Most central banks around the world are either researching or launching their own central bank digital currency (CBDC), a trend driven by technological advances, changing consumer behavior, and disruptive forces including cryptocurrencies and stablecoins.

In a new paper titled Central bank digital currencies: motives, economic implications and the research frontier, the Bank for International Settlements (BIS) provides an overview of CBDC initiatives around the world, explores their potential implications on the financial system, financial stability, and monetary policy, and shares considerations regarding data privacy and integrity.

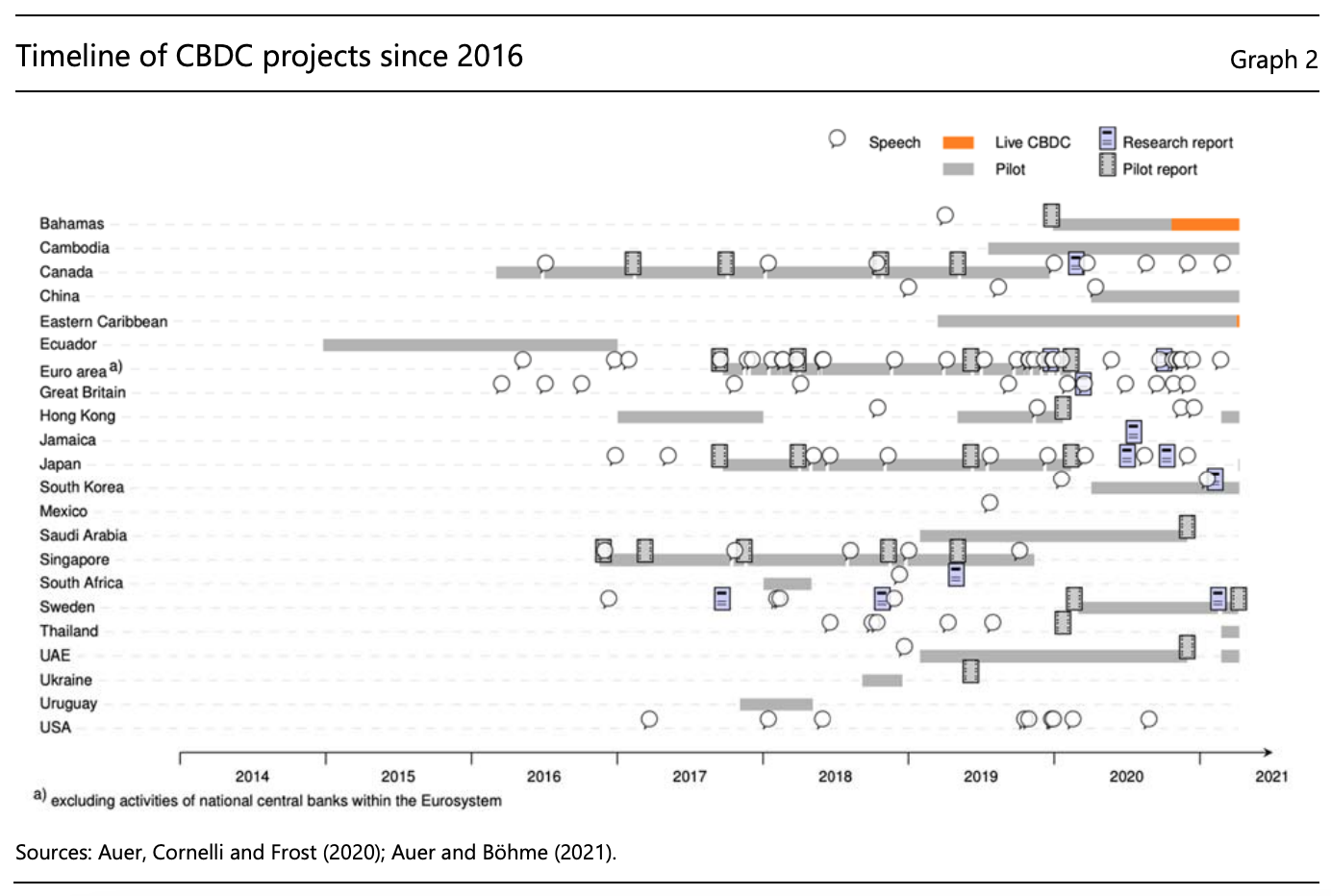

According to the paper, CBDC initiatives started in 2015 with a number of central banks running internal experiments. From 2016 onward, a slew of central banks, including those in Canada, Singapore, England, and Japan, launched research projects on wholesale CBDCs, focusing primarily on leveraging DLT for the settlement of interbank payments, as well as cross-border payments.

