Xapo Bitcoin Debit Card: A Costly Bitcoin Spending Tool With Limits

by Fintechnews Switzerland October 16, 2015Bitcoin startup Xapo is widely known in the space for being: 1) one of the most well funded startups; 2) one of the very first companies to offer bitcoin debit cards.

Announced in mid-2014, the Xapo bitcoin debit card promised to allow bitcoin users similar spending freedoms to traditional debit cards. “With the new Xapo Debit Card you have the best of both worlds in the palm of your hand,” the company claims. But at what cost?

How does it work?

The Xapo Debit Card is a Visa card, meaning that you can use it anywhere on the Visa network for buying goods and services in stores, online, as well as withdrawing cash at ATMs.

Like any other debit card, the card debits directly in bitcoin from your Xapo main wallet – not the vault. It is available in three different spending currencies: USD, EUR and GBP, and is valid for three years.

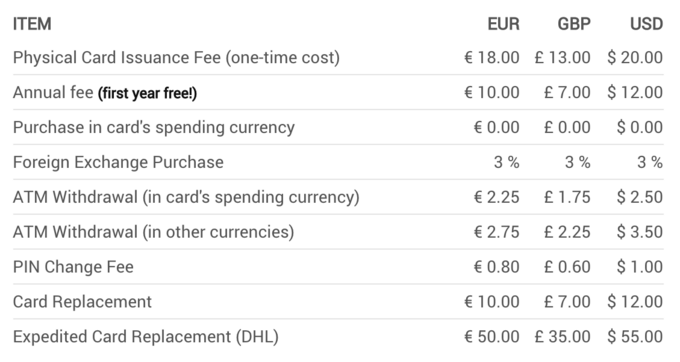

Now, one thing that should be considered seriously is the cost of using such a tool.

Purchases in your card’s spending currency are free of charge. However, you will be charged a 3% Foreign Exchange fee if you make a purchase in a different currency.

ATM withdrawals always have a fixed fee, which is here lower than with traditional Visa cards (at least Swiss cards), but slightly higher than with normal debitcards. Good to know: Swiss Bitcoin ATM’s are charging also a fee of 5%. But if you dare making an ATM Xapo Debit Card withdrawal in another currency, then that’s a fixed fee PLUS a 3% Foreign Exchange fee, which is quite in line with normal credit and debit cards.

Oh and let’s not forget the annual fee and the one time issuance card fee.

It’s obvious that Xapo issues this debitcards via a third party and this is for sure also the reason why the fees are that high. For a deeper discussion about the Xapo debit card fees we would like also to refer to the following article from August 2014 “Xapo Responds to Backlash Over Bitcoin Debit Card Fees” (see Coindesk)

Xapo Bitcoin Debit Card Fees – http://https://support.xapo.com/

Inconvenient Lifetime Limits

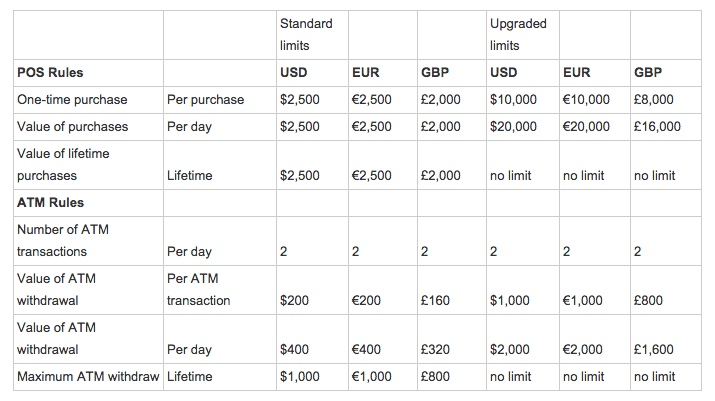

Unfortunately, the fees aren’t the only drawbacks of this card. In fact, the spending limits are also somewhat inconvenient. Users are only allowed to make two ATM withdrawals per day with a daily value limit of US$400. The maximum value in ATM withdrawals you can make with one card – which is valid for three years in case you forgot – is US$1,000.

As of purchases, you are limited to US$2,500 in value of lifetime purchase.

