In 2021, Swiss fintech funding activity regained some of its strengthen with companies in the space raising a total of US$530 million, data from Dealroom show.

The sum represents a 129% increase from 2020, and follows a three-year period of stagnation during which annual fintech funding hovered in the US$200 million – US$300 million range, after peaking in 2017 at US$532 million.

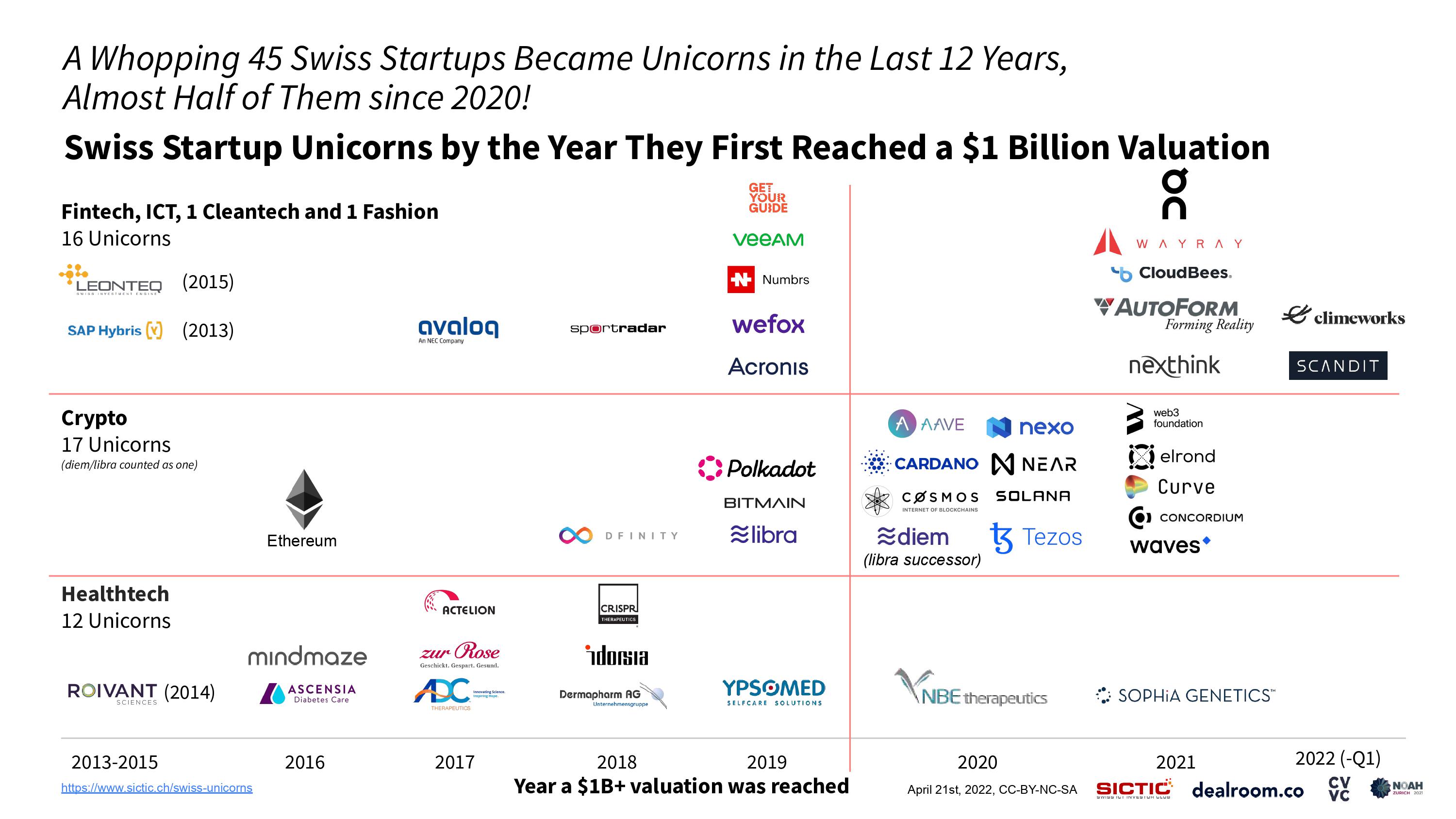

Despite the dip, fintech funding activity has remained somewhat consistent throughout the years and has helped push startups’ valuations further up. A new analysis by the Swiss ICT Investor Club (SICTIC) found that since 2013, a total of 45 unicorns with Swiss origins have been minted, with half of them reaching the coveted status in the past three years.

