Open banking has grown to become a global phenomenon and while pioneers like the UK and the European Union (EU) have turned to regulatory action to support the industry’s transition into this new era of banking, legislators in Switzerland has reacted more cautiously so far.

The Swiss Bankers Association (SBA) has already rejected the proposal for an interpretation of PSD2, the EU’s second payment services directive, to be adapted to the Swiss market and have instead let the market decide how the topic should be tackled.

Trade group associations have shared their views on that matter. The Swiss Finance Startups (SFS) association has proposed setting up a wide-ranging association dedicated to developing a viable and flexible Swiss Open Banking solution through self-regulation, while Swiss Fintech Innovations (SFTI) has argued that self-regulation could not function without a legal basis.

Overall, all the main stakeholders seem to agree on the fact that open banking can only function and grow sustainably on the basis of common standards.

Establishing Swiss open banking standards

Over the past couple of years, numerous initiatives led by organizations including SIX Swiss Exchange, Swisscom and SFTI have emerged to develop standards designed to make it easier for banks and third-party providers to enter open banking.

These initiatives are developing standardized interface solutions through which banks, fintechs and other third-party providers can exchange customer and account data in a structured manner on behalf of the respective customer.

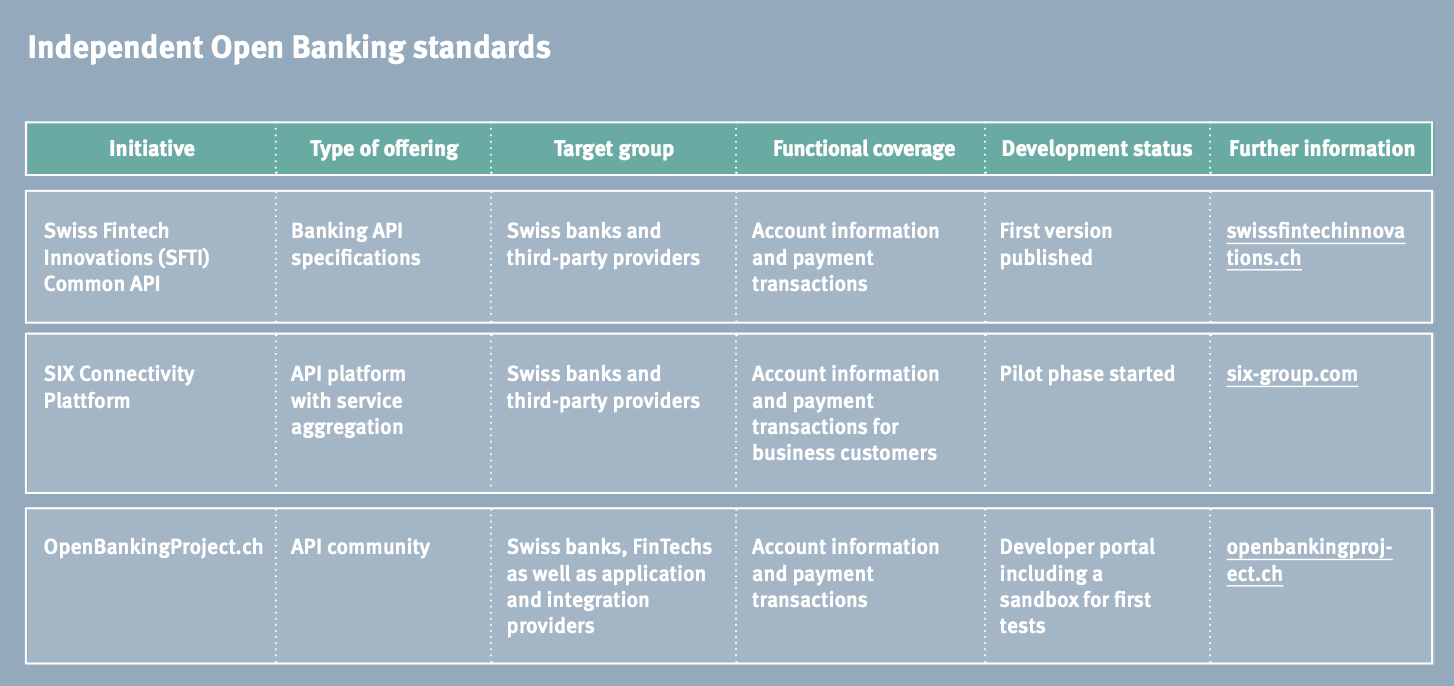

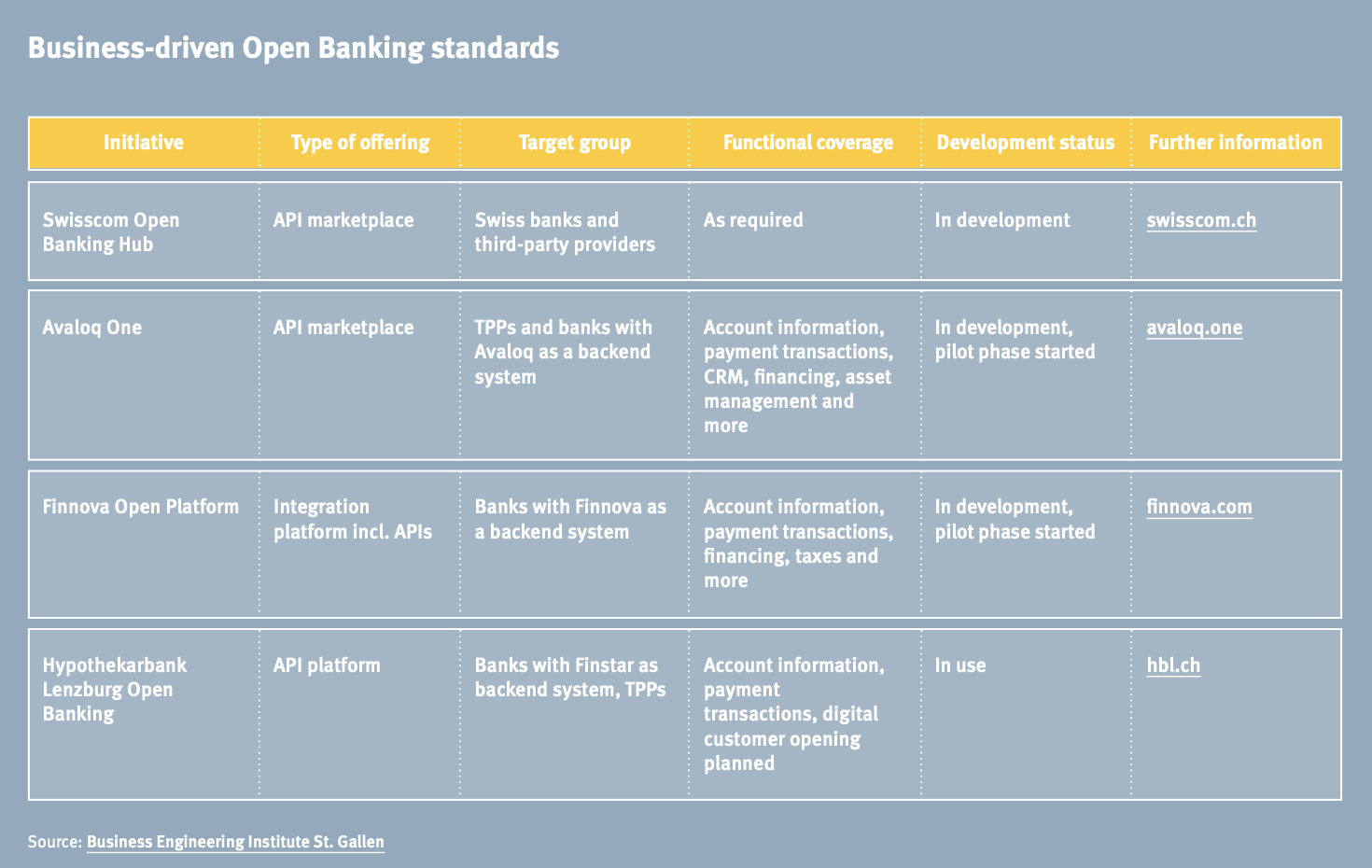

In a report titled Open Banking is on its way: What Swiss Banks should know now, Contovista, a Swiss Personal Finance Fintech first mover, identifies two main types of Swiss open banking initiatives: the independent open banking standards, and the business-driven open banking standards.

Independent Open Banking standards, Open Banking is on its way: What Swiss Banks should know now, Contovista

Business-driven Open Banking standards, Open Banking is on its way: What Swiss Banks should know now, Contovista

