The Most Well-Funded Fintech Startup in Each Country in Europe

by Fintechnews Switzerland February 3, 2021In Europe, fintech is the largest investment category, receiving more than EUR 30 billions of venture capital (VC) investment since 2014, ahead of health (EUR 29B), enterprise software (EUR 27B) and transportation (EUR 12B), data from Dealroom show.

An analysis by Tech.eu and Finstar suggests that the region’s fintech industry has been maturing quickly over the past years, with deal sizes significantly growing, and early-stage rounds becoming fewer. Between 2018 and 2019, the size of financing rounds for fintech companies more than doubled from EUR 11 million to EUR 25.5 million. In the same timeframe, the number of EUR 100 million+ fintech financing deals in Europe increased by 5X.

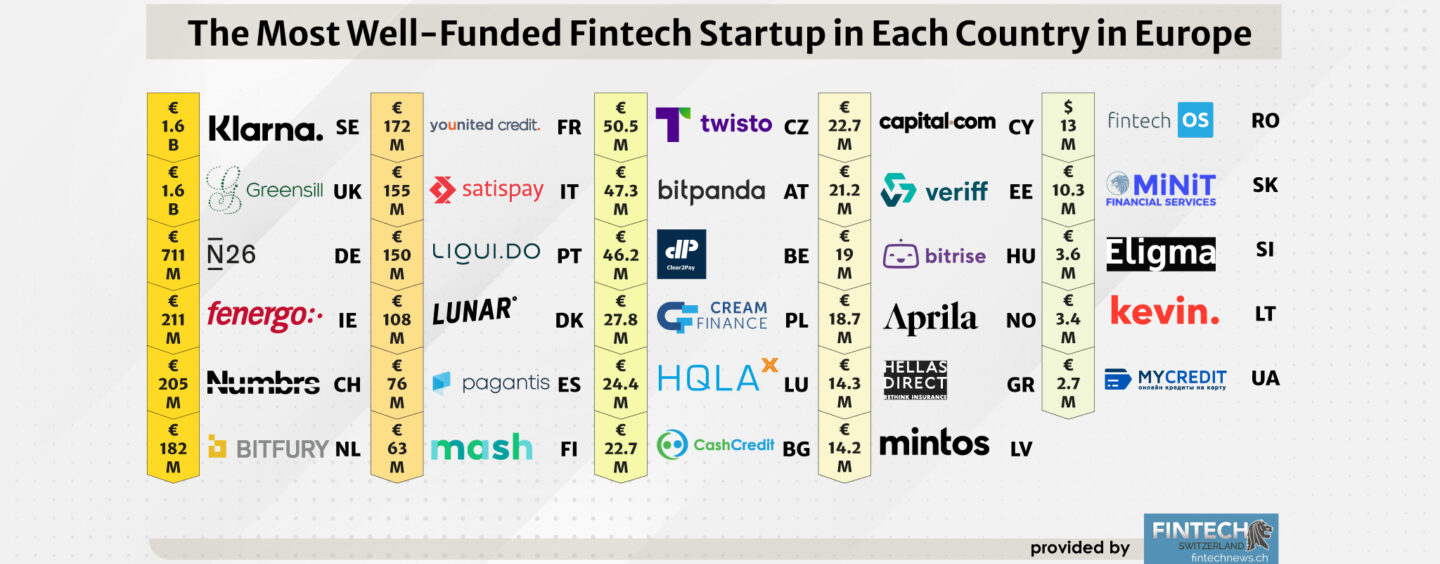

Fintech is such a hot segment in Europe’s startup scene that for countries including Sweden, Italy, Romania, Cyprus, Latvia and Slovenia, the most well-funded tech startup is actually a fintech, CB Insights data show.

In Sweden, the top-funded tech startup is Klarna, a company that offers a “buy now, pay later” e-commerce solution. In Italy, it’s Satispay, a smart payment platform; in Latvia, it’s peer-to-peer lending marketplace Mintos; in Slovenia, it’s blockchain-based payment network Eligma; in Cyprus, it’s trading app Capital.com; and in Romania, it’s FintechOS, the provider of digital banking and insurance solutions.

To get a sense of the region’s fintech leaders, we used data from CB Insights, Sifted, Tech.eu, Finstar, Raiffeisen Bank International, Statista, Dealroom and Crunchbase, to identity the rest of Europe’s most well-funded fintech companies. For each country in the region, we identified the fintech that raised the most funding. For some nations, including Albania, Croatia, and Malta, we weren’t able to identify the top-funded fintech company due to lack of available data.

The most well-funded fintech startup in each country in Europe are:

Sweden: Klarna (EUR1.6B)

UK: Greensill (EUR 1.6B)

Germany: N26 (EUR 711 million)

Ireland: Fenergo (EUR 211M)

Switzerland: Numbrs (EUR 205M)

Netherlands: BitFury Group (EUR 182M)

France: Younited Credit (EUR 172M)

Italy: Satispay (EUR 155M)

Portugal: Liqui.do (EUR 150M)

Denmark: Lunar (EUR 108M)

Spain: Pagantis (EUR 76M)

Finland: Mash (EUR 63M)

Czech Republic: Twisto (EUR 50.5M)

Austria: Bitpanda (EUR 47.3M)

Belgium: Clear2Pay (EUR 46.2M)

Poland: Creamfinance (EUR 27.8M)

Luxembourg: HQLAx (EUR 24.4M)

Bulgaria: Cash Credit (EUR 22.7M)

Cyprus: Capital.com (EUR 22.7M)

Estonia: Veriff (EUR 21.2M)

Hungary: Bitrise (EUR 19M)

Norway: Aprila (EUR 18.7M)

Greece: Hellas Direct (EUR 14.3M)

Latvia: Mintos (EUR 14.2M)

Romania: FintechOS (US$13M)

Slovakia: Minit (EUR 10.3M)

Slovenia: Eligma (EUR 3.6M)

Lithuania: Kevin. (EUR 3.4M)

Ukraine: MyCredit (EUR 2.7M)