Banks Still Falling Short in Improving Customer Experience: World Fintech Report 2020

by Fintechnews Switzerland April 27, 2020Despite having invested heavily in front-end IT infrastructure to improve customer experience, traditional banks are still falling short behind bigtechs and challenger banks, according to new report by Capgemini and Efma.

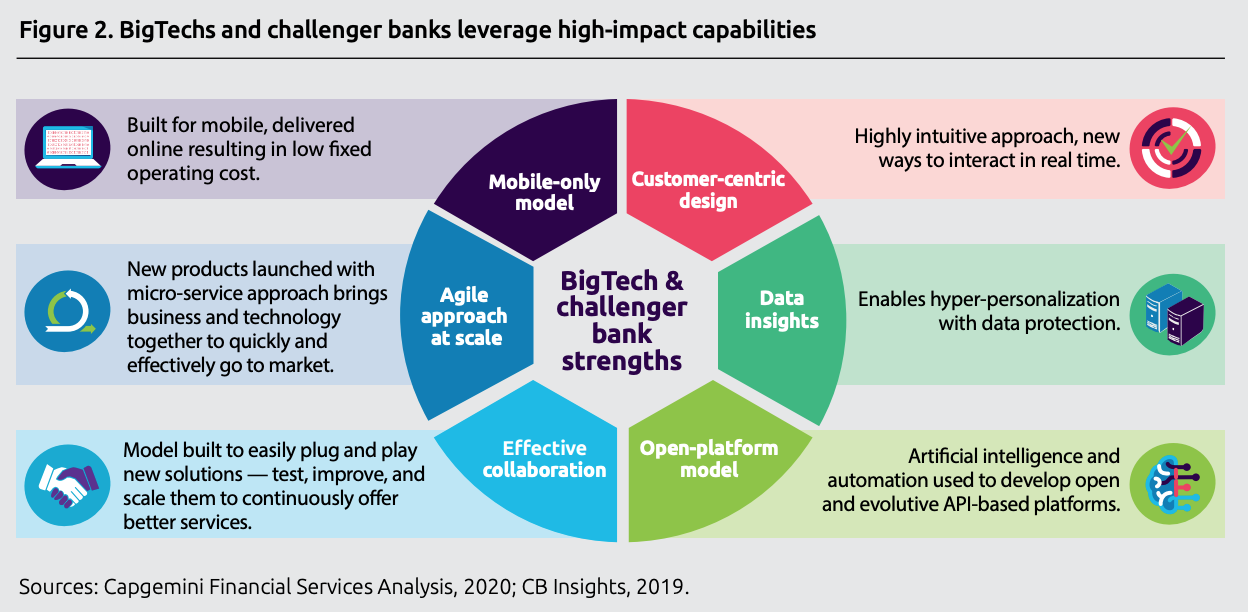

In their annual World Fintech Report, the two organizations highlight that bigtechs and challenger banks have demonstrated their ability to win customers over by providing data-fueled, hyper-personalized experience in real-time.

Capitalizing on the growing demand for improved services, these players are leveraging the wealth of data they’ve gathered over the years through open and evolving platforms to offer customers a convenient, personalized experience.

These tech players, which oftentimes began with a single offering, have since evolved to now providing a wide portfolio of products ranging from lending, savings, wealth management, and more, and are rapidly growing and scaling their financial services capabilities. With fintech funding continuing to increase, bigtechs and challenger banks are now posing a tangible threat to established banks, the report says.

BigTechs and challenger banks leverage high-impact capabilities, World Fintech Report 2020, Capgemini and Efma, April 2020

Despite all the efforts, traditional banks are struggling to keep up, and still fall behind in terms of customer experience, it says.

