EU Consumers Uncomfortable Sharing their Data, Finds New Open Banking Survey

by Fintechnews Switzerland December 14, 2020European consumers still have reservations about open banking offerings despite the entry into force of the Revised Payment Services Directive (PSD2) and efforts from governments to promote fintech and open banking, according to a new survey by PwC’s Strategy&.

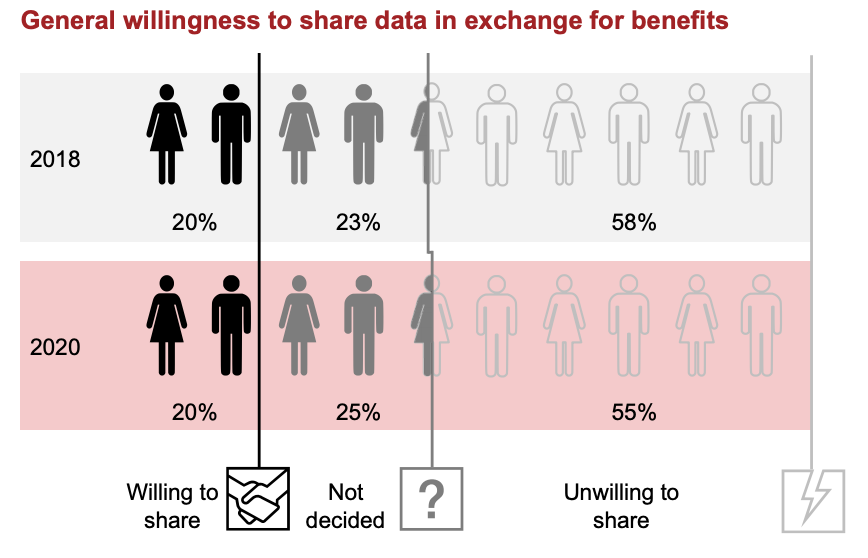

The study, conducted earlier this year in Europe, found that only 20% of the 3,500 respondents who took part in the survey are willing to share their financial data with banks or third-party providers. This figure draws a rather unchanged picture in consumers’ willingness to share their data since 2018.

General willingness to share data in exchange for benefits, Source: Strategy& Payments Survey 2020, Strategy& Payments Survey 2018 (10 countries)

However, a breakdown by country shows a significant increase in willingness coming from German and Swiss consumers, while a decrease was reported in Spain and the Netherlands.

Overall, consumers’ sentiment varies drastically between countries. In Switzerland and Poland, about 30% of consumers are willing to share their data, a figure that drops to less than 13% for those in Spain and France.

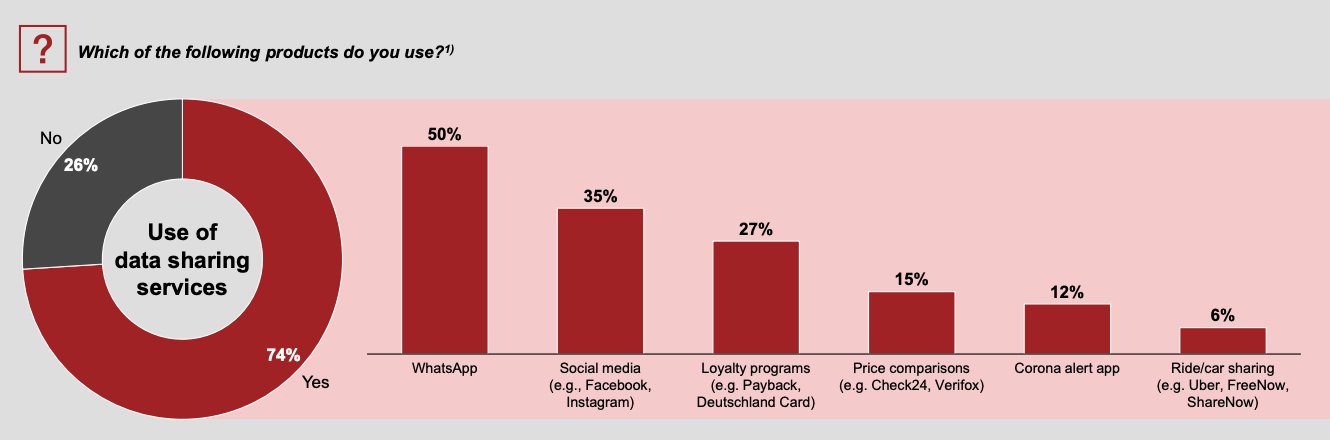

Looking more broadly at European consumers’ data sharing activities, findings suggest that a wider reach in the banking sector is possible. Across the region, 74% of consumers already use data sharing services, whether that’s WhatsApp (50%), social media platforms (35%), loyalty programs (27%) or price comparison platforms (15%).

