POS consumer credit develops explosively. There are two main segments of POS credit industry solutions — for offline and online sellers. Affirm, working with borrowers under 35, has already shipped its solution to 850+ offline sellers and more than 10 big e-commerce platforms.

In round D the company raised $100M ($420M in total). Canadian startup FinanceIt attracted another $17 M (sold its solution to more than 1000 customers). Russian REVO raised $20M (with another $5M in 2015), American BlisPay — $12.75M at seed stage (now they are in a process of raising of similar amount of money), LoanHero — $2.5M ($4.2M in total, integrated with 100+ stores).

China Rapid Finance has an interesting strategy: they grow mostly due to numerous partnerships with e-commerce platforms (in such industries as tourism, electronics, games and apparel), focusing on EMMA-clients (Emerging Middle class Mobile Active), however, in order to spread to offline segment, they have opened around 70 offices.

The company has got more than 1.2M customers already, announced strategic partnership with Tencent (owner of WeChat, invested in American lending startup Payoff) and raised $90M in total in two rounds of 2016 with evaluation at $1B.

Also, this platform doesn’t spend its own money issuing credit — it acts as intermediary between client and partner banks, which couldn’t reach him otherwise. German Kreditech pursues the same strategy (although it credits only online purchases currently).

Vostok Emerging Finance (VEF) announced that it has agreed to invest up to USD 5 mln over a number of tranches in REVO Technologies and Sorsdata as part of a broader funding round, totalling up to USD 20 million. The new round is led by Baring Vostok, a Private Equity firm operating in Russia and the CIS. This is a second investment by VEF into the companies, following on an earlier round in late 2015.

Revo is a first mover to leverage mobile Internet and latest cloud technologies to deliver instant store finance services for leading on- and off-line merchants and services providers in Russia. Operating since 2013, Revo has a proven business model, an outstanding team, and a leading position in this fast growing segment.

Financeit pulled in a $17 million venture funding round that was led by new investors Pritzker family business interests advised by The Pritzker Organization and DNS Capital. Existing investors also contributed. The new installment boosts the Canada-based company’s total funding up to more than $38 million since it was established in 2011. This comes less than a month after Financeit announced the acquisition of TD Bank Group’s indirect home improvement financing assets.

This installment will be used to fund the $339 million transaction, which included the purchase of more than 800 merchant dealer agreements. Once things have settled from the deal, Financeit will be servicing 45,000 existing TD consumer loans.

The company has already increased its lending activity in the home improvement industry by almost 2X since 2015. Earlier this [2016] fall the company debuted its direct-to-consumer financing platform, Financeit Direct, which enables consumers to apply for funds via their mobile device.

Blispay, a Baltimore financial technology startup, is seeking nearly $12 million in new funding. The funding round comes after Blispay raised $12.75 million in a funding round last year. About $4 million in equity has already been sold to unnamed investors, according to the Securities and Exchange Commission filing.

Blispay is a startup founded by Greg Lisiewski, formerly of BillMeLater, which was acquired by PayPal for nearly $1 billion in 2008. From that point, he served as global head of credit products at PayPal until the past year, when he went on to found Blispay.

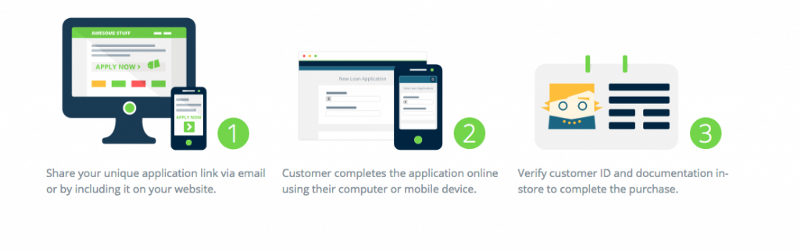

Blispay tested its service in stealth mode for about a year, starting in January 2015. In March 2016 the company received $12.75 million in seed funding led by FirstMark Capital, with participation from Accomplice, NEA and TriplePoint Capital. Blispay signs on with merchants to offer financing programs that are free for the merchants and require no extra time or energy from the retail associates.

These merchants simply hang signage that explains to customers that a financing plan is available to them. When a customer walks into the store and either can’t, or doesn’t wish to, pay for the item in full on the spot, they can sign up for Blispay on their phone.

The sign up includes a few minutes of fine-print reading and asks the user to include their name, email, password, phone number, DOB and Social Security number. From there, it takes under a minute to either approve or decline the application for financing. If accepted, the user can buy the item on the spot using their mobile phone, getting six months of interest-free time to pay for the product, if paid in full.