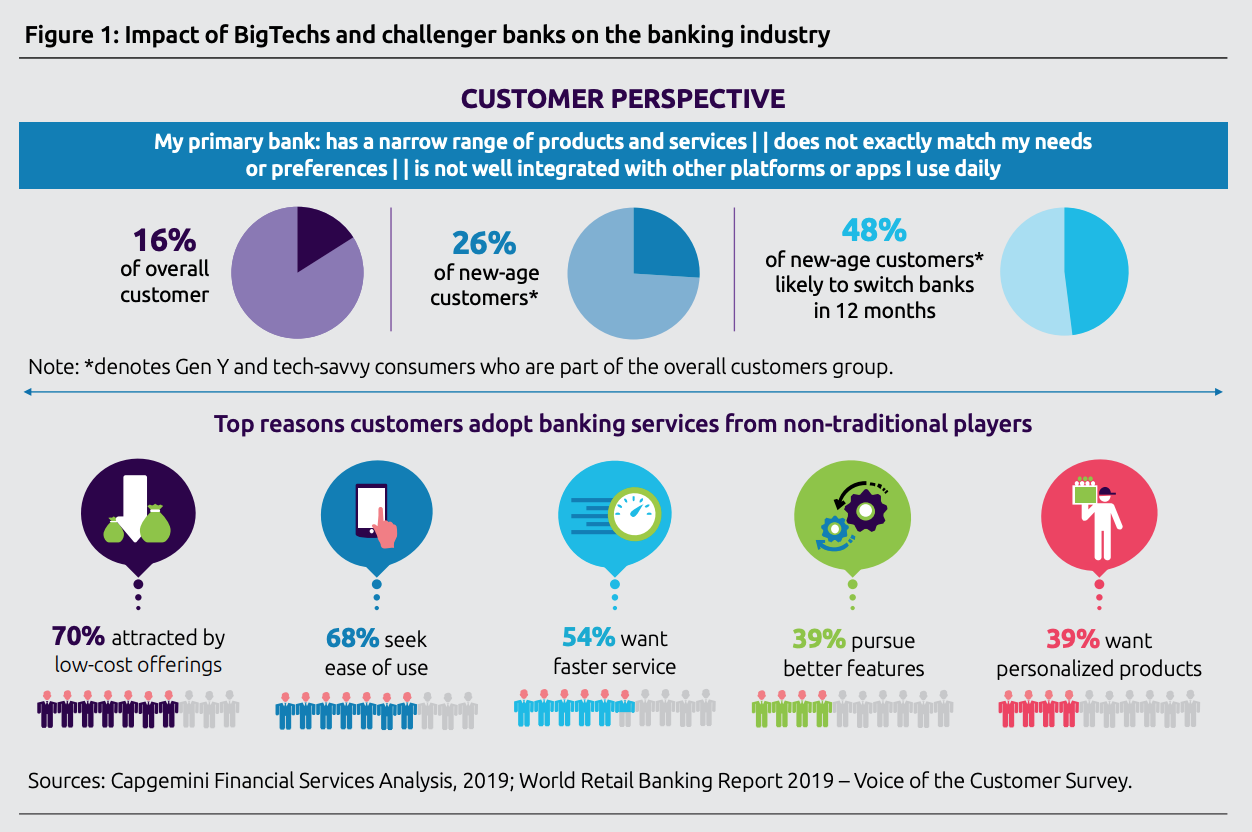

According to a study conducted last year by Capgemimi, customers are particularly frustrated with the narrow ranges of products and services their primary bank offers. The lack of personalization and inability to match needs or preference was named as another major drawback, in addition to the fact that their banks were found to be not well integrated with other platforms and apps customers use daily.

Customers cited low-cost offerings (70%), ease of use (68%) and faster services (54%) as the top three reasons why they would adopt banking services from non-traditional players.

Impact of BigTechs and challenger banks on the banking industry, World Fintech Report 2020, Capgemini and Efma, April 2020

Embracing Open X

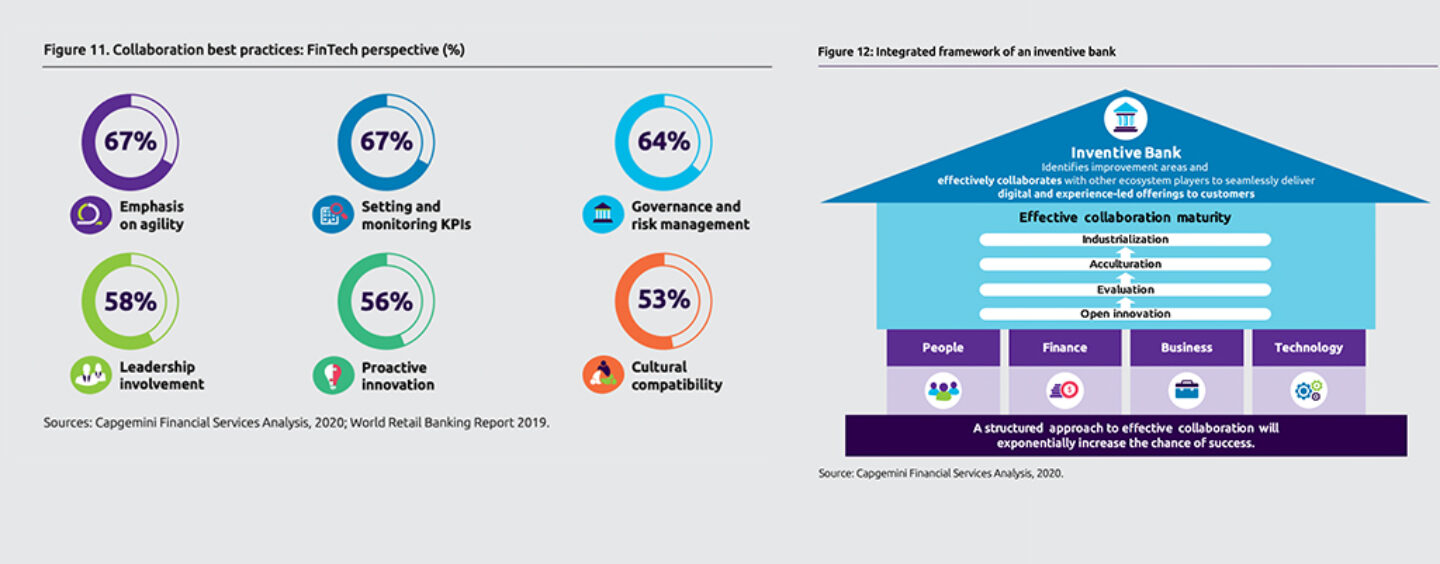

To catch up with new-age players and remain relevant, the report says that traditional banks must transform into agile and customer-centric Inventive Banks and embrace Open X.