Use of data sharing services, Source: Strategy& Payments Survey 2020

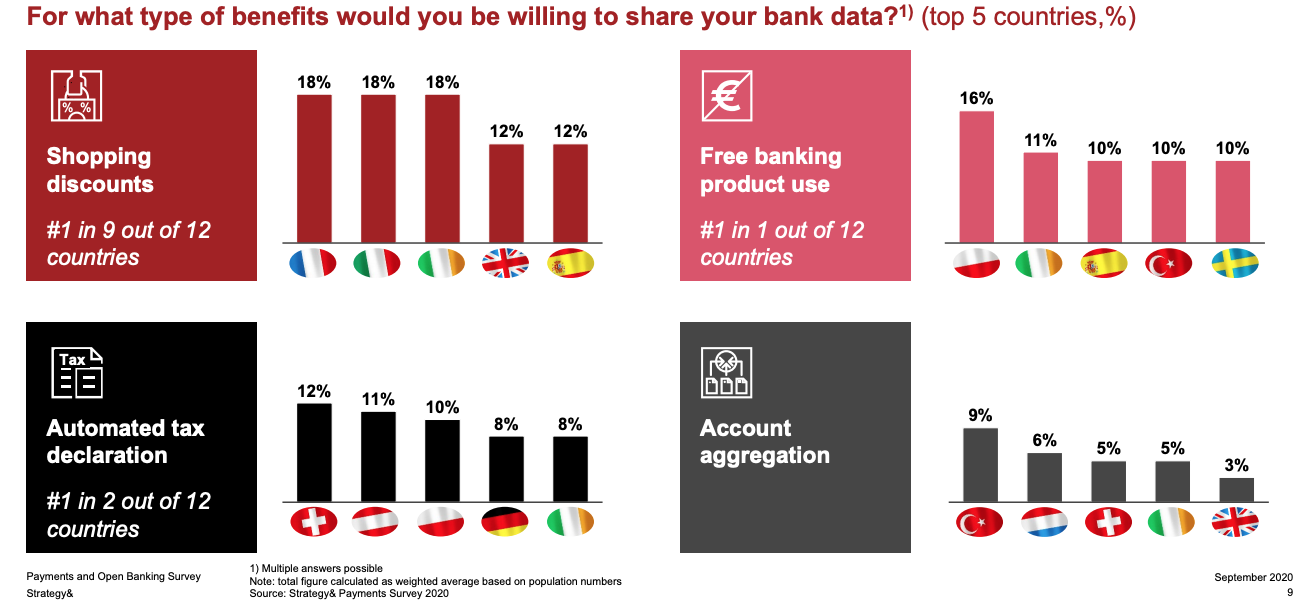

When asked about incentive programs and benefits that would persuade them to share their bank data, European consumers cited purchase discounts, free use of banking services, and automated tax returns as the most attractive benefits.

For what type of benefits would you be willing to share your bank data?, Source: Strategy& Payments Survey 2020

Declining use of cash in Europe

In addition to assessing consumers’ willingness to share their data and potentially adopt open banking products, the Strategy& study also looks at the payment behaviors in Europe.

