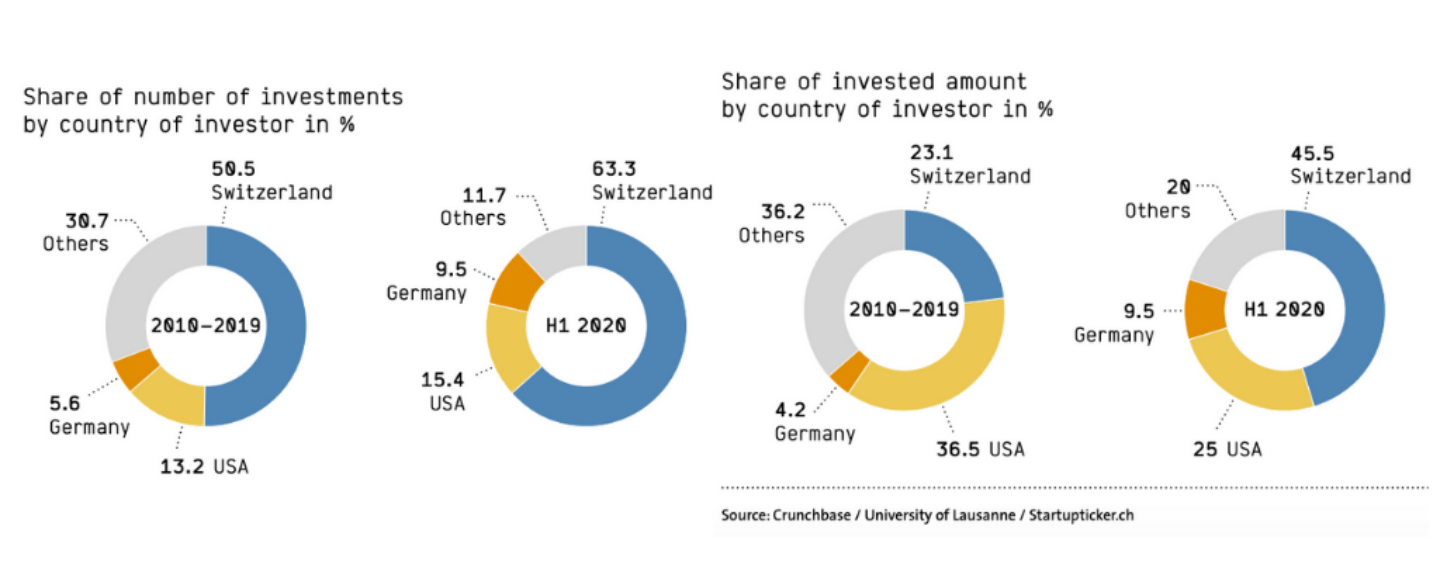

In the first half of 2020, fintech investment represented 10.4% of all funding going towards Swiss startups. As a comparison, fintech accounted for 15.7% of all invested capital in 2019, showcasing a notable shift in investment trends with investors preferring biotech, according to the Swiss Venture Capital Report Update H1 2020.

In terms of deal count, fintech accounted for 10.5% of all financing rounds, a decline compared to 2019’s 14.7%.

Share of funding rounds/invested capital by sector in H1 2020, Source: Swiss Venture Capital Report Update H1 2020, Startupticker.ch, July 2020

Swiss fintech funding takes a hit

Like other sectors, fintech funding has been hit hard by the COVID-19 pandemic with investment down globally in the first months of 2020.

Early-stage fintech companies suffered the most as investors opted to double down on larger, more mature winners.

Despite the global economic turmoil ensued by COVID-19, several young Swiss startups successful managed to raise funding in H1 2020. Notable deals included challenger bank Alpian’s CHF 12.2 million Series A, AlgoTrader’s CHF 3.7 million round, and Crypto Finance’s CHF 14 million Series B.

H2 2020 has started well for the Swiss fintech sector with already some noteworthy funding rounds taking place. These include Bitcoin Suisse’s CHF 45 million round, digital asset infrastructure provider Metaco’s US$17 million Series A, and business lending startup Teylor’s CHF 8 million funding round.