Open X refers to an open platform approach in which participants of all sizes and from across industries work together.

It cites the example of Uber, a non-financial player which has used the full potential of the Open X ecosystem: Uber’s flagship ride-sharing offering was built on a partnership model with car owners and relies on a plethora of third-party providers and services for navigation, digital payments, and other capabilities. For its food delivering offering, Uber Eats, the company created a three-sided marketplace with customers, restaurant partners, and delivery partners. It also partnered with Visa and Barclays to launch a credit card in the US in 2017.

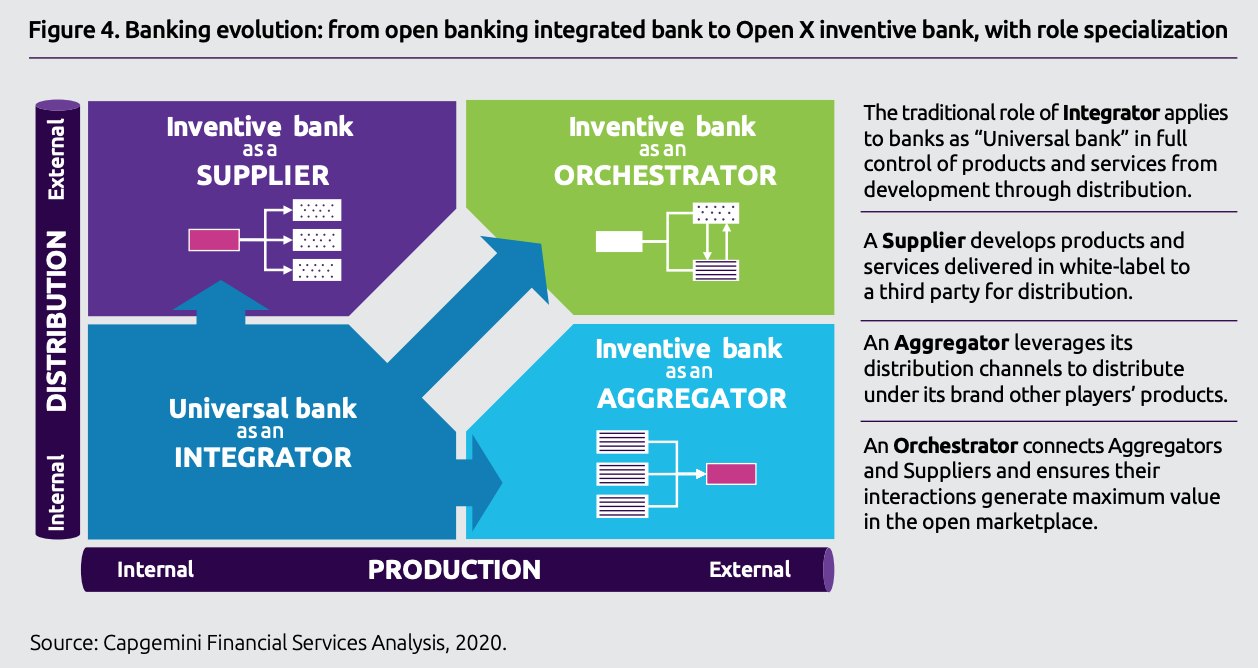

In this new ecosystem, banks must focus on what they do best and take on a specialized role, rather than a universal one, such as supplier or aggregator, the report says.

Banking evolution: from open banking integrated bank to Open X inventive bank, with role specialization, World Fintech Report 2020, Capgemini and Efma, April 2020

It notes that around the world, banks have begun adopting this strategy, citing the examples of Goldman Sachs, which has been using Amazon’s lending platform to extend loans to small and medium-sized businesses (SMEs), as well as Spanish banking group BBVA, which started exploring product sales via Amazon earlier this year.

Improving middle- and back-office operations

According to the report, one topic banks should begin prioritizing is middle- and back-end transformation. Though essential for customer satisfaction, middle- and back-office operations are often neglected, resulting in many banks failing to deliver seamless and personalized customer experiences despite substantial front-end investment, the report says.

To do this, banks must partner with fintechs and form effective, structured collaborations, it says, citing the example of Santander UK, which collaborated with several companies including Quadient, Comply Advantage, DocuSign, DueDil, TransUnion and nCino, to improve processes and optimize its end-to-end customer onboarding journey.

“Fintechs have moved from disruption to maturity to become serious, globally expanding players that are acquiring millions of customers and heading towards profitability,” the report says. “It’s time to consider them as tangible competitors or enabling partners.”