, cloud computing drives down costs, enables innovation and creates the flexibility to respond to change.

Cloud computing allows banks to scale-up and scale-down their IT infrastructure as required, escape the encumbrances of their legacy IT systems and avoid regular and expensive upgrade work. And with respect to cyber security, cloud service providers can provide more up-to-date security, reliably and on a cost-effective utility-based model.

With regards to regulation, financial institutions’ cloud arrangements are subject to both cybersecurity and data protection regulations, as well as banking-specific outsourcing rules.

Blockchain

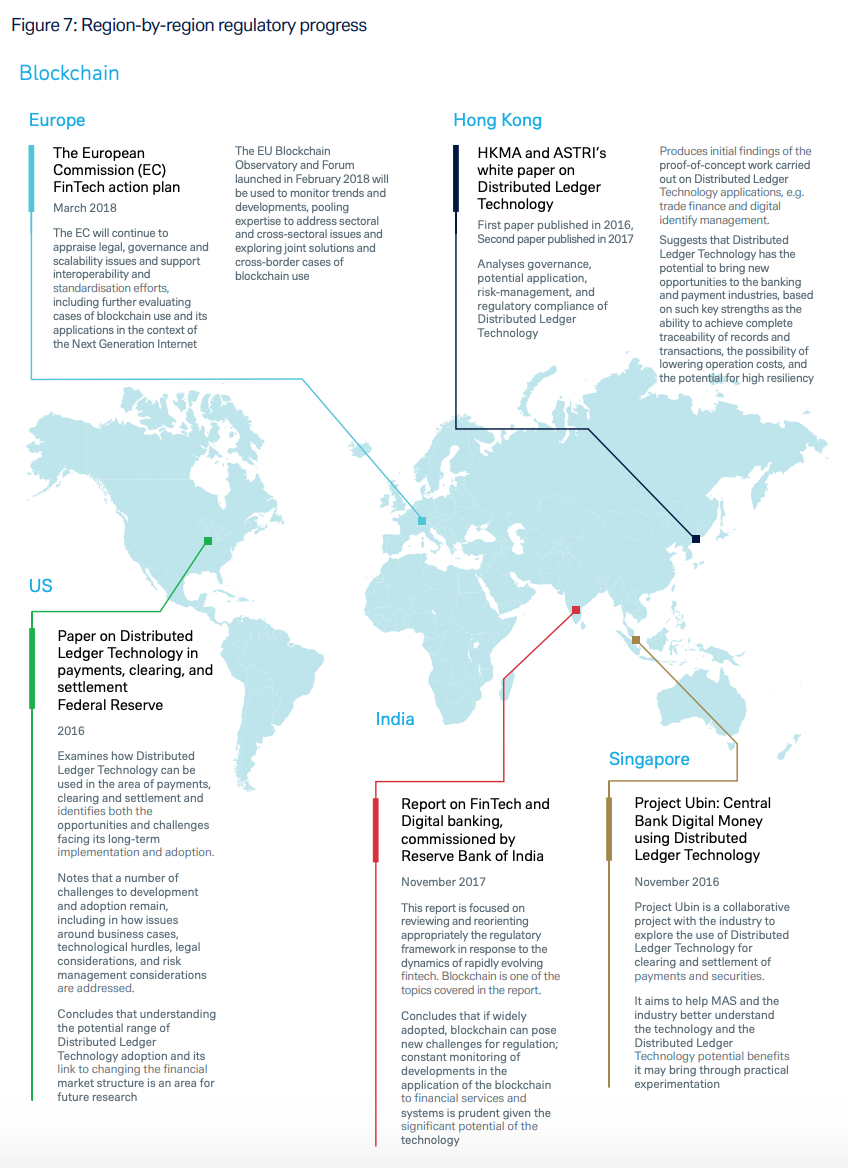

Blockchain technology, which works by creating blocks of records, enables for faster end-to-end processing, improved transparency, enhanced assessment of operational and financial risks, and reduced costs.

Corporations and financial institutions have poured billions into blockchain startups and solutions. Global spending is forecast to reach US$11.7 billion in 2022, according to the International Data Corporation.

In Asia-Pacific, the regulatory landscape is dominated by the progress made towards integrating the technology into innovative solutions while mitigating the risks of cybercrime.

As an inherently global technology, blockchain requires cross-border regulatory solutions, something that remains highly challenging to achieve due to the need to unite authorities from numerous jurisdictions behind a single policy, the report says. It also stresses the need for technology-neutrality and focus on regulating the applications and outcomes of blockchain, rather than the technology itself.

