Swiss Fintech Study “Switzerland Needs to Seize the Fintech Opportunity”

by Fintechnews Switzerland November 10, 2015Swiss Fintech Study by Roland Berger: Fintech will play an important role in the financial services industry. While Switzerland’s financial center offers a promising starting point for fintech companies, the country is still well behind expectations, according to this new report.

Conducted by global consultancy firm Roland Berger and Swiss Finance Startups, the Swiss Fintech study is based on a set of experts interviews, questionnaires and analysis of global trends, and aims to identity the opportunities and challenges of the Swiss fintech ecosystem.

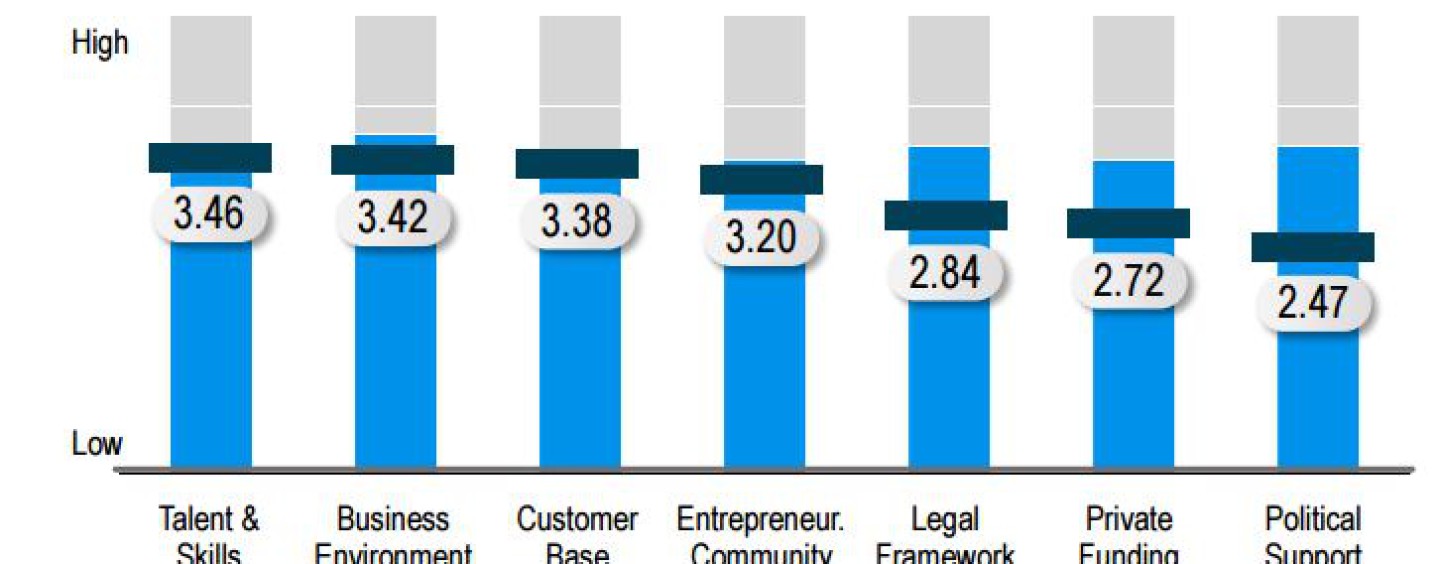

Compared to leading international fintech hubs such as London, New York or Silicon Valley, experts said that Switzerland is well ranked in terms of talent and skills, as well as customer base.

However, results show that in terms of the legal framework, private funding and political support, Switzerland is still lagging behind. Additionally, participants said that there are still limited social acceptance or encouragement of entrepreneurs in Switzerland. This in fact, has led some Swiss entrepreneurs are starting companies abroad, the document says.

Swiss fintech ecosystem

Switzerland’s fintech startup ecosystem is accelerating with more than 100 startups from a broad range of verticals. Additionally, corporate players have been launching a number of initiatives in the last months.

These initiatives include the Incubator F10 by SIX, the Future of Finance Challenge by UBS, the Impact Hub by Credit Suisse, and the Swiss Early Stage Fund by Swisscom Ventures.

Associations and incubators as well as are launching initiatives to help accelerate the local fintech startup ecosystem. For instance, the Digital Zurich 2025 has recently launched its platform aiming at building a digital hub in Zurich, and Fintech FUSION, an acceleration program, was established this year in Geneva.

Moreover, respondents said that dialogue between politicians, regulators, corporates and fintech startups has recently intensified.

