5 Recommendations for Wholesale Central Bank Digital Currency Design and Implementation

by Fintechnews Switzerland March 14, 2022A new paper from the Boston Consulting Group (BCG) and Clifford Chance, commissioned by the Global Financial Markets Association (GFMA), looks at the potential benefits and challenges relating to wholesale central bank digital currencies (wCBDCs), and shares five critical considerations for a successful design and implementation.

Over 70% of central banks around the world are exploring the possibility of introducing CBDCs as they seek to capitalize on the potential benefits promised by the technology including enhanced efficiency, resilience and effectiveness of money flows and capital markets.

But these benefits will only be achieved if both the wCBDCs themselves and the infrastructure which facilitates their uses are appropriately and effectively designed, says the paper, titled Central Bank Digital Currencies: A Global Capital Markets Perspective.

The report outlines five essential building blocks for consideration by central banks and other financial market authorities when developing a wCBDC, which relate to access, interoperability, regulation, prudential treatment and risk management.

The first recommendation involves the level of access which should be given to participants in the financial landscape. The paper notes that while there are many benefits to extending access of CBDCs to non-regulated institutions, at the initial stage of deployment, a wCBDC should be limited to regulated financial institutions that are eligible to hold central bank accounts in their respective jurisdictions. This will help mitigate potential financial stability issues.