45 Swiss-native unicorns have been minted since 2013, Source: The Swiss ICT Investor Club (SICTIC), April 2022

Of these 45 companies, nine are fintech startups and fintech-focused blockchain projects (excluding Ethereum and Near) that cover a broad range of subsegments including digital assets, investment, insurtech and lending.

These nine Swiss-native fintech unicorns are:

Curve (reached unicorn startup in 2021)

Founded in 2019, Curve is an exchange liquidity pool on Ethereum designed for extremely efficient stablecoin trading, and low risk, supplemental fee income for liquidity providers, without an opportunity cost.

Curve allows users (and smart contracts like 1inch, Paraswap, Totle and Dex.ag) to trade between DAI and USDC with a bespoke low slippage, low fee algorithm designed specifically for stablecoins and earn fees.

Waves (2021)

Launched in 2016, Waves is a global open source platform designed to enable users to create and launch custom crypto tokens.

Waves allows for the creation and trade of tokens without the need for extensive smart contract programming. Rather, tokens can be created and managed via scripts that run in user accounts on the Waves blockchain.

The enterprise-ready platform emphasizes on security, easy digital asset operations (including creation, transfer, exchange) and straightforward user experience.

Nexo (2020)

Launched in 2019, Nexo claims to be one of the world’s leading regulated institution for digital assets. Nexo’s mission is to maximize the value and utility of cryptocurrencies by offering tax-efficient instant crypto credit lines, a high-yield earn crypto interest product, send and pay capabilities, and sophisticated trading and over the counter (OTC) services, all the while providing the top-tier custodial insurance and military-grade security of the Nexo Wallet.

Nexo claims it manages assets for over 4 million users across 200+ jurisdictions and has processed over US$80 billion in transactions since its launch.

Tezos (2020)

Tezos is an open source blockchain protocol for assets and applications backed by a global community of validators, researchers, and builders. Tezos was built to facilitate formal verification, a technique that boosts the security of the most sensitive or financially weighted smart contracts by mathematically proving the correctness of the code governing transactions.

The non-profit Tezos Foundation, based in Zug, Switzerland, was created in 2017 to support the project and raised US$232 million in bitcoin and ether in one of the biggest initial coin offerings (ICOs) at the time.

Aave (2020)

Aave is a decentralized, open-source, and non-custodial liquidity protocol on the Ethereum blockchain. Depositors earn interest by providing liquidity to liquidity pools, while borrowers can obtain liquidity by tapping into these pools with variable and stable interest rate options.

The Aave protocol is unique in that it tokenizes deposits as aTokens, which accrue interest in real time. It also features access to flash loans and credit delegation as uncollateralized borrowing options.

Numbrs (2019)

Numbrs started off in 2013 as an account aggregation app but pivoted earlier this year to become a bitcoin storage vault and wallet, and moved its headquarters from Zurich to Crypto Valley Zug.

The company now provides the Numbrs Bitcoin Account, an institutional grade self-custody solution to store Bitcoin in a high security military bunker. The solution comes with transfer and payment capabilities, 24/7 service, as well as cutting edge research and data-driven analysis.

Wefox (2019)

Founded in November 2014 in Switzerland as FinanceFox, Wefox is a full-stack digital insurance company that aims to disrupt the insurance business through the deployment of technology.

With Wefox, brokers can conclude paperless insurance policies for their clients within a few minutes. Claims are filed digitally and settled on the same day in over 60 percent of cases. Policies are available in Germany, Italy, Poland, and Switzerland.

Avaloq (2017)

Founded in 1985, Avaloq is a provider of core banking software and a global leader in digital banking solutions, serves more than 150 customers in 30 countries worldwide. Avaloq’s key business activities include the provision of software as a service (SaaS) and business process as a service (BPaaS) for wealth management and other applications.

Headquartered in Switzerland, Avaloq has more than 2,000 employees and has a presence in the world’s most demanding financial and innovation centers, including Berlin, Frankfurt, Hong Kong, London, Luxembourg, Madrid, Paris, Singapore, Sydney and Pune. In 2020, the company was acquired by Japan-based NEC Corporation for CHF 2.05 billion.

Leonteq (2015)

Founded in 2007, Leonteq is a Swiss fintech company with a leading marketplace for structured investment solutions. Based on proprietary modern technology, the company offers derivative investment products and services and predominantly covers the capital protection, yield enhancement and participation product classes.

Leonteq acts as both a direct issuer of its own products and as a partner to other financial institutions. The company further enables life insurance companies and banks to produce capital-efficient, unit-linked pension products with guarantees.

Leonteq has offices and subsidiaries in 13 countries, through which it serves over 50 markets. Leonteq is listed on the SIX Swiss Exchange.

Featured image credit: Edited from Unsplash