Swiss Fintechs Raised US$530M in 2021, More Than Double 2020’s Total

by Fintechnews Switzerland January 31, 2022In 2021, Swiss fintech funding activity regained some of its strengthen after underperforming for three years in a row.

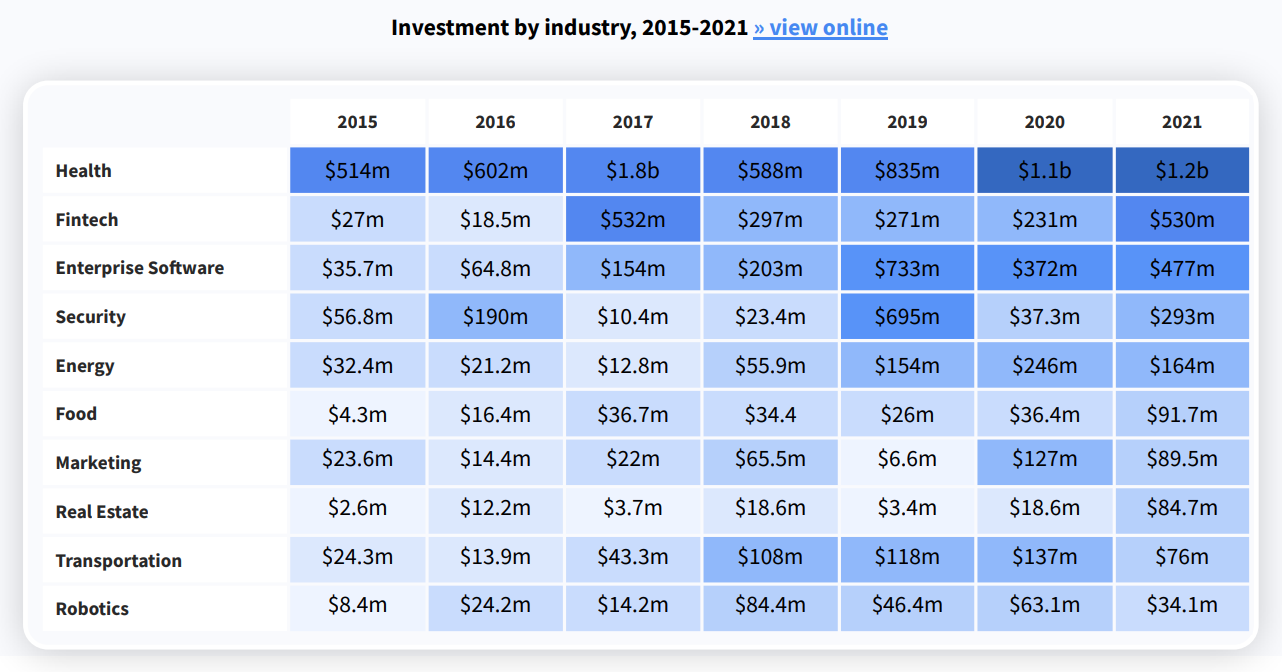

Data from Dealroom show that Swiss fintech companies raised a total of US$530 million, up 129% from 2020. The surge followed a period of stagnation during which annual fintech funding hovered in the US$200 million – US$300 million range, after peaking in 2017 at US$532 million.

Investment by industry in Switzerland, 2015 – 2021, Source: Dealroom.co

The COVID-19 pandemic took a toll on fintech funding not just in Switzerland but globally. The downtrend started in late-2019 and continued on throughout 2020. But in 2021, the tables turned as established fintech firms completed large funding rounds.

In Switzerland, Komgo, which provides a platform that digitalizes trade finance, raised CHF 26 million in May 2021, Numbrs, a personal finance app, closed a CHF 27 million funding round in January, Yokoy, a spend management firm, raised US$26 million in October, and ZoodPay, a buy now, pay later (BNPL) completed a US$38 million Series B fundraising in November.

