FundsDLT: A Blockchain-Based Platform For The Investment Fund Industry

by Company Announcement March 18, 2020Clearstream, Credit Suisse Asset Management, the Luxembourg Stock Exchange, and Natixis Investment Managers join forces to launch FundsDLT, a blockchain-based technology platform for the investment fund industry.

They have announced a Series A investment in FundsDLT to develop a novel decentralised technology platform to facilitate the distribution of funds based on distributed ledger technology (DLT). This move marks a major milestone in the evolution of FundsDLT, originally initiated and incubated by the Luxembourg Stock Exchange and its affiliate Fundsquare.

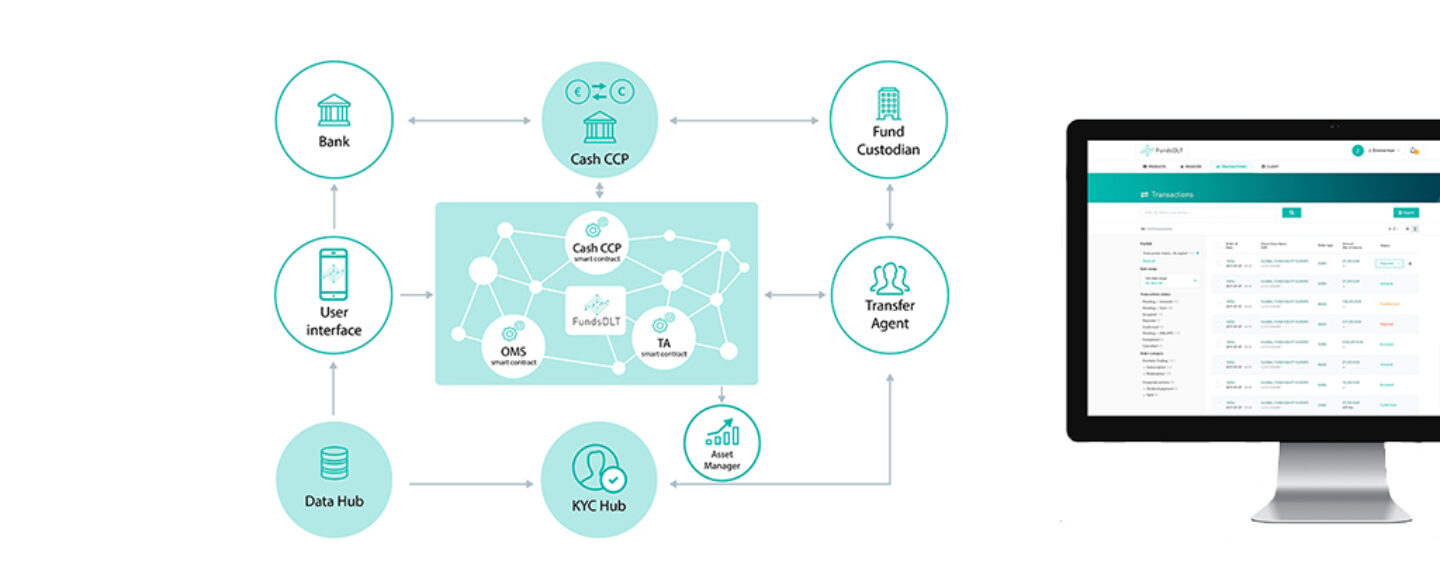

FundsDLT is built using permissioned blockchain technology based on Ethereum, that ensures privacy and high performance. FundsDLT enables the reengineering of the fund distribution value chain, from front to back, covering the entire fund lifecycle. The platform allows asset managers, distributors, asset servicers, and the entire supply chain to reduce costs by removing redundant activities, while providing the opportunity to achieve necessary transparency on end investors and creating the foundation for digital fund distribution. The Series A funding will strengthen the FundsDLT platform and accelerate its commercial development.

Michel Degen, Head of Credit Suisse Asset Management Switzerland and EMEA, said:

“We continuously seek to ease the access to our products for clients. As part of our digitalization journey, we consider FundsDLT as a further powerful lever to increase efficiency but also to create new distribution channels, enabling considerable benefits for both clients and asset managers.”