Swiss financing remaining strong

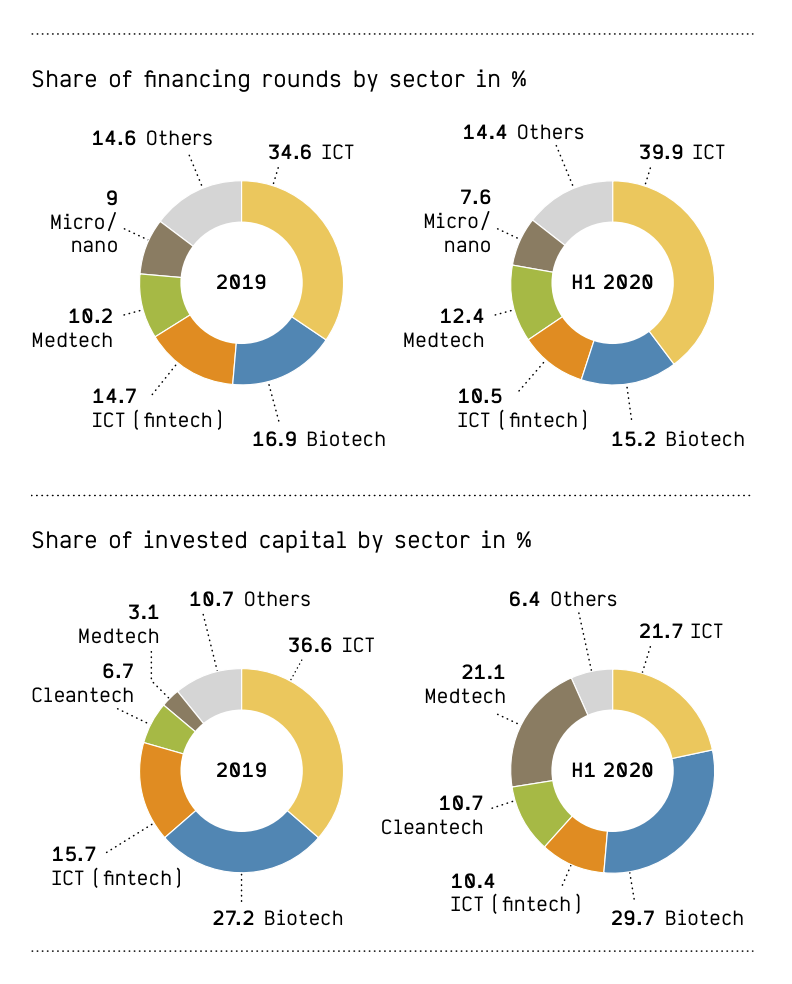

Overall, Swiss companies raised a combined CHF 763 million through 105 financing rounds in H1 2020, and though the amount is more than a third lower that what was raised during the same period last year, it is actually a fairly good performance considering that no mega-rounds of CHF 100 million or more occurred in H1 2020, the Startupticker.ch report says.

Investments in Swiss startups in H1 2020, Source: Swiss Venture Capital Report Update H1 2020, Startupticker.ch, July 2020

Life sciences and biotech dominated the startup funding landscape in H1 2020 with some of the biggest investment rounds. Biotech accounted for 15.2% of financing rounds and 29.7% of invested capital over the period.

Information and communications technology (ICT), excluding fintech, made up of 39.9% of all funding rounds, while accounting for 21.7% of all invested capital during H1 2020.

