Peer-to-peer lending is all the rage in the small-loans sector: for credits that are too small or non-traditional for banks, for borrowers who want to avoid high-interest credit cards and payday lenders.

But the same feature that has made P2P an initial hit – easy arrangement of loans amongst peers – is also limiting its size. While plenty of peers want to borrow, not as many want to lend. The answer, says the aptly-named Lendity, is the option of institution-to-peer.

Institutions are entering peer-to-peer lending

This makes sense. Pensions, mutuals, insurers, hedge funds and private equity have a lot more money than peers. They own some two-thirds of equity markets, and they also dominate the supply of credit. At the same time, institutions are reluctant to take on individual peer loans as such, because these are not broadly diversified and it requires specialised investment as well as risk management expertise.

Bundling loans across several P2P platforms

Lendity Note via Lendity

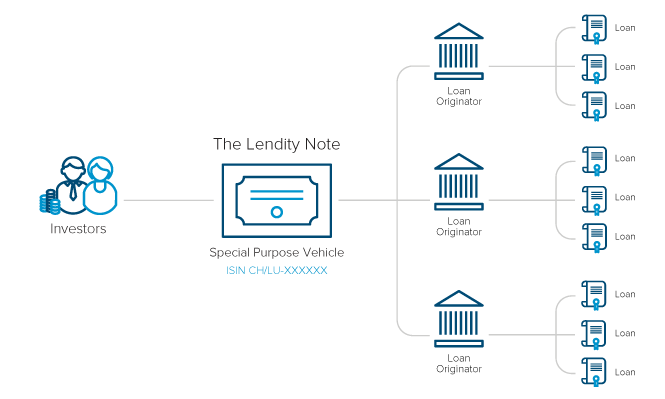

So here comes the Lendity Note.

“The Lendity Note is a registered security that bundles loans across a diversity of P2P platforms, loan types, grades and maturities,”

says Lendity co-founder Rafael Karamanian.

“It is highly diversified among platforms and loans, producing returns uncorrelated to traditional instruments.”

Fintech makes other economies possible as well. Through big-data analysis, Lendity monitors the stability and performance of P2P platforms and of the loans’ riskiness.

The Zurich-based firm has a strong local focus. Switzerland’s relevant consumer and small and medium (SME) sized-credit market is nearly CHF 300 billion, Karamanian says, with around one-third of all loans being renewed annually.

“Just 2% of that,” he adds, “or CHF 6 billion, would be a fantastic start.”

After graduating from the F10 FinTech Incubator and Accelerator, Lendity entered into a collaboration with Julius Baer, to develop the Lendity Note. This collaboration underscores Julius Baer’s commitment to supporting start-ups and fostering innovation.

This article first appeared on Juliusbaer.com