Fintech Takes Second Place in Swiss Startup Funding; Secures CHF 910M in 2022

by Fintechnews Switzerland February 6, 2023In 2022, Swiss fintech companies secured a total of CHF 910 million, a figure that puts the sector at the second position in terms of startup funding raised last year, data from a new report by news portal startupticker.ch and investor association SECA show.

Fintech was overshadowed by information and community technology (ICT), a sector that saw startups secure a total of CHF 1.2 billion. The figure pushed ICT at the top of the ranking, taking the crown from fintech, the top startup sector in 2021.

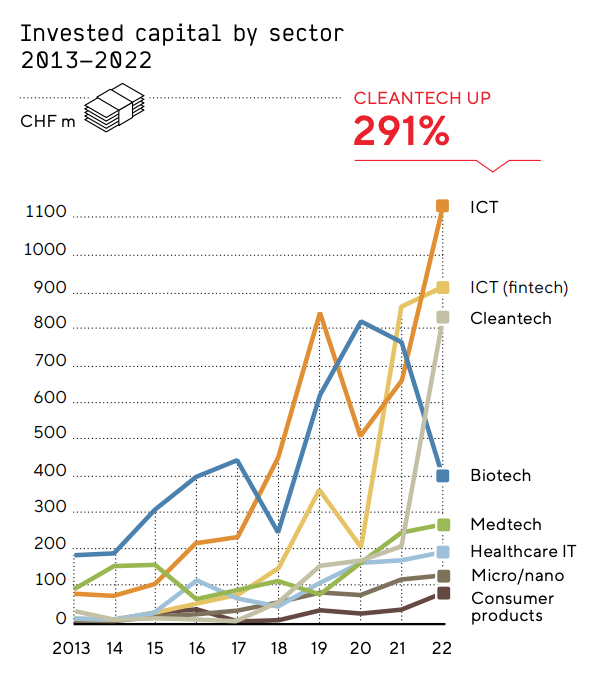

Invested capital by sector 2013-2022, Source: Swiss Venture Capital Report 2023, Startupticker.ch/SECA, Jan 2023

These figures were shared in the newly published Swiss Venture Capital Report 2023, an annual research that looks at startup funding trends and studies investor sentiment on the Swiss startup ecosystem.

Despite the ICT overtake in 2022, historical data shows that fintech funding increased in Switzerland last year, rising 6% from CHF 857.9 million in 2021. This is in contrast to what was observed globally in 2022, during which fintech startup funding slumped drastically by 46% year-on-year (YoY) as investors scaled back their investment pace amid declining public markets.

The Swiss fintech sector saw some sizeable deals in 2022, reflective of investors’ continued bullishness in the industry. Of the top 20 largest financing rounds secured in Switzerland last year, five involved fintech companies, data from the Swiss Venture Capital Report 2023 show.

Two of these rounds were mega-rounds of CHF 100 million and over: Wefox, a software-as-a-service (SaaS) platform for insurance providers and intermediaries, closed a CHF 392 million Series D in July, the largest fintech investment in the country last year; and SEBA Bank, a licensed digital asset banking platform, closed a CHF 110 million Series C in January.

Wefox, which is present in countries including Germany, Switzerland and Poland, plans to expand in the Netherlands. The round brought the startup’s total funding to more than US$1.3 billion and pushed its valuation to US$4.5 billion.

Similarly, SEBA Bank, which provides fiat and digital asset payments, transfers, and card services, said it would use the proceeds to expand into new markets and solidify its presence in key markets including Hong Kong, Singapore, and the Middle East. SEBA Bank has secured about US$240 million in funding, data from CB Insights and Dealroom show.

Other fintech deals in the top 20 list include Sygnum, another regulated digital asset bank which closed a CHF 82.4 million Series B in January at a US$800 million valuation; Yokoy Group, a spend management platform for businesses which raised CHF 74.90 million in March, bringing its total funding to over US$107 million; and Portofino Technologies, a company that builds high-frequency trading grade technology for digital assets which secured CHF 48.2 million in September.

Fighting the odds: Swiss startup funding reaches new record

Against the odds, Swiss startup funding reached a new high in 2022, totaling nearly CHF 4 billion in funding secured in 383 deals. The figures represent a YoY increase of 29.7% in funding and 7.9% in deal count.

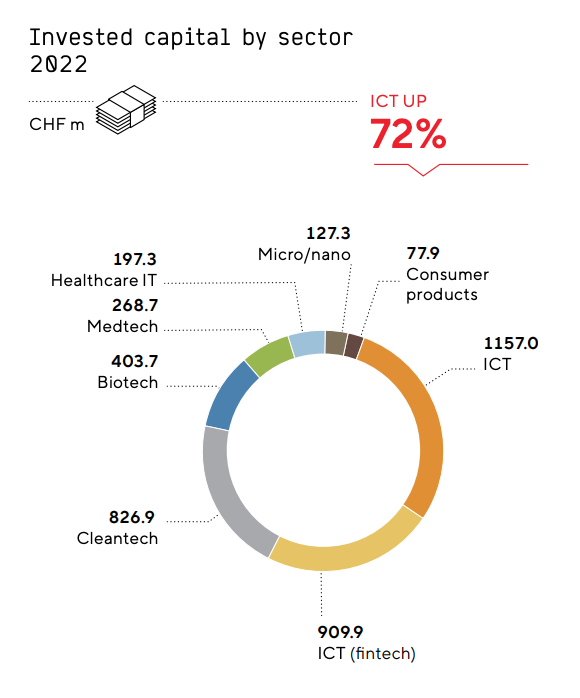

ICT was among the winners in 2022, with startups in the space attracting over 70% more capital than in 2021 and total funding exceeding the CHF 1 billion mark for the first time. Valuations of startup companies also reached new dimensions for Switzerland, with SonarSource reaching CHF 4.6 billion.

Cleantech is another sector that witnessed strong traction in 2022, raising a total of CHF 826.9 million, thanks to a massive mega-round of CHF 600 million secured by Climeworks. The sum represents a near fourfold increase compared with the previous year. 45 cleantech deals were closed in 2022, representing a 32.3% increase from 2021.

At the other end of the spectrum, biotech funding dipped significantly in 2022, with the amount invested in the sector falling by 47.4% to CHF 400 million in 2022, and the number of rounds decreasing by 48.7%.

Invested capital by sector 2022, Source: Swiss Venture Capital Report 2023, Startupticker.ch/SECA, Jan 2023

Looking at investment stages, data show that seed rounds continued their strong growth trend in 2022, increasing by 27% in number to 166 transactions. For the first time, seed rounds made up for most of financing rounds, accounting for 43% of all startup deals in 2022.

Later stage rounds also grew in number, rising 12% YoY from 78 in 2021 to 87 in 2022. That increase was most noticeable in cleantech and consumer products startups, data show.

2022 also witnessed an increase in the number of growth financing rounds of between CHF 10 million and CHF 20 million. The number of these deals increased from 19 in 2021 to 28 in 2022, representing a 47% growth. This trend showcases the maturing of the Swiss startup ecosystem where more established players are now securing capital to fuel their growth, scale and expand overseas.