Work on retail CBDC, meanwhile, was first publicly announced in 2017 by Riksbank. Though Sweden was early to the CBDC game, China’s electronic Chinese yuan (e-CNY) project is by far the most advanced CBDC initiative today, with experts predicting that the People’s Bank of China (PBoC) could very well be the first to fully launch a CBDC. The PBoC started piloting the e-CNY in 2020.

Meanwhile, that same year, the Central Bank of the Bahamas began issuing the Sand Dollar through authorized financial institutions, providing residents with accessibility through digital wallets, physical payment cards and mobile apps.

This year, the Eastern Caribbean Central Bank (ECCB) launched its DCash, a retail CBDC distributed by licensed financial institutions and used for financial transactions between consumers and merchants, as well as in peer-to-peer (P2P) transactions.

As of mid-July 2021, at least 56 central banks had published retail or wholesale CBDC work, the paper says. At least three countries (Ecuador, Ukraine and Uruguay) have completed a retail CBDC pilot, and eight retail CBDC pilots are currently ongoing, including in China, South Korea and Sweden.

Timeline of CBDC projects since 2016, Source: BIS, 2021

Motivations for a CBDC

Motivations to launch a CBDC are numerous and are driven by both global trends and country-specific circumstances, the paper notes.

For one, the entry of bigtechs into payments and the growing centrality of data have raised concerns around competition, payment system integrity and privacy. Against this backdrop, a retail CBDC would help reduce a country’s dependency on bigtechs, experts have said. In China, for example, Alibaba and Tencent currently account for more than 90% of mobile transactions.

Additionally, the rapid rise in interest in cryptocurrencies and stablecoins has pushed central banks to step up efforts on CBDCs out of fear over their potential impact on financial stability and traditional monetary policy. Challenges posed by stablecoins include operational and financial integrity risks from cryptocurrency asset providers, investor protection risks, and inadequate reserves and disclosure. Between May 2020 and June 2021, stablecoin supply increased 13 times to reach more than US$100 billion, according to data from Blockdata, showcasing their dazzling growth.

Overall, central banks around the world see CBDCs as an opportunity to address risks to the safety of digital payments, ensure competition and data privacy, reduce costs and support their mandates for the smooth functioning of retail and wholesale payments, the paper says. In emerging markets, CBDCs could also help improve financial inclusion by enhancing access to payment services for the unbanked and reducing payment friction, it adds.

Accelerating CBDC efforts

CBDC efforts have significantly accelerated since the beginning of COVID-19.

During the 2021 Singapore Fintech Festival last week, the Monetary Authority of Singapore (MAS) unveiled Project Orchid, an initiative aimed at exploring the merits of a retail CBDC.

Though MAS said it has no immediate plan to launch a digital currency for the general public, it is nevertheless working with the private sector to build the technology infrastructure and capabilities needed for a retail CBDC system, should the nation decide to launch a digital currency in the future.

Similarly to Singapore, Switzerland is not planning to introduce a CBDC at the moment but research has nevertheless been ongoing since at least 2019.

In Europe, the European Central Bank (ECB) is exploring whether to issue a digital euro. In October, the Digital Euro Market Advisory Group was established to advise the Eurosystem – the ECB and the national central banks of the member states – on the design and distribution of a potential digital euro, as well as on how a digital euro could add value for all players in the euro area’s payment ecosystem.

Last week, the Bank of England said that it was advancing its exploration of CBDCs but added however that the so-called Britcoin was unlikely to arrive before 2025.