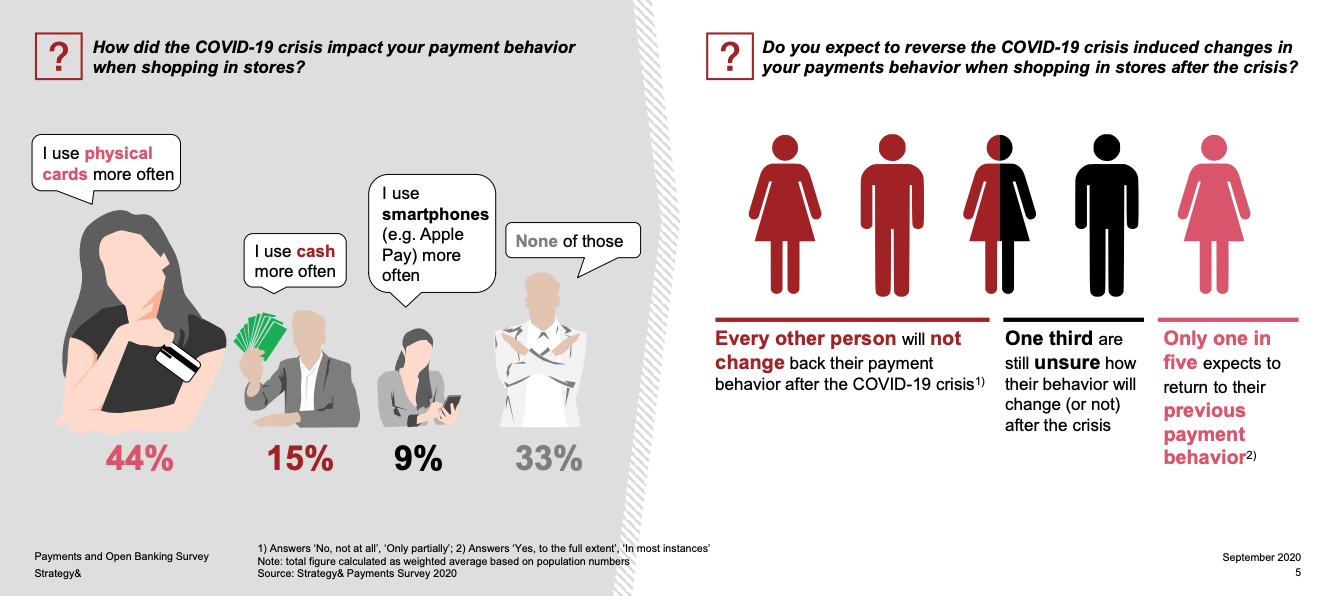

The research found that usage de cash has been declining for years but COVID-19 has accelerated that trend. 44% of consumers said they use physical cards more often now with the pandemic, and 9% said they use smartphones and mobile wallets more. Every other person indicated that they will not change back their payment behavior after the crisis, showcasing a long-lasting impact of COVID-19 on consumer behavior.

Long lasting impact of COVID-19 on payment behavior, Source: Strategy& Payments Survey 2020

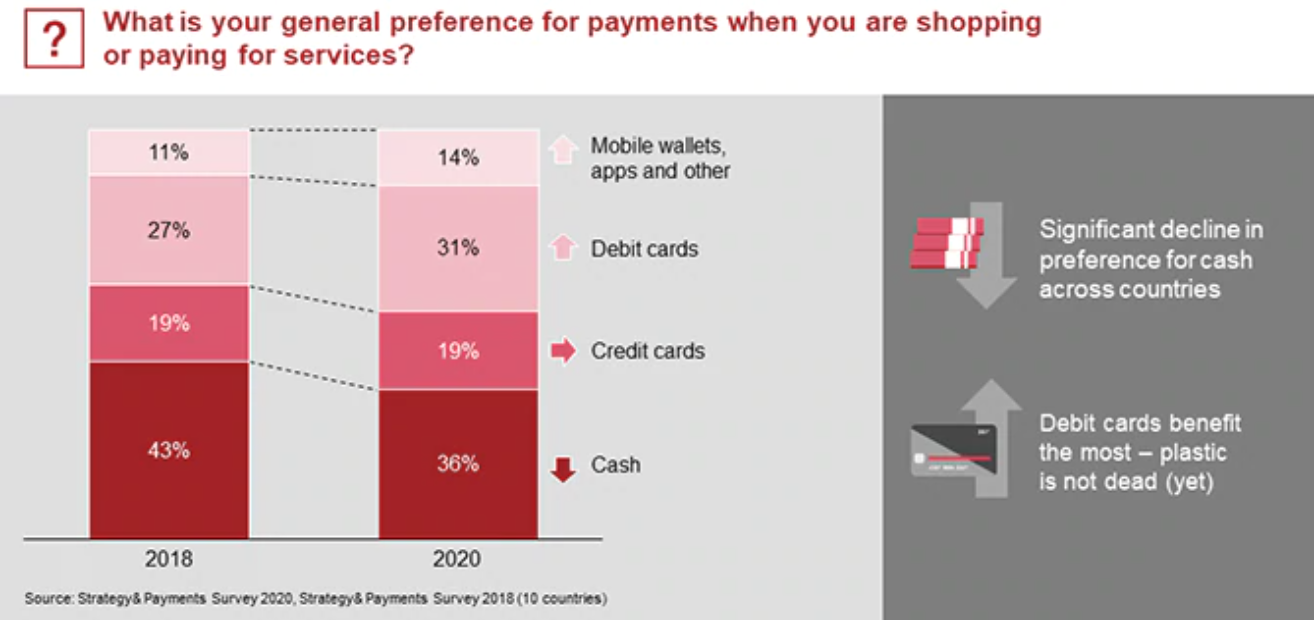

Preference for cash declined in 2020, dropping from 43% in 2018 to 36% this year, while preference for mobile wallets and apps rose from 11% to 14%. But it is debit cards that saw the highest jump, growing from 27% in 2018 to 31% in 2020.

What is your general preference for payments when you are shopping or paying for services? Source: Strategy& Payments Survey 2020, Strategy& Payments Survey 2018 (10 countries)

Europe welcomes new data regulation

The European Union (EU) has been working towards establishing a favorable regulatory landscape to support emerging technologies including artificial intelligence (AI).

In February, the European Commission (EC) announced its data strategy, which aims to make the EU “a leader in a data-driven society.” Last month, lawmakers introduced a major legislative proposal on data governance that seeks to facilitate data sharing across the EU and between sectors.

Data sharing and reuse could generate EUR 1.3 trillion in increased productivity in manufacturing through Internet-of-Things data by 2027, the EC says. In the EU health sector, digital solutions could help the public sector save up to EUR 120 billion per year.

Data Governance Act, Source: European Commission, Nov 2020

Featured image credit: Pexels