Switzerland Is an Early Adopter to a Trend That Could Change the Face of Banks Forever

by Fintechnews Switzerland October 16, 2018Before 2015, the idea of banks actively working together and sharing information with each other seemed like a pipe dream, or end results of corporate espionage.

This is, until the UK embarked on their Open API banking initiative, which has since been adopted by the EU. The goal is to create a more integrated, innovative and competitive banking and payments system by, in parts, compelling banks to foster integration amongst each other and with the extended fintech scene.

Open Banking could be a boon to any local finance scene, which is why bank in 2016, an ambitious project called the Swiss Open Finance API (SOFA) hit the public consciousness, with the goal of creating a common API and a new standard for Swiss financial services.

After all, it was said that if Switzerland didn’t attempt to disrupt their own payments scene, something from the EU would take up that role instead.

With multiple major fintech hubs across the globe undertaking their own open banking initiatives, it’s “do or die” for Swiss banks.

What Open Banking is About

Image credit: Suisse Group

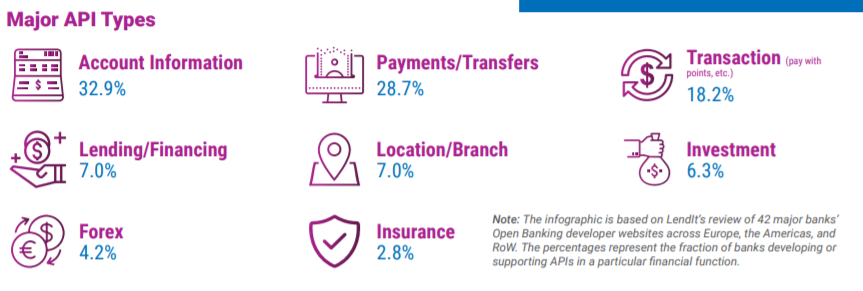

Driving the whole open banking movement are APIs, or application programming interfaces, which should enable financial institutions to share access to their data seamlessly and securely.

By promoting openly-published API specifications, open banking generates the types of innovation possible through collaboration across a variety of enterprises.

Banks are focused on account information access and payment initiation for their consumers.

It is said that similar APIs have already been used in lending for credit checks, and could relatively easily expand into loans on simple products, as well as repayment automation.

Everyone Wins in Open API

Consumers in a region could gain more financial freedom to compare between financial products, while still keeping their hard-earned cash in established banks. Open information sharing could also allow consumers to see real-time data of all of their finances in a single platform, which could help them keep better tabs on their finances.

Meanwhile fintechs will be able to reach the banks’ customer base much easier—which could be valuable in the country of bankers. They could form their business around aggregating data, or construct their business around analytics and personalisation.

And cycling back to banks, they’ll be able to adopt solutions that are created based on the data they’ve put out, instead of having to build their own interfaces ad hoc. They would also be able to share information with other banks, and uplift the finance services in their region with technology to compete in an increasingly tech-reliant world.

Open Banking Initiatives

image credit: HSBC

Considering its origins as a global trend, it makes sense that some of the more prominent banks participating in open banking hail from the UK.

HSBC was said to become on of the first big banks int eh UK to launch a standalone open banking app called Connected Money, which allows customers to access other bank accounts, credit cards and loans. Other names participating include Barclays and Royal Bank of Scotland.

However, the true innovation with banks lies in specialist banks, that provide alternative solutions that are presented to consumers through aggregators. Through partnerships with other financial service providers, they are broadening their reach in a bid to ensure that financial services can be access by the underserved.

There are also the growing numbers of digital-only banks that are either branchless, or even mobile banks. These banks come into the world with already establishe dmodular systems and API-based from the get-go.

Some digital banks are offering APIs to other banks and fintech companies to grow their own businesses.

19 Starling bank in the UK is a notable example, a lender that has offered its API, with documentation and sandbox testing environment.

Of Course, There Are Risks

The radical shifts that open banking can bring are putting traditional financial institutions at somewhat of a crossroads—what should they keep in-house, and what should they pay other companies to do?

Payments service companies like Visa, PayPal and MasterCard are also feeling the open banking pinch. They are currently responding to the issue by playing the role of facilitator in open banking transformations, forging partnerships across the value chain.

They will not die under the new ecosystem, but their power could be diminished to give room for companies like VibePay to rise.

But one of the biggest issues in open banking is the risk for hacks.

Banks have over their many years of existence, slowly upgraded its securities to protect consumer information. With open banking, sensitive data are extended outside of their corporate premises into third-party provider infrastructures that may not have the proper securities in place.

There is also a higher risk of frauds from the increasingly automated processes that open banking would offer, especially if a malicious player figured out how to turn automated processes to their favour.

With consumers’ money and sensitive data on the line, financial institutions and its open banking constitutents will have to continuously upgrade their systems and securities and keep on their toes.

The above information was a summary of the LendIt White Paper on open banking, discussing the state of open banking globally.

The company will also be hosting their LendIt Fintech Europe, an essential event in the continent for those interested in innovations in financial services. 2018’s event hopes to attract more than 1,200 fintech companies, banks, and investors from Europe’s most influential companies.

Hot topics will include: lending innovation, financial inclusion, digital banking, blockchain and AI.

Register now and get 15% off with code FintechNewsCH15%

Featured image credit: Switzerland flag, via Pixabay.