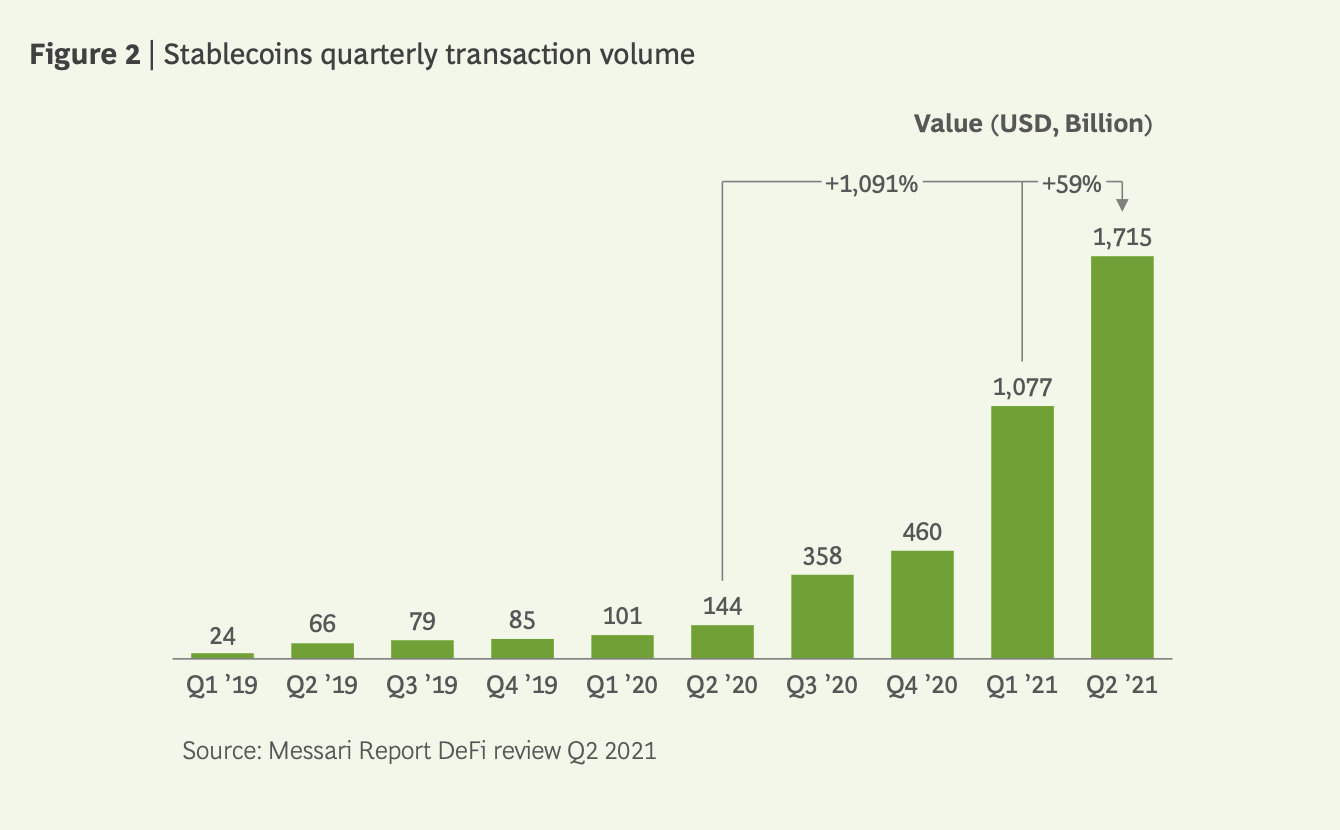

Stablecoins quarterly transaction volume

Over time, access can be extended to select financial institutions that have comparable governance, risk management, anti-money laundering, counter terrorist financing (AML/CFT) and sanctions, capital, liquidity and operational resilience standards of regulated financial institutions, the paper says.

The second building block outlined in the paper is interoperability, a critical element considering that wCBDC are generally meant to work as an additional payment instrument and system rather than a replacement to existing ones.

Hence, ensuring that a wCBDC is interoperable with the broader financial ecosystem is critical to achieving full impact on payments and settlements, the paper says. This means making sure that the wCBDC system is interoperable with both existing and new wholesale payment instruments and systems, other capital market financial market infrastructures (FMIs), and cross-border foreign exchange (FX) systems.

Against this backdrop, central banks and policymakers should work together to set common standards. They also should partner with the private sector to design, experiment and implement solutions for interoperability, it says.

Next, the third building block revolves around legislation. The paper says that in order to be able to determine the status of a wCBDC, its treatment when held by intermediaries and the impact of an intermediary’s insolvency, legislative frameworks must legally classify wCBDCs as fungible with fiat currency. This will also be critical in establishing the duty of care required of intermediating entities for a CBDC that is held by them or accessed through them. In addition, standards for obtaining a security interest in CBDC should also be established, it adds.

The fourth building block concerns the prudential treatment of wCBDC. The paper argues that if wCBDCs were to be given a less favorable prudential treatment than central bank cash balances, their usability would be significantly reduced, impacting thus market efficiency. Hence, wCBDCs must be considered analogous to other central bank money and have the same prudential treatment to reach their full potential.

Finally, the fifth and last building block relates to risk management, including threat to financial stability, credit and liquidity, operational risk, and reputational risk. All in all, central banks should not overlook the potential risks of introducing wCBDCs and need to balance the risks and benefits. They should act conservatively when making decisions and properly structure the wCBDC so that it doesn’t diminish the central bank’s ability to conduct monetary policy and maintain financial stability.

In addition to these five building blocks, the paper also highlights other considerations, including whether or not to make the wCBDC programmable, cybersecurity risks, and operational resilience.

A 2021 survey of central banks by the Bank for International Settlements (BIS) found that 86% were actively researching the potential of CBDCs. Efforts have intensified over the past year amid a decline in cash usage, rising digital payment adoption, and growing interest in cryptocurrencies.

In Switzerland, Project Helvetia concluded earlier this year with the completion of Phase II that sought to integrate a wCBDC running on a distributed ledger technology (DLT) platform into existing core banking systems.

Besides Project Helvetia, the Swiss National Bank (SNB) also took part in Project Jura, alongside Banque de France, and the BIS Innovation Hub, an initiative that focused on exploring the direct transfer of euro and Swiss franc wCBDCs between French and Swiss commercial banks on a single DLT platform operated by a third party.

The 2022 work program of the BIS Innovation Hub gives mention of an upcoming initiative called Project Titus which will be led by the organization’s Swiss hub. No further details have been released at this stage.