The momentum continued on this year with crypto banks in particular closing mega-rounds: SEBA Bank just recently secured a CHF 110 million Series C funding round, and Sygnum closed a US$90 million round.

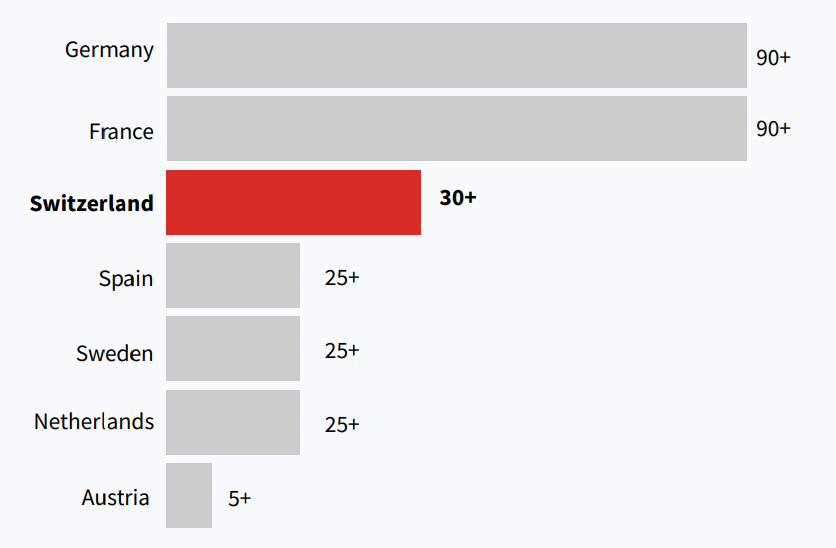

With a valuation of US$800 million for Sygnum and between US$474 million and US$712 million for SEBA Bank, according to Dealroom, these two companies are amongst Switzerland’s 30+ potential future unicorns, a number that makes Switzerland one of the largest pools of potential future successes in Europe.