After that six months, the user will pay back the loan on a 19.99 percent interest rate, which is relatively lower than the average 26 percent for other financing programs from big box retailers, but slightly higher than a traditional credit card (average 17 percent interest).

What’s more, after the user goes home with the initial product, they receive a Blispay Visa card in the mail to use on other purchases. The same six-month-interest-free deal applies to all purchases over $199, but the card can also be used for every day purchases like Starbucks, etc. The card also offers a flat 2 percent cash back program on all purchases. On the backend, Blispay partners with a Utah-based bank called First Electronic Bank.

When the original purchase goes through, First Electronic Bank pays Visa, which pays the merchant the next day, with both entities taking a small transaction fee. At that point, Blispay buys back the loan and bills the customer directly, receiving 100 percent of the purchase price, which is the way they generate revenue. Beyond that, they also receive most of the interest for users who either can’t or don’t wish to pay back the loan in the first six months.

Affirm is a SF-based and focuses its lending on the millennial market, individuals under the age of 35. Alternative to credit card via offering Point of Sale loans to online shoppers. Affirm is also in top of the most funded companies in a sector of consumer loans with $420M raised. Affirm has raised a $100M Series D led by fellow PayPal co-founder Peter Thiel’s Founders Fund and included participation from existing investors including Lightspeed Venture Partners, Spark Capital, Khosla Ventures, Andreessen Horowitz, and Jefferies.

The startup will use some of this new funding to develop a host of services outside of traditional financing, all designed to grow and increase user engagement. In terms of partnerships, announced support for four additional e-commerce platforms: Kibo Commerce, BigCommerce, AspDotNetStorefront and Zen-Cart. Retailers that utilize any of these e-commerce platforms are now able to offer consumers the ability to purchase goods and services online, and break up payments over multiple months. Up to date, Affirm is partnering with over 850 offline merchants.

LoanHero is another POS lender, based in CA and founded in 2014. It focuses on prime consumers and industries as consumer goods, home improvement, auto services and repair, medical devices and services, other. LoanHero’s interest accrues during promotional period, but if purchase balance is paid in full by end of the period and a consumer has made all required monthly payments, then interest is waived. This [2016] year LoanHero also secured an additional $2,5M in seed funding.

Led by Alsop Louie Partners and Mucker Capital, this investment will allow LoanHero to offer financing to consumers nationwide. Since launching in April 2015, LoanHero has raised a total $4.2 million in equity funding and has achieved a lending capacity of $20 million. In just six months, LoanHero has made thousands of loans to prime, mid-prime and sub-prime consumers, all in a controlled rollout to five states and a select group of 100 merchant partner locations.

Right after the funding round, LoanHero announced it has expanded its lending operations to a nationwide footprint in partnership with First Electronic Bank, Member FDIC. This will allow LoanHero to partner with nationwide retail establishments seeking to offer a more comprehensive financing option to their consumers at the point of sale.

Kreditech is the German startup that offers loans and other financial services to consumers who have little or no credit history by using some 20,000 data points online to assess their suitability.

Kreditech is the German startup that offers loans and other financial services to consumers who have little or no credit history by using some 20,000 data points online to assess their suitability.

This [2016] year it has added two financing rounds, $11 million (€10 million) in its Series C round of funding from the International Finance Corporation (IFC), a division of the World Bank group that focuses on economic development in emerging countries. And the second one was in December — $10.4 million (10 million euros) from Rakuten, the e-commerce giant out of Japan., out of Rakuten’s fintech startup fund, launched last year. Lastly, Kreditech has announced its new business line, Online Point-of-Sales (POS) Financing, with its first client, PayU Global BV.

The new integration allows customers to instantly finance their online purchases at charges comparable to local banks. Loan amounts are granted at up to EUR 5,000 and for a duration of up to 36 months.

China Rapid Finance is one of the most interesting lending platforms in China which intended to go IPO this year in the US. With more than 4,000 employees and 70 branch offices, the company has one of the largest multi-channel offline and is the largest consumer lending marketplace in terms of number of loans. Despite this, it still had certain milestones to speak about, at first, China Rapid Finance announced that its platform has exceeded 1,2 million borrowers and it facilitated 8.8 million loans in total as of October 31st.

Additionally it also revealed it is partnering with various China’s internet platforms, including Tencent (owner of WeChat), online travel agencies, online group-buy and shopping platforms, online gaming companies, online e-commerce platforms and payment service providers to reach and serve these potentially qualified EMMA (Emerging Middle class Mobile Active) borrowers.

This article first appeared on Medium