Payments

Visa To Acquire UK Payments Startup Currencycloud

Visa has signed a definitive agreement to acquire London-based payments startup Currencycloud, Visa announced today. The acquisition builds on an existing strategic partnership between the two companies. Visa had led an $80 million investment round for Currencycloud at the beginning

Read MoreRevolut Forays Into the Travel Sector in a Bid to Become a Superapp

London-headquartered fintech giant Revolut is betting on the rebound of the travel sector. The company launched a new feature called Stays, that allows users to book hotels and other accommodation through the app. With its premium plans, Revolut’s Stays will

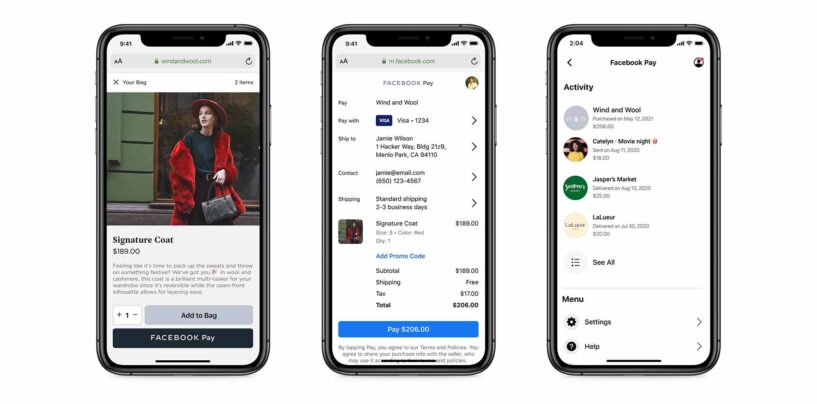

Read MoreFacebook Pay To Be Available to Online Retailers Starting With Shopify

With digital payments picking up pace across the globe, social media giant Facebook is extending its payment services to online retailers. Shopify has become the first e-commerce platform to sign up for Facebook Pay. This will allow Shopify merchants to

Read MoreRevolut Raises US$800 Million in Series E Fundraise, Valuing It at US$33 Billion

Revolut, the financial superapp with more than 16 million customers worldwide, announced an US$800 million series E funding round, valuing the business at US$33 billion. The new funding round brings onboard two new investors, SoftBank Vision Fund 2 and Tiger

Read MoreSwitzerland Has The Highest Contactless Payment Limit In Europe

Switzerland’s contactless payment limit stands at CHF 80 (approximately GBP 63) – the highest in Europe, a new study has found. Approximately two-thirds of the Swiss population currently owns a credit card but the country still lags far behind on the list

Read MoreConcardis Schweiz and CCV Schweiz Finalised Merger to Form Nets Schweiz

The legal merger of Swiss payment terminal provider CCV Schweiz SA with Concardis Schweiz AG by the Nets Group, a payment service provider in Europe, has been completed. As of 30 June 2021, the two companies will continue to operate

Read MoreNetcetera, Entersekt Enables Secure Payments With FIDO Authentication for PLUSCARD

PLUSCARD, a full-service processor for numerous card-issuing institutions across Germany, Netcetera, a digital payment solutions provider, and Entersekt, a customer authentication specialist, launched the FIDO-certified alternative to app-based authentication in Europe in June 2021. The solution enables secure online credit card

Read MorePayoneer Finalises Merger With SPAC Company, Begins Trading on Nasdaq

Cross border payments specialist Payoneer announced that it has completed its merger with the FTAC Olympus Acquisition Corp. (FTOC), a special purpose acquisition company, to become a publicly traded company. As a result of this merger, a new public entity

Read MoreAccenture Invests US$12 Million in Swiss Payments Firm Imburse

Accenture has made a strategic investment of US$12 million in Imburse, a Swiss cloud-based, payments-as-a-service enterprise platform that simplifies the way businesses around the world access the global payments ecosystem. Imburse will join Accenture Ventures’ Project Spotlight—an immersive engagement and

Read MoreDutch Payments Provider Mollie Raises US$800 Million In Series C Funding Round

Mollie, a Netherlands-based payment service provider, announced the closing of US$800 million in a Series C funding round. This takes the total amount raised by the company to over US$940 million, pushing its valuation to US$6.5 billion. The round was

Read More