AI

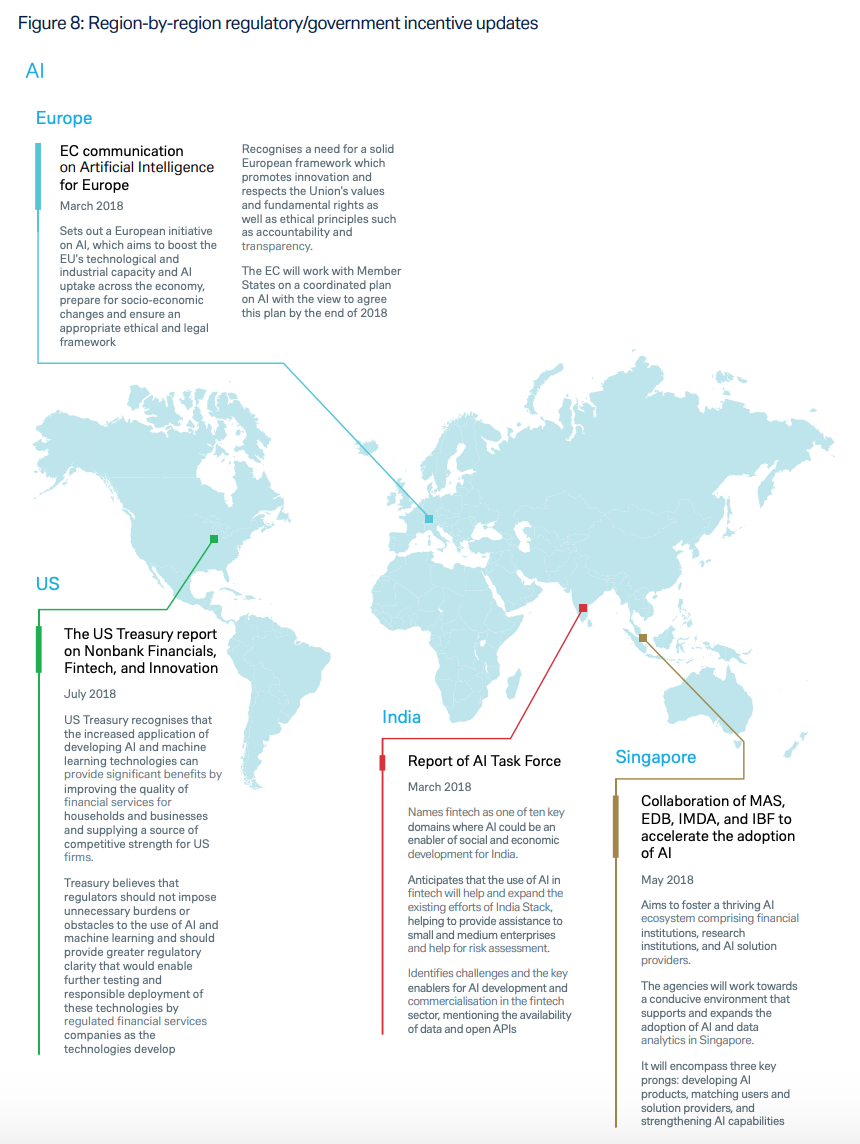

AI offers a range of benefits to market participants including improved client experience, efficient risk management and compliance, and operational efficiency. For banks, AI provides them with the opportunity to offer a better, more tailored service to clients, but also recommend other products in the the bank’s catalogue that can add value.

AI falls under current regulations including data privacy regulations but major regulators around the world are diving deeper into the subject and assessing the key risks associated with AI, its control principles and the question of ethics.

In November 2017, the Financial Stability Board called for monitoring the uses of AI in order to maintain financial stability, outlining the importance of assessing the implementation of relevant data privacy, conduct risk and cybersecurity protocols.

The US has established an AI congress advisory committee to assess the technology, while the EC’s European Group on Ethics in Science and New Technologies (EGE) has put ethics at the center of the debate, calling for the launch of a common, internationally recognized ethical and legal framework for the design, production, use and governance of AI.

In Asia, MAS announced in April 2018 that it was working with key stakeholders to develop a guide for promoting the responsible and ethical use of AI and data analytics by financial institutions.

The report concludes that regulation has proven to be both an enabler and a challenger to transformation in global transaction banking. But in order for regulations to become a catalyst for a thriving and innovative banking industry, the regulatory approach should be globally aligned, technology-neutral, digitally relevant, embracing of new solutions, and industry-led.