President Barack Obama will be remembered in history as the man who saved the United States from the worst financial crisis since the Depression. The 44th President of the United States left behind other legacies such as sweeping reforms to protect consumer rights, strengthen banking regulations and increase healthcare coverage among others.

While some of these progress might be reversed by his successor, one of his more neglected and enduring achievement would be to oversee the maturity of the fintech industry. In 2009, while mainstream banks (e.g. Citibank) were struggling with the crisis, online marketplaces such as Prosper and Lending Club took up the slack and provided the credit for small businesses and the average consumer.

In June 2016, the White House organized a Fintech Summit which gathered various agencies under one roof and their discussions resulted in this final report. In the final days of the Obama Administration, the White House released a final report card on its fintech achievement from a regulatory viewpoint. It also provided the framework to guide the future progression of the fintech industry.

Strong Government Support For Fintech

The United States is the top country for fintech investments in 2016 and there are various regulatory and agency support for this. One important milestone would the Open Data Initiative (ODI) authorized by President Obama in May 2013. ODI gave the private sector access to 200,000 sets of government data. This provides information for companies to build better financial products and this ties in with the Open Government Initiative to standardize financial data.

The Treasury backed the MyMoneyAppUp Challenge to encourage the public to create mobile apps that will help consumers make better financial decision. Other agencies pushed for responsible innovation and consumer friendly financial products. All these agencies are supportive of the fintech industry but they regulate with the knowledge that this industry is untested.

Fintech emerged in 2009 when the United States was at the initial stage of recovery. Interest rates were low, employment were raising and the equity markets were recovering. Can the industry survive its first major crisis? This provides a dilemma for policy makers and regulators. Regulations have to be flexible so as not to stifle this young industry and yet provide financial stability. The Treasury Department is the lead regulator in the financial industry and they are looking towards the United Kingdom and Singapore for answers.

Fintech Value Add – Increase Access To Affordable Credit

You might be surprised to learn that within the world’s sole superpower, there are 9 million households (representing 7%) without bank accounts. Another 24.4 million households have to resort to payday lenders even though they have bank accounts. In other words, they are underbanked. The White House noted that these households are the victims of predatory lending practices such as exorbitant interest rates.

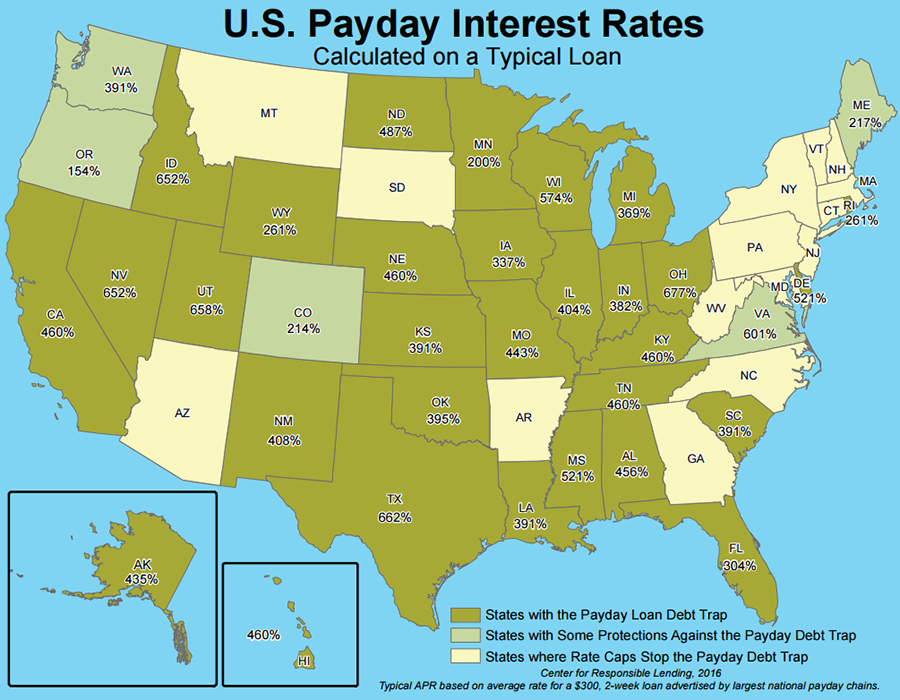

U.S. Payday Interest Rates, Source: Responsible Lending

The annual interest can range from 154% to 662% across the different US States. A US consumer protection agency noted that the average rate is 400% which is significantly higher than credit cards’ 30%. The emergence of online marketplace allowed this lenders a new source of borrowing from the crowd.

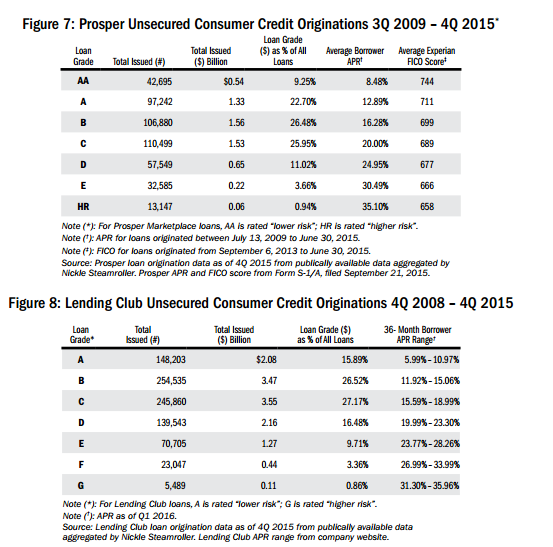

US Interest Rates, Source US Treasury

They are able to provide affordable credit where even the worst borrower don’t pay more than 36% and the good borrowers pay just 5.99% on an annualized rate. Besides lending to consumers, small businesses also find it hard to borrow money. Many US consumers use these platforms to consolidate their loans and reduce their interest rates.

Since the financial crisis, banks are still reluctant to grant small loans of $250,000 even though the situation had improved. The Obama Administration noted the importance of credit for growth. In order to aid in responsible lending, they have allowed agencies such as Social Security and IRS to provide data for financial capacity verification (e.g. Income, assets, etc). Interestingly, traditional banks are now working with online marketplace to leverage on their credit scoring algorithm.

10 Principles For Fintech

Beyond government support and policy goals, the report also list out 10 different principles to guide regulatory and policy making behaviour. The first principle is to look at building a strong financial ecosystem instead of seeing it as traditional banks fighting against fintech. One of the lessons of the crisis that products became so complicated that banks and consumers don’t know what they are creating and buying.

Regulators should make fintech safe and transparent and companies should consider the interest of consumers first when they build their products. Next, the government should harmonize standards and ensure cyber security from the beginning. More investments should be poured in to increase the efficiency of the financial infrastructure.

The report placed an emphasis on the importance of financial stability and government engagement with various industry players regardless of its size and influence. The idea is that such close engagement will allow issues to surface and reduce regulatory uncertainty. The final goal is for the fintech industry to provide more value add to consumers, businesses and the broader economy.

Conclusion

In the Global Enterprenuership Summit in 2016, President Obama linked the benefits of entrepreneurship to create jobs, increase prosperity and economic growth. Most importantly, small businesses are the engines that turn ideas into reality. Fintech can provide the credit for such small businesses and the emergence of the fintech industry under the Obama Administration is the manifestation of such entrepreneurial spirit.

The Obama Administration had gone into the history book but the fintech industry is just starting out. This legacy report aims to influence the thinking of regulators and policy maker in the new Trump Administration. The implied message is clear: the US’s leading position in fintech cannot be taken for granted.

Featured Picture via- publicdomainpictures.net