Swiss Fintech: Three major opportunities

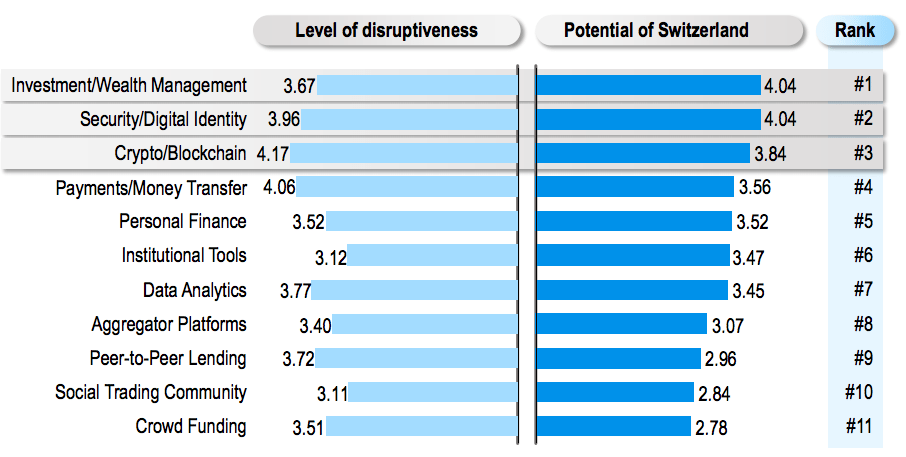

According to the survey results, wealth management, security and digital identity, and blockchain technology are the verticals that have the most potential in Switzerland; wealth management because of the existing strength of Switzerland, the report claims. It also highlights that many startups are already active in investment and wealth management, for both in B2C and B2B.

Key opportunities based on survey results – Roland Berger & Swiss Finance Startup, Swiss Fintech Study

Similarly, the security and digital identity vertical has a lot of potential as startups can leverage the existing reputation and values of Switzerland in terms of security and stability.

The cryptocurrency and blockchain vertical on the other hand, has the potential to have a big impact on the financial services industry, the study found, and startups in the space are expected to raise significant amount of funds. However, there are still a lot of questions surrounding the future of these technologies.

But in order to realize the potential of these three verticals, startups have to drive break-through innovation beyond existing strengths of Switzerland, respondents said.

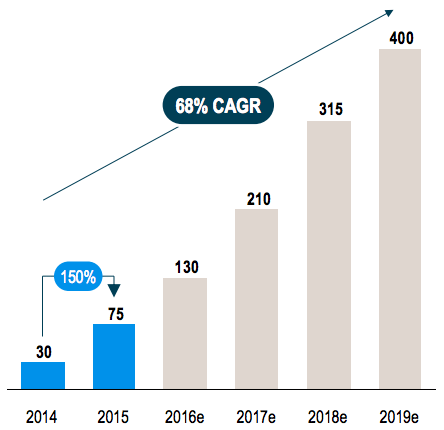

Estimated global capital market spending on blockchain technology – Swiss Fintech Report from Roland Berger & Swiss Finance Startups

Key challenges (Swiss Fintech Study)

While Switzerland has the potential to be a big player in the fintech space, there are still challenges that need to be faced.

According to the report, Switzerland has seen very few deals, and while startups need to focus more on attracting funding, corporates on the other hand need to dedicate budgets to invest into innovation.

Another key challenge is the fact that the Swiss consumer base is significantly smaller than in the US or EU countries. In fact, many Swiss startups that provide B2C products are looking to expand beyond Switzerland to larger markets such as Germany or the US.

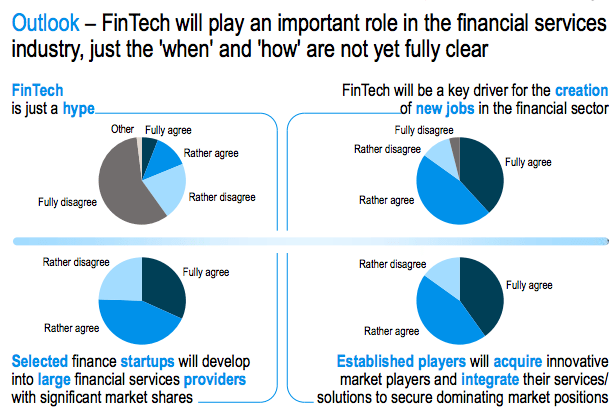

Overall, “fintech will play an important role in the financial services industry, just the ‘when’ and ‘how’ are not yet fully clear,” the Swiss Fintech Study says, and Switzerland needs to seize that opportunity.

Outlook – Swiss Fintech Study from Roland Berger & Swiss Finance Startups

Read here the full Swiss Fintech study

1 Comment so far

Jump into a conversation