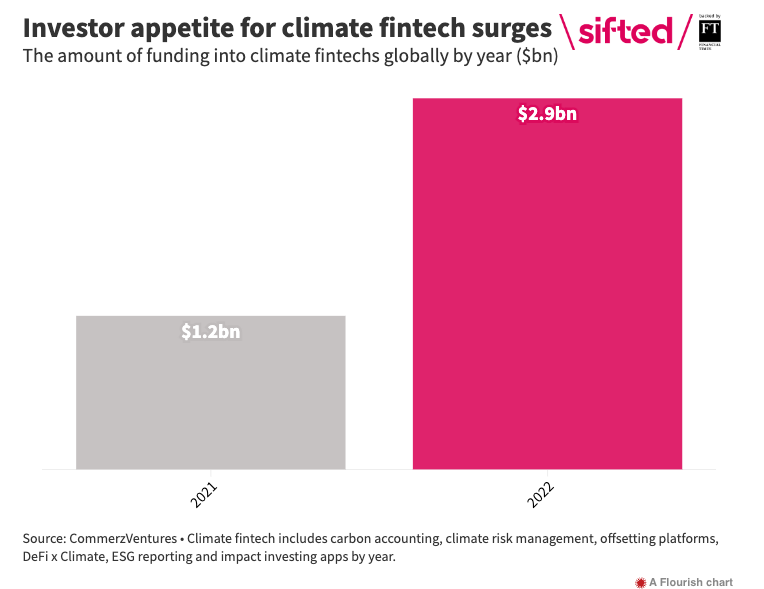

Global Climate Fintech Funding More Than Doubled to US$2.9B in 2022

by Fintechnews Switzerland February 3, 2023In 2022, funding to climate fintech companies reached a new high, totaling US$2.9 billion in venture capital (VC) raised by companies in the sector, new data from CommerzVentures, the corporate venture capital (CVC) arm of Commerzbank in Germany, show. The sum represents more than double what was secured in 2021 (US$1.2 billion) and showcases accelerating investor appetite for the nascent sector.

Often referred to as green fintech, climate fintech is a relatively new ecosystem of fintech startups that aims to facilitate climate action and drive decarbonization. These companies operate in several segments from carbon accounting software, carbon management platforms and environmental, social and governance (ESG) standards reporting, to impact investing and climate risk management and insurance.

Looking at regional trends, data show that Europe maintained its leadership position in 2022 with startups in the space bringing in 1.4 times more funding than their US counterparts.

Across the continent, France took the lead by securing a total of US$770 million. Much of that sum came from EcoVadis’ US$500 million fundraise closed in June 2022.

Founded in 2017 and headquartered in Paris, EcoVadis is a provider of business sustainability ratings, intelligence and collaborative performance improvement tools for global supply chains. The company’s sustainability scorecards and carbon action solutions give businesses detailed insights into environmental, social and ethical risks across 200+ purchasing categories and 175+ countries, allowing organizations to monitor and improve the sustainability performance of their business and trading partners.

EcoVadis claims more than 100,000 business collaborators, among which Amazon, Johnson & Johnson, L’Oréal, Unilever, LVMH, Salesforce, Bridgestone, BASF and JPMorgan.

After France, the UK ranked second, securing a total of US$562 million. The UK is followed by Iceland with US$117 million, Germany with US$109 million and Switzerland with US$84 million.

Looking at funding trends, data from CommerzVentures show that carbon accounting is the most funded climate fintech subsector, having raised a total of US$970 million in 2022.

Carbon accounting refers to tools and solutions that measure and track how much greenhouse gas an organization emits.

Europe’s most well-funded carbon accounting startup is Sweep, a French company founded in 2020 which helps businesses track and act on their carbon emissions. Sweep has secured a total of US$100 million in funding, its latest round being a US$73 million Series B closed in April 2022.

After carbon accounting, carbon offsetting ranked as the second largest climate fintech subsector, raising a total of US$505 million in 2022. The sum represents three times what companies in the subsector secured the year prior, making carbon offsetting the fastest growing climate fintech category.

Carbon offsetting solutions allow organizations to invest in environmental projects around the world in order to balance out their own carbon footprints. These solutions are particularly relevant for industries struggling to lower emissions directly, such as automotive, oil and gas, and aviation.

In Europe, the most well-funded carbon offsetting startup is BeZero Carbon, a London-based carbon ratings agency which has raised US$50 million in funding so far.

A positive outlook for 2023

Paul Morgenthaler, managing partner at CommerzVentures, told Sifted in a recent interview that although carbon accounting and carbon offsetting remained the climate fintech sector’s favored categories last year, new subsectors like biodiversity and natural capital are emerging and gaining traction.

These companies are tackling the “biodiversity crisis” and are introducing “new approaches for investing in natural capital and preserving biodiversity,” similarly to what startups in the carbon offsetting space have been doing with carbon credits. Companies in this space include Natural Metrics, a developer of molecular methods for biodiversity monitoring, and Cecil, a company that provides a platform for natural asset management.

Nevertheless, Morgenthaler expects the whole climate fintech sector to perform well in 2023, a sentiment that was echoed by Nick Sando, principal at UK-based Octopus Ventures, who told Sifted in a separate statement that the upcoming Fit for 55 package in the European Union (EU) will most likely pave the way for “exciting opportunities in the fintech investment space.”

Fit for 55 is a package by the EU designed to reduce the bloc’s greenhouse gas emissions by 55% by 2030. In December 2022, the Council reached agreement on the proposal.

CommerzVentures, a German VC firm founded in 2014, is a specialist fintech investor with EUR 550 million under management. The firm backs early and growth-stage companies in the fintech and insurtech sectors, as well as the emerging climate fintech space in which it claims to be Europe’s largest investor.

CommerzVentures has led investments with ventures like ClimateView, a Swedish climate tech company that helps cities transition to zero carbon, and Doconomy, a provider of applied impact solutions serving banks, brands and consumers from Sweden as well.

The firm closed its third fund in March 2022, amassing a total of EUR 300 million.