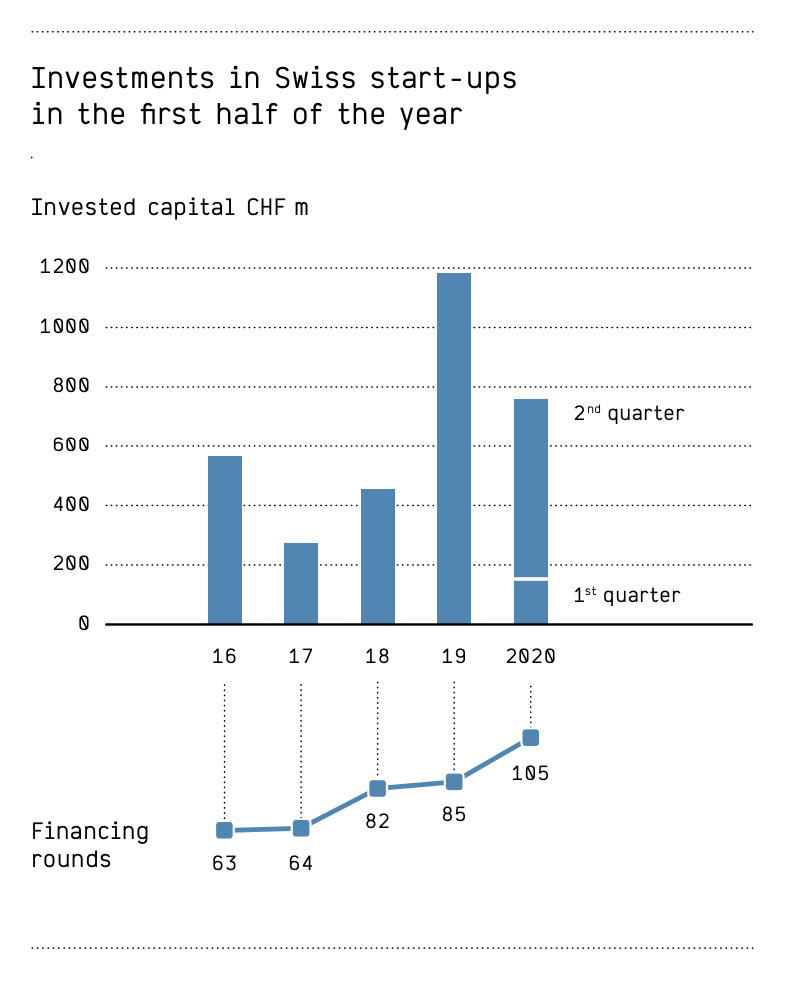

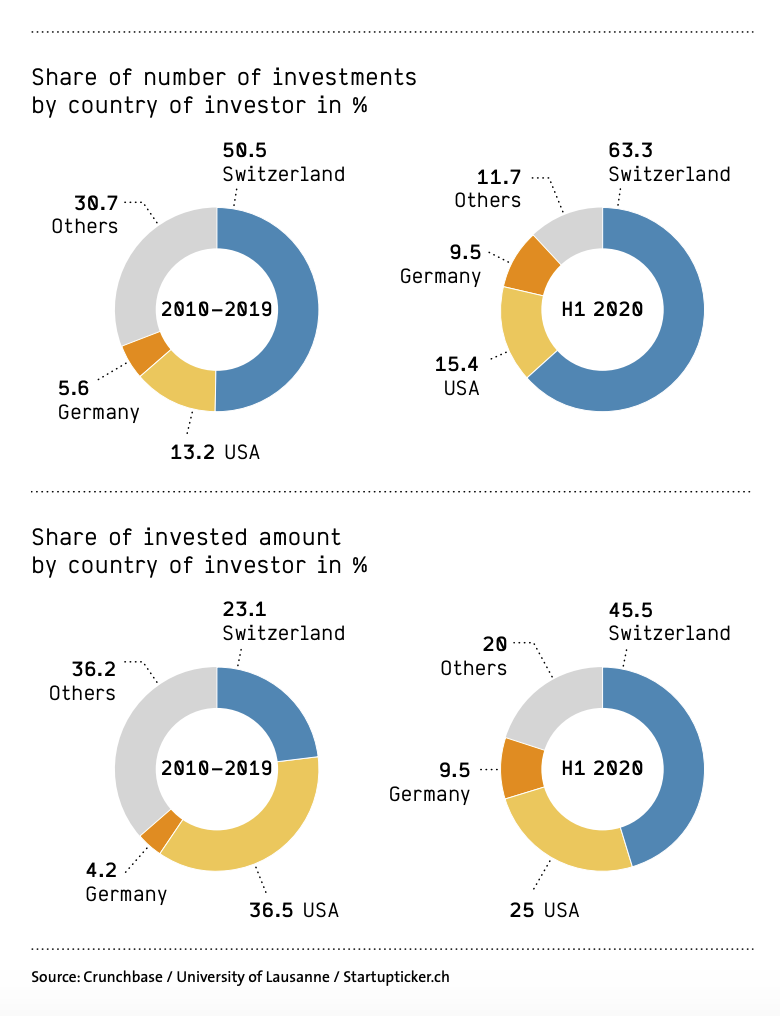

In H1 2020, Swiss investors took a bigger role in funding their local startups. The share that Swiss investors contributed rose from about a quarter in the long-standing average to about half. Meanwhile, investment by US and European investors declined sharply, the research found.

Share of number of investments/invested amount by country of investor in H1 2020, Source: Swiss Venture Capital Report Update H1 2020, Startupticker.ch, July 2020

Swiss venture capital investors are optimist

As part of the study, Startupticker.ch conducted a survey of Swiss venture capital (VC) investors. The research found that COVID-19 has not stopped them from working with about 50% of the 29 Swiss VCs surveyed actively fundraising in H1 2020.

Overall, respondents shared optimism with the majority of them expecting to achieve the originally planned amount, and almost one third even showing confidence in exceeding their pre-coronavirus targets.

The pandemic, however, will likely cause a delay in fundraising, with two thirds of managers expecting between one to six months in delay to close their funds.

Unsurprisingly, a majority of Swiss VC investors observed a decline in valuation of startups in the first half of 2020, though the dip was relatively moderate, the research found.

For H2 2020, three quarters of fund managers expect lower valuations compared with pre-pandemic levels, but by 2021, startups valuations should return to their pre-COVID-19 levels.