Independent initiatives include OpenBankingProject.ch, a project aimed at facilitating cooperation and offering open banking as a common basis for banks, fintechs, and integration providers. OpenBankingProject.ch is building a knowledge platform, operationalizing API standards relevant to Switzerland together with the community and publishing them on a developer portal including a sandbox for initial tests.

Founding partners of the initiative include the Business Engineering Institute St. Gallen, DXC Technology, Ergon, Finnova, Finstar (Hypothekarbank Lenzburg) and the University of Bern. Avaloq has also been a partner since September.

Another initiative is the SIX Connectivity Platform. The platform is designed as an open system that invites the participation of all financial institutions and third-party providers. Its purpose is to lay the foundation for the reliable, secure and efficient exchange of financial data.

Finally, the third independent initiative is led by SFTI. With its Common API working group, the association is working with key industry players to establish a widespread API standard.

In the business-driven initiatives category, Contovista notes four projects: the Swisscom Open Banking Hub, Avaloq One, Hypothekarbank Lenzburg Open Banking, and the Finnova Open Platform.

The three former ones are API marketplaces targeted at Swiss banks and third-party providers, while the Finnova Open Platform is an integration platform featuring APIs targeted at banks that use Finnova as a backend system.

Despite the several voluntarily open banking initiatives by the Swiss financial services industry, Switzerland still lags behind the likes of the UK, the EU and Australia, the world’s leaders in open banking. In these three jurisdictions, regulators have provided the conditions to accelerate migration towards open banking through a series of reforms.

Closely behind are Japan, Hong Kong, South Korea, Bahrain, and Brazil, according to the Open Banking Report 2019 by the Paypers.

Featured image credit: edited from Freepik