Now that’s of course, if you haven’t upgraded your status to increase those limits. To upgrade your card, you need to provide Xapo with ID documents and proof of residence documents – obviously.

Xapo Bitcoin Debit Card Usage Limits – https://support.xapo.com/

Bitcoin debit cards have some obvious advantages. First, they remove the headache of finding bitcoin-accepting merchants. Then, they, in a way, bring the digital currency to people’s wallet, moving bitcoin from an online-only niche to people’s everyday life.

But clearly, there is still room for improvement. Despite the convenience of being able to spend our bitcoins using a plastic card that is accepted almost everywhere in the world, we may ask ourselves if the cost is worth hanging on our old habits.

Bitcoin is widely praised for allowing nearly free value transfers by removing intermediaries. But these bitcoin debit cards are everything but cheap.

Image credit: Xapo Bitcoin Debit Card, https://xapo.com/.

16 Comments so far

Jump into a conversationXapo has just announced a debit card for users of the Bitcoin digital currency, which connects to a Bitcoin wallet. The card costs 15 USD, the card has the same function as a debit card, but instead of real money, Xapo will process transactions in real time to withdraw money from the user’s Bitcoin wallet. Bitstamp conversion rate.

The great information about xapo bitcoin debid card costly bitcoin spending tool

Hey, thanks for updating us regarding the bitcoin debit card. But tell me one thing will this work worldwide?

but instead of real money, Xapo will process transactions in real time to withdraw

thanks for this knowledge

very intresting. good job and thanks for sharing

this is a really good article. thanks for sharing

This is the information I really need. I asked my teacher about 토토사이트, but I couldn’t get a detailed explanation. However, I am very happy to get information about the major playground here. I have to go to school tomorrow and study with my friends.

This is such a cool game.

I like fast paced games like geometry dash lite because the graphics and features of this game have been upgraded so amazingly !

I hope this one affects more widely so that many people could be happier than before. I have something simmilar too. 토토사이트 could also make people feel much better I guess.

Being one of the most downloaded Extreme Demons in the geometry dash lite game, the level has grown in popularity owing to its extreme difficulty and has received over seven million downloads.

نقل الأثاث هو عملية نقل العناصر المنزلية والأثاث من مكان إلى آخر. يعتبر نقل الأثاث عملية مهمة وتتطلب التخطيط والتنظيم لضمان نقل الأثاث بسلاسة وبأمان.يتضمن عملية نقل الأثاث تفكيك الأثاث وتغليفه بشكل صحيح لحمايته من التلف أثناء النقل. يتم استخدام مواد التغليف المناسبة مثل الكرتون والفقاعات البلاستيكية والأفلام البلاستيكية لحماية الأثاث من الخدوش والكسور والضرر الآخر الناجم عن الاهتزازات والاصطدامات أثناء النقل.بعد التغليف السليم، يتم نقل الأثاث باستخدام وسائل النقل المناسبة مثل الشاحنات أو الشاحنات المغلقة. يجب تحميل الأثاث بشكل آمن وتثبيته بإحكام داخل وسيلة النقل لضمان عدم تحركه أثناء النقل.عند الوصول إلى وجهة النقل، يتم تفريغ الأثاث وتجميعه مرة أخرى وفقًا للترتيب المطلوب في المنزل الجديد. يتطلب ذلك مهارات في ترتيب الأثاث وترتيبه بشكل صحيح لتسهيل عملية الترتيب وتوفير أقصى قدر من الراحة والوظائف العملية في المساحة الجديدة.بشكل عام، يعتبر نقل الأثاث عملية تستدعي الحذر والاهتمام للحفاظ على سلامة الأثاث وضمان وصوله بسلامة إلى وجهته الجديدة. يمكن الاعتماد على خدمات شركات نقل الأثاث المحترفة للقيام بهذه العملية بطريقة فعالة وموثوقة.

افضل شركة نقل عفش

I’m relieved to have found this helpful resource. The preceding piece in particular has taught me a great deal about the world and its workings.

This is such a great resource that you are providing and you give it away for free. I love seeing blog that understand the value of providing a quality resource for free