Swiss fintechs sector is booming, this is made evident by the fact that fintech startups in Switzerland has raised more than CHF 100 Million last year.

Supporting the growth in this segment are the team behind Venturelab.

Every year for the past 19 years, VentureLab has been supporting some Swizterland’s best startups by organising international roadshows to Silicon Valley, Boston, New York, China and Barcelona. This year, Venturelab will be sending 10 winners of the “Venture Leaders Fintech” to Hong Kong Fintech Week with the intention of fund raising in Hong Kong.

The roadshow to Hong Kong is jointly organised by Venturelab and swissnex China and supported by digitalswitzerland, EPF Ladigitalswitzerland, EPF Lausanne, ETH Zurich, IMMOMIG, PostFinance, Redalpine, Walder Wyss and Canton of Zurich.

Both Fintech News Switzerland and our sister site Fintech News Hong Kong are also supporting this roadshow

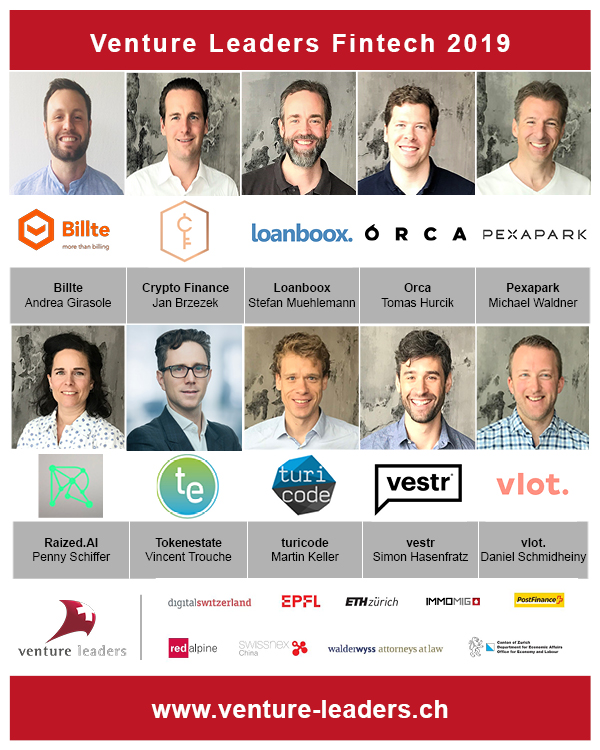

The ten innovative startups were chosen by a jury of professional investors and experts.

Stefan Steiner

“We are very happy to bring this competitive selection of fintech startups for the first time to Hong Kong to approach investors and explore the booming fintech startup ecosystem in Hong Kong and Asia in general,”

said Stefan Steiner, co-managing director of Venturelab.

Now is the perfect time to fundraise in Hong Kong, as the region’s fintech market experiences a boom. China is the world’s largest fintech marketplace, and Hong Kong the bridge connecting it with the rest of global finance.

Felix Moesner

“Hong Kong has a vibrant innovation ecosystem with 4 startup unicorns among its 550 fintech companies. Hong Kong, with a population on par with Switzerland, profits from being part of China’s Guangdong-Hong Kong-Macau Greater Bay Area: a megalopolis with 70 million people. Swiss fintech startups have the expertise and are well-prepared to tap into Hong Kong’s rich fintech ecosystem full of opportunities,”

said Felix Moesner, Science Consul and CEO of swissnex China.

Qumram is one of many success stories from the Venture Leaders Fintech program: after attending the Venture Leaders Fintech roadshow to New York in 2017, founder Patrick Barnert’s startup was acquired by U.S. software group Dynatrace. Other successful alums include Knip (acquired by Digital Insurance Group), TradePlus24 (raised $220m), Advanon (raised $13.5m), Lend (raised $6m) among others.

Below are the ten winners that will be taking a part in the roadshow to Hong Fintech Week, you can also catch on 24th September during the Startups Champion event in Zurich

Venture Leaders Fintech winners 2019

Billte AG | Andrea Girasole | billte.ch | Zurich

Billte AG | Andrea Girasole | billte.ch | Zurich

Processing and tracking paper invoices are expensive and time consuming. Billte digitizes and automatizes companies’ entire billing process. The startup already works with insurer Generali in Switzerland and is looking to expand into Asia this year.

Crypto Finance AG | Jan Brzezek | cryptofinance.ch | Zug

Crypto Finance AG | Jan Brzezek | cryptofinance.ch | Zug

Implementing blockchain technology can be difficult for financial institutions and investors. Crypto Finance, Switzerland’s first and only FINMA-regulated asset manager for crypto assets, offers exposure to reputable and regulated products in the crypto asset class via its own brokerage and fund.

Loanboox AG | Stefan Muehlemann | loanboox.com | Zurich

Loanboox AG | Stefan Muehlemann | loanboox.com | Zurich

Debt capital markets are intransparent for public sector authorities, who seek an easier and more efficient loan process. Loanboox’s independent debt capital platform simplifies the comparability of interest rates and legal clauses to allow borrowers to close deals with banks and institutional investors online. Clients from four countries have already requested financing of CHF 25 billion.

Orca AG | Tomas Hurcik | orca.xyz | Zurich

Orca AG | Tomas Hurcik | orca.xyz | Zurich

Over the next seven years the largest transition of wealth ever is due to take place. The next generation of high-and ultra-high-net-worth individuals is digitally native and requires tools that balance their privacy with the need to share digital information with family, advisors and service providers. Orca’s zero knowledge platform is the single point of contact for coordinating this flow of information for individual and corporate clients.

Pexapark AG | Michael Waldner | pexapark.com | Schlieren

Pexapark AG | Michael Waldner | pexapark.com | Schlieren

Renewable energy sales have become more complex and volatile as governments reduce subsidies. At the same time installed renewable capacity is set to double in the next five years. Pexapark’s complete revenue management solution for renewables gives investors and renewable-energy-asset owners a single place to price energy sales, close transactions and monitor their energy risks.

Raized.AI AG | Penny Schiffer | raized.ai | Zurich

Raized.AI AG | Penny Schiffer | raized.ai | Zurich

Venture capitalists need to manually review hundreds of pitchdecks before finding an investment, and startups pitch hundreds of VCs before winning funding. Raized.AI uses artificial intelligence to improve deal flow for VCs, to help the market clear more efficiently.

Tokenestate SA | Vincent Trouche | tokenestate.io | Neuchatel

Tokenestate SA | Vincent Trouche | tokenestate.io | Neuchatel

Traditional processes to manage and verify investors in private companies and real-estate are obsolete, which makes it difficult to trade these assets in secondary markets. Tokenestate originates deals and offers digital securities – the digital representation of regulated financial instruments – on its own platform. The company also helps startups and SMEs to manage their own token-sales, executing its first digital sale last year.

turicode AG | Martin Keller | turicode.com | Zurich

turicode AG | Martin Keller | turicode.com | Zurich

Eighty percent of business-relevant data is unstructured, much of it locked inside the 2.5 trillion PDFs created every year. In the financial industry document-heavy processes are considered part of the daily routine and often outsourced to humans in lower-wage countries. Turicode uses machine-learning to train its information retrieval software MINT.extract to analyze documents more quickly and accurately.

vestr AG | Simon Hasenfratz | vestr.com | Zurich

vestr AG | Simon Hasenfratz | vestr.com | Zurich

Actively managed certificates are a growing class of structured products, whose dynamism makes them difficult for banks to manage and scale. Vestr’s b-to-b platform simplifies this for financial institutions and their customers.The startup, with investors including the Swiss Stock exchange, aims to have more than a billion francs in assets on the platform by end of the year.

vlot Ltd | Daniel Schmidheiny | vlot.ch | Zurich

vlot Ltd | Daniel Schmidheiny | vlot.ch | Zurich

The complexity of modern social security systems is compounded by citizens having more dynamic employment and family lives. Understanding their own life insurance needs has become a big challenge. Vlot’s software evaluates a family’s or individual’s life insurance coverage needs and helps financial institutions advise them better.

Follow the Venture Leaders Fintech roadshow in Hong Kong from Nov. 3rd – 9th on social media using the hashtag #vleadersFintech.