Future unicorns in Europe, Source: Dealroom.co

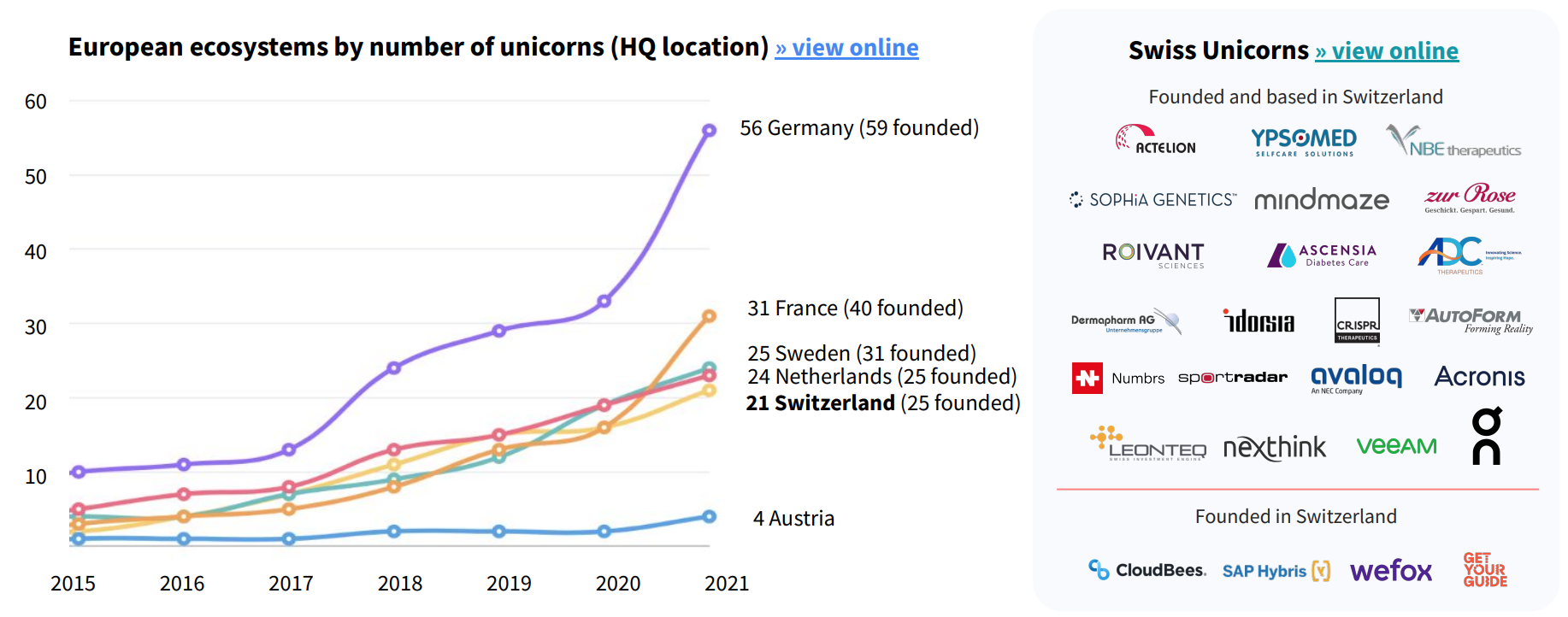

Despite Switzerland being a relatively small country with a population of just 8.6 million, the nation is currently home to 21 homegrown unicorns, making it one of the top hubs in Europe, behind only Germany (59), France (31), Sweden (25) and the Netherlands (24), according to Dealroom.

European ecosystems by number of unicorns (HQ location), Source: Dealroom.co

2021 fintech funding trends

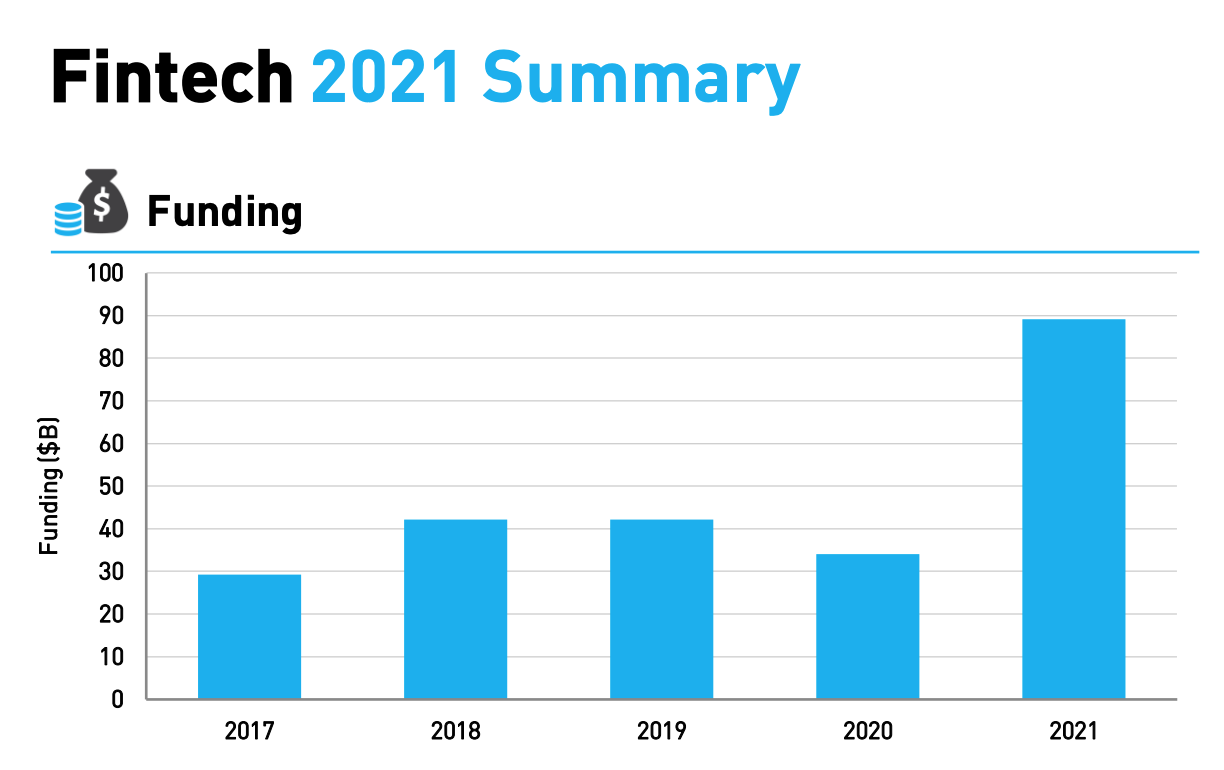

The surge in fintech funding in Switzerland is reflective of global trends observed in 2021. A new report by Venture Scanner, which looks at venture capital (VC) activity globally in 2021, shows that fintech funding more than doubled from the previous record, closing the year at US$89 billion.

The three largest funding rounds completed in 2021 went towards Swedish BNPL leader Klarna (US$1 billion), German digital bank N26 (US$900 million), and German neobroker Trade Republic (US$900 million).

Fintech funding in 2021, Source: Venture Scanner, Dec 2021

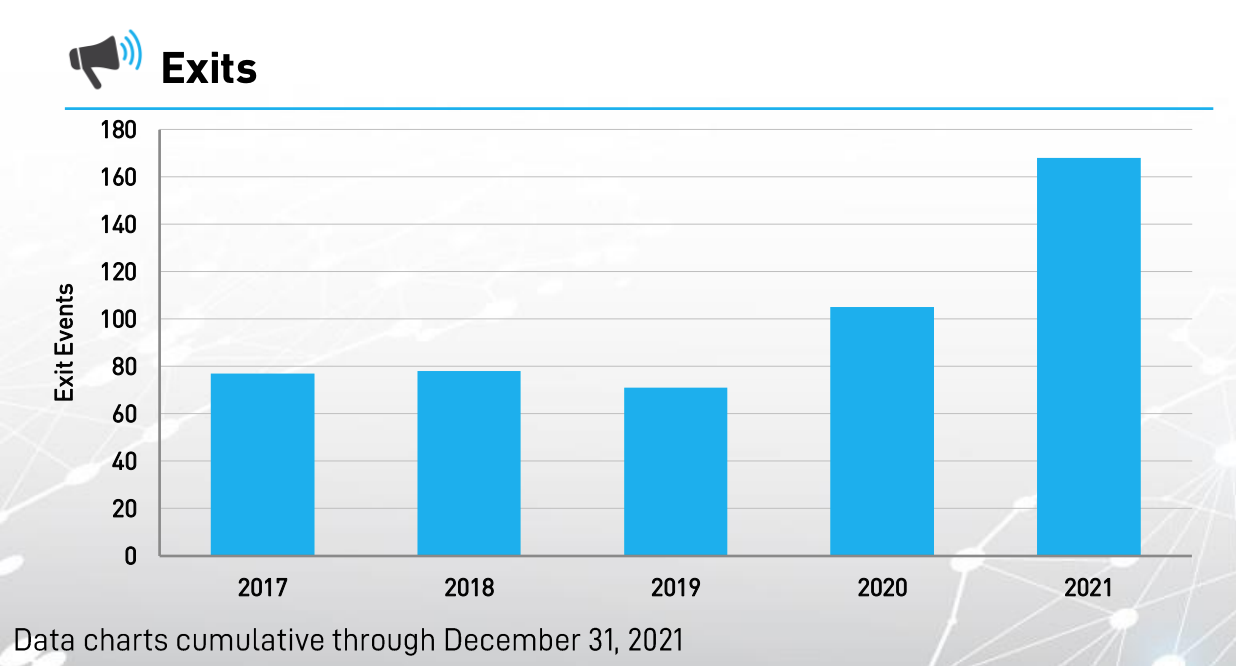

Fintech exits also reached a new high, with 168 transactions in 2021, against a little over 100 deals in 2020 and just about 70 in 2019.

Notable initial public offerings (IPOs) in 2021 included payment processing company Marqeta, stock trading platform Robinhood, and cryptocurrency exchange Coinbase.

UK cross-border transfer specialist Wise, formerly TransferWise, listed in London via a direct listing, while companies including SoFi, an online personal finance company, Payoneer, a digital payment company, and Dave, a banking app, started trading last year after merging with special purpose acquisition companies (SPACs).

Fintech exits in 2021, Source: Venture Scanner, Dec 2021

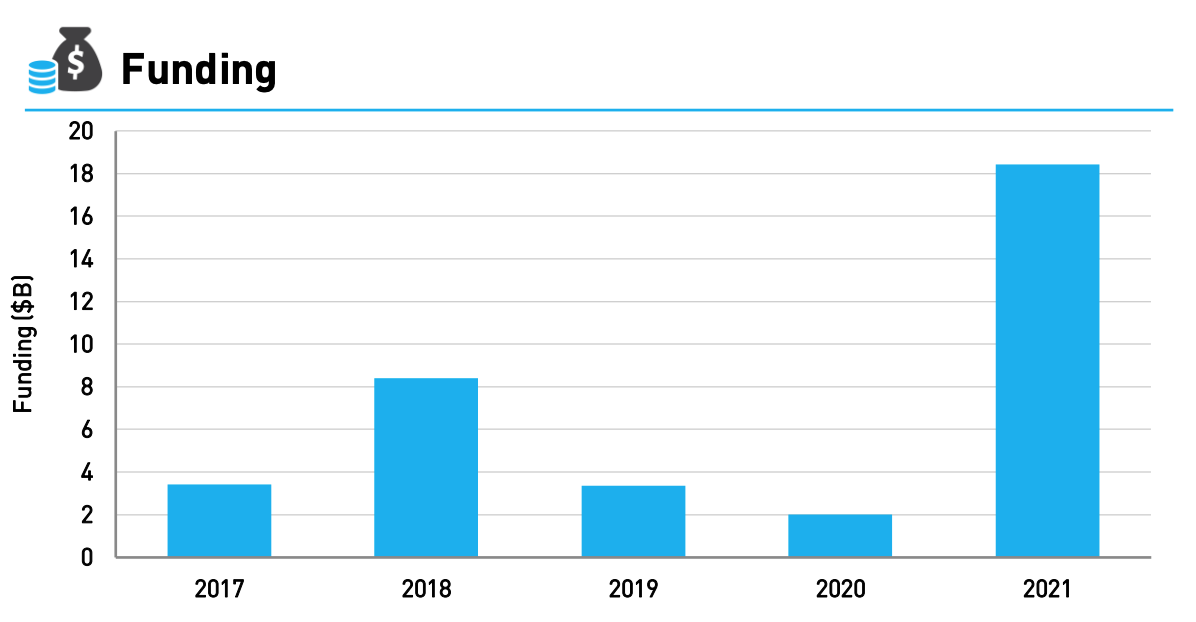

Insurtech, regtech and blockchain are other tech markets that saw soaring funding activity in 2021.

Annual funding into blockchain companies recorded staggering growth, closing at US$18 billion and surpassing the total raised between 2017 and 2020. The top three funding events last year included Nydig’s US$1 billion round, FTX’s US$900 million round and Forte’s US$725 million.

Blockchain funding in 2021, Source: Venture Scanner, Dec 2021

Insurtech companies raised a total of US$20 billion, nearly tripling from the previous annual high, while regtech funding nearly doubled